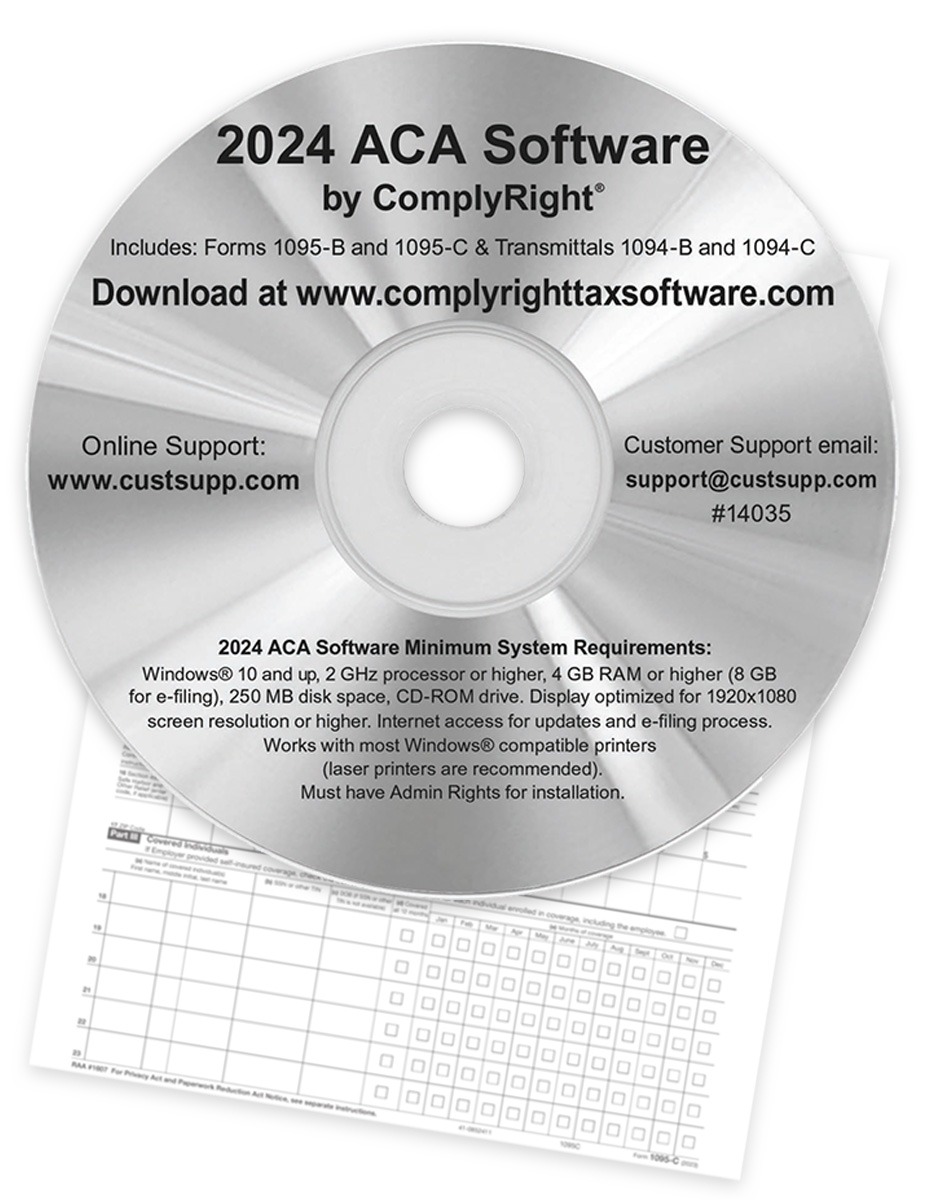

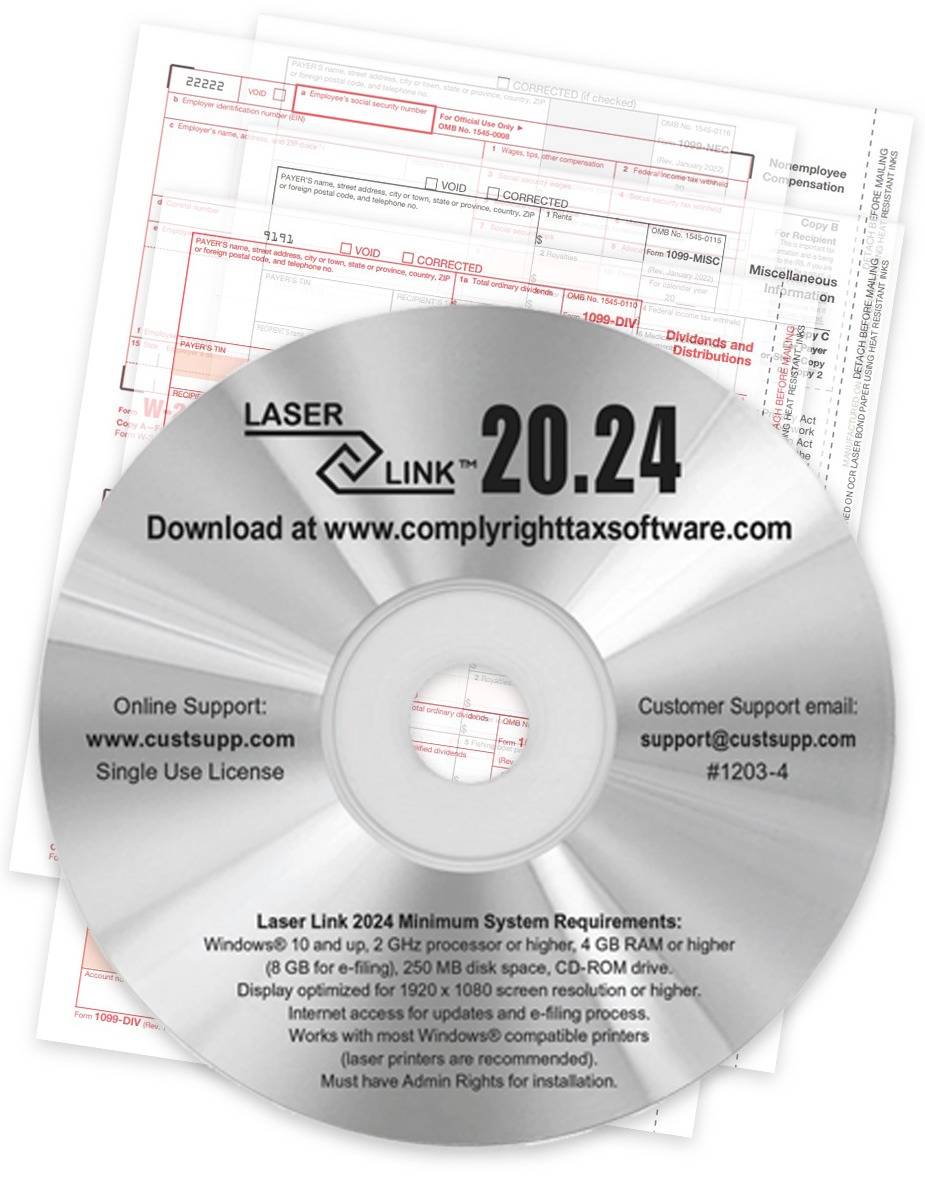

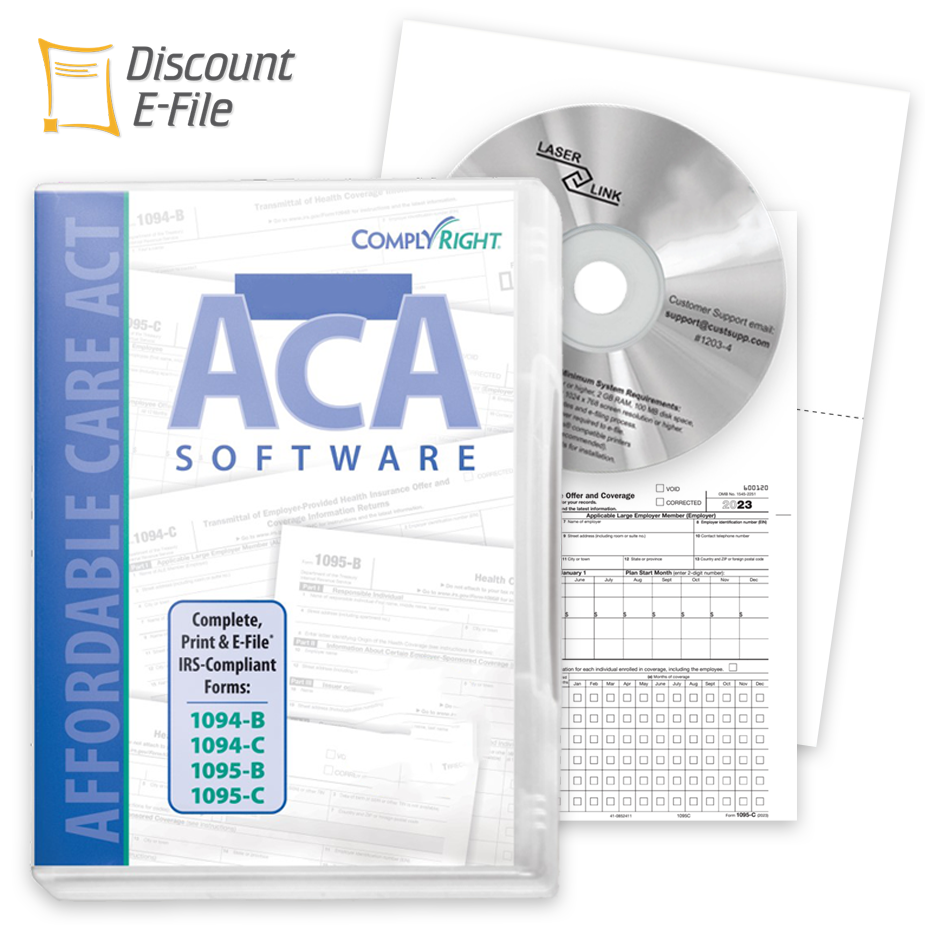

