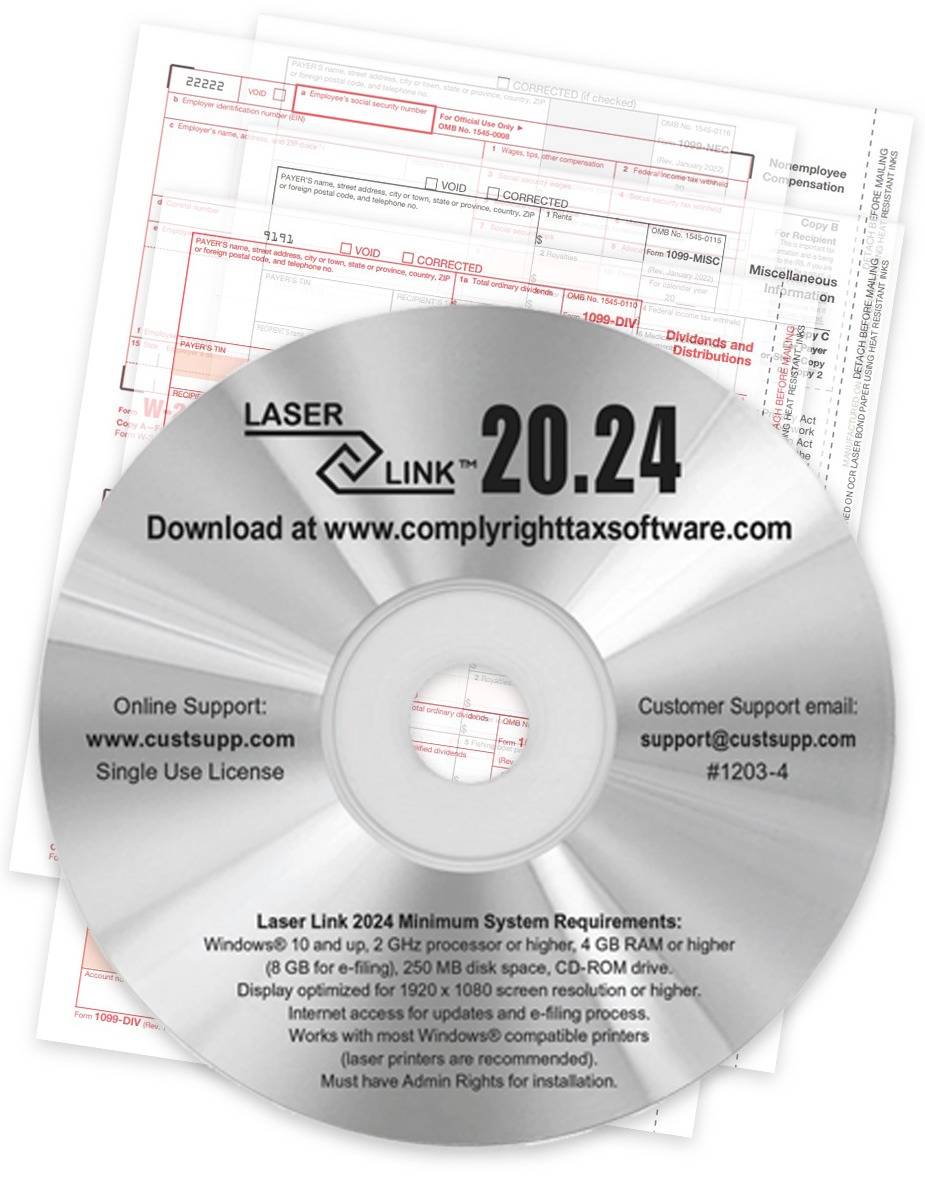

Software to Print and E-file Any 1099, W2 or 1095 Form, Easily!

LaserLink software is the easy, affordable answer for easy 1099 & W2 wage reporting. Print recipient and government copies on both preprinted form and/or blank perforated form paper. Includes the ability to E-file to the IRS or SSA.

E-Filing 1099 & W2 forms is simple, with a quick and easy process to upload files and send to the IRS and/or SSA.*

- Access e-filing information for up to 4 years on our platform

- E-mail communications as forms are filed and accepted

- Forms available for e-filing: 1099-NEC, -MISC, -DIV, -INT, -B, -S, -R, 1098, 1098-T and W-2

- E-filings are $1.65 per form

Secure filing with password protection and SSN masking to show only the last 4 digits of recipient SSN.

