Official 1099 Tax Forms

Order preprinted 1099 tax forms for 2024.

- Discount prices – no coupon code needed!

- Small minimum quantities for 1099 forms

- Compatible with accounting software

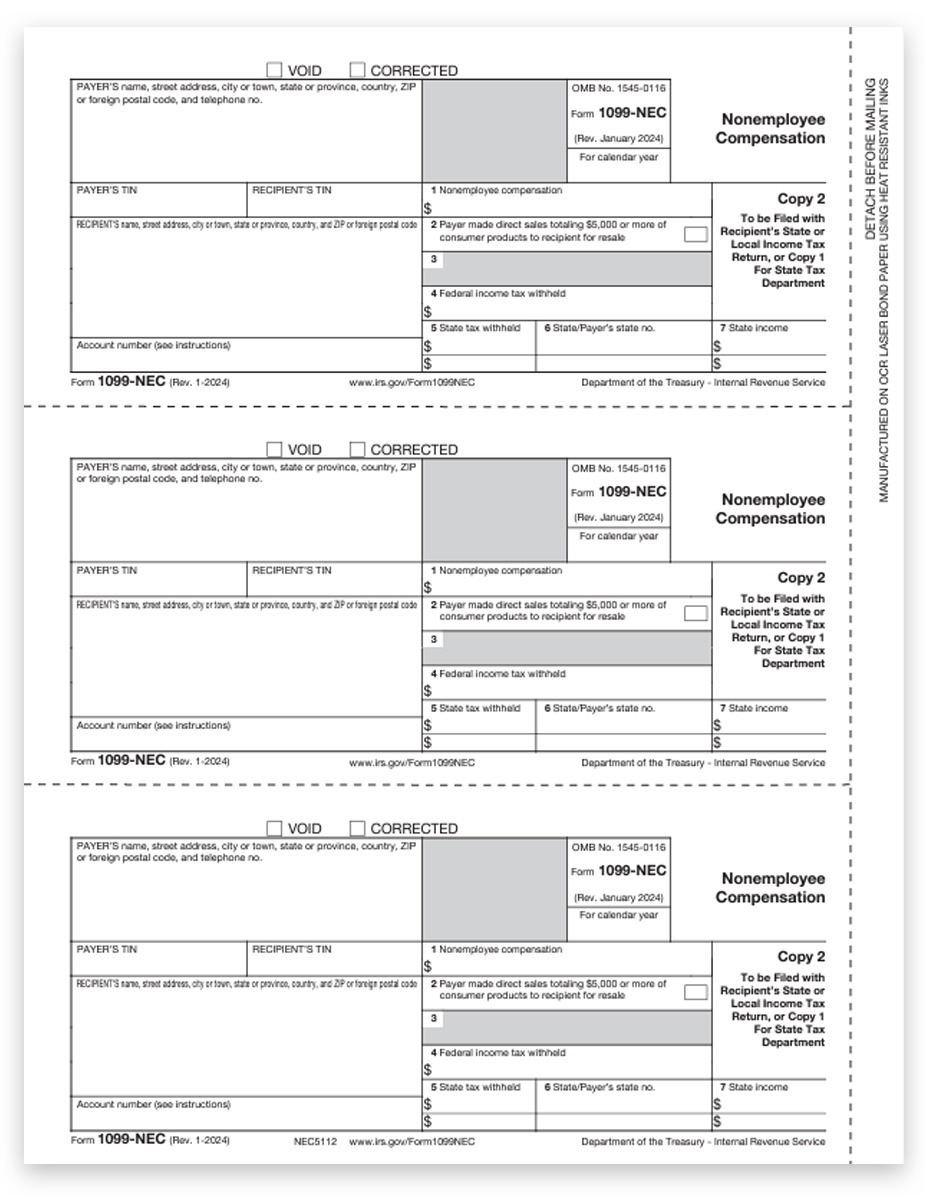

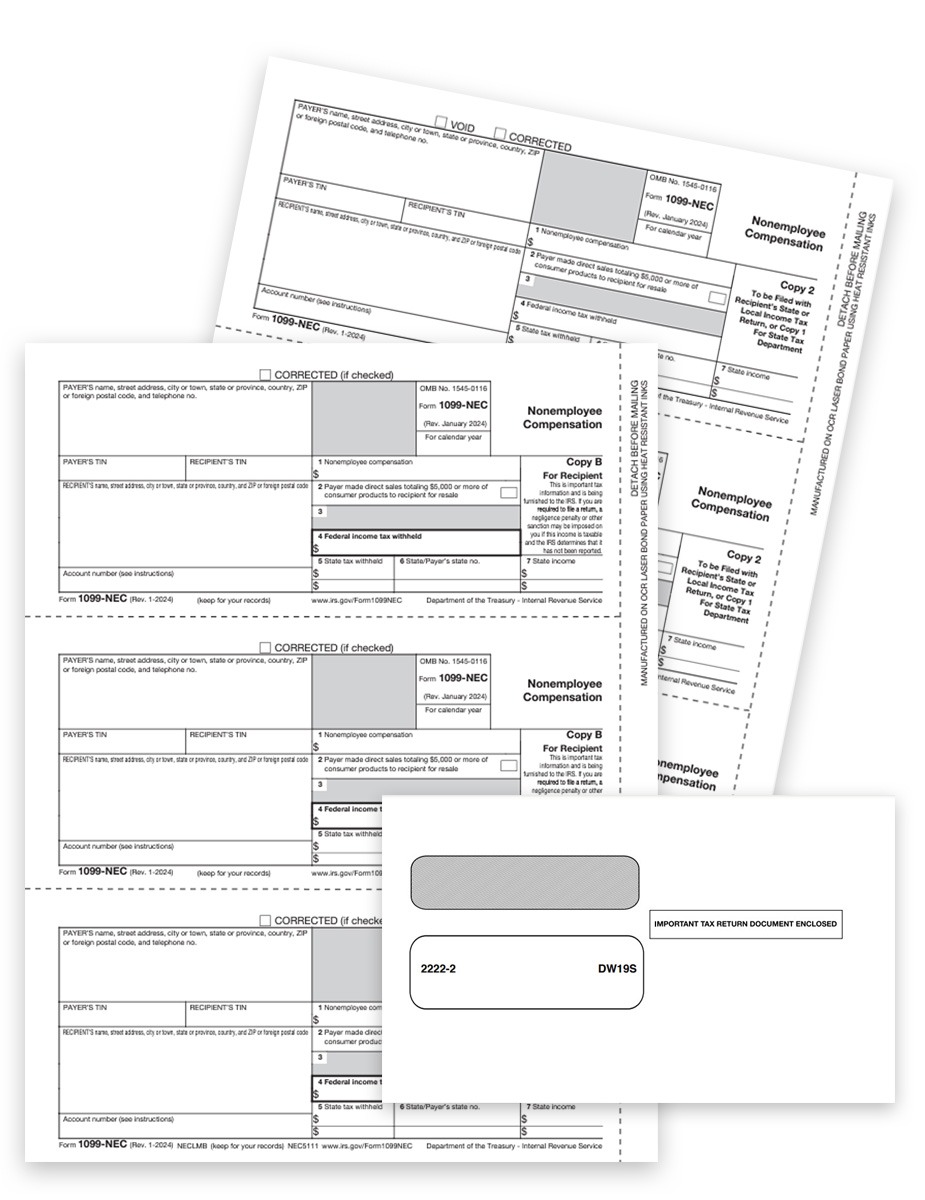

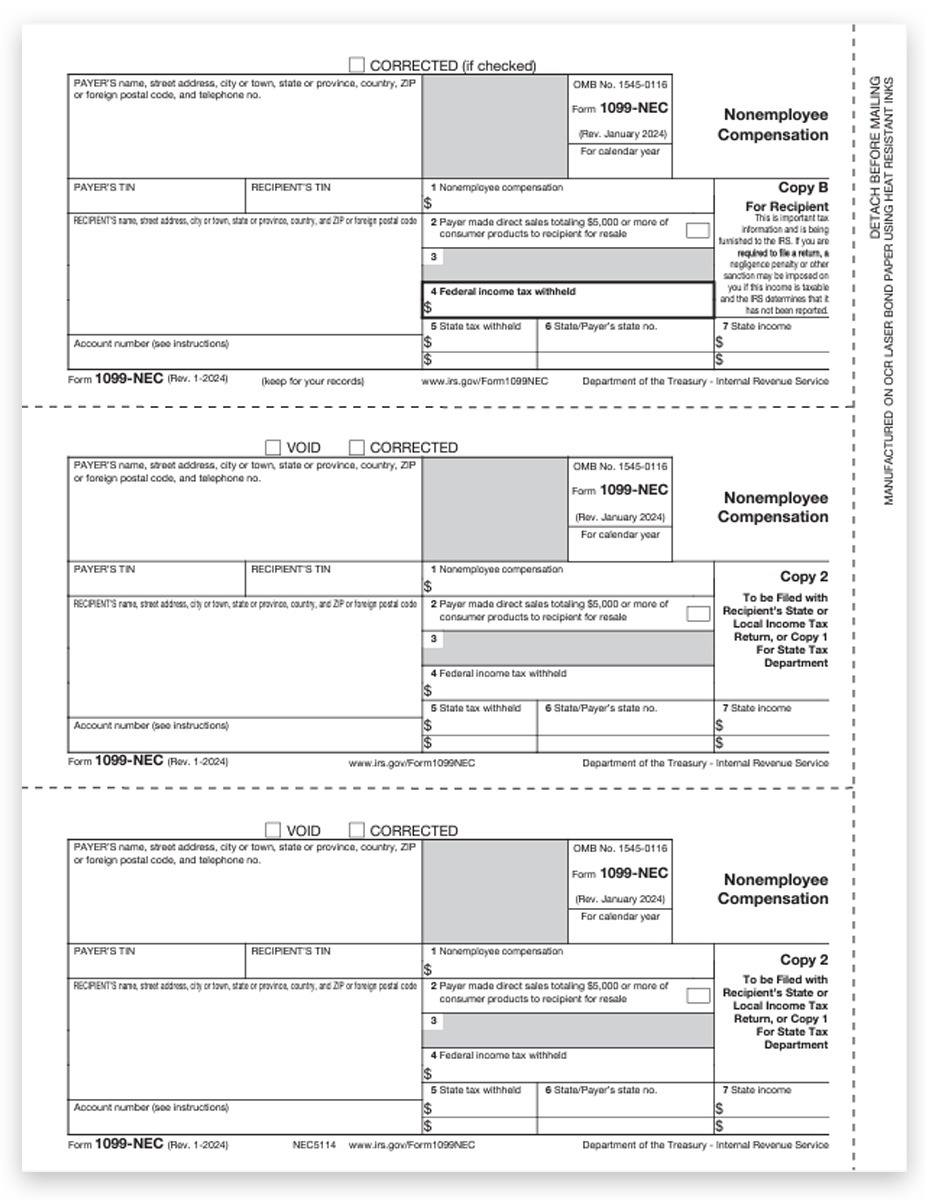

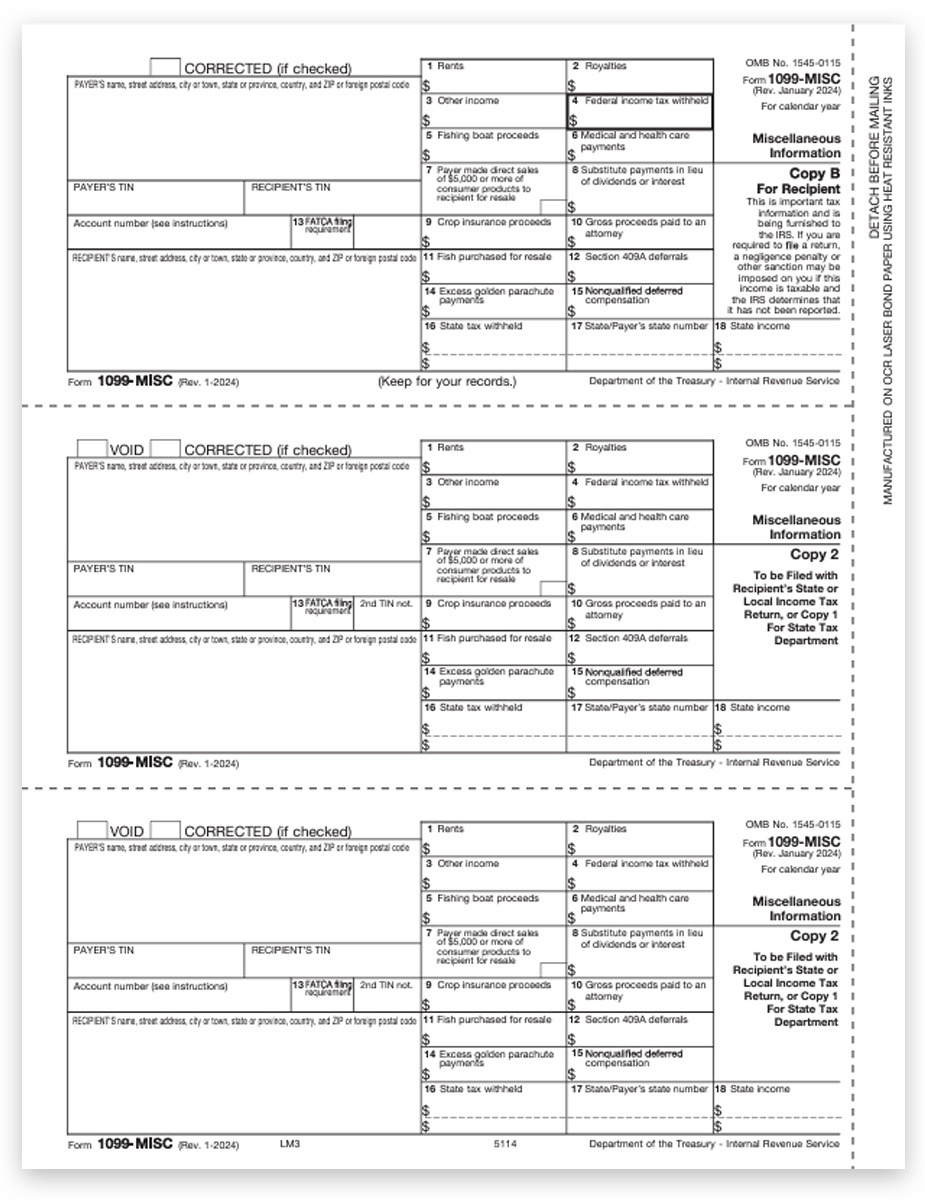

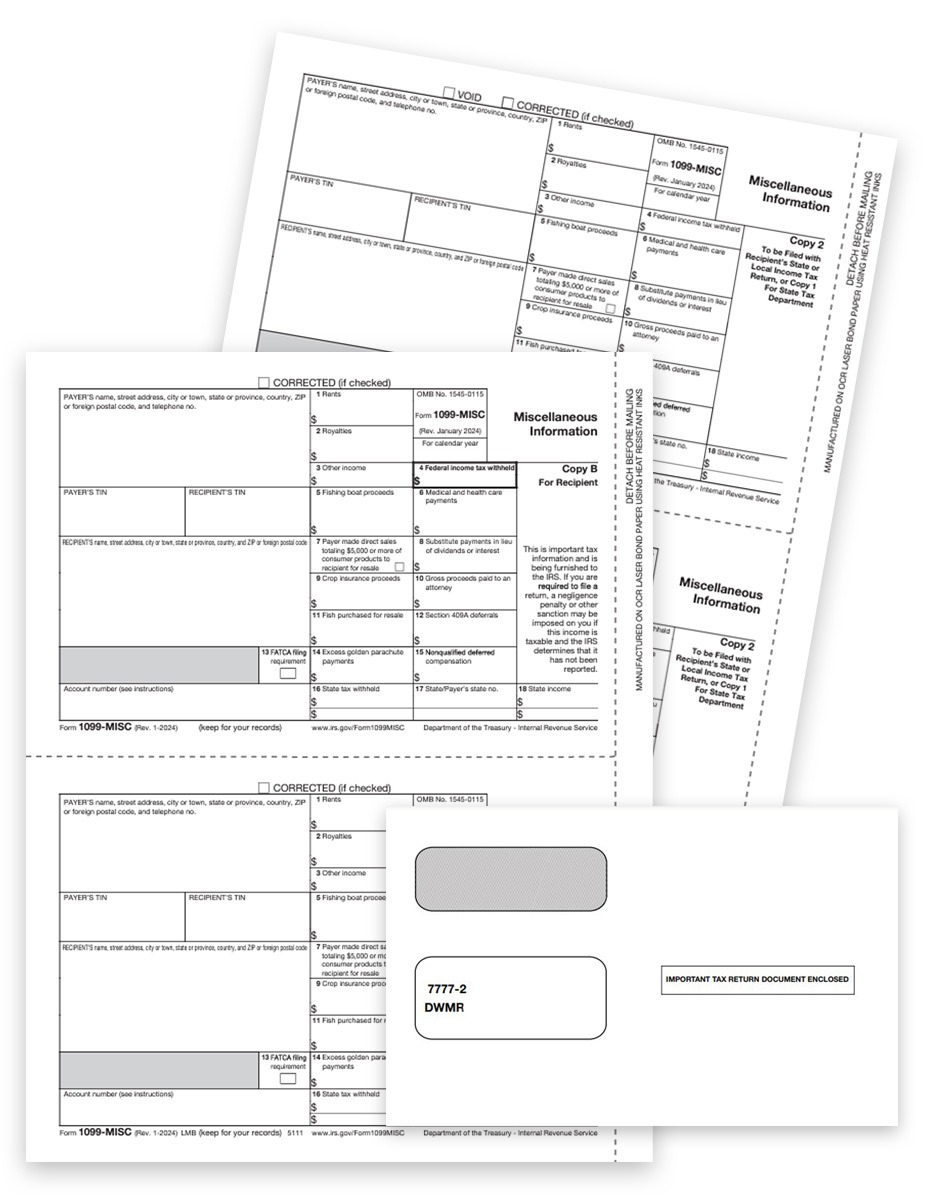

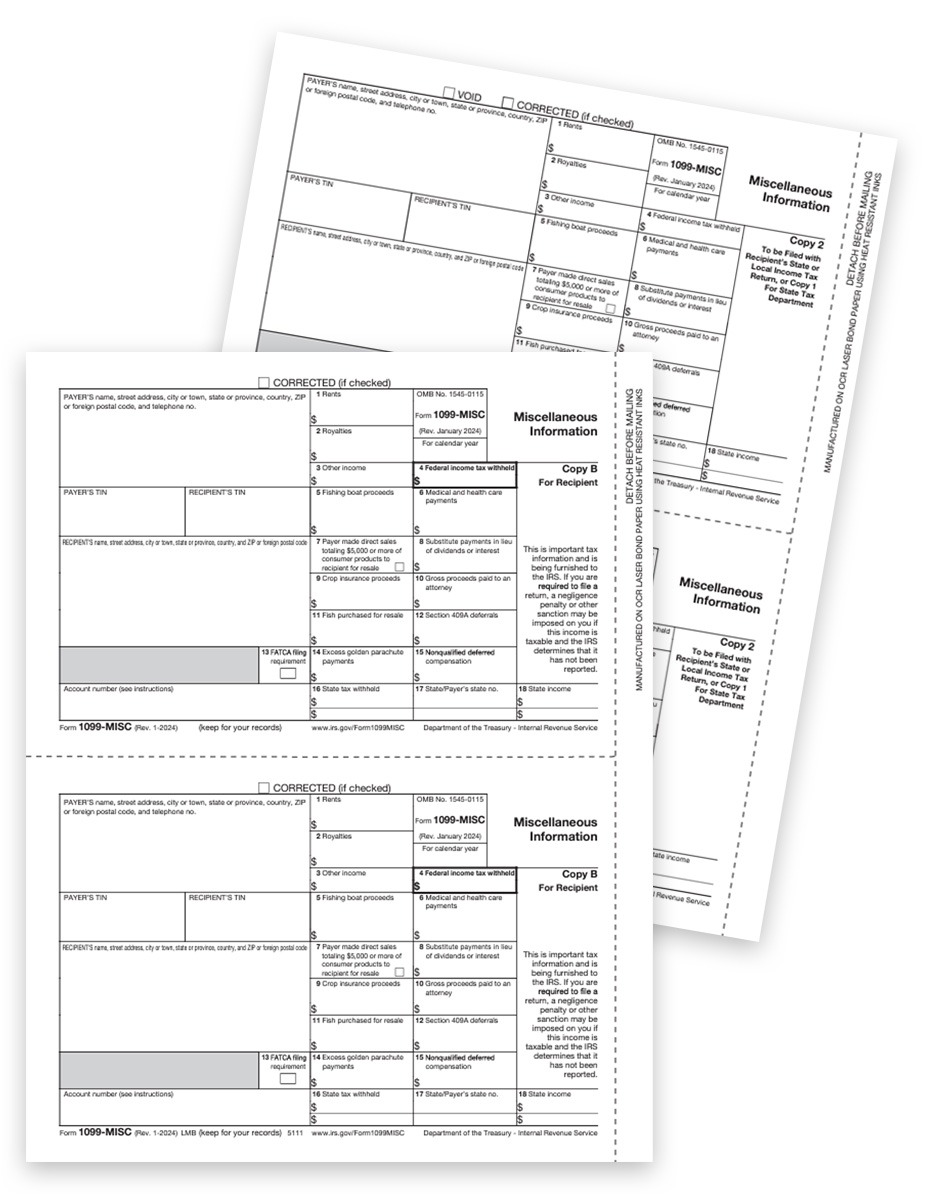

- 2024 CHANGE: Copy C is eliminated, replaced with Copy 2 for most types of 1099 forms

1099 E-filing requirements — e-file Copy A for 10+ 1099 & W2 forms combined. We make 1099 e-filing easy!

Easily print and efile official 1099 tax forms at discount prices – no coupon needed.

Shop easy with The Tax Form Gals!

Have 10+ W2 & 1099 Forms to File? You Must E-file!

The IRS requires e-filing for 10+ W2 &1099 forms, combined, per EIN.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except corrections. Efile Copy A forms by January 31, 2025.

ONLINE 1099 & W2 E-FILING = EASY 2024!

Efile, print and mail 1099 & W2 forms online.

No paper, no software, no mailing, no hassles!

Use DiscountEfile.com to enter or import data, then we'll e-file with the IRS or SSA and can even print and mail recipient copies.

Create a free account and get started today!

Order 1099 Tax Forms for 2024

1098

Mortgage Interest

1098-E

Student Loan Interest

1098-T

Tuition Payments

1099-B

Proceeds from Broker Transactions

1099-C

Cancellation of Debt

1099-CAP

Corporate or Capital Changes

1099-DIV

Dividends and Distributions

1099-G

Certain Government Payments

1099-INT

Interest income

1099-K

Payment Cards & Transactions

1099-LTC

Long-Term Care & Death Benefits

1099-MISC

Miscellaneous Income

1099-NEC

Non-Employee Compensation

1099-OID

Original Issue Discount

1099-PATR

Distributions from Cooperatives

1099-R

Distributions from Retirement Plans, etc.