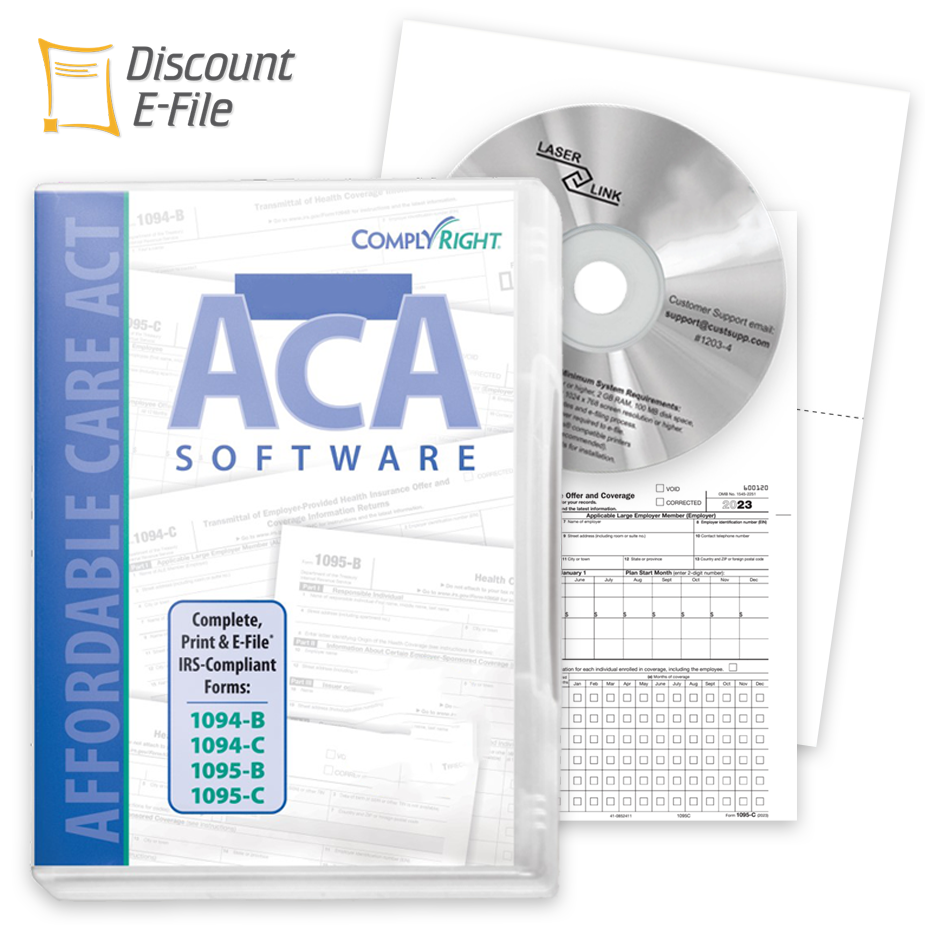

ACA 1095 Software

Easy software for 1095 filing with IRS e-file options.

Large employers and insurance companies are required to report coverage of health insurance for employees to use when filing their annual tax returns.