Simple functionality with step-by-step user guides, templates for importing data and enhanced reporting to see payer and recipient summary information.

W2 & 1099 E-filing Requirements

If your business has 10+ W2 and 1099 forms, combined, pre EIN, you must e-file Copy A forms with the IRS and SSA. This software makes it easy! Learn More About the Changes >

Software for Printing All 1099, W2 & 1095* Forms!

1099 Forms: 1099-A, -B, -C, -CAP, -DIV, -G, -INT, -LTC, -MISC, -NEC, -OID, -PATR, -Q, -R, -S, -SA, 1096, 1098, 1098-E, 1098-T, 3921, 3922, 5498, 5498-ESA, 5498-SA

Order 1099 Forms Use blank or preprinted forms with LaserLink software

W-2 Forms: W2, W2C, W2G, W3, W3C

Order W2 Forms Use blank or preprinted forms

1095*: 1094-B, 1094-C, 1095-B, 1095-C

Order 1095 Forms Use blank or preprinted forms

1099 & W2 E-filing Requirements for 2024

The threshold for e-filing with the IRS is 10+ W2 and 1099 forms, combined, per EIN. This was changed in 2023.

That means, for example, if your business has 5 1099NEC forms and 5 W2 forms, you must e-file the red Copy A forms with the IRS and SSA by January 31, 2024.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except correction forms. Here is a great article with insights to the changes.

Penalties apply if you don’t – $60 per form if you file on time and up to $310 per form if you file late.

Get the Details

1099 & W2 Forms that must be e-filed according to the requirements above: 1042-S, 1094 series, 1095-B, 1095-C, 1097-BTC, 1098, 1098-C, 1098-E, 1098-Q, 1098-T, 1099 series, 3921, 3922, 5498 series, 8027, W-2, and W-2G.

Efile Online with DiscountEfile.com

If your business is required to e-file 1099 & W2 forms, we make it easy! Use our top-rated online filing system, DiscountEfile.com and we’ll e-file with the IRS for you, and can even print and mail recipient copies for you. Get it all done quickly, without purchasing any forms.

Online 1099 & W2 Filing

How to Choose the Right W-2 Forms

W2 E-FILE REQUIREMENTS FOR 2024

The IRS requires e-filing for payers with 10+ 1099 & W2 forms combined, per EIN, they MUST efile Copy A forms with the IRS or SSA. Learn More >>

We make it easy! Set up a free account on DiscountEfile.com and you can e-file, plus print and mail recipient copies in one easy step. Learn More >>

OPTIONS FOR FILING W-2 FORMS

- Your Accounting Software: Print W-2 forms compatible with your software, such as QuickBooks®.

- Specialized W-2 Software: Print and e-file W-2 forms if your accounting software does not.

- Online W-2 Filing: Enter or import data and we print, mail and e-file for you!

TYPES OF W-2 FORMS

All government copies must be printed in a 2up format (2 forms per page)

Employee copies may be printed in a 2up, 3up or 4up format (2, 3 or 4 forms per page; also called ‘condensed forms). All of the copies for a single employee will print on one page. You simply fold and mail – no need to separate and collate forms! Your software may support these formats, be sure to check its functionality before ordering.

