E-Filing Requirements for 1099 & W2 Forms

Most businesses need to E-file 1099 & W2 Copy A forms with the IRS and SSA in 2024.

The threshold for e-file is 10 forms per EIN – for 1099 and W2 forms combined.

If a business files 10 or more 1099 and W2 forms, they MUST e-file the Copy A in 2024 with the change enacted last year.

Learn more about the requirements below and find easy e-filing solutions from The Tax Form Gals at Discount Tax Forms!

Easily comply with 1099 & W2 e-filing requirements with DiscountEfile.com.

Efile is Easy with The Tax Form Gals!

E-filing Requirements for 1099 & W2 IRS Filing for the 2024 Tax Year

The e-file threshold for 2024 is 10 or more W2 and 1099 forms, combined, per EIN.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except correction forms. Here is a great article with insights to the changes enacted last year.

For example, if your business has 5 1099NEC forms and 5 W2 forms, you must e-file the red Copy A forms with the IRS and SSA by January 31, 2025.

Penalties apply if you don’t – $60 per form if you file on time and up to $310 per form if you file late.

ONLINE 1099 & W2 E-FILING = EASY 2024!

Efile, print and mail 1099 & W2 forms online.

No paper, no software, no mailing, no hassles!

Use DiscountEfile.com to enter or import data, then we'll e-file with the IRS or SSA and can even print and mail recipient copies.

Create a free account and get started today!

Official IRS Statement Regarding 1099 & W2 Efiling Requirements.

Regulations section 301.6011-2 was amended by Treasury Decision 9972, published February 23, 2023, which lowers the threshold to 10 for which employers must file certain information returns electronically, including Forms W-2, W-2AS, W-2GU, W-2VI, and Form 499R-2/W-2PR (collectively Forms W-2), but not Form W-2CM.

To determine whether they must file information returns electronically, employers must add together the number of information returns (see the list below) and the number of Forms W-2 they must file in a calendar year. If the total is at least 10 returns, they must file them all electronically.

The new threshold is effective for information returns required to be filed in calendar years beginning with 2024. The new rules apply to tax year 2023 Forms W-2 because they are required to be filed by January 31, 2025.

The following information return forms must be added together for this purpose: Form 1042-S, the Form 1094 series, Form 1095-B, Form 1095-C, Form 1097-BTC, Form 1098, Form 1098-C, Form 1098-E, Form 1098-Q, Form 1098-T, the Form 1099 series, Form 3921, Form 3922, the Form 5498 series, Form 8027, and Form W-2G.

