1099-R Tax Forms

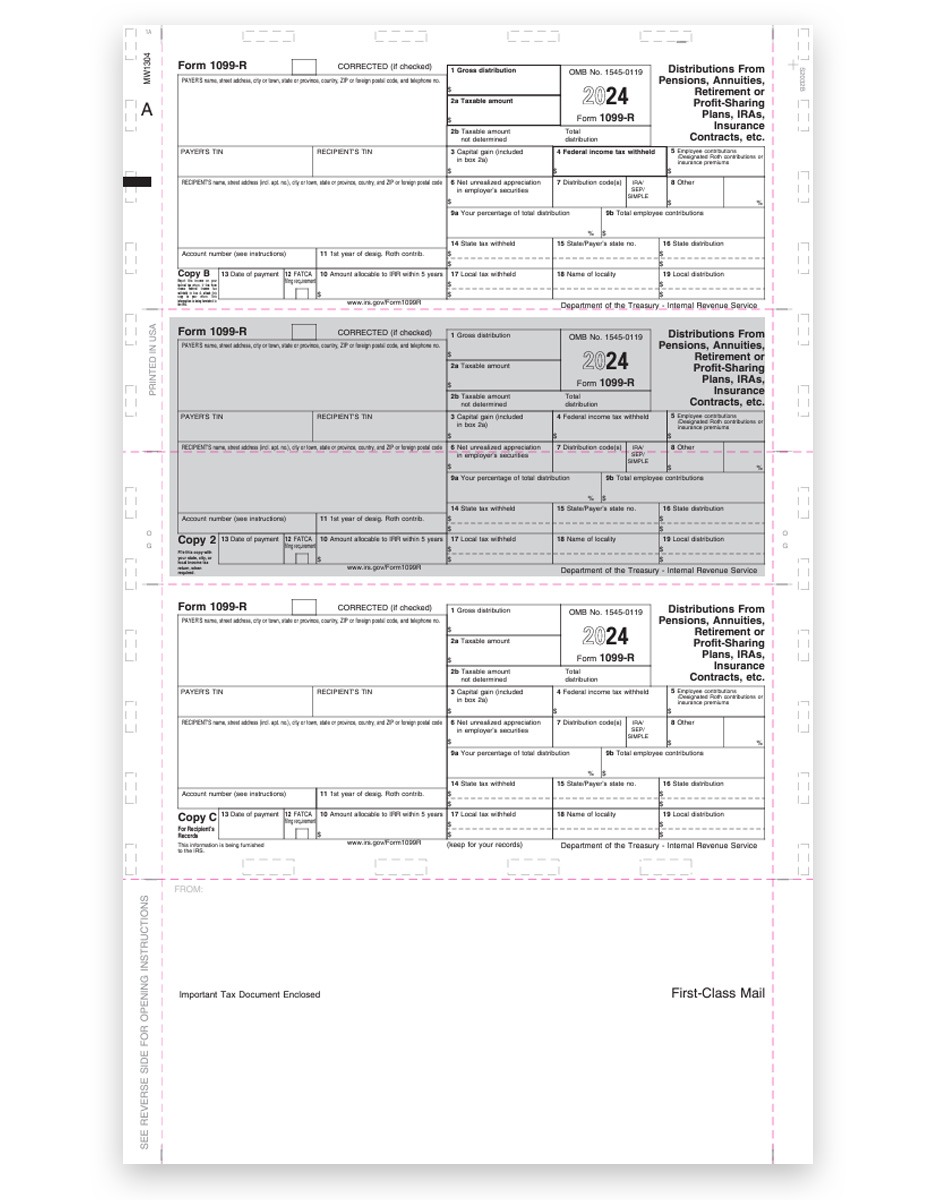

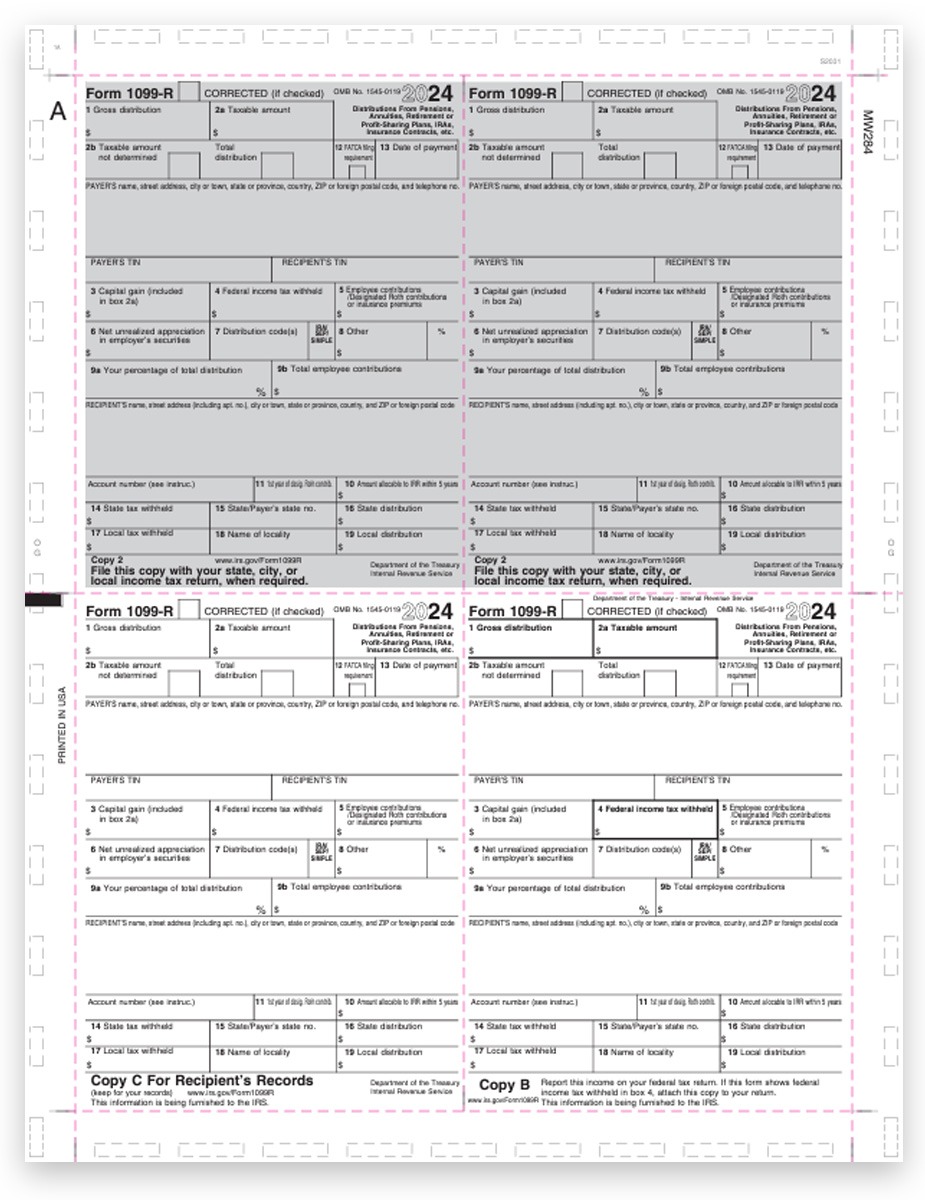

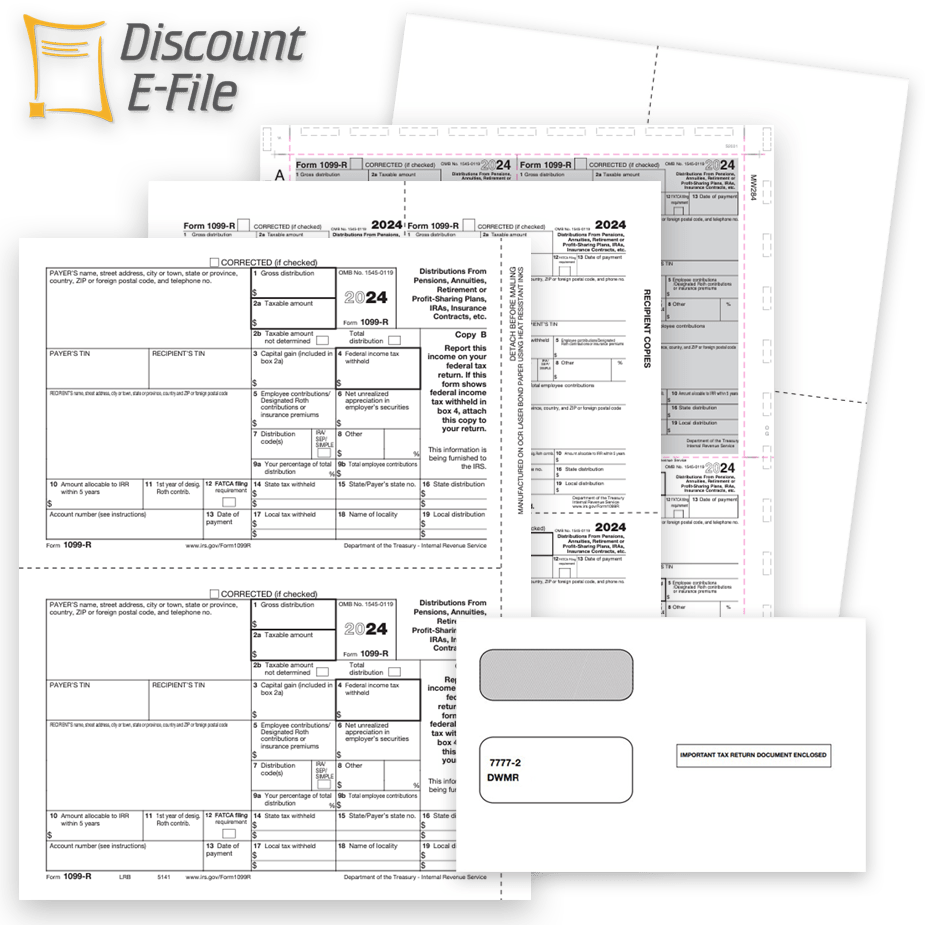

Order 1099 Forms for Reporting Distributions from Pensions, 401K, IRA, Profit Sharing and More in 2024.

- Discount prices – no coupon needed

- Official IRS forms compatible with software

- Preprinted, carbonless, blank & pressure seal 1099-R forms

- Compatible 1099R security envelopes

- Easy online 1099 e-filing + print and mail service options

- Fast, friendly service from The Tax Form Gals!

1099 E-filing requirements — e-file Copy A for 10+ 1099 & W2 forms combined. We make 1099 e-filing easy!

Easily print, mail and e-fille 1099R tax forms. Everything you need at discount prices – no coupon needed.

Shop easy with The Tax Form Gals!

Have 10+ W2 & 1099 Forms to File? You Must E-file!

The IRS requires e-filing for 10+ W2 &1099 forms, combined, per EIN.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except corrections. Efile Copy A forms by January 31, 2025.

ONLINE 1099 & W2 E-FILING = EASY 2024!

Efile, print and mail 1099 & W2 forms online.

No paper, no software, no mailing, no hassles!

Use DiscountEfile.com to enter or import data, then we'll e-file with the IRS or SSA and can even print and mail recipient copies.

Create a free account and get started today!