1099-S

Proceeds from Real Estate

1099-SA

HSA / MSA Distributions

5498

IRA Contributions

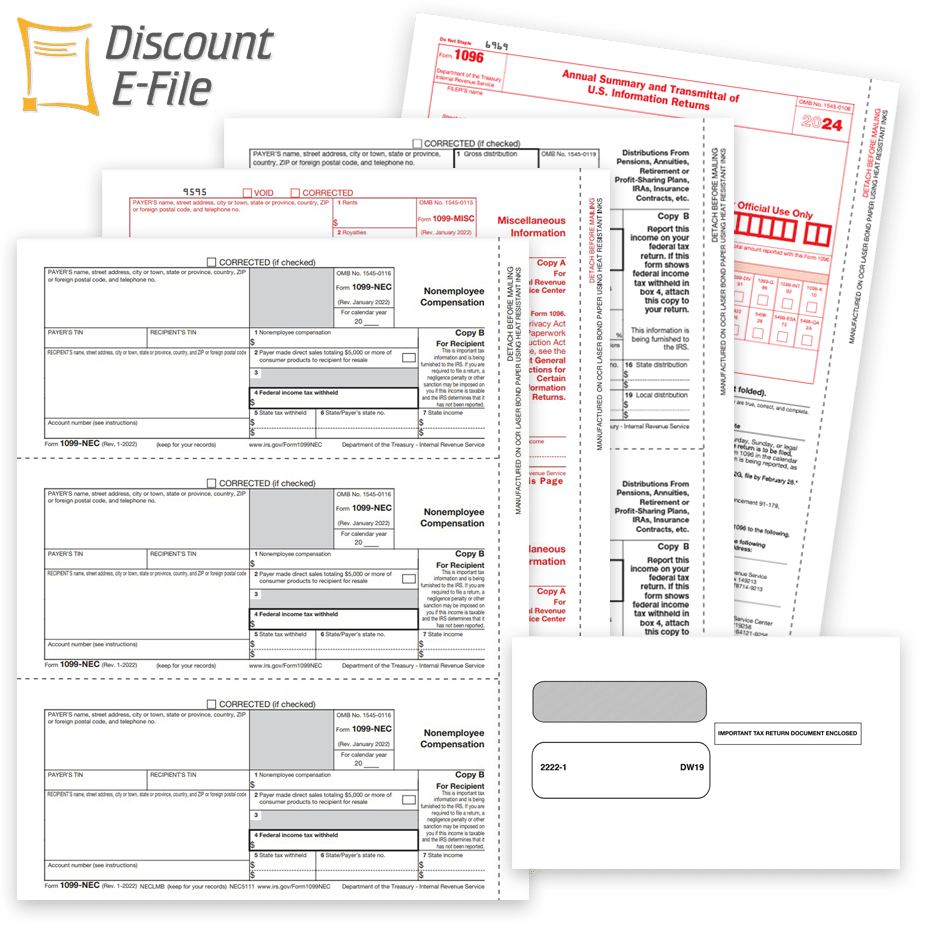

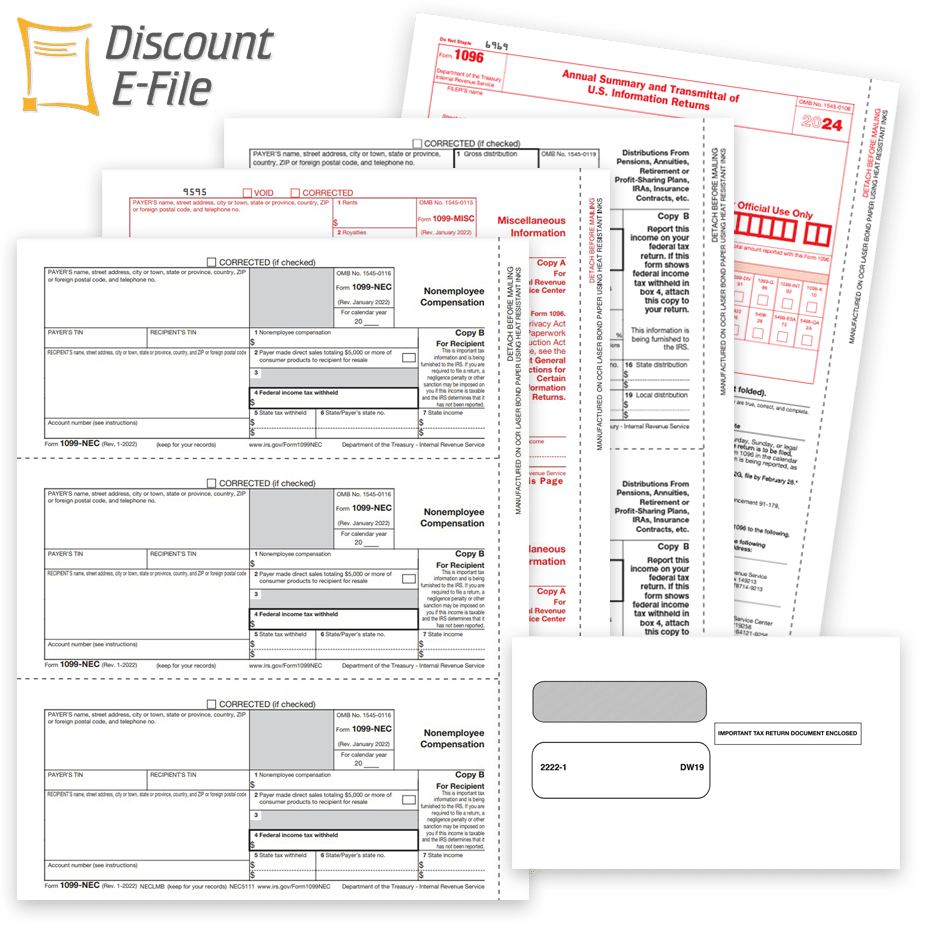

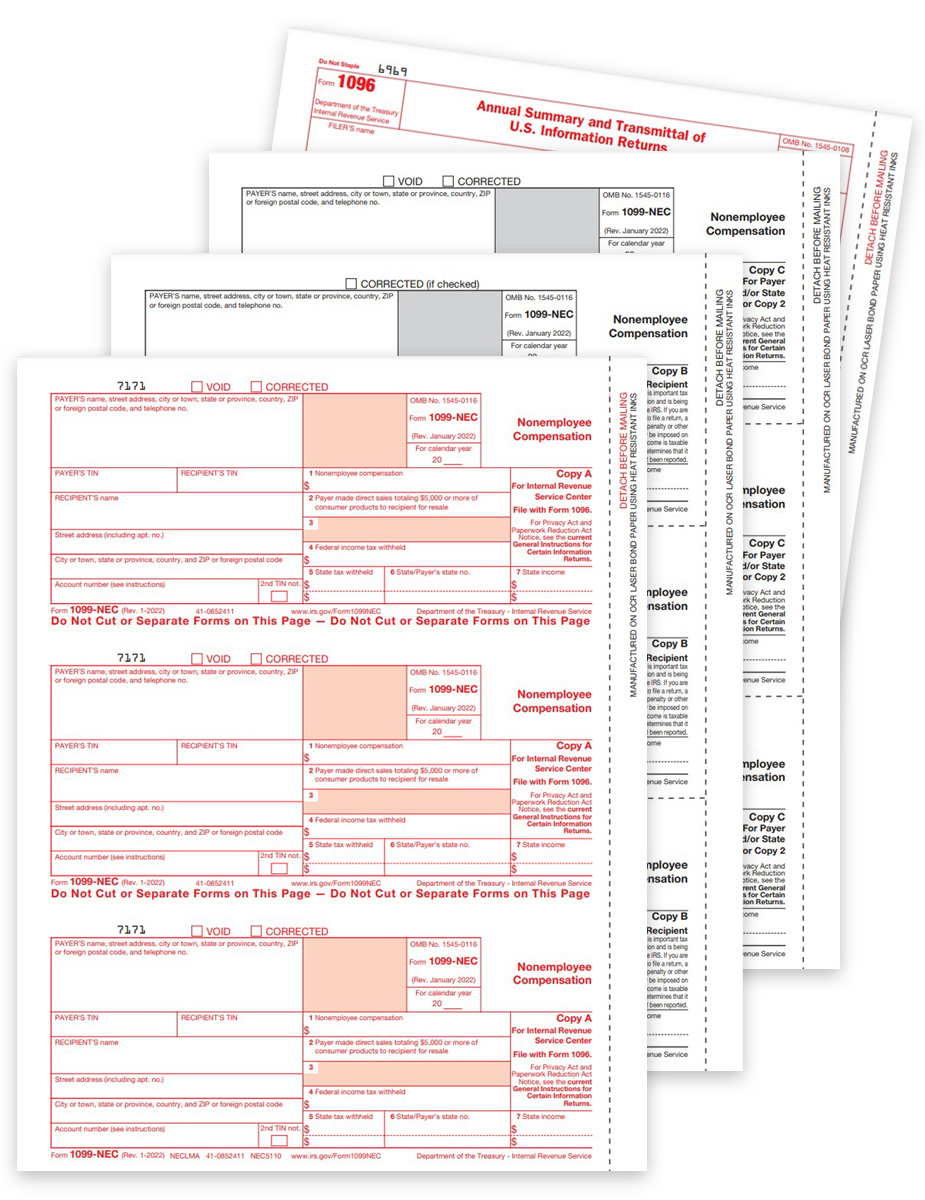

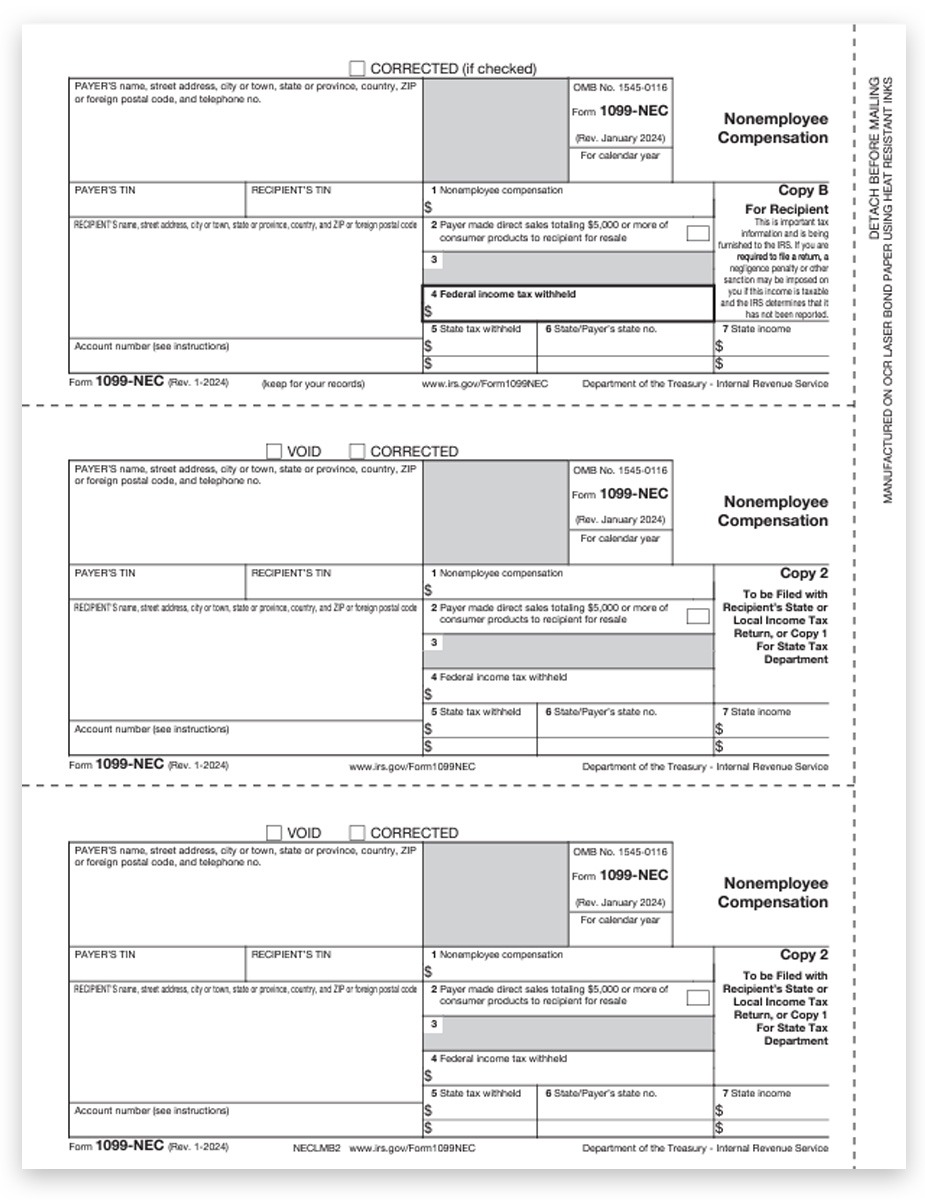

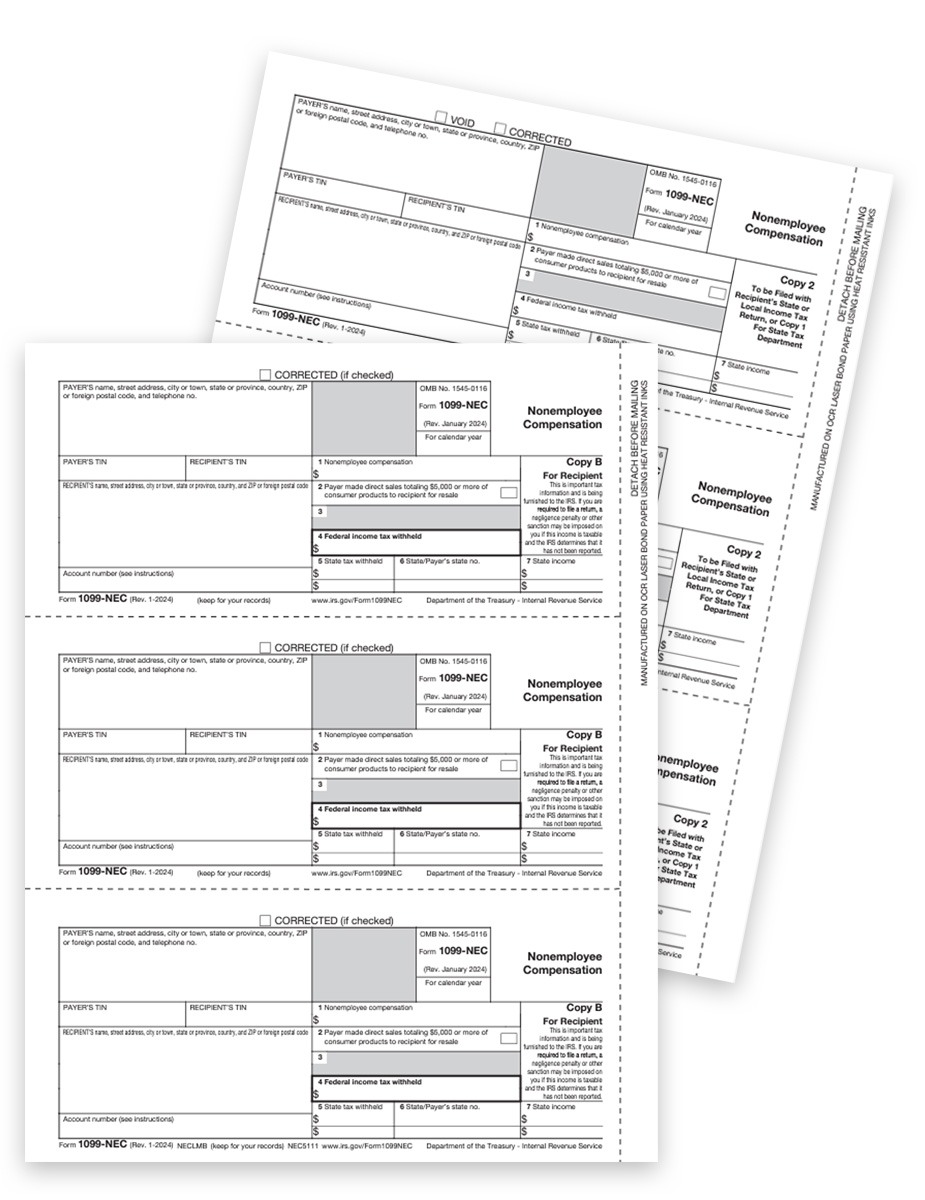

1099-NEC Forms

for Non-Employee Compensation

-

1099 Envelope – 3up

-

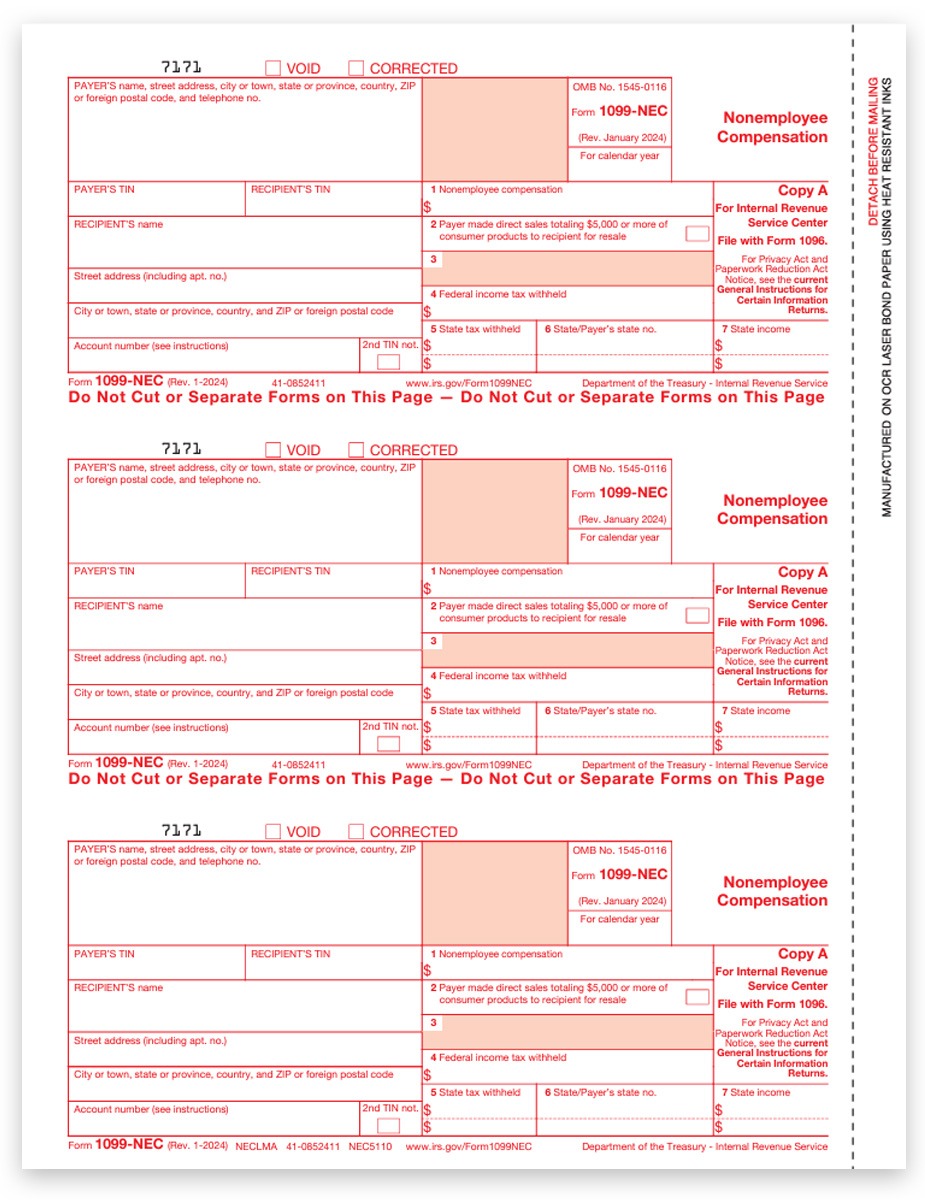

1099-NEC Form – Copy A, Payer Federal

-

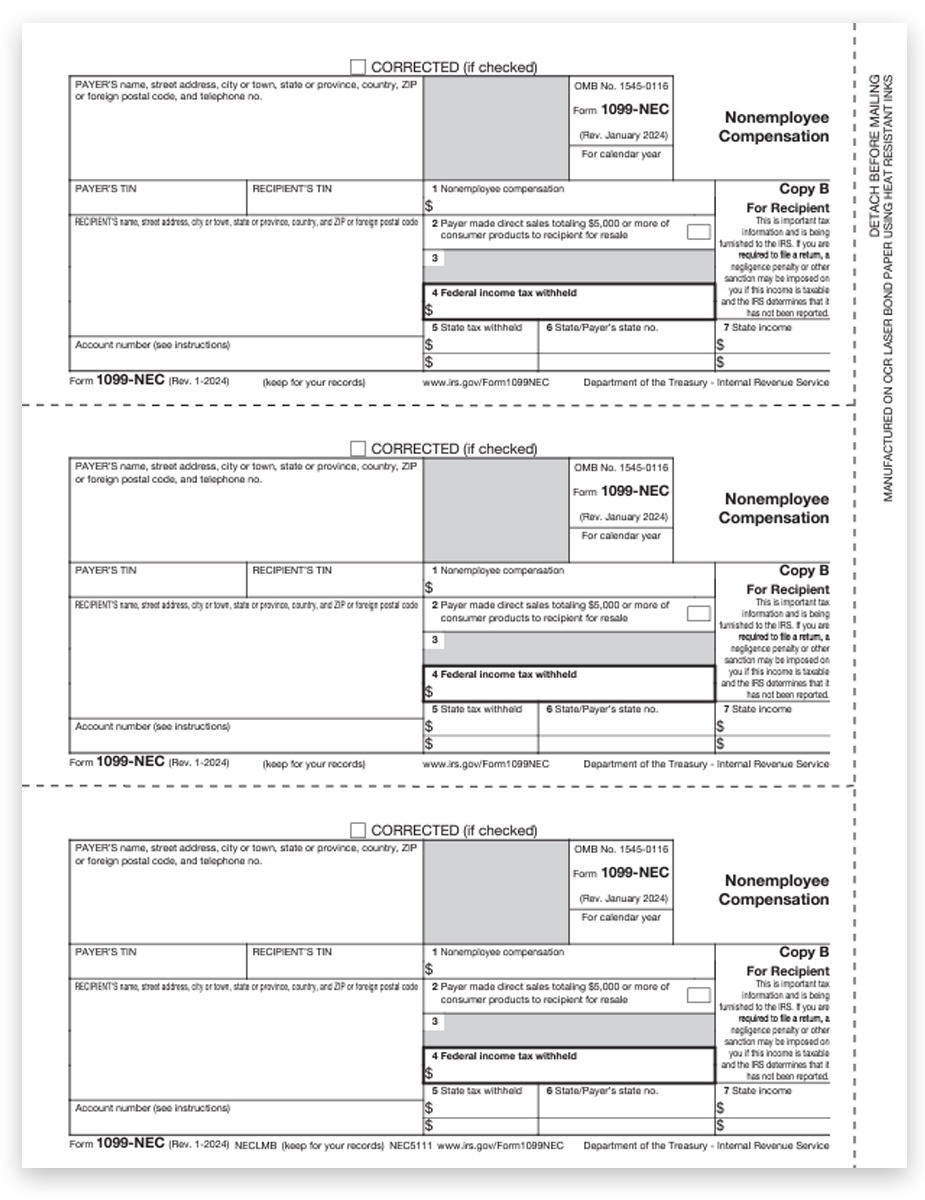

1099-NEC Form – Copy B Recipient

-

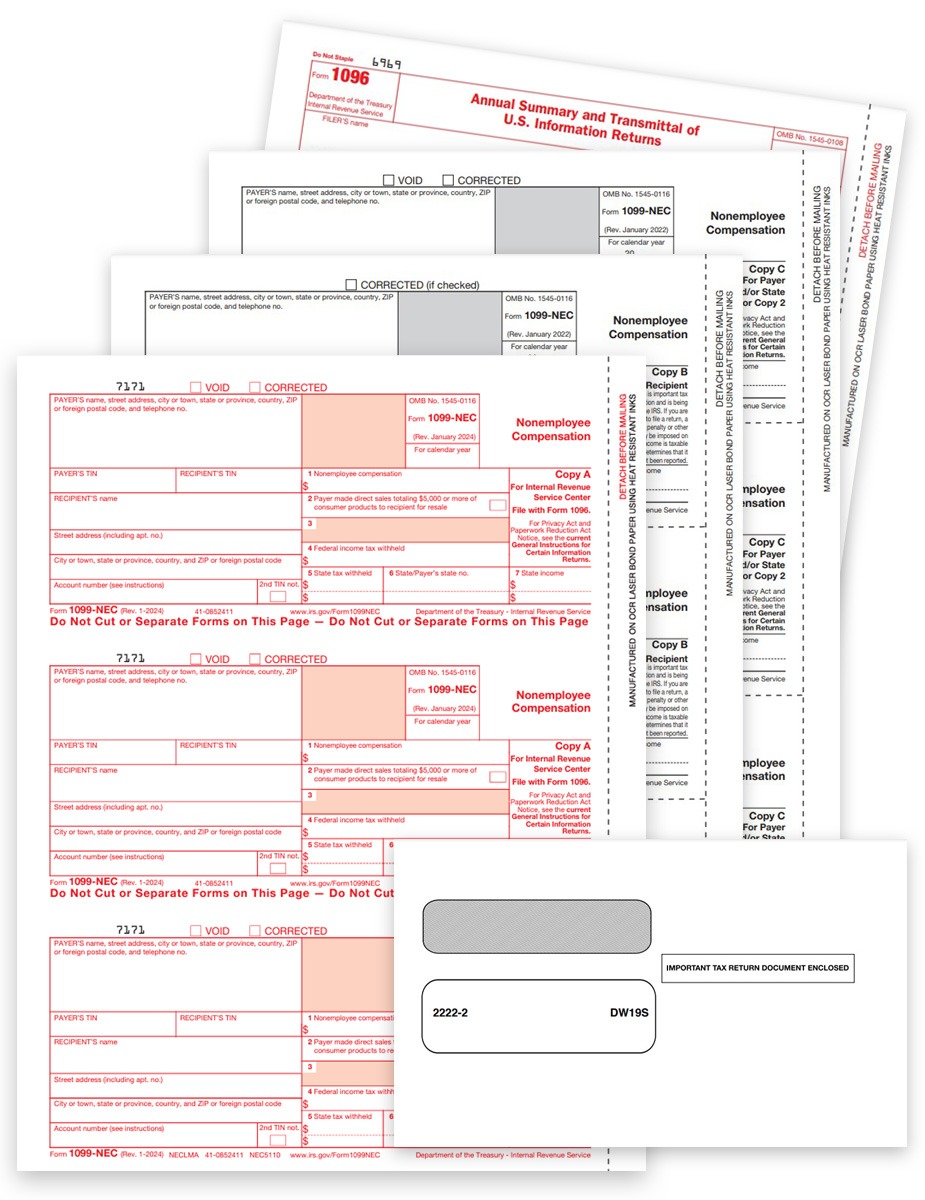

