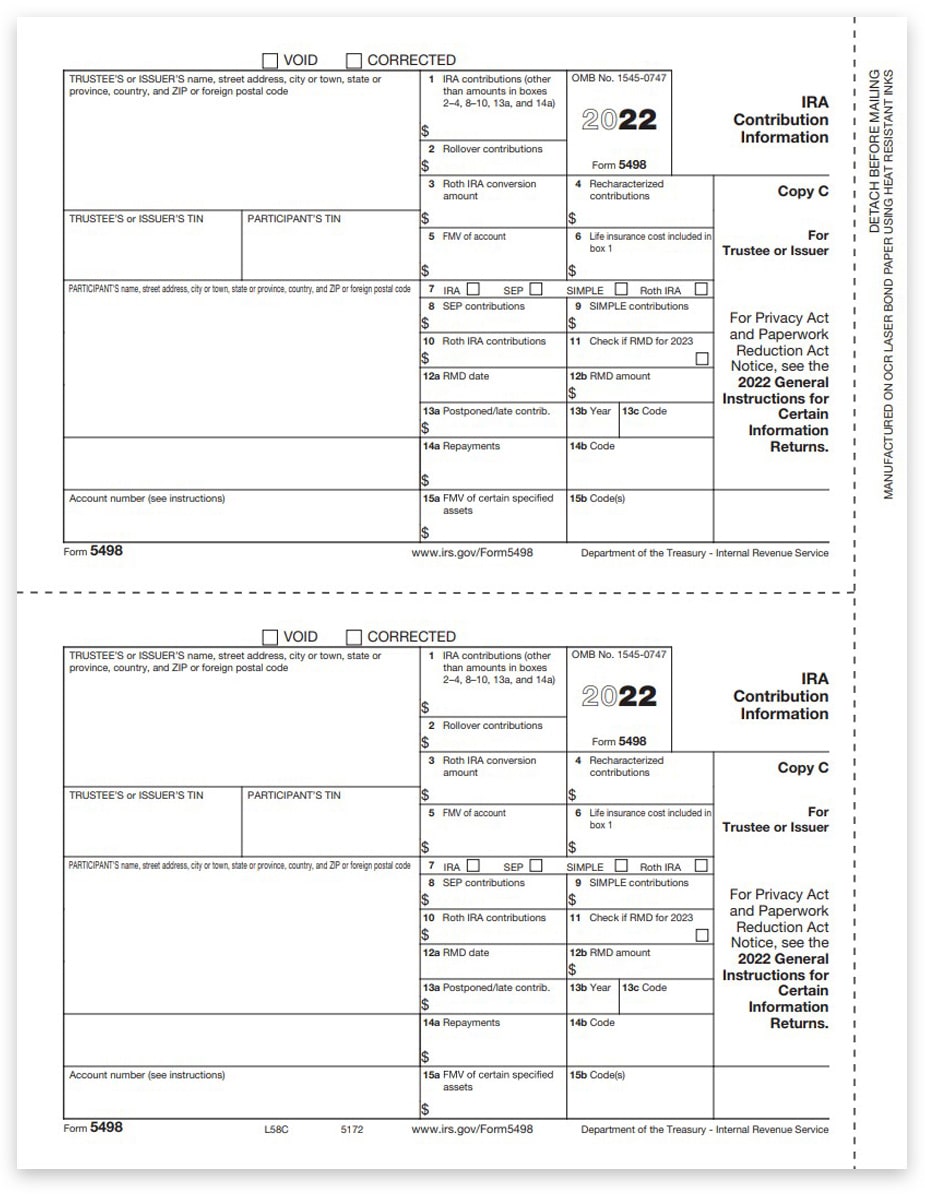

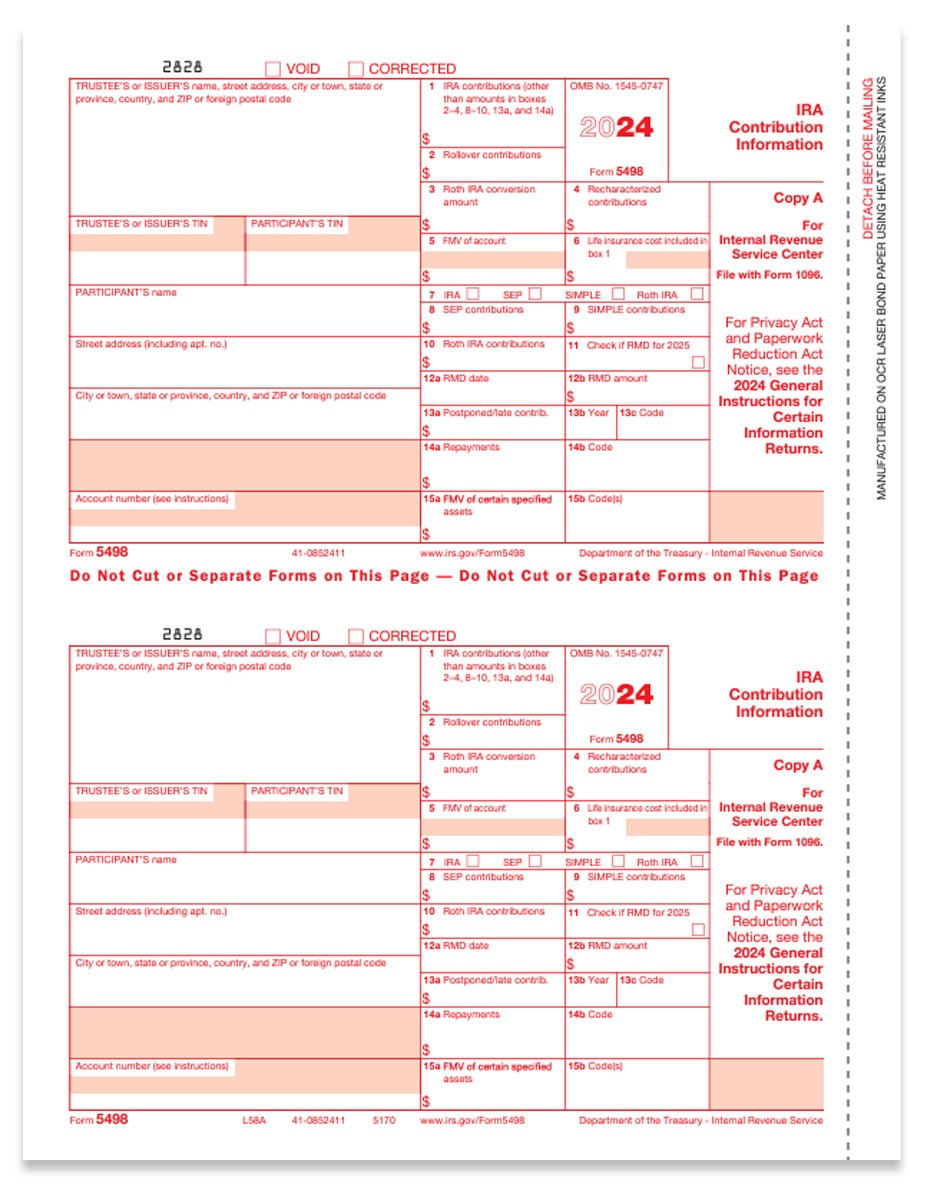

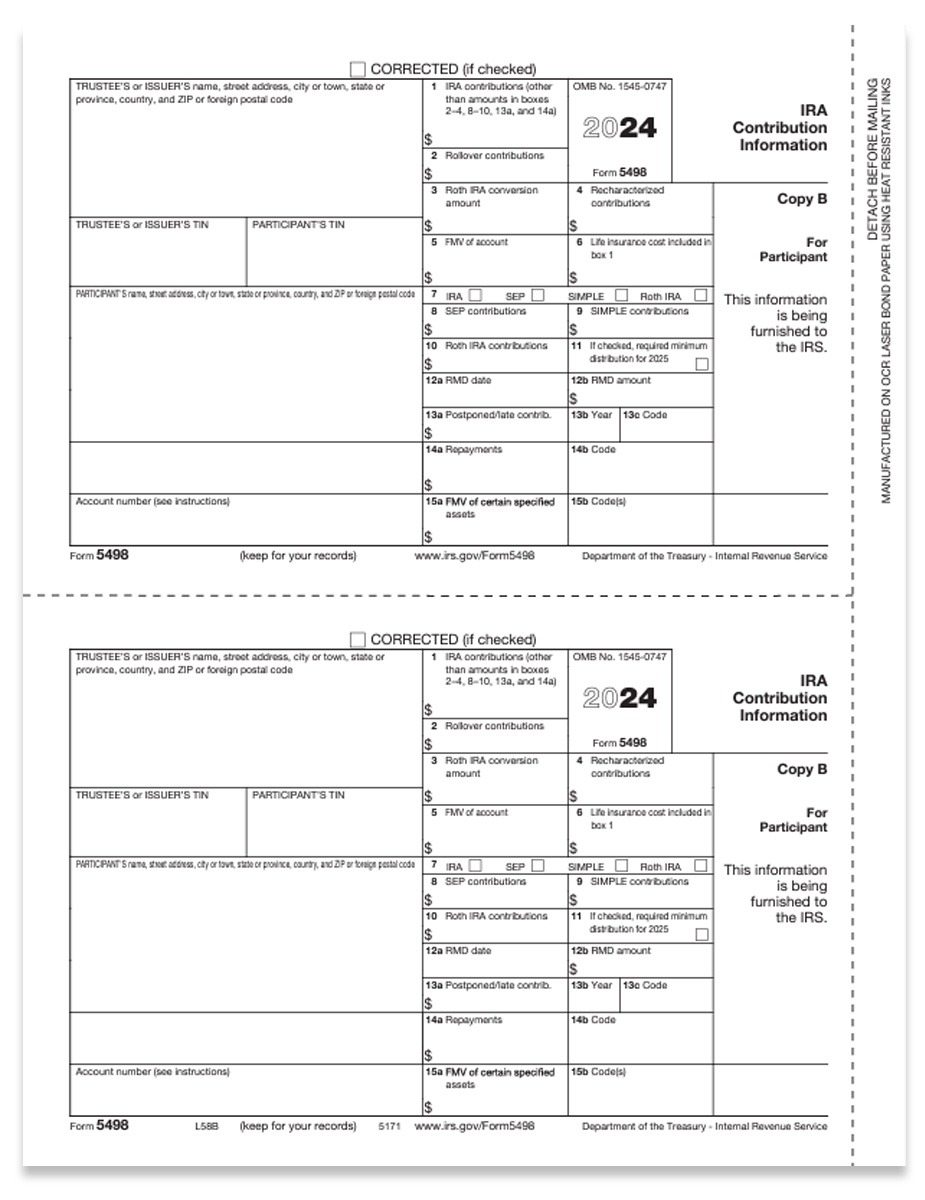

5498 Tax Forms Copy C for Trustee or Issuer

Order Form 5498 to report IRA Contribution Information for 2024. The Trustee or Issuer keeps Copy C for their records.

Get big discounts – no coupon needed with The Tax Form Gals!

Keep 5498 Copy C for the issuer’s files.

5498 Copy C Form Specs:

Order a quantity equal to the number of recipients you have.

- 2-up Format

- 8.5″x 11″ with side perforation

- Printed on 20# laser paper

- Item# L58C

Choosing the Right 1099 Forms

NEW E-FILE THRESHOLDS FOR 2023

The IRS has made a MAJOR change to e-filing requirements for the 2023 tax year. If a payer has 10+ 1099 & W2 forms combined, per EIN, they MUST efile Copy A forms with the IRS or SSA. Learn More >>

We make it easy! Set up a free account on DiscountEfile.com and you can e-file, plus print and mail recipient copies in one easy step. Learn More >>