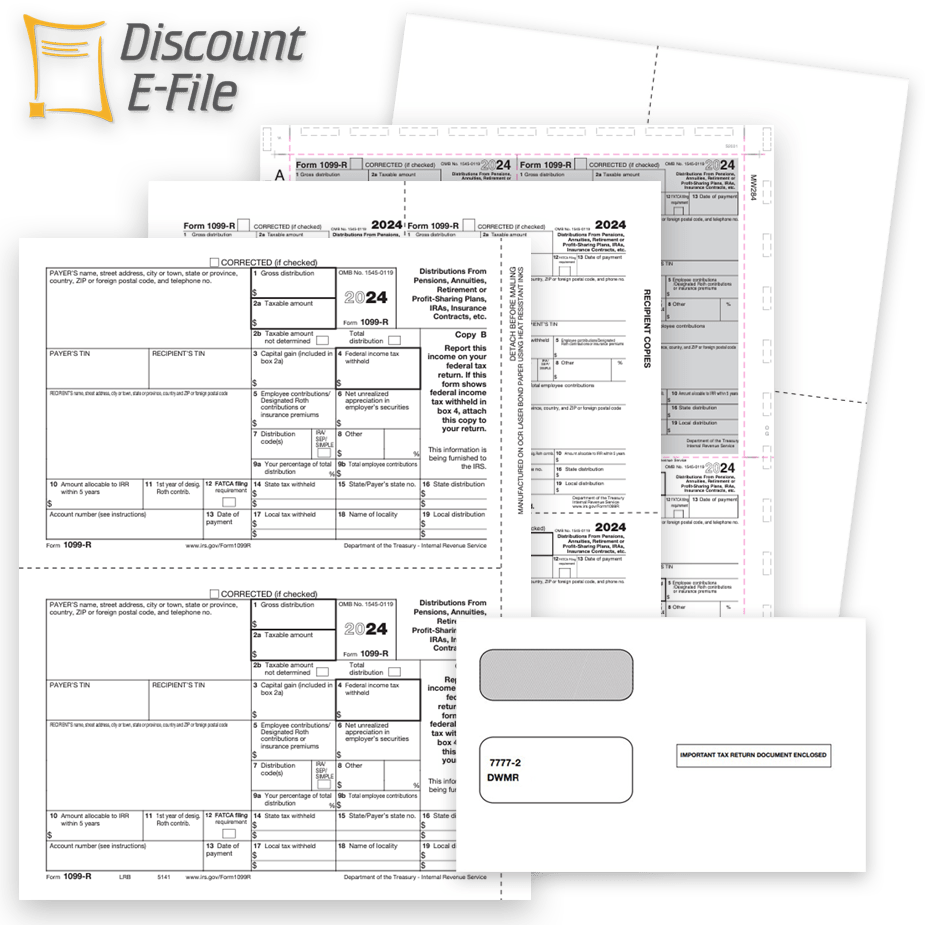

Order Official Preprinted 1099R Tax Forms & Envelopes

-

1099 Envelope – 3up

-

1099 Envelope – 2up

-

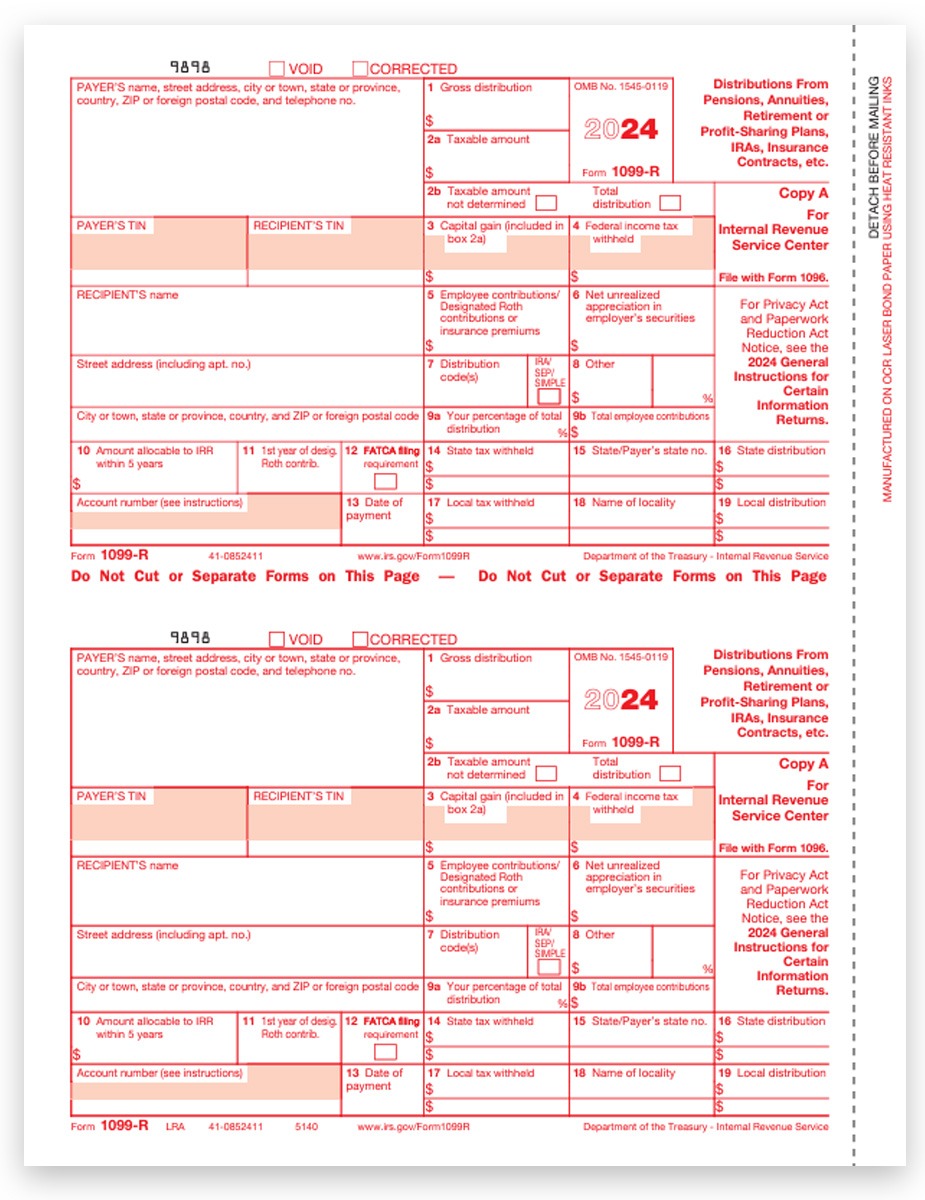

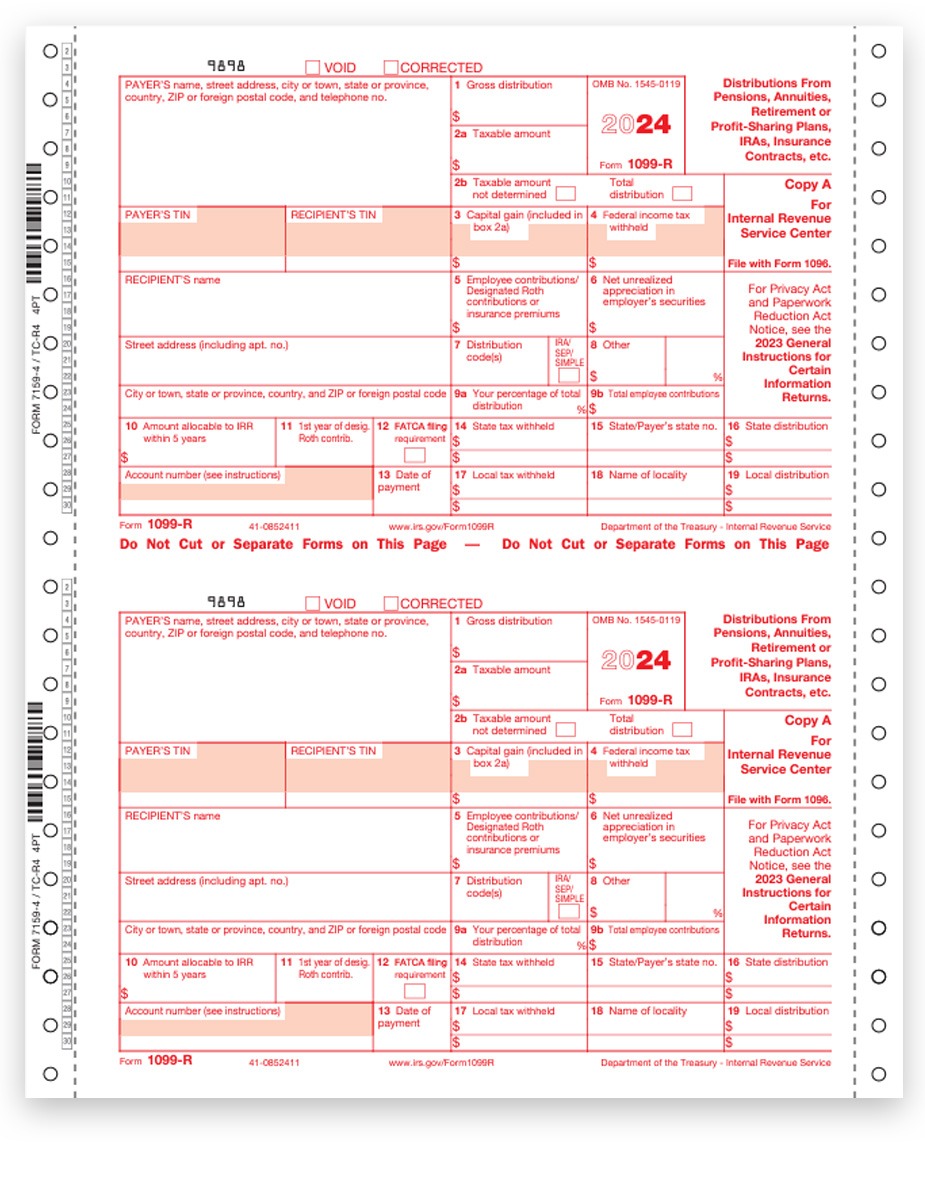

1099-R Form – Copy A Federal

-

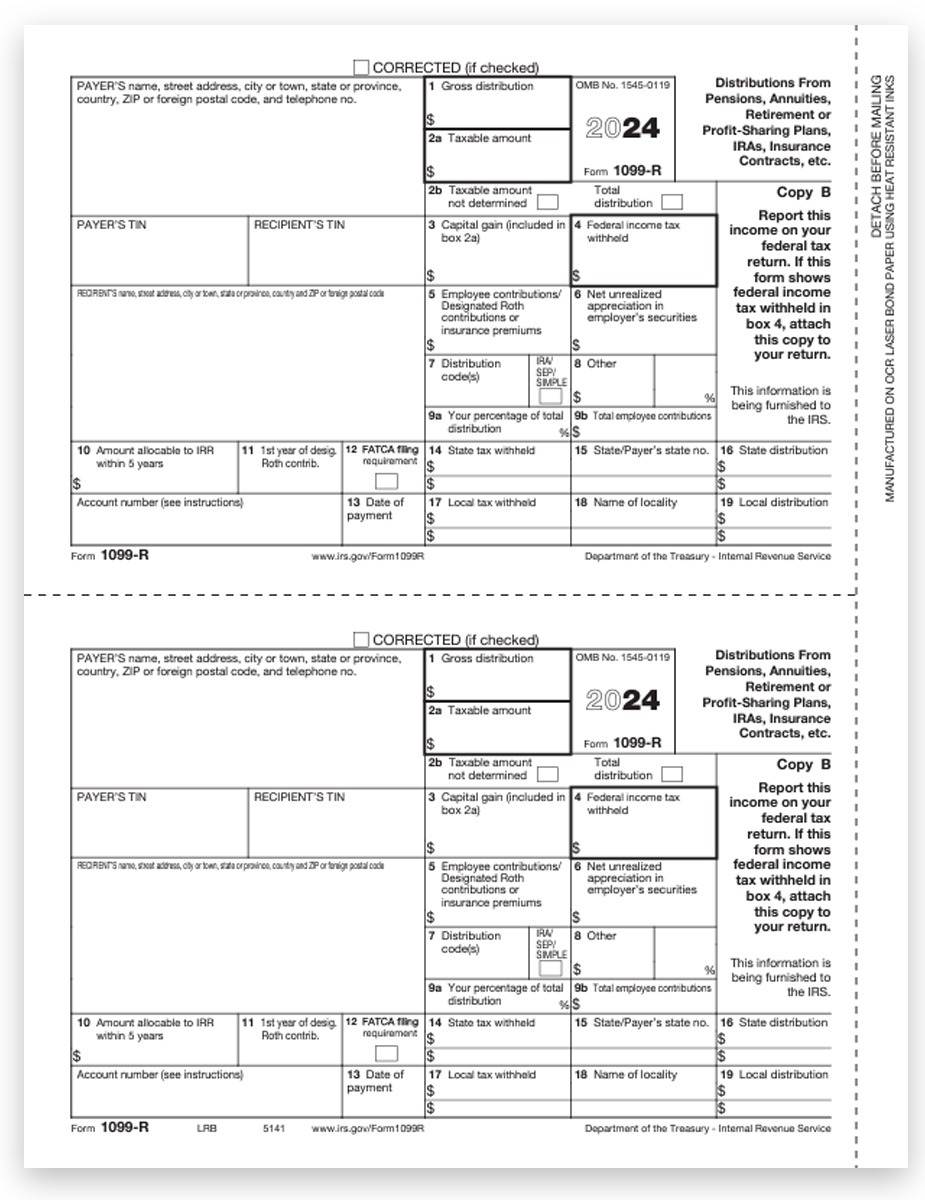

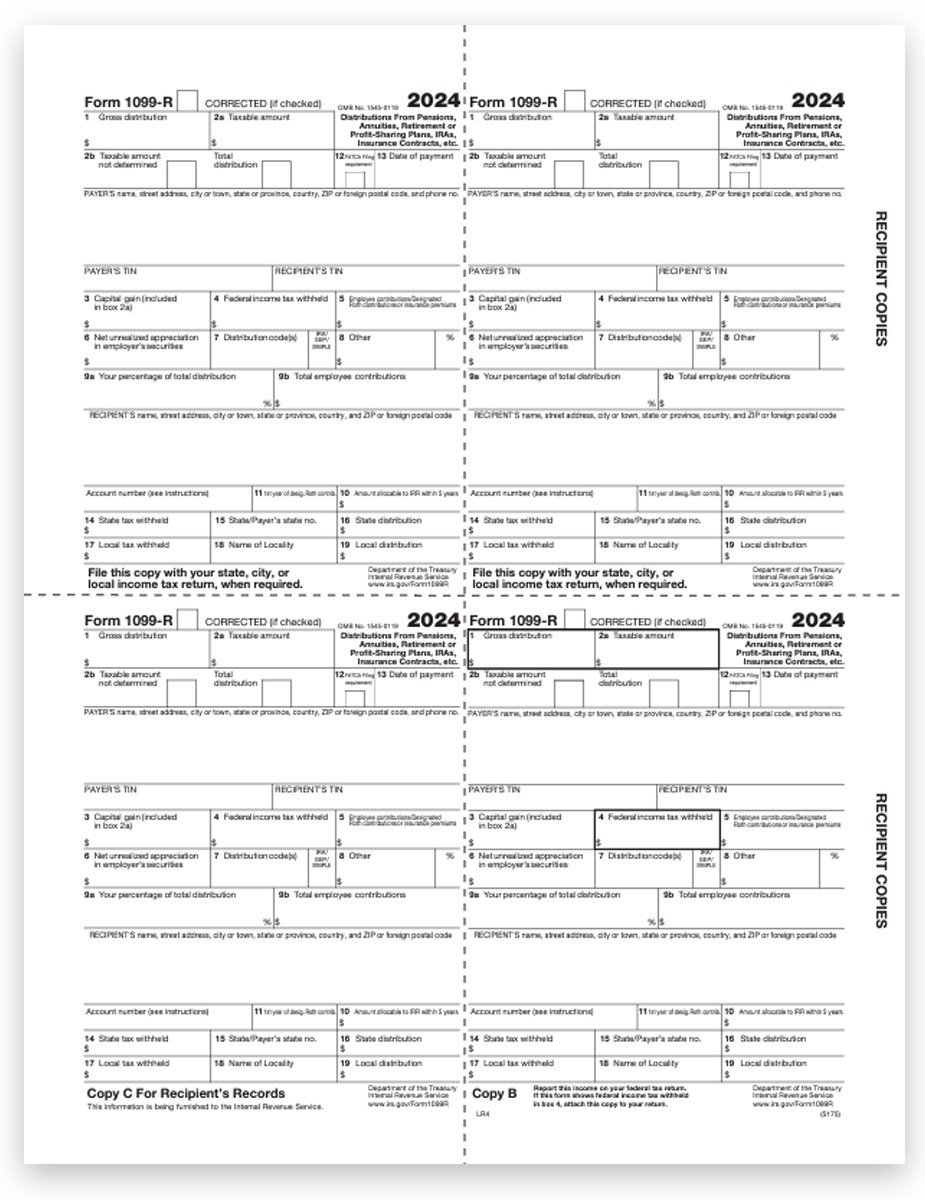

1099-R Form – Copy B Recipient

-