1099-NEC Forms Set with Envelopes

-

1099-NEC Form – Copy 2 Payer

-

1099-NEC Forms Set

-

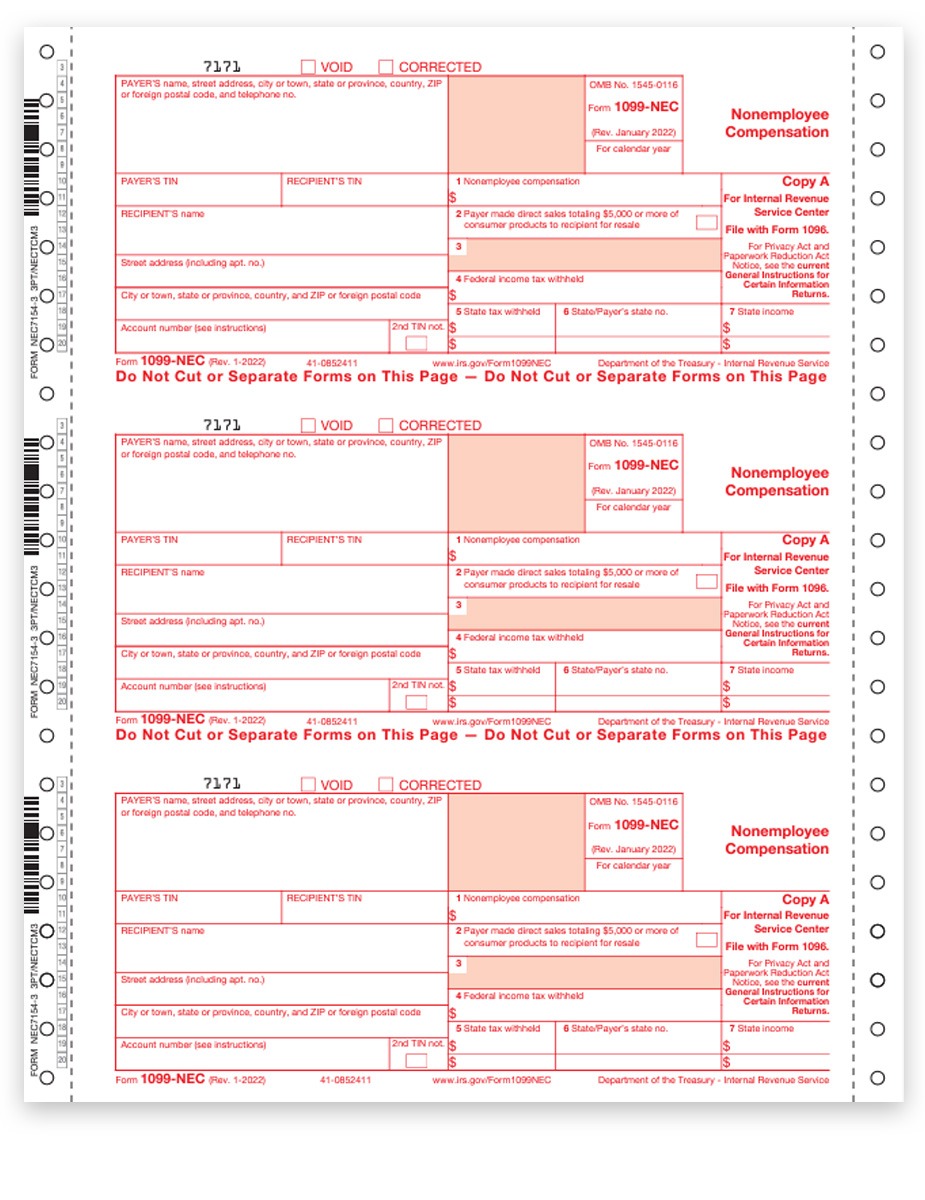

1099-NEC Carbonless Continuous Forms

-

1099-NEC Forms Sets with Envelopes for E-filers – 3-part

-

1099-NEC Form – Combined Copy B-2-Extra Recipient & Payer

-

1099-NEC Form – Combined Copy B-2-2 for Recipient

-

1099-NEC Forms Sets for E-filers – 3-part

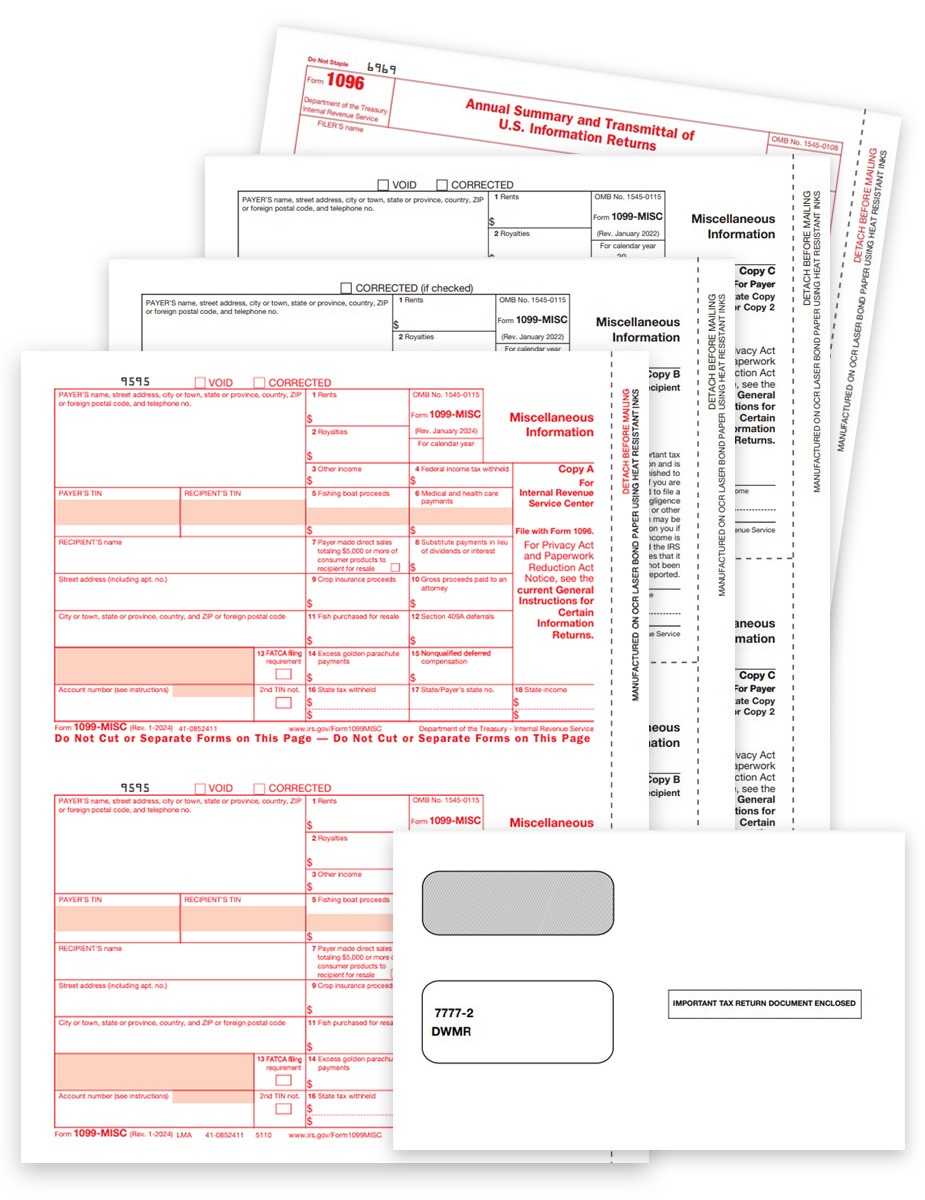

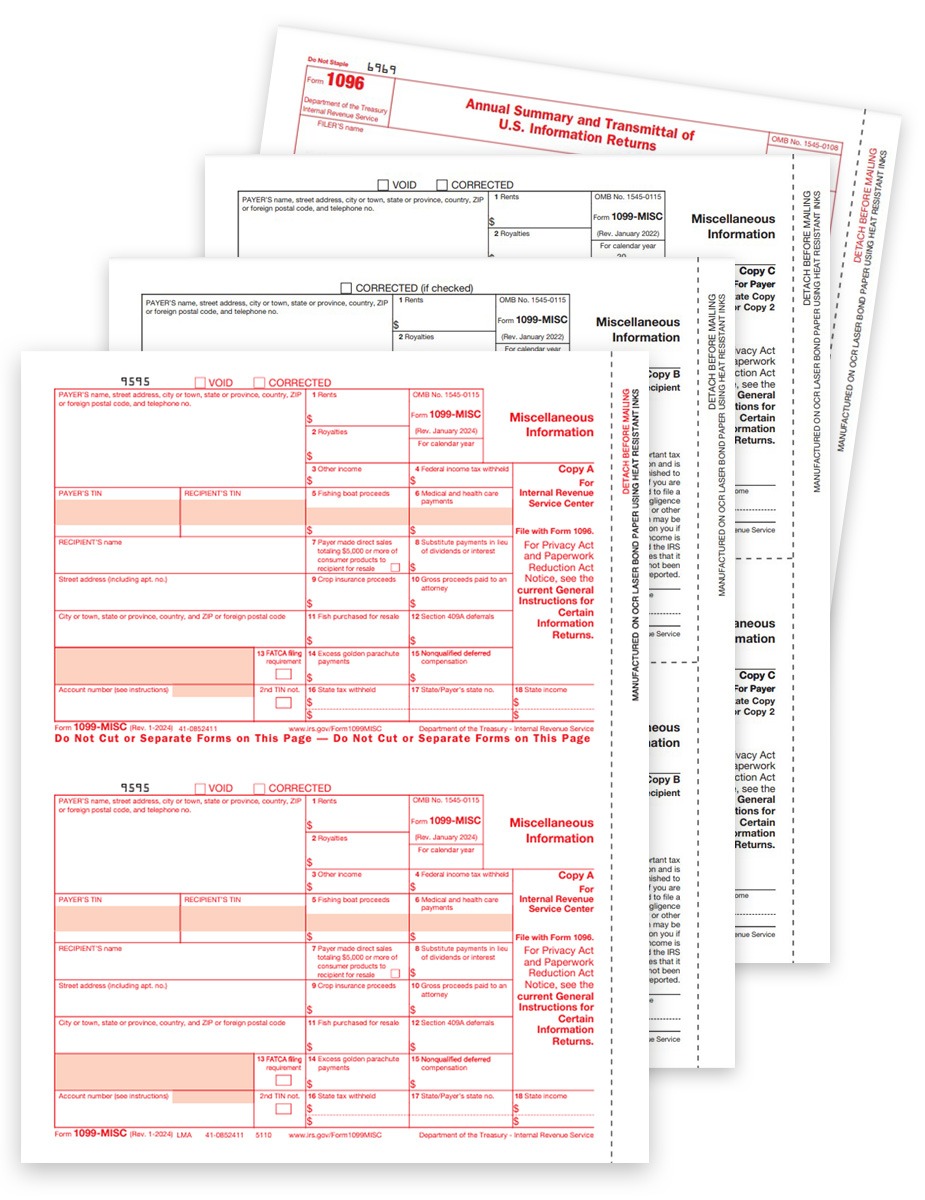

1099-MISC Forms

for Miscellaneous Income

-

1099 Envelope – 3up

-

1099 Envelope – 2up

-

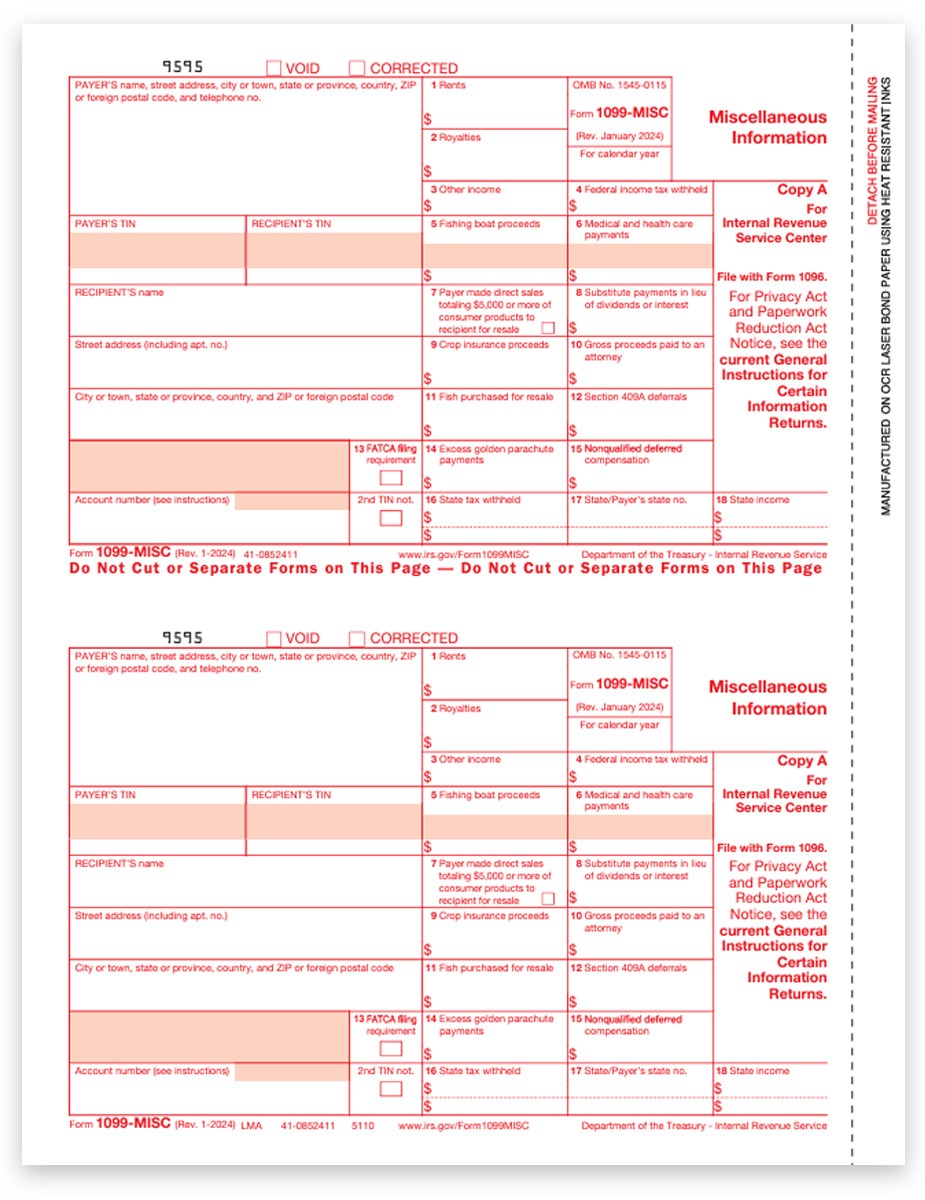