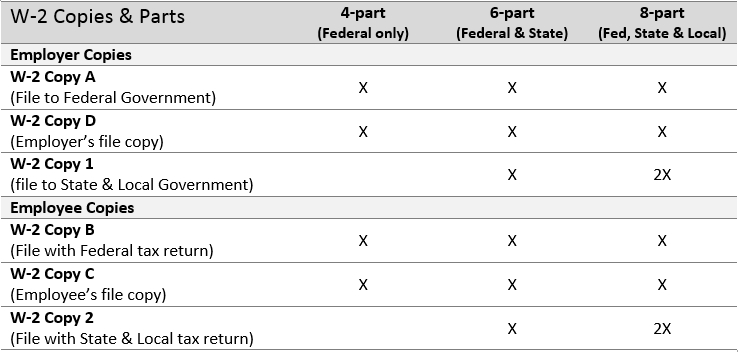

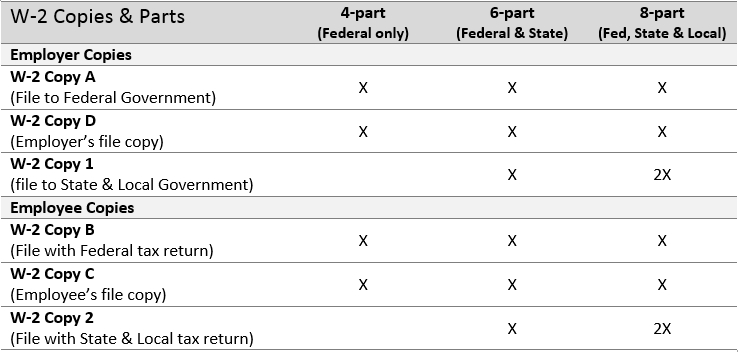

NUMBER OF W2 PARTS

The number of parts you need is determined by which government agencies you are reporting to.

- Federal Only – 4 parts

- Federal and State – 6 parts

- Federal, State and City – 8 parts

When using condensed 2up, 3up or 4up forms, you can print all employee copies on a single sheet to save time.

- For a 4-part form, use 2up paper.

- For a 6-part form, use 3up paper.

- For an 8-part form, use 4up paper.

4-Part States: AK, FL, NV, NH, SD, TN, TX, WA, WY

6-Part States: AL, AZ, AK, CA, CO, CT, DC, DE, GA, HI, ID, IA, IL, IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, MS, MT, NC, NE, ND, NJ, NM, NY, OH, OK, OR, PA, RI, SC, UT, VA, VT, WI, WV (add extra parts for city withholding taxes)

8-Part States: AL, DE, KY, MD, MI, MO, NY, OH, PA

Read More: Decoding W2 Copy Requirements >

EASY ONLINE FILING FOR W2 FORMS

File W2 forms online and save time! Skip the hassle of buying and printing forms, stuffing envelopes and paying for postage with DiscountEfile.com

With our online W2 filing system, simply enter or import your data and we’ll efile with the SSA and can even print and mail employee copies for you, for $4.75 or less per form.

Visit DiscountEfile.com for more information.

W3 TRANSMITTAL FORMS

Transmittal W-3 Forms are required only if you are printing and mailing W2 Copy A to the Federal Government.

One W3 is required to summarize all W2s for one employer. Order W-3 Forms.

W2 ENVELOPES

Order compatible W-2 Envelopes to ensure mailing information aligns correctly in the windows. Order W-2 Envelopes

W-2 FILING DEADLINE

- January 31 – Recipient copies postmarked, Copy A mailed or efiled with IRS

These are federal deadlines. Most states follow the same dates.

W-2C CORRECTION FORMS

If you need to correct a W2 form that has already been filed with the SSA because the original has errors, you will need to file a W2C form (W-2 Correction Form).

This is different than a standard W2 form, and requires a few additional steps. You’ll need to fill in all of the fields, once for the information originally filed, and once for the correct information (if applicable).

You must file the W2C form with the SSA in the same manner as the original W2.

- If you e-filed, you must e-file the correction.

- If you printed and mailed the original Copy A, you must also print and mail the W2C.

You can also file W2C forms online and let us do the work for you!

More on W2C Filing

Choosing the Right 1099 Forms

NEW E-FILE THRESHOLDS FOR 2023

The IRS has made a MAJOR change to e-filing requirements for the 2023 tax year. If a payer has 10+ 1099 & W2 forms combined, per EIN, they MUST efile Copy A forms with the IRS or SSA. Learn More >>

We make it easy! Set up a free account on DiscountEfile.com and you can e-file, plus print and mail recipient copies in one easy step. Learn More >>

