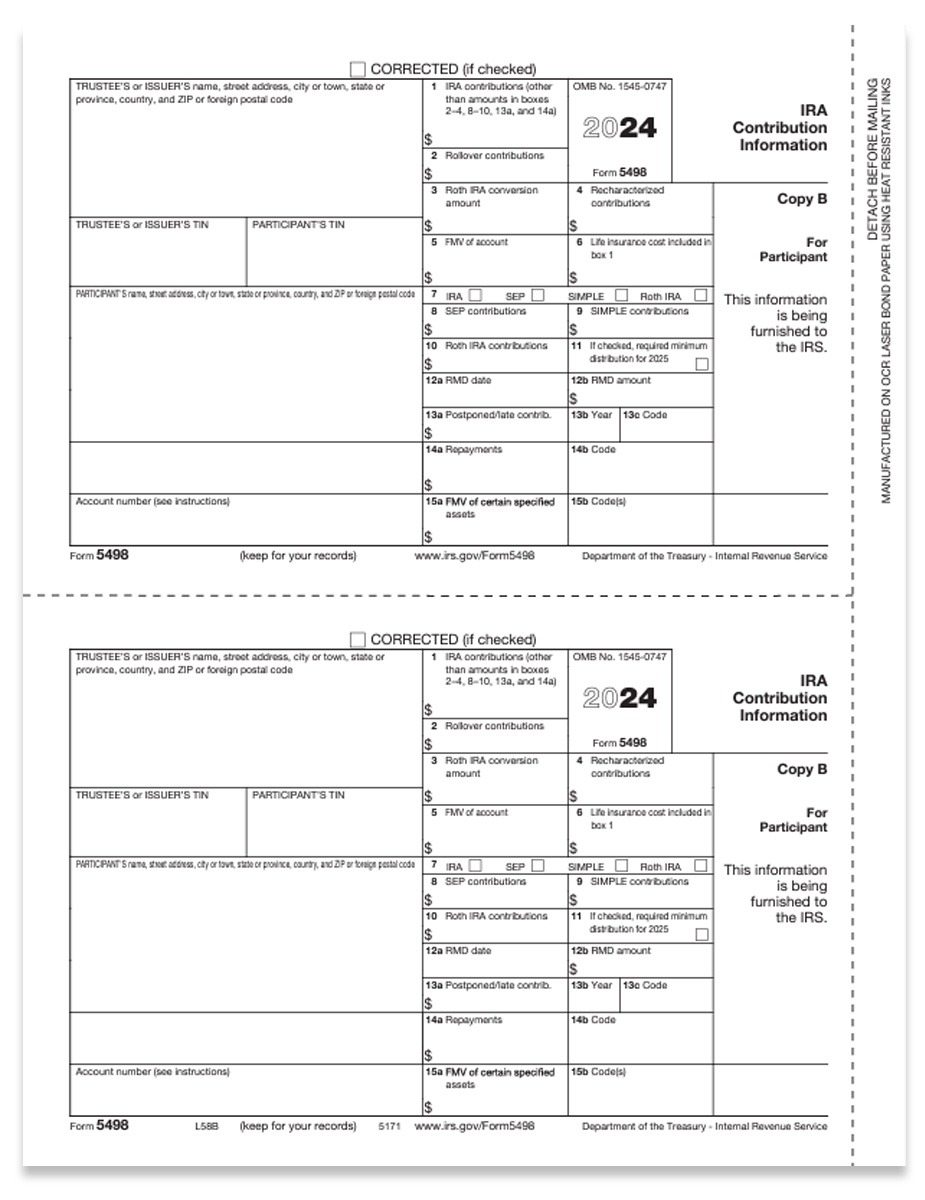

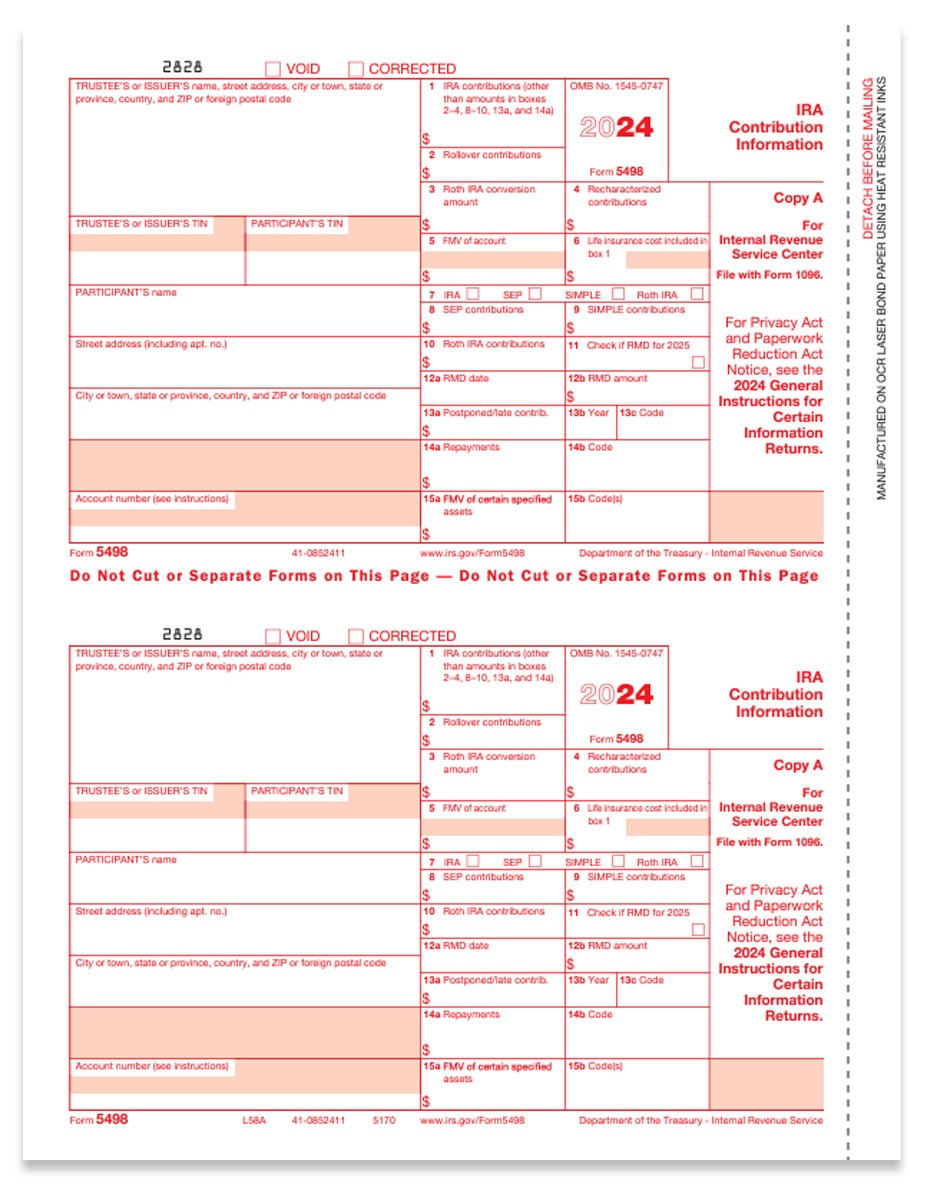

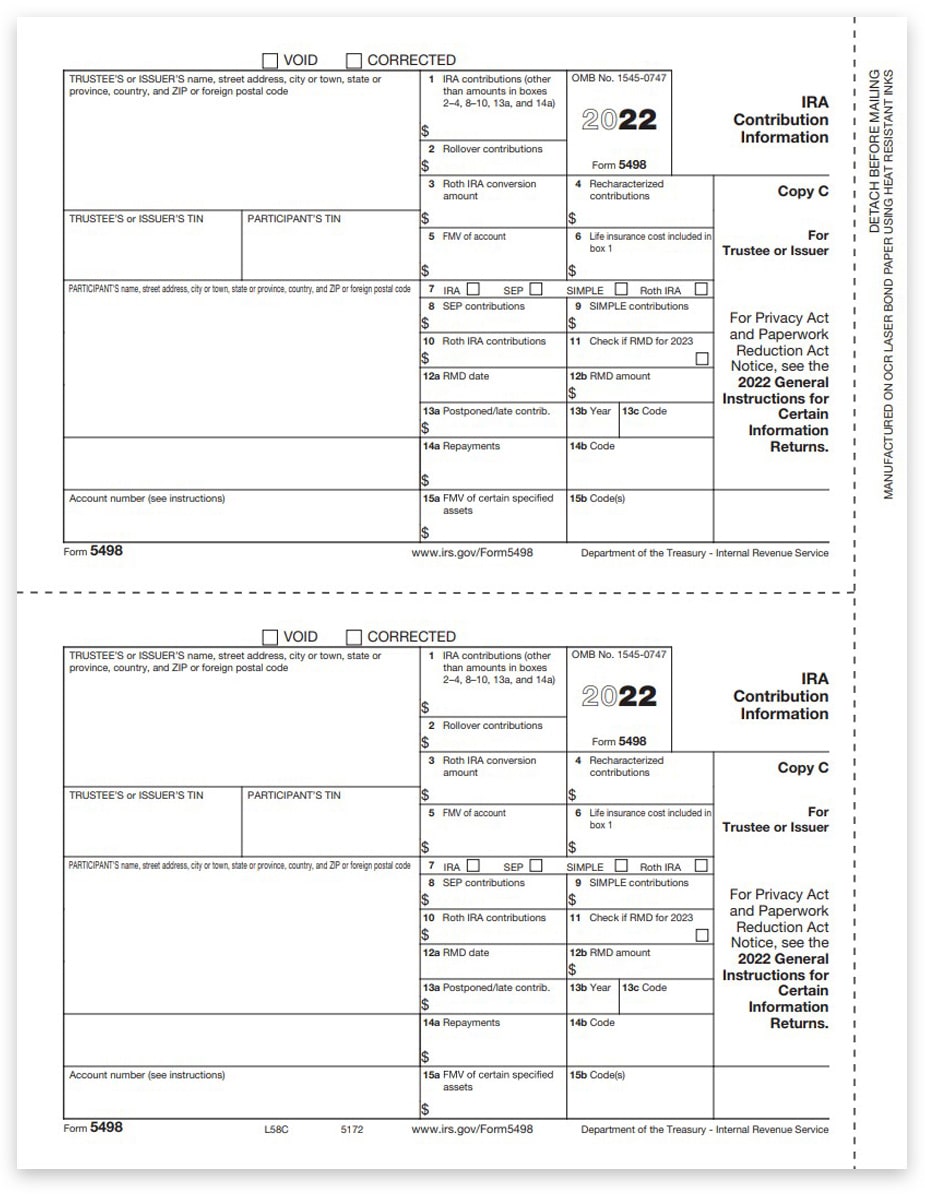

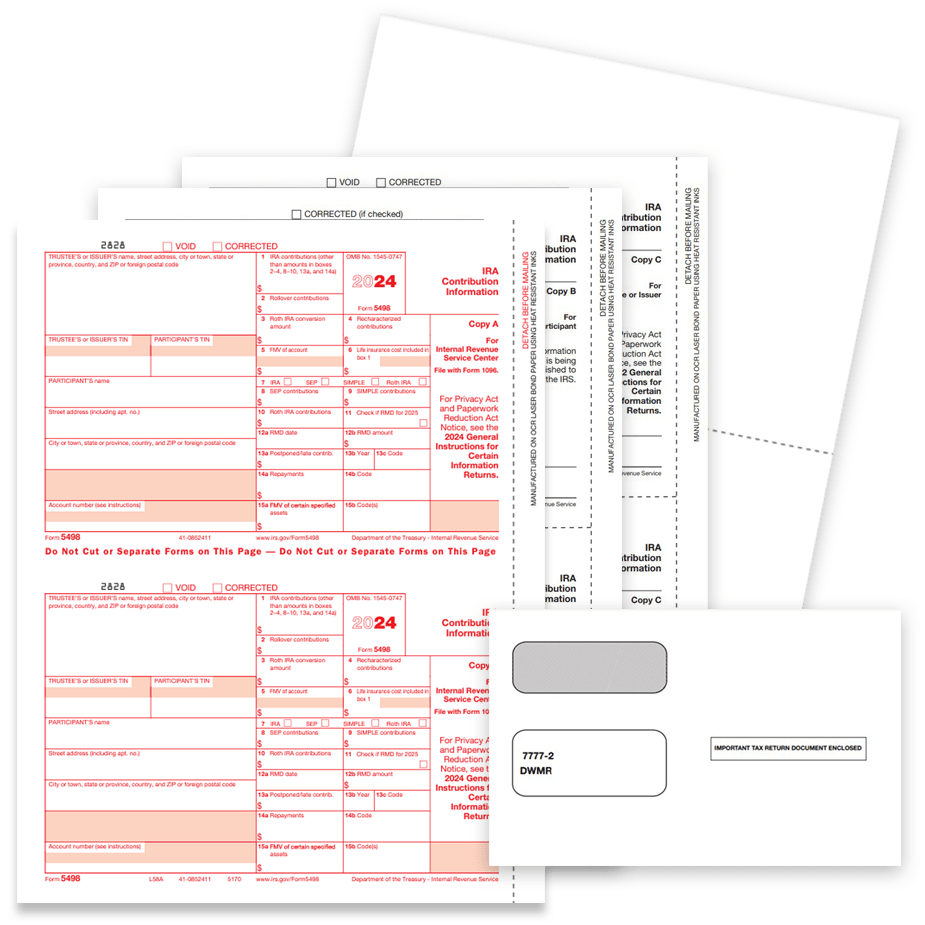