1099-MISC Form – Copy A Federal

-

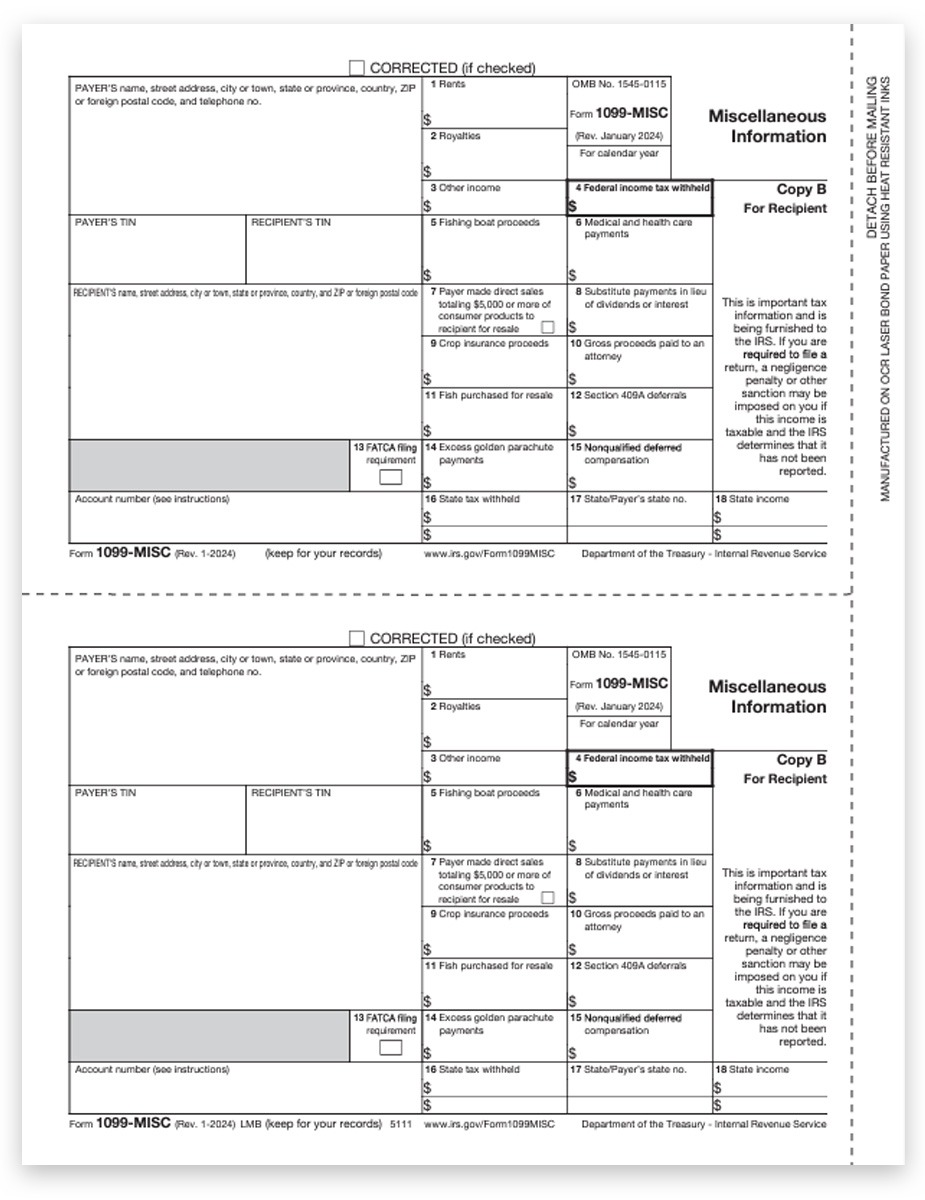

1099-MISC Form – Copy B Recipient

-

1099-MISC Forms Set with Envelopes

-

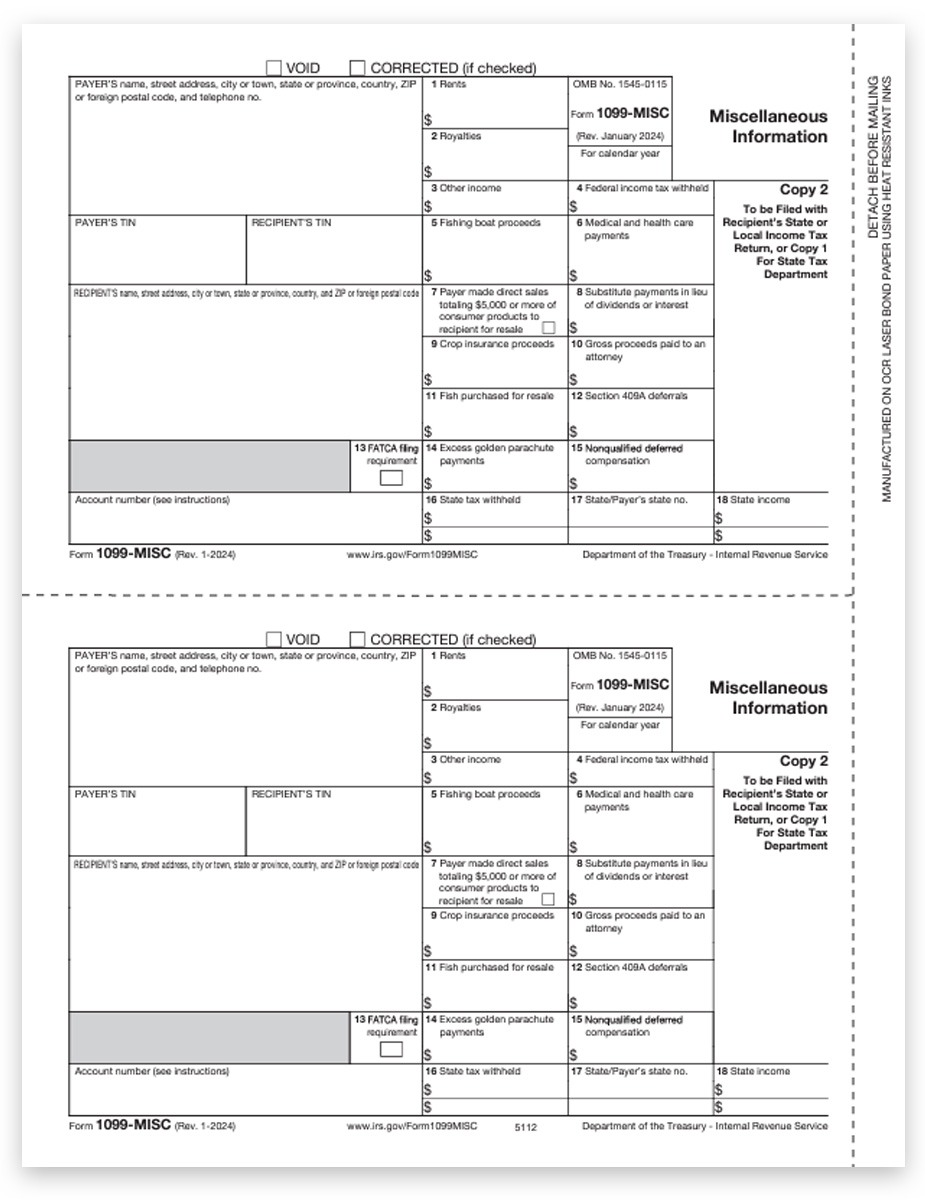

1099-MISC Form – Copy 2 Payer/State

-

1099-MISC Forms Set

-

1099-MISC Form – Copy B-2-2 3up for Payer & Recipient

-

1099-MISC Forms Set with Envelopes for Efilers – 3-part

-

1099-MISC Forms Set for Efilers – 3-part

Rely on The Tax Form Gals for personal, friendly service and fast shipping.