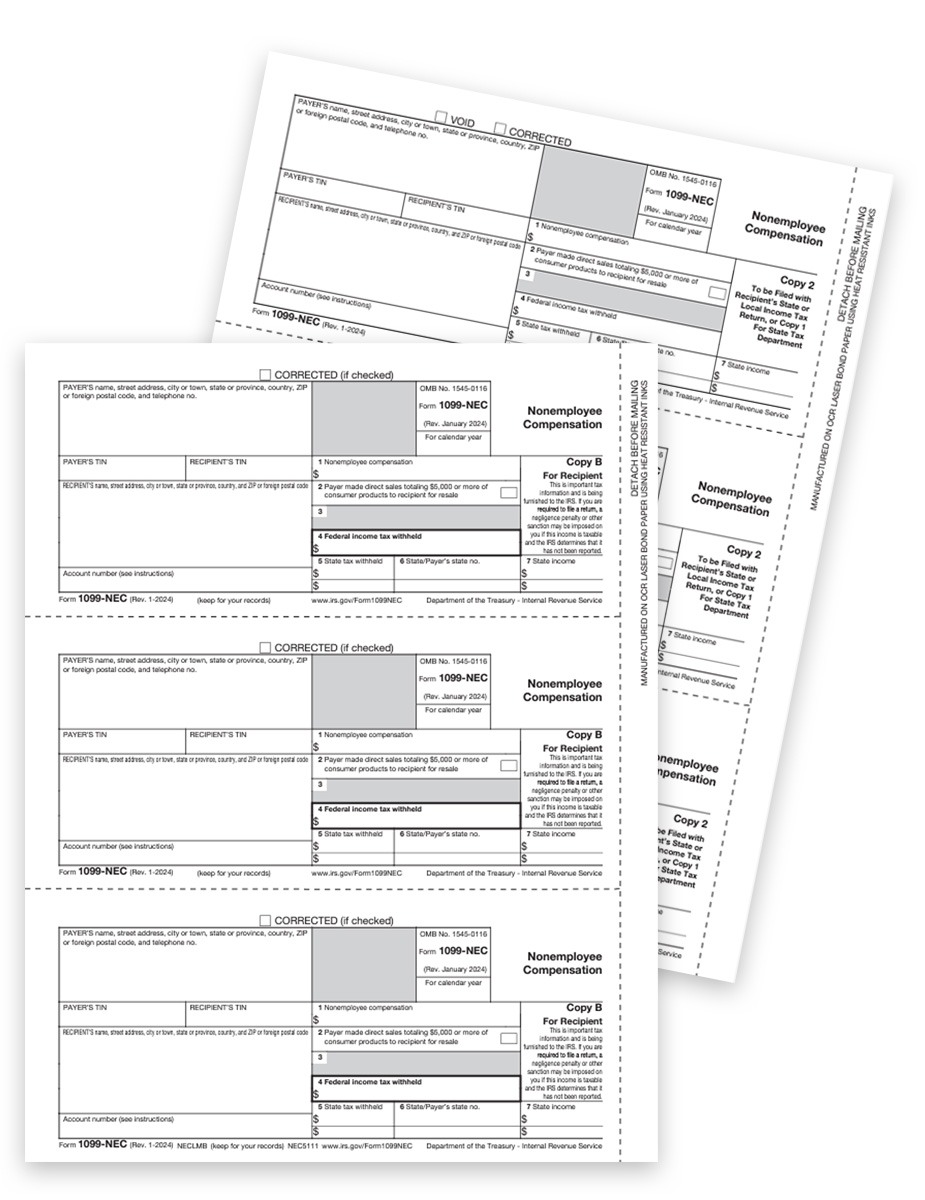

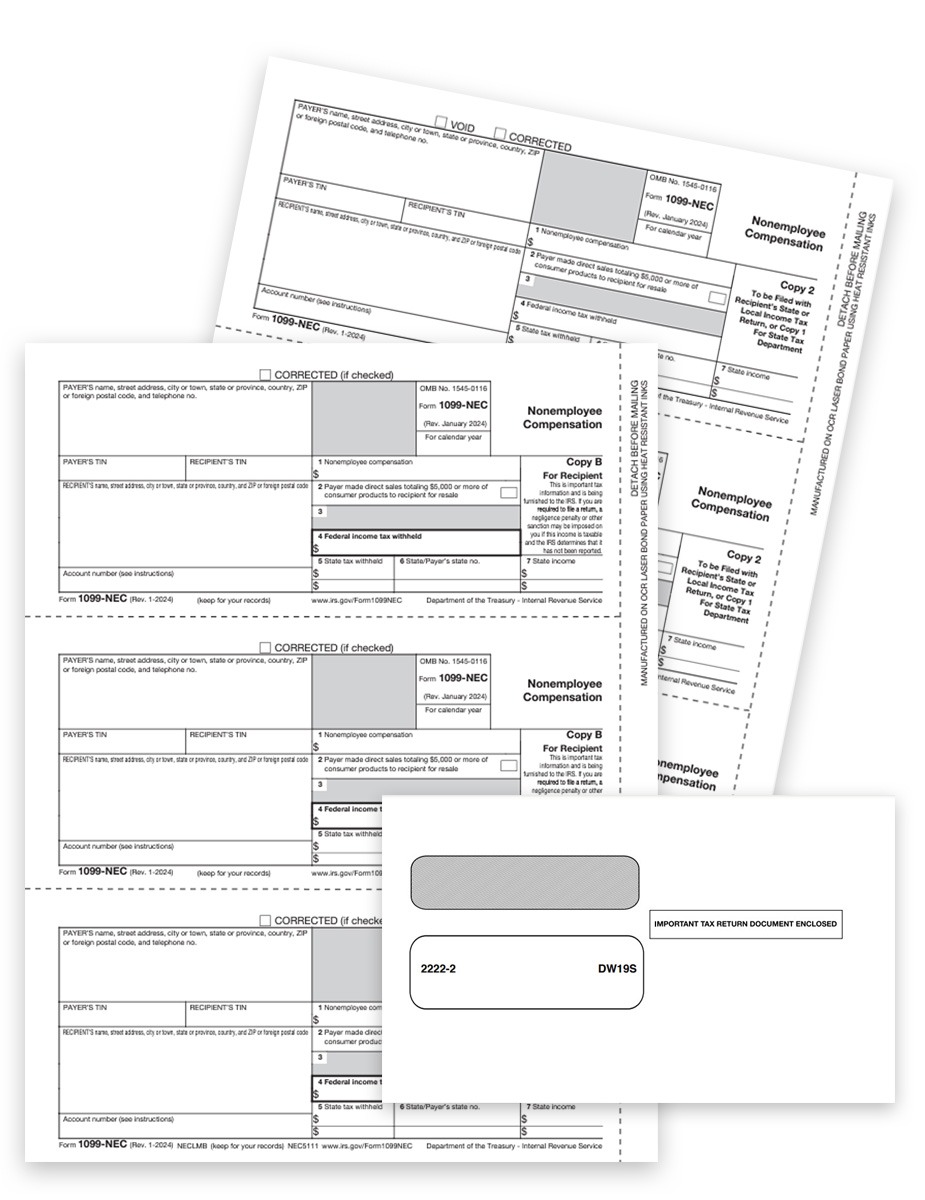