- Simple 1095 filing software by ComplyRight®

- Compatible 1095B & 1095C forms and mailing envelopes

- Software can print on preprinted forms or blank perforated 1095 paper

- Complies with ACA healthcare insurance reporting requirements

- Switch to online filing and we’ll do the work for you with DiscountEfile.com

Affordable software for easy printing, mailing and e-filing 1095B and 1095C forms to report healthcare coverage.

Shop easy with The Tax Form Gals!

Online Filing Eliminates the Hassle!

ACA 1095 Filing Requirements for Healthcare Insurance Coverage Reporting

As part of the Employer Shared Responsibility Rule of the Affordable Care Act (ACA), 1095 forms are required to be filed by employers and insurance companies to report individual health care coverage during a tax year.

Medium-to-large size businesses and health insurance companies need to file 1095 forms.

Who exactly needs to file:

- Employers with 50+ full-time employees (or full-time equivalent)

- Self-insured employers with fewer than 50 employees (a very small number of businesses)

- Health insurance companies

- Businesses can file these forms themselves, or outsource to a payroll company.

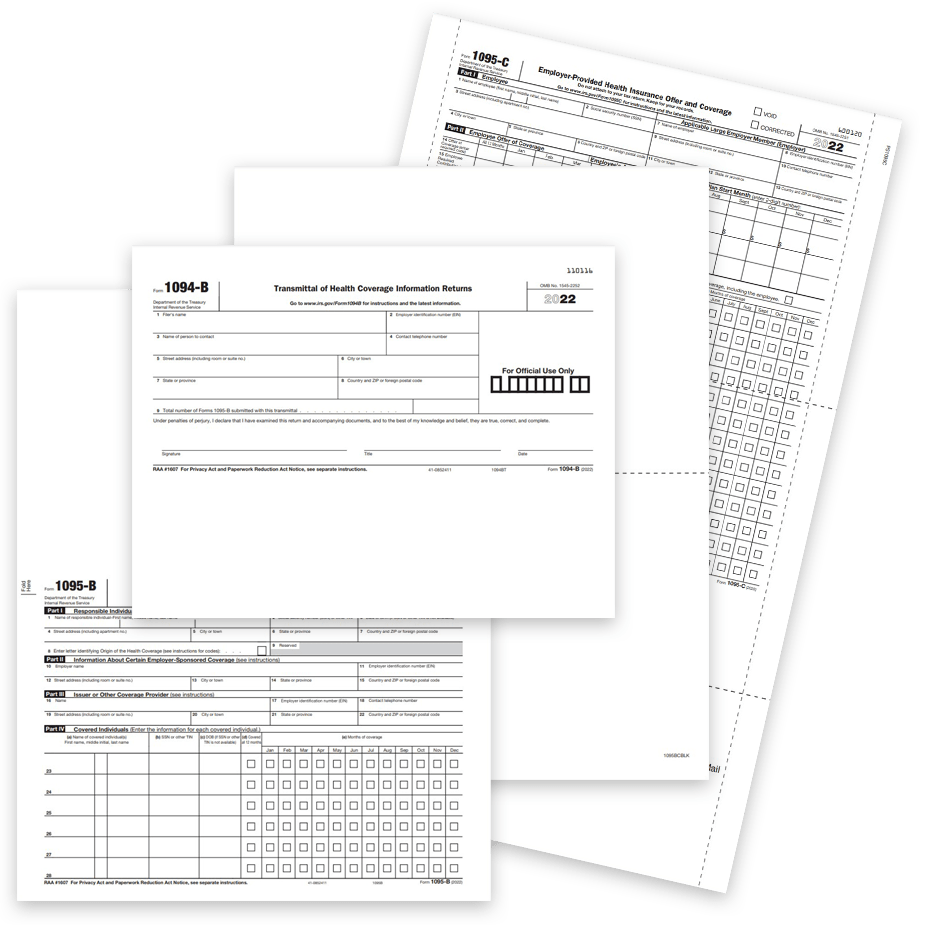

Forms 1095-B and 1095-C are used to report coverage information to the IRS and employees.

1095 forms include the following information:

- Enrolled employees and former employees

- Details of employees’ health insurance coverage

- Verification that the minimum essential coverage (MEC) requirement has been met.

Employees and their dependents will use this information to complete their personal tax returns – and those who do not have minimum essential coverage may receive a penalty on their tax returns.

1095-C is for applicable large employers with 50+ full time employees

1095-B is for self-insured employers and health insurance companies

1094-C and 1094-B are the summary transmittal forms

1095 forms must be filed with the IRS on paper or efile, and also provided to the employee.

[wptb id=627304]