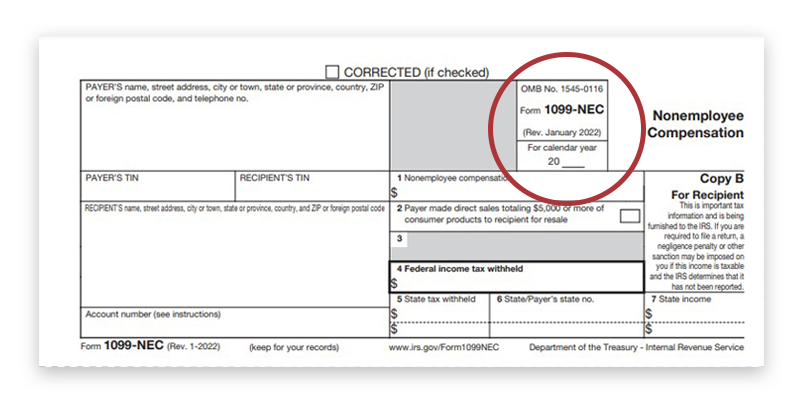

1099-NEC vs. -MISC

In 2020, the IRS released a new 1099 form for reporting non-employee compensation, the 1099-NEC form. If you need to report income of $600+ for contractors, freelancers, gig workers, etc, use the 1099NEC form. This information was previously reported on 1099MISC box 7.