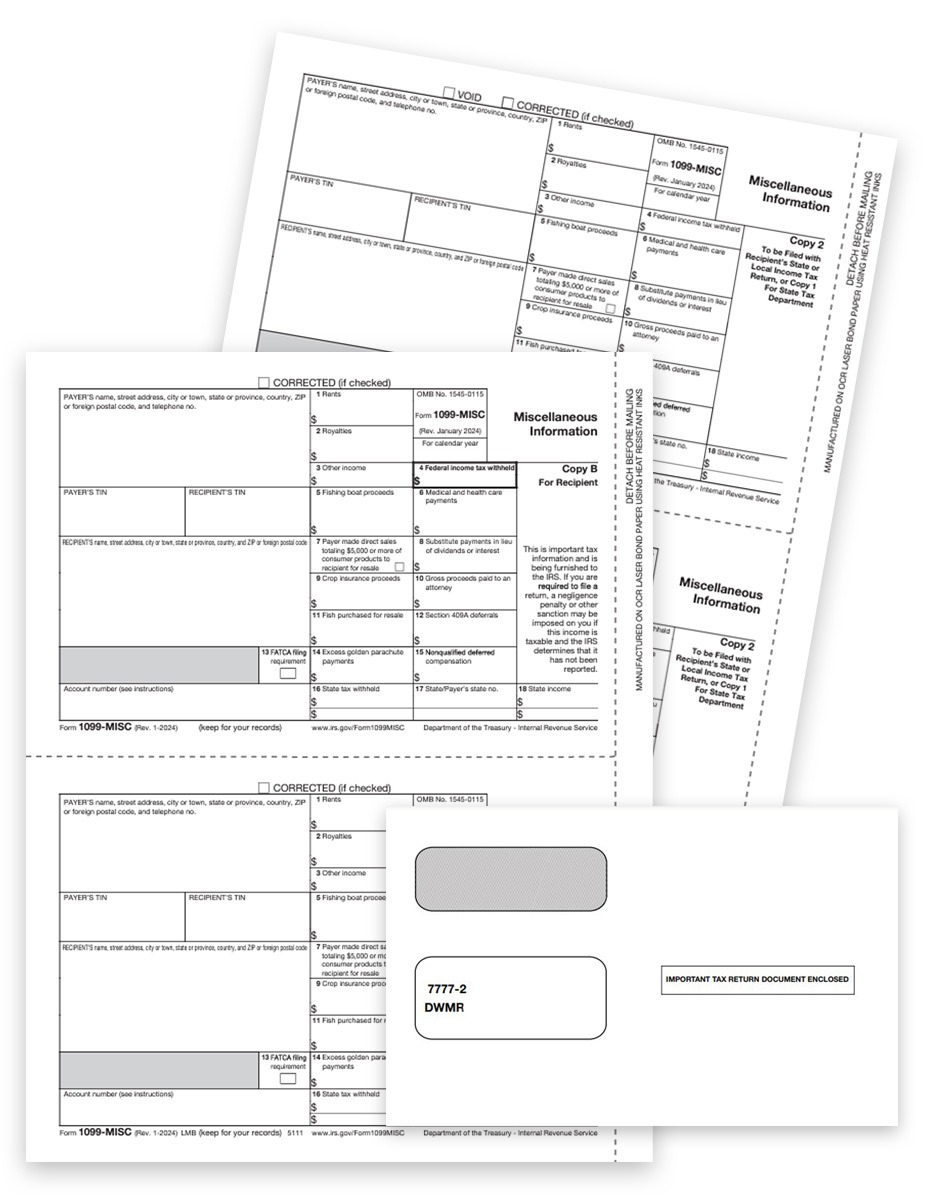

