Blog

Expert insights to

easy 1099 & W2 filing.

3 Easy Ways to File 1099 & W2 Forms

How to File 1099 & W2 Forms

If your business needs to file W2 forms for employees, or 1099s for contractors or other purposes, we offer 3 simple ways to get them done efficiently before the January 31 deadline.

- Online Filing

- Software

- Forms

Choose the Best 1099 & W2 Filing Option for Your Business

No matter what kind of technology you have (or don’t have), regardless of the size of your business, or even if you are a bookkeeper or tax professional, we have the best options for filing 1099 & W2 forms on time, efficiently and affordably!

ONLINE 1099 & W2 FILING

Simply input or import your data and we’ll do the rest!

Whether you have 1 form, or 1000 forms to file, DiscountEfile.com makes it super simple. Online 1099 Filing and Online W2 Filing streamlines and revolutionizes this traditionally labor intensive process, creating one easy system that gives you everything you need in one place, and stores your information for years to come too.

Once your data is all set up (which is free to do!), submit the forms and we take it from there. We’ll e-file with the IRS or SSA according to the e-file requirements, and can even print and mail recipient copies for you. Everything is stored on the system for easy reference and we communicate with you every step of the way.

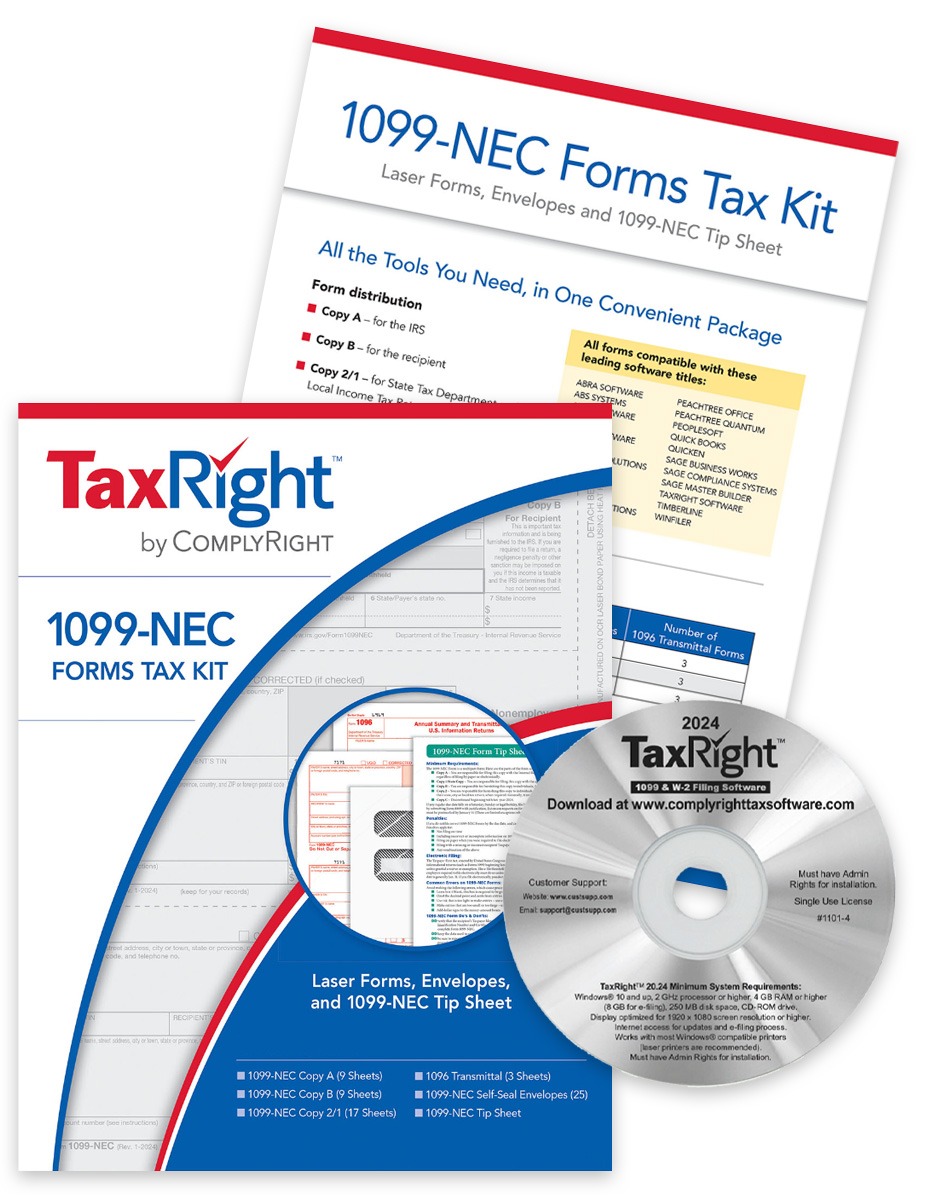

1099 & W2 SOFTWARE

Stand-alone software that specializes in one thing, easy 1099 & W2 filing!

Sometimes, you just need a product that does one thing really well, and that’s what you’ll find with our 1099 software, W2 software or even one package that handles both (which is especially great if you’re a bookkeeper or tax preparer).

1099 & W2 software has all the right bells and whistles to simplify filing and give you the confidence you’re doing it right. After all, no one wants to incur penalties for misfiling.

Choose from a simplified software package that does only the popular forms, or the deluxe version that does it all. We even offer software that’s bundled with forms to make printing simpler.

And all of them have e-filing options so you can easily comply with the requirement for e-filing 10+ forms.

1099 & W2 FORMS

If your accounting software prints recipient 1099 and W2 forms, you’re in the right place!

We offer a large variety of forms, in various formats that are compatible with all of the popular tax and accounting or bookkeeping software.

Since we’re a small business with low overhead, we can sell them for less than the big guys! Our everyday low prices can’t be beat, even without a coupon.

From 1099-NEC and -MISC forms to the lesser known 1099s, to official W2 formats and even 3up and 4up W2 blank forms, and of course envelopes too, we have you covered!

More from the Blog…

Business Penalties & Fines for Incorrect 1099 & W2 Filing

If your business fails to file 1099 & W2 forms on time, or provides incorrect information, you could incur large fines. Learn about the penalties how how to avoid them!

Navigating the IRS E-Filing Requirement Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file Copy A forms with the IRS and SSA. We make it easy! And can even print and mail recipient copies for you.

Decoding 1099NEC Copy Requirements

1099-NEC ‘Copies’, or parts, report non-employee compensation to recipients and government agencies and help ensure accuracy of income tax filing. 1099-NEC Forms are filled out by the payer and provided to the recipient and government agency.