As a women-owned and operated business in Michigan, the friendly Tax Form Gals at Discount Tax Forms work hard for you, and have fun every day – even on Mondays!

With the goal of delivering the best value and best service for essential business supplies that you rely on every day to make your small business run like a well oiled machine.

Give us a call at 877.824.2458 or email hello@taxformsgals.com.

Insights to Easy 1099 Form Filing

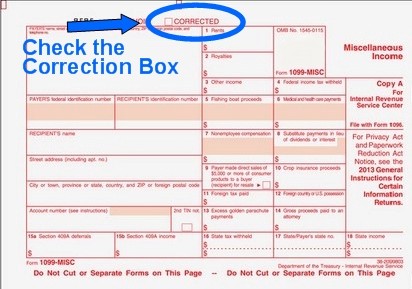

How to Correct a 1099 Form

You do not need to correct a 1099 the same way you filed it, so if you mailed a paper copy, you can e-file a correction, or vice versa. However, if you have 250 or more corrections that need to be filed, they MUST be e-filed with the IRS. Learn More >

The easiest way to correct a 1099-MISC form is by using our 1099 Filing Hub > You simply enter the corrected information and we e-file with the IRS and generate a correction form that you print in your office.

Instantly Efile a Corrected 1099

Or, you can Order new 1099-MISC forms to file a correction. Simply check the ‘Corrected’ box at the top and mail it to the IRS and the recipient.

Business Penalties & Fines for Incorrect 1099 & W2 Filing

If your business fails to file 1099 & W2 forms on time, or provides incorrect information, you could incur large fines. Learn about the penalties how how to avoid them!

How to Correct a 1099 Form

If you need to correct a 1099 form because the original has errors, you will need to re-file the 1099 form and check the box at the top. But there is an easier way…

Decoding 1099-MISC Copy Requirements

1099-MISC ‘Copies’, or parts, report income to recipients and government agencies and help ensure accuracy of income tax filing. 1099-MISC Forms are filled out by the payer and provided to the recipient and government agency.