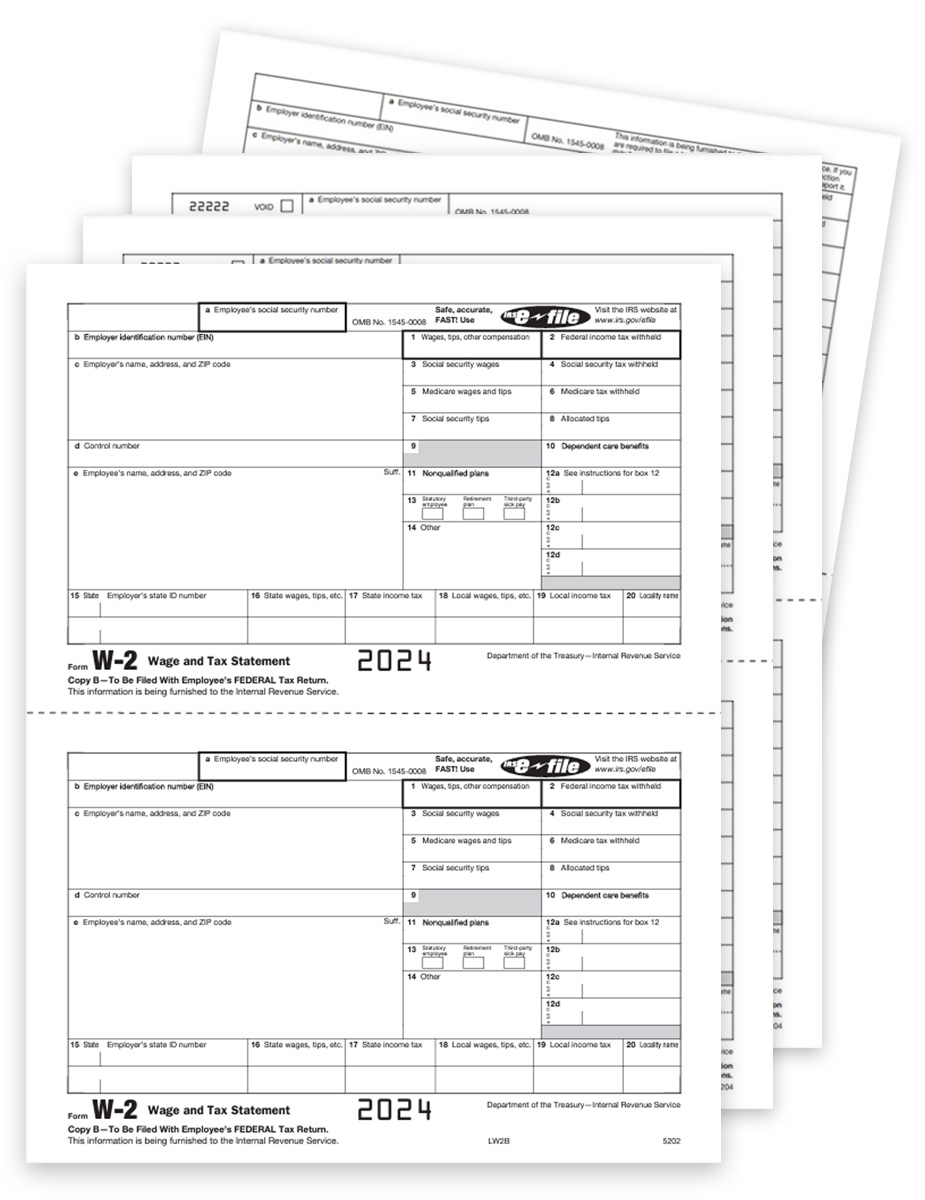

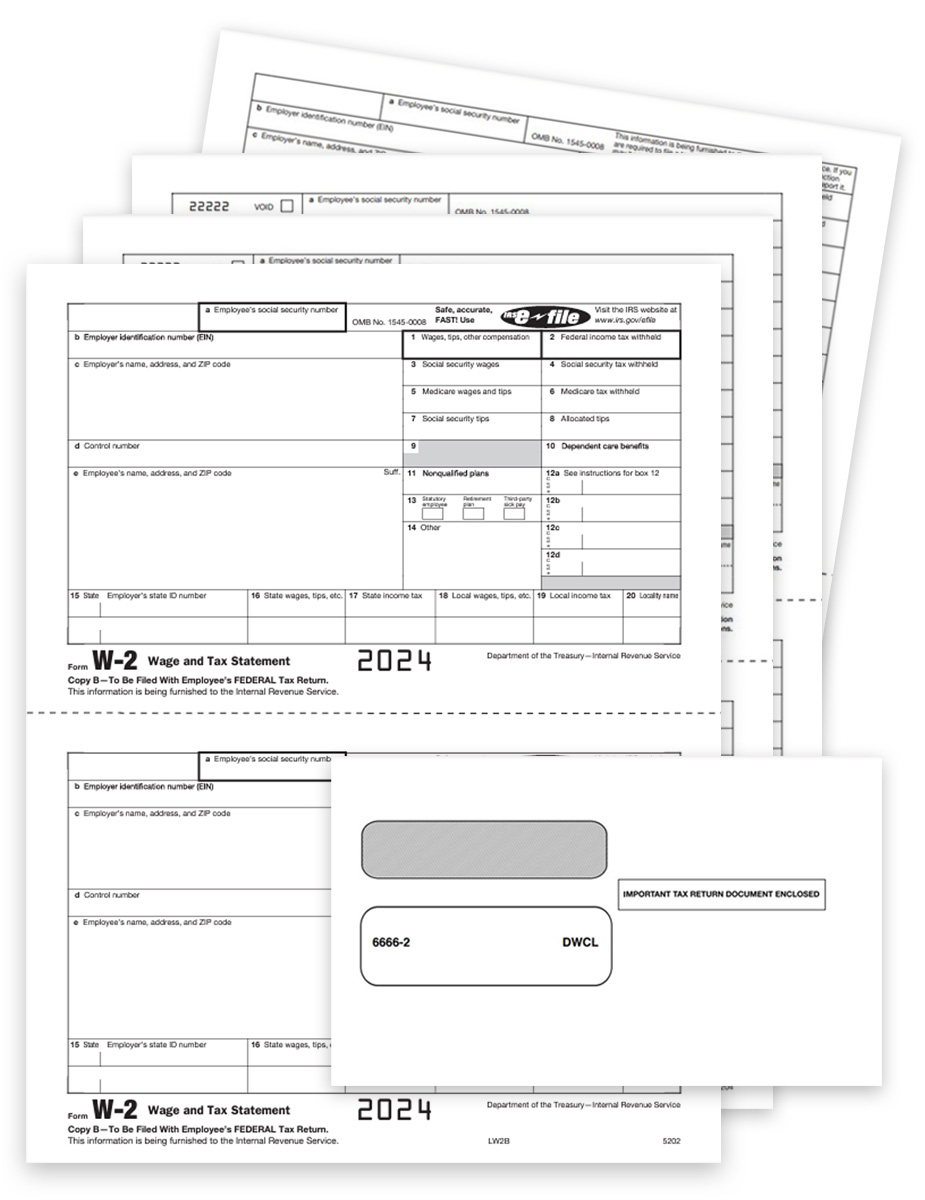