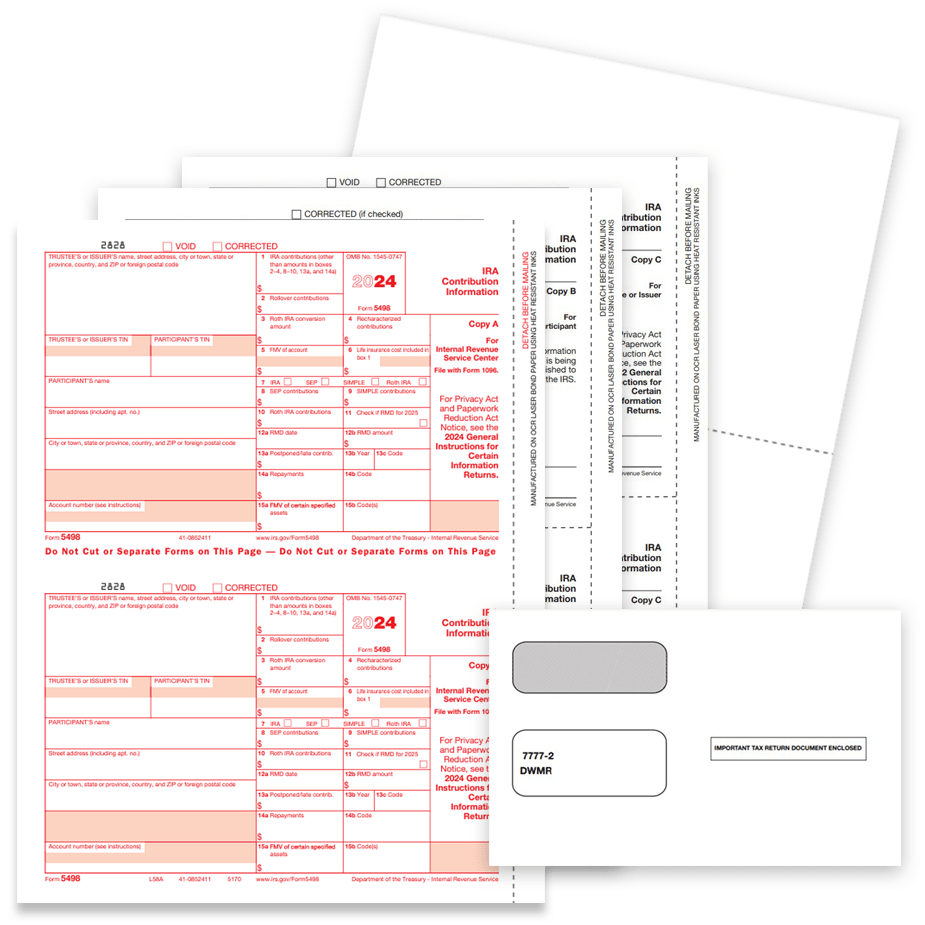

5498 Tax Forms

Order 5498 Forms and Envelopes for Reporting IRA Contributions in 2024

- Discount prices – no coupon needed

- Official IRS forms compatible with software

- Preprinted and blank perforated 5498 forms

- Compatible security envelopes

- Ships fast and friendly with The Tax Form Gals!

Easily print and mail 5498 tax forms to report IRA contributions at discount prices – no coupon needed.

Shop easy with The Tax Form Gals!