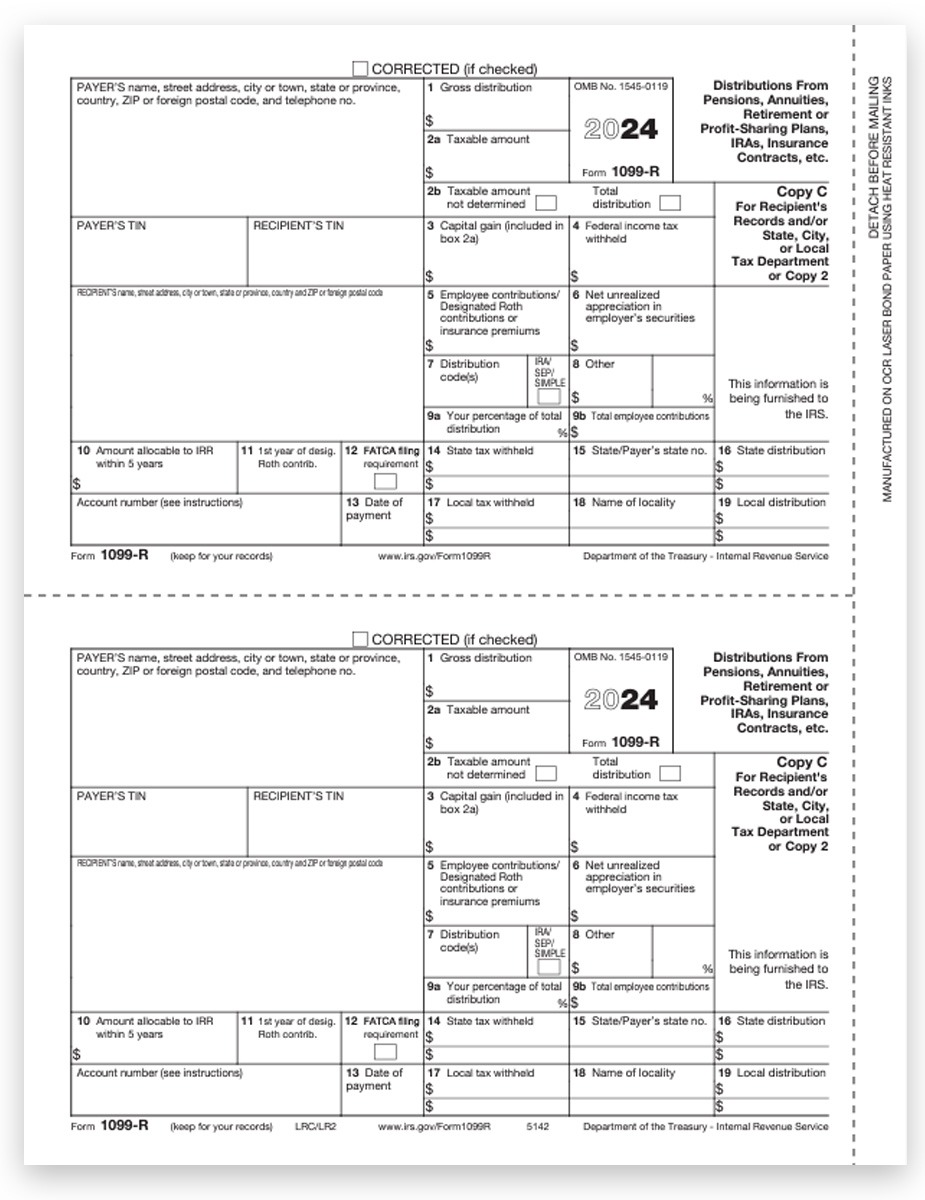

1099-R Form – Copy C-2 Recipient

-

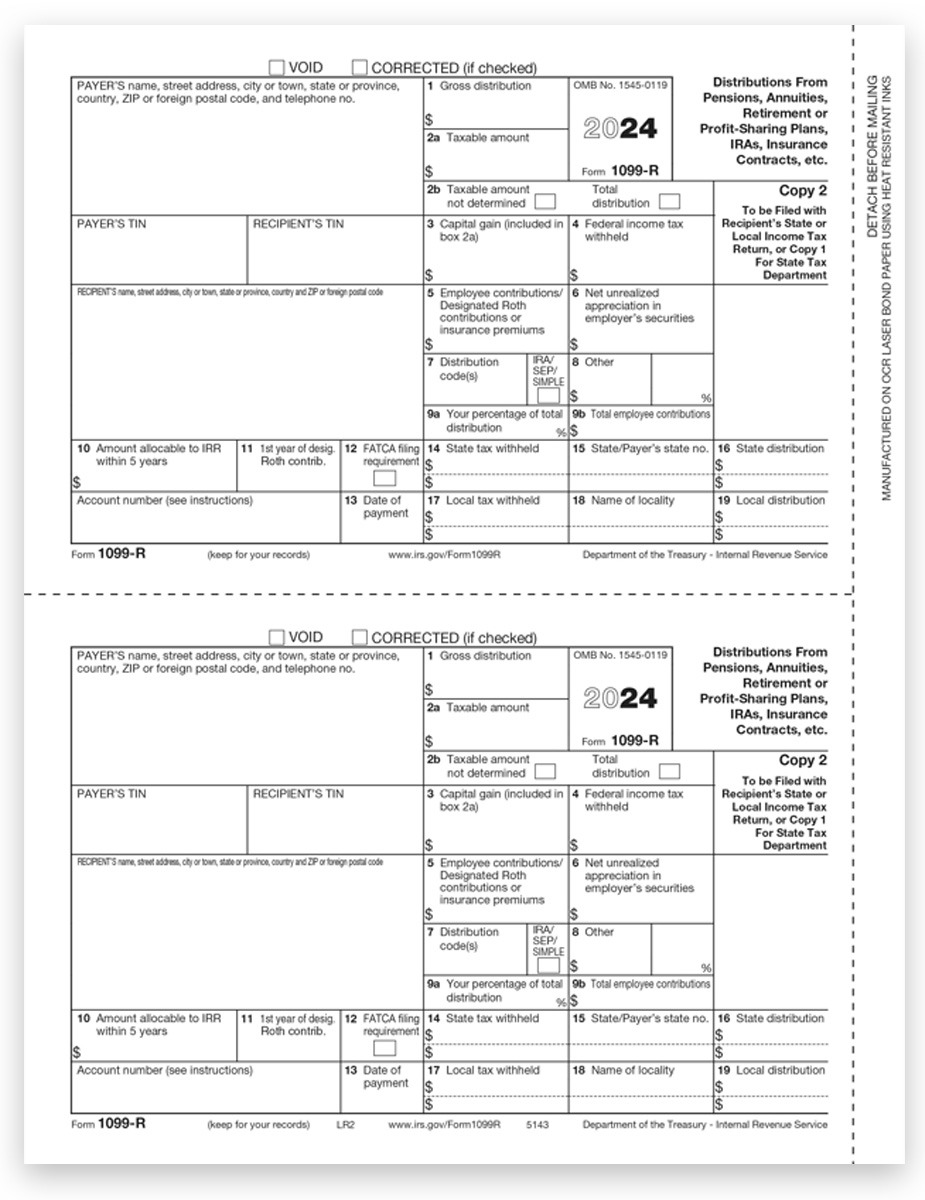

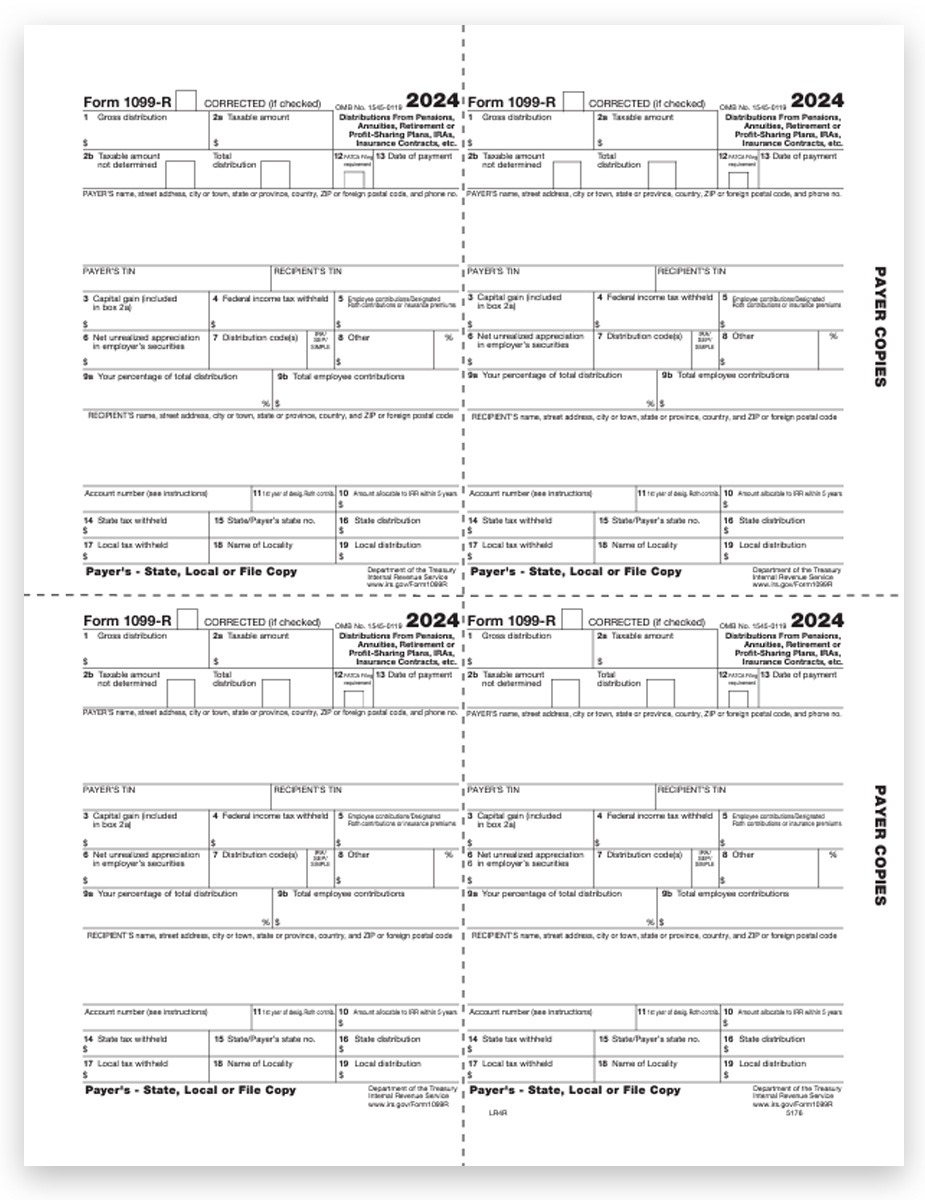

1099-R Form – Copy 2 Payer

-

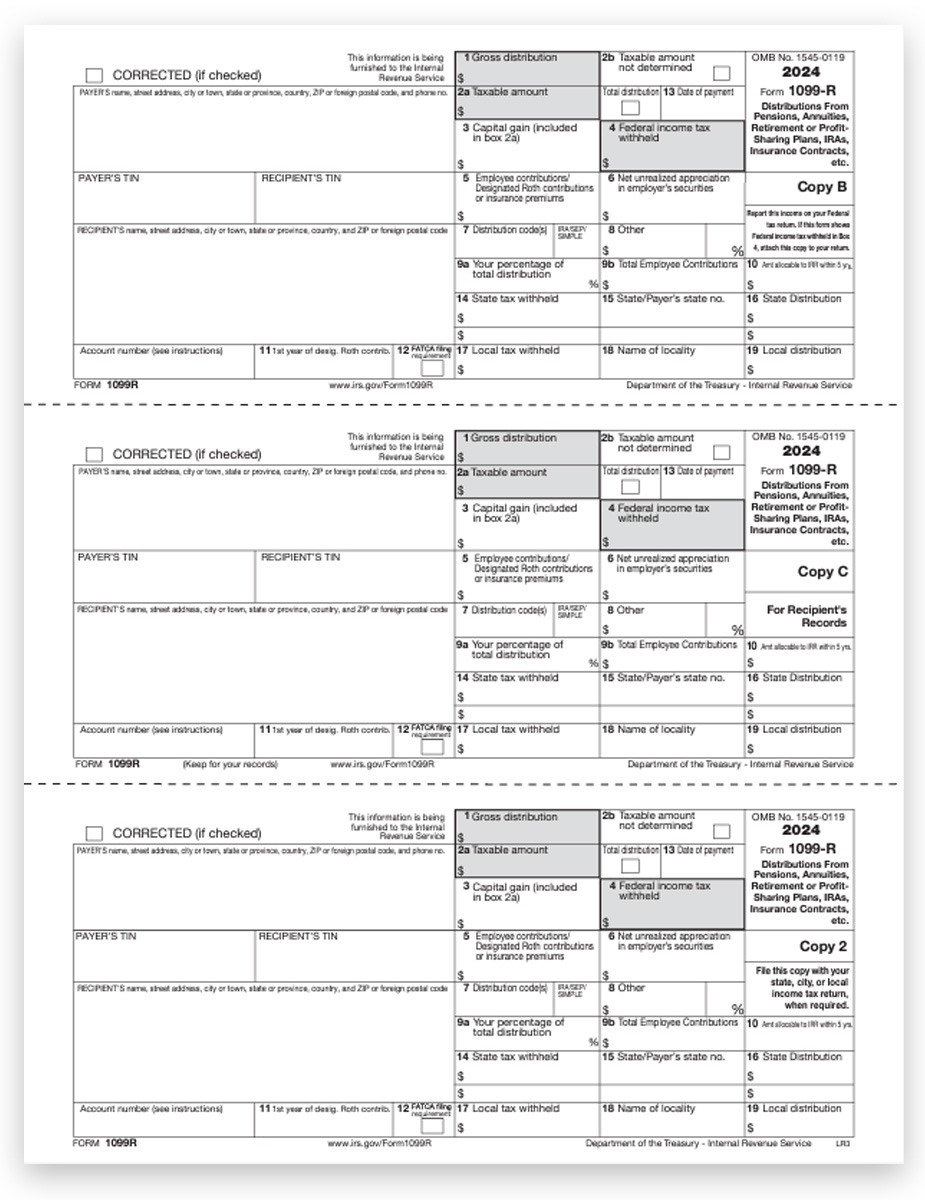

1099-R Form – 3up Copy B-C-2 Recipient

-

1099-R Carbonless Continuous Forms

-

1099-R Form – 4up Recipient Copies B-C-2-2

-

1099-R Form – 4up Payer Copy 2