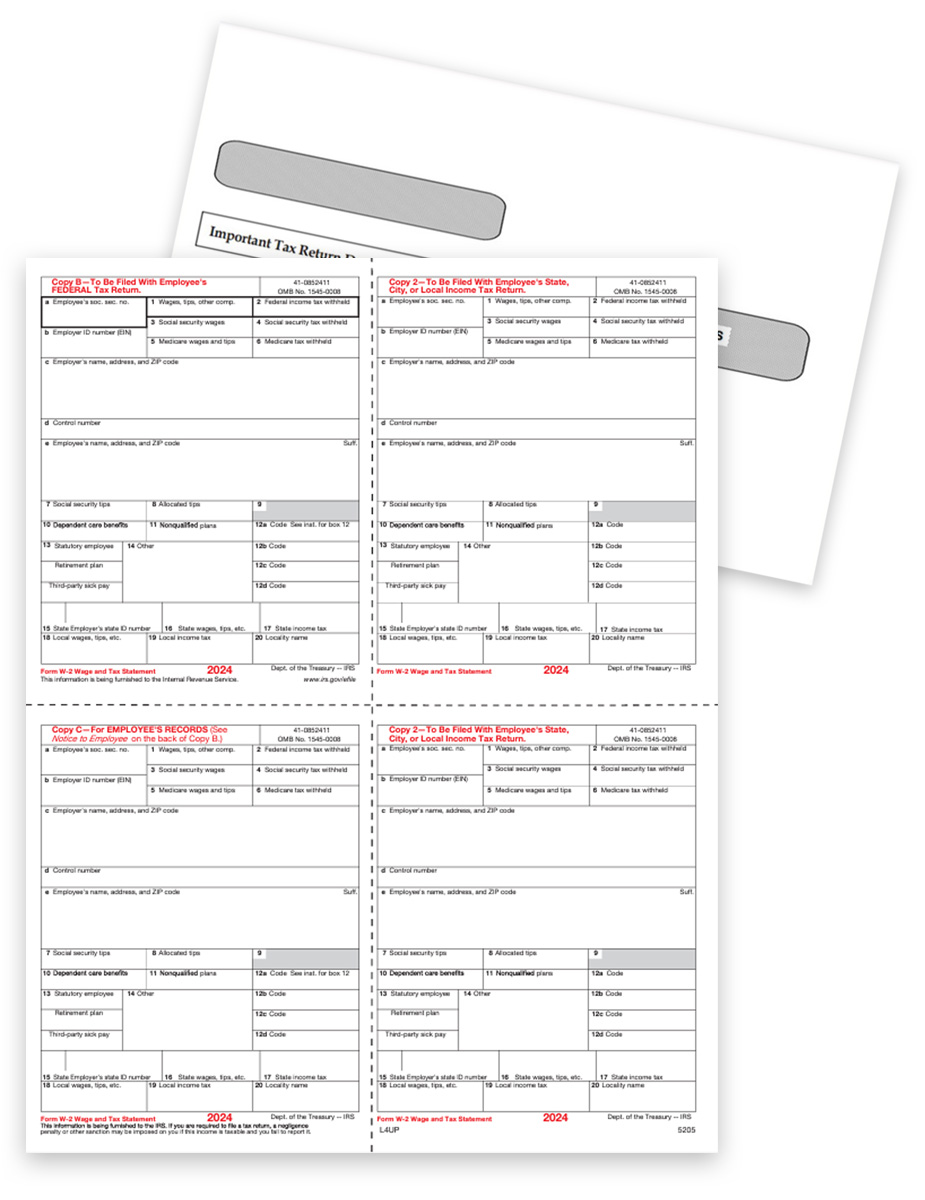