Order 5498 IRA Forms & Envelopes

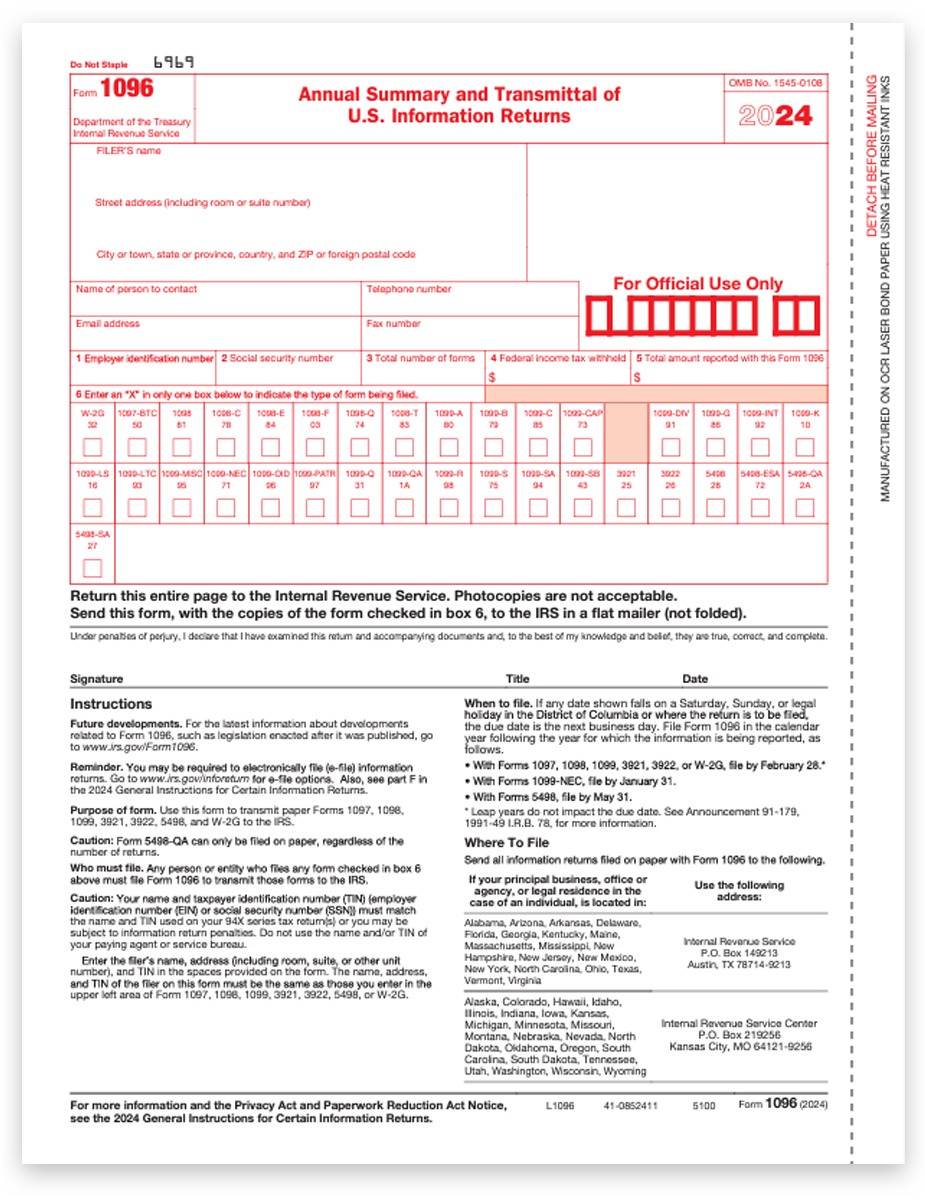

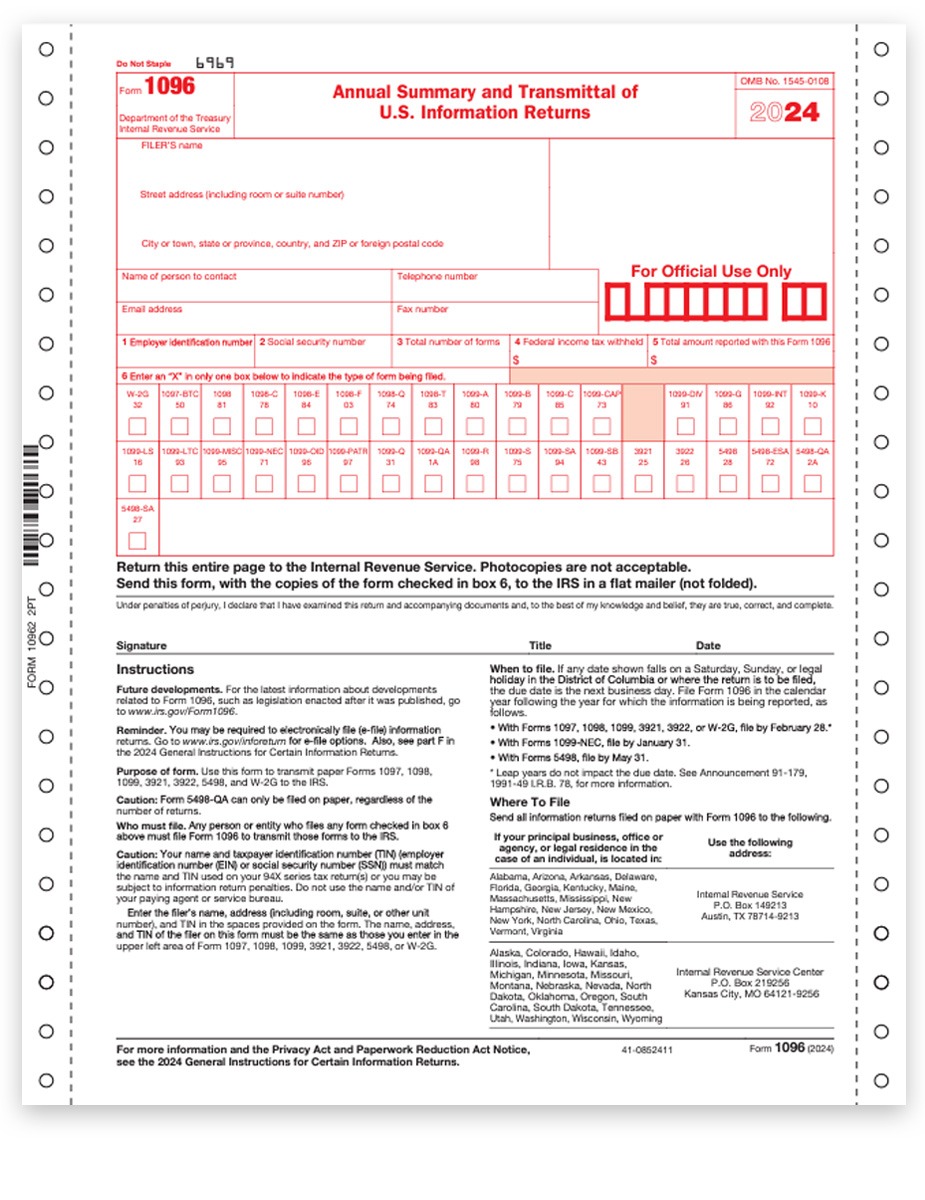

1096 Summary & Transmittal Forms

Submit one 1096 Transmittal Form to summarize the batch of Copy A forms for a single payer.

Laser forms – minimum 25 | Continuous forms – minimum 10

Insights to Easy 1099 Filing

3 Easy Ways to File 1099 & W2 Forms

If your business needs to file W2 forms for employees, or 1099s for contractors or other purposes, we offer 3 simple ways to get them done efficiently before the January 31 deadline: Online Filing, Software, and Forms

Business Penalties & Fines for Incorrect 1099 & W2 Filing

If your business fails to file 1099 & W2 forms on time, or provides incorrect information, you could incur large fines. Learn about the penalties how how to avoid them!

Navigating the IRS E-Filing Requirement Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file Copy A forms with the IRS and SSA. We make it easy! And can even print and mail recipient copies for you.

Decoding 1099NEC Copy Requirements

1099-NEC ‘Copies’, or parts, report non-employee compensation to recipients and government agencies and help ensure accuracy of income tax filing. 1099-NEC Forms are filled out by the payer and provided to the recipient and government agency.

Official vs. Condensed W2 Forms: Understanding the Formats

Understand the Different W2 Formats Easily! Compare Traditional 2up W2 Forms to 4up & 3up W2 Forms for Efficient Printing & Mailing of Employee Copies.