Order Blank 1099R Perforated Form Paper

Order Pressure Seal 1099R Forms

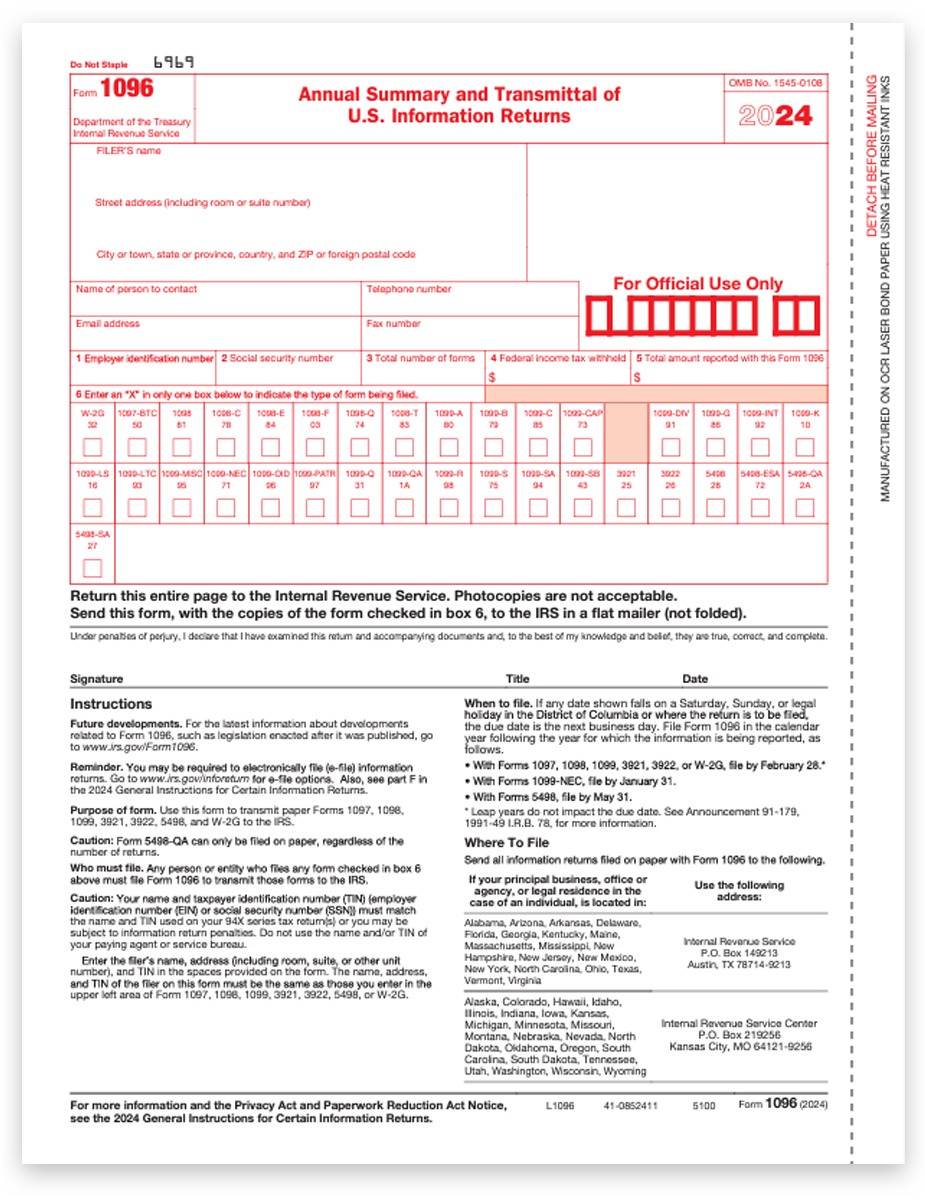

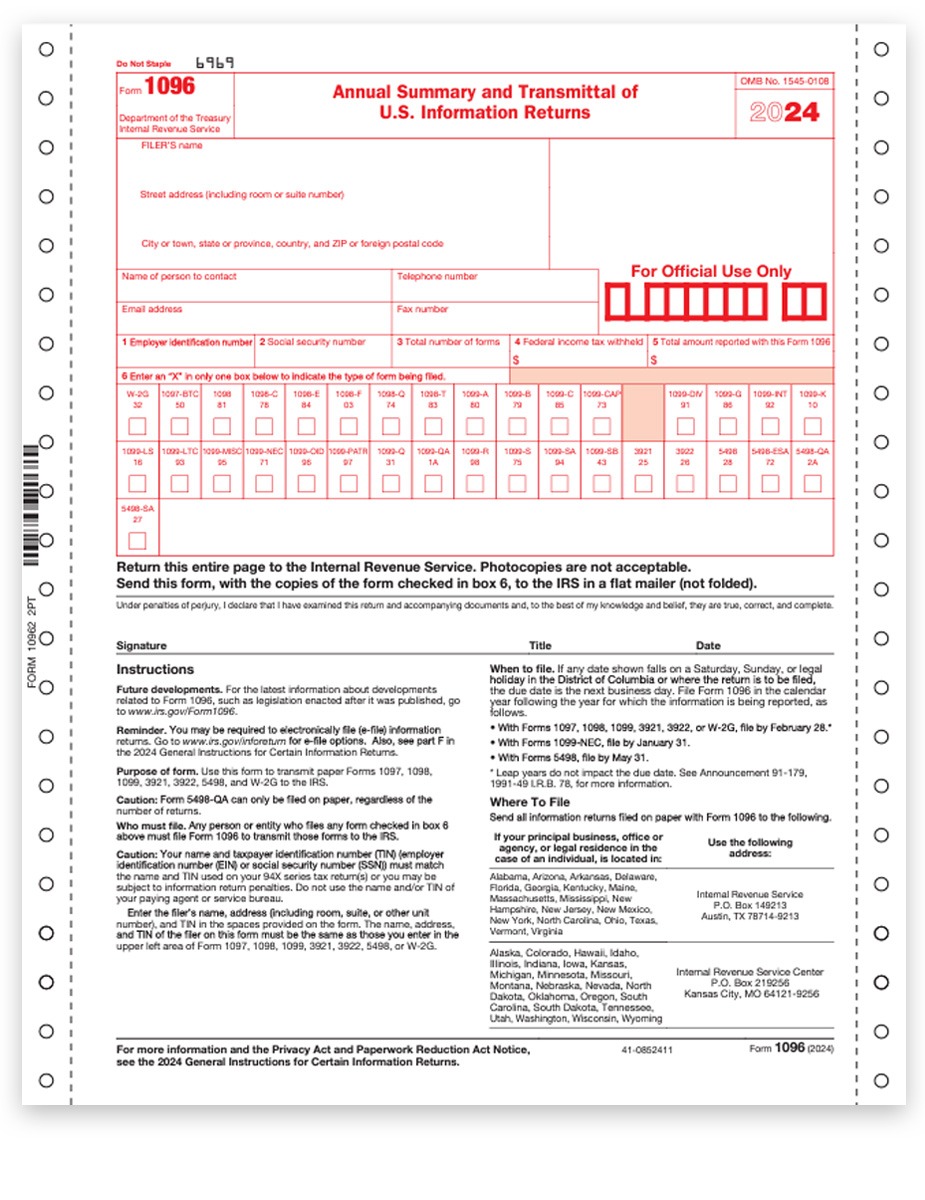

1096 Summary & Transmittal Forms

Submit one 1096 Transmittal Form to summarize the batch of Copy A forms for a single payer.

Laser forms – minimum 25 | Continuous forms – minimum 10

Insights to Easy 1099 Filing

3 Easy Ways to File 1099 & W2 Forms

If your business needs to file W2 forms for employees, or 1099s for contractors or other purposes, we offer 3 simple ways to get them done efficiently before the January 31 deadline: Online Filing, Software, and Forms

Business Penalties & Fines for Incorrect 1099 & W2 Filing

If your business fails to file 1099 & W2 forms on time, or provides incorrect information, you could incur large fines. Learn about the penalties how how to avoid them!

Navigating the IRS E-Filing Requirement Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file Copy A forms with the IRS and SSA. We make it easy! And can even print and mail recipient copies for you.

Decoding 1099NEC Copy Requirements

1099-NEC ‘Copies’, or parts, report non-employee compensation to recipients and government agencies and help ensure accuracy of income tax filing. 1099-NEC Forms are filled out by the payer and provided to the recipient and government agency.

Official vs. Condensed W2 Forms: Understanding the Formats

Understand the Different W2 Formats Easily! Compare Traditional 2up W2 Forms to 4up & 3up W2 Forms for Efficient Printing & Mailing of Employee Copies.