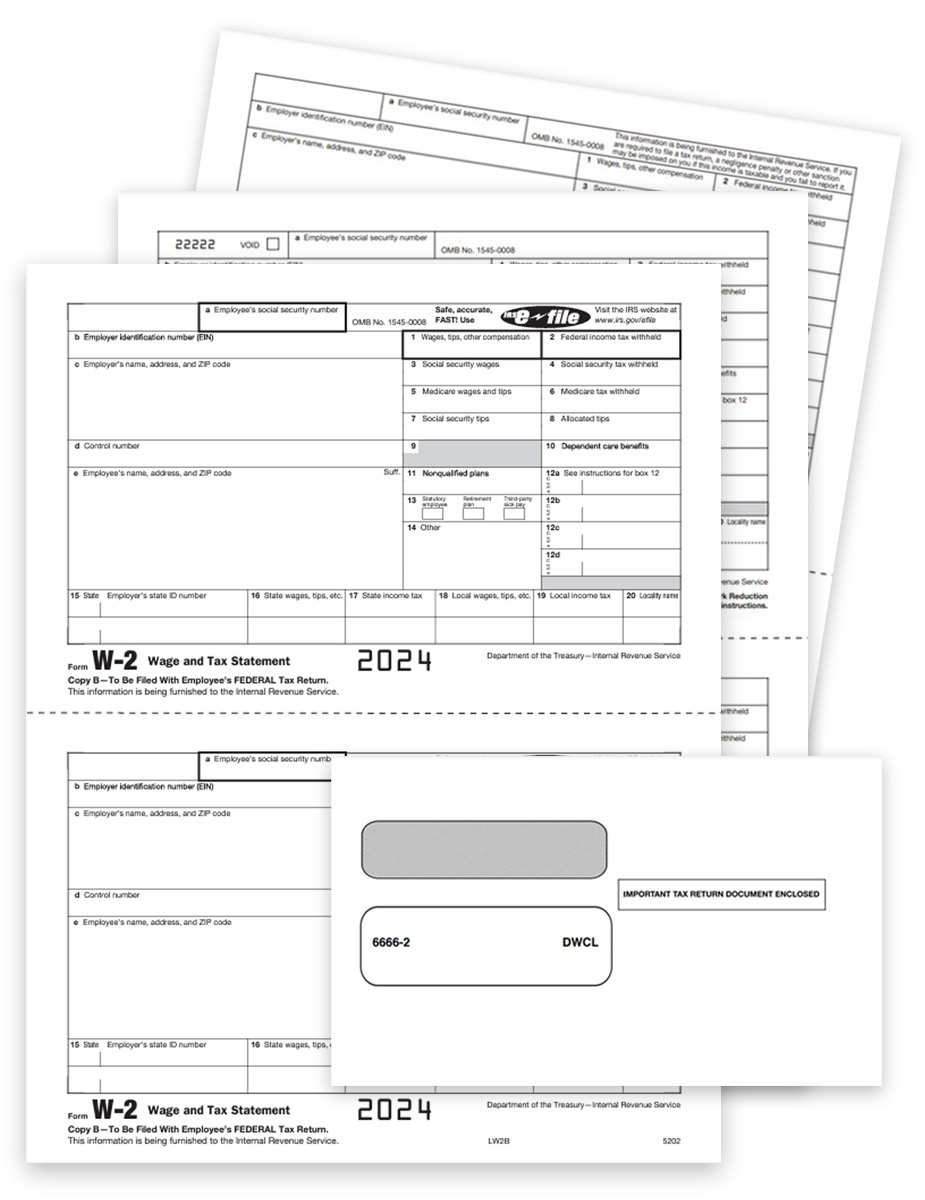

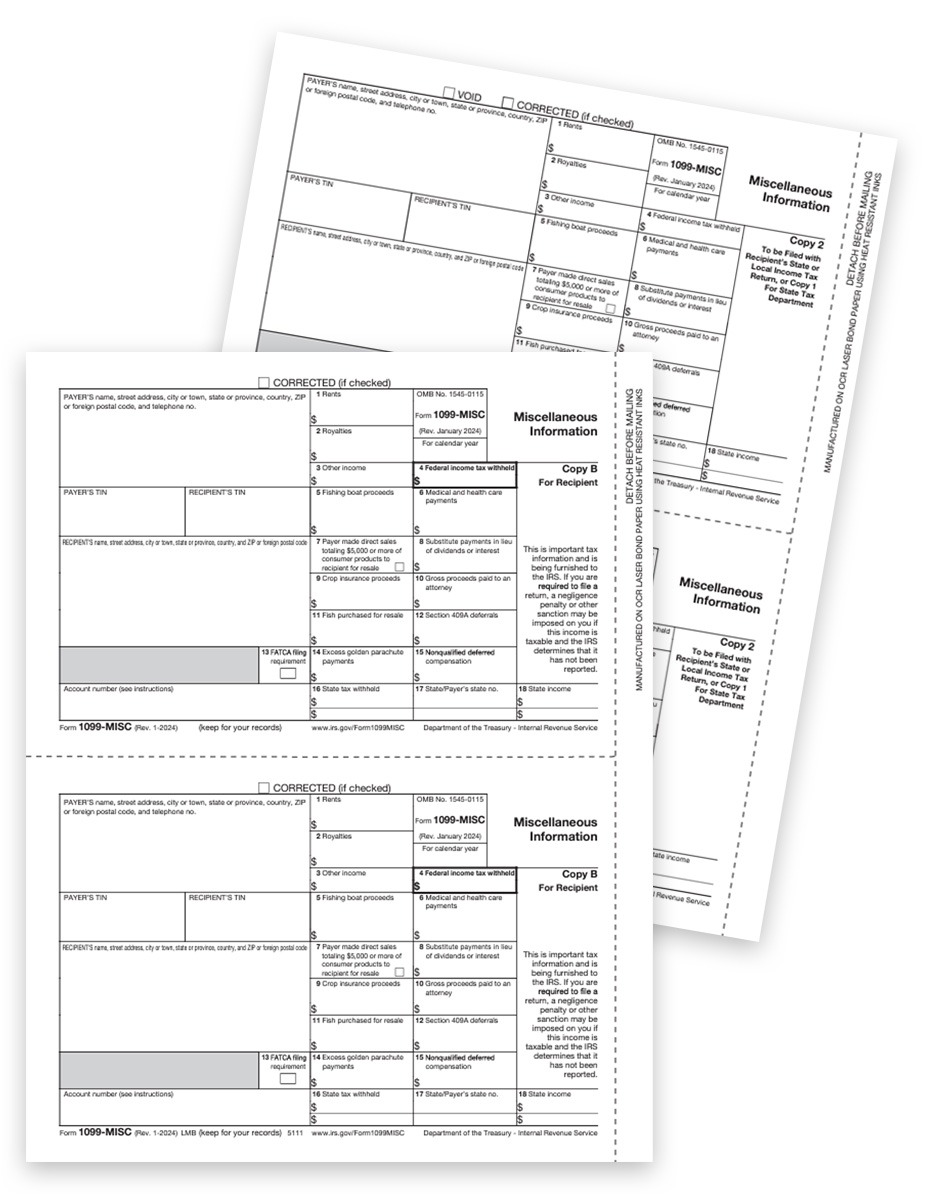

1099 & W2 Forms for Efilers

Sets of Forms for Recipient and Payer State Filing Only – Copy A Forms are NOT included