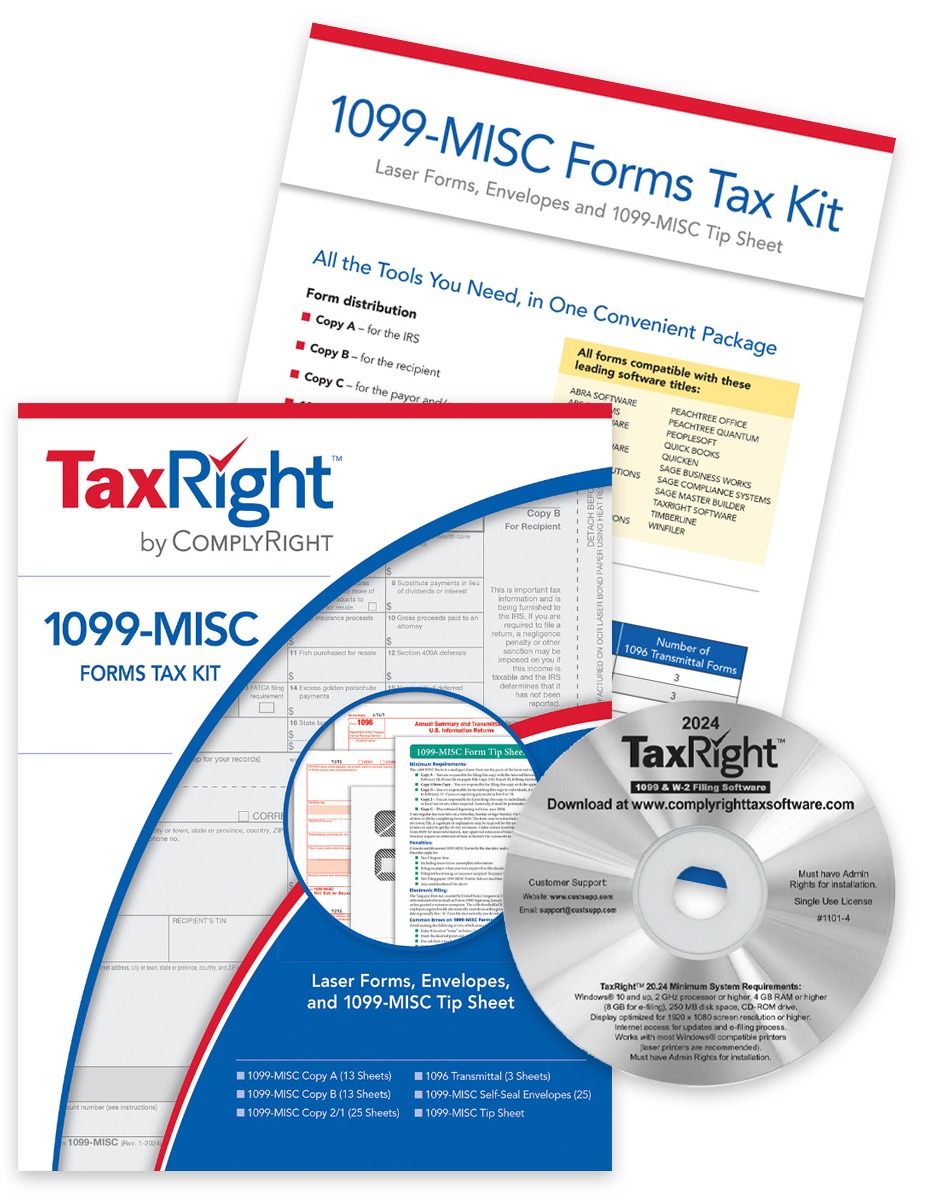

1099-MISC forms are now used to report royalties, rent, prizes, proceeds to attorneys, fishing boat proceeds and other miscellaneous information. Official IRS 1099-NEC & MISC instructions.

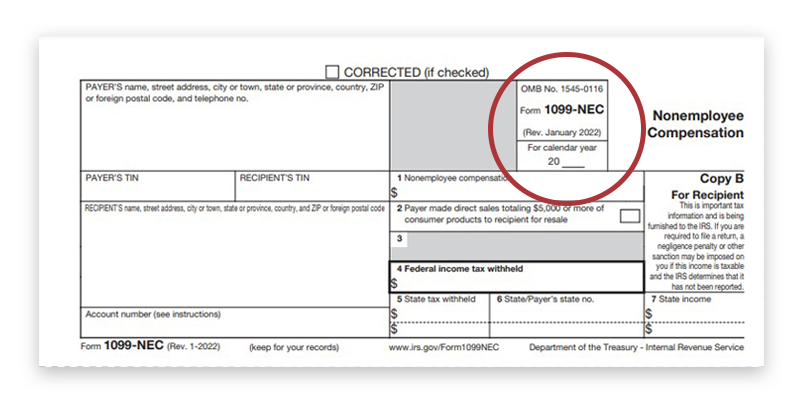

DATELESS 1099 FORMAT

DATELESS 1099 FORMAT

Many 1099 forms have changed to a dateless, continuous-use format for 2022. This means you will need to fill in the year on each form. Don’t forget to update your software!

OPTIONS FOR 1099 FILING

TYPE OF FORMS

NUMBER OF PARTS

The number of 1099 pars needed is based on government filing requirements.

- Copy A: Federal Copy for the IRS

- Copy B: Recipient Copy

- Copy C: Payer Copy

- Copy 2: State and Local Copies

Read more on our blog: Decoding 1099-MISC Copy Requirements

3-PART STATES: AK, CA, FL, GA, IL, IN, IA, KY, LA, MD, MI, MO, NV, NH, NM, NY, OR, SD, TN, TX, VT, WA, WY

4-PART STATES: AL, AR, AZ, CA, CO, CT, DE, DC, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MO, MS, MT, NE, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, UT, VT, VA, WV, WI

5-PART STATES: AL, AZ, CO, CT, DE, HI, ID, ME, MA, MN, MS, MT, NE, NC, ND, OH, OK, PA, SC, UT, WI

1096 FORMS

Transmittal 1096 forms are required only if you are printing and mailing 1099-MISC Copy A to the Federal Government. One 1096 is required to summarize all 1099s for a single payer.

1099 ENVELOPES

Order compatible 1099 envelopes to ensure mailing information aligns correctly in the windows.

1099 FILING DEADLINES

- January 31 – All W2 & 1099 Recipient Postmarked; 1099-NEC and W2 Federal Copy A Postmarked or e-filed with IRS

- February 28 – Paper Copy A filed with the IRS for all 1099s except MISC

- March 31 – E-filed copies to the IRS for all 1099s except MISC

These are Federal filing deadlines. Most states follow the same dates.

1099 CORRECTIONS

If you need to correct a 1099 form because the original has errors, you will need to re-file the same 1099 form.

The only difference is a simple “Corrected” checkbox at the very top of the 1099. Checking this box signifies to the IRS and recipient that there is different information than on the original 1099.

This is the approach for correcting any type of 1099 form, from the popular 1099NEC and 1099MISC to obscure types of 1099 forms too.

You can print and mail the corrected 1099 forms yourself, or file them all online to save time!

Online 1099 Correction Filing

DATELESS 1099 FORMAT

DATELESS 1099 FORMAT

Reviews

There are no reviews yet.