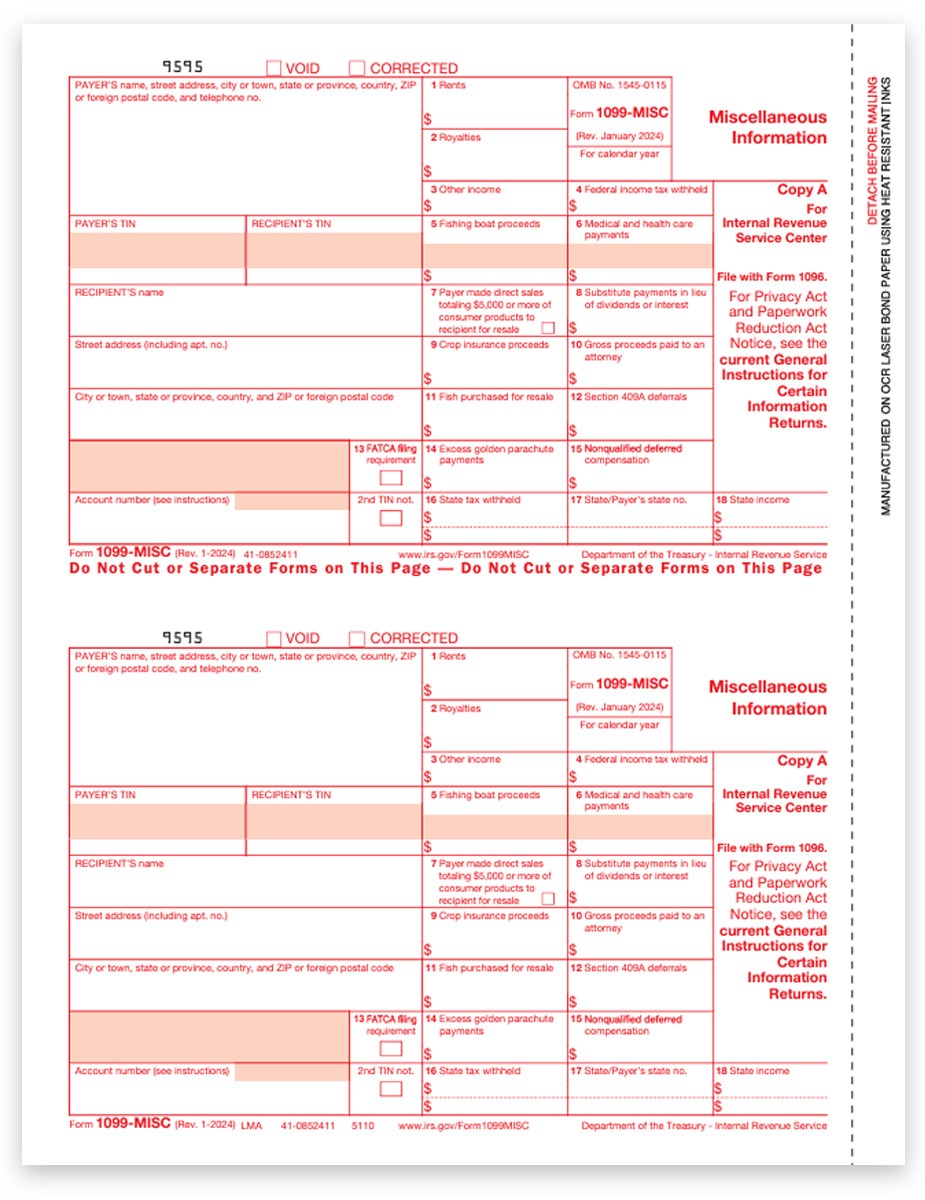

1099-NEC vs. -MISC

In 2020, the IRS released a new 1099 form for reporting non-employee compensation, the 1099-NEC form. If you need to report income of $600+ for contractors, freelancers, gig workers, etc, use the 1099NEC form. This information was previously reported on 1099MISC box 7.

1099-MISC forms are now used to report royalties, rent, prizes, proceeds to attorneys, fishing boat proceeds and other miscellaneous information. Official IRS 1099-NEC & MISC instructions.

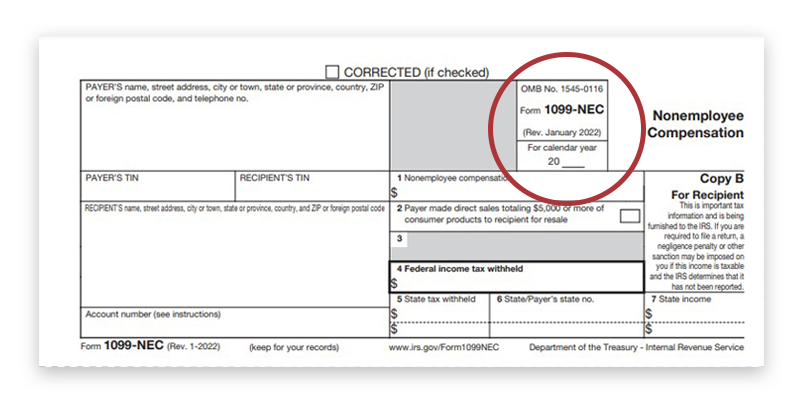

DATELESS 1099 FORMAT

DATELESS 1099 FORMAT

Many 1099 forms have changed to a dateless, continuous-use format for 2022. This means you will need to fill in the year on each form. Don’t forget to update your software!

OPTIONS FOR 1099 FILING

TYPE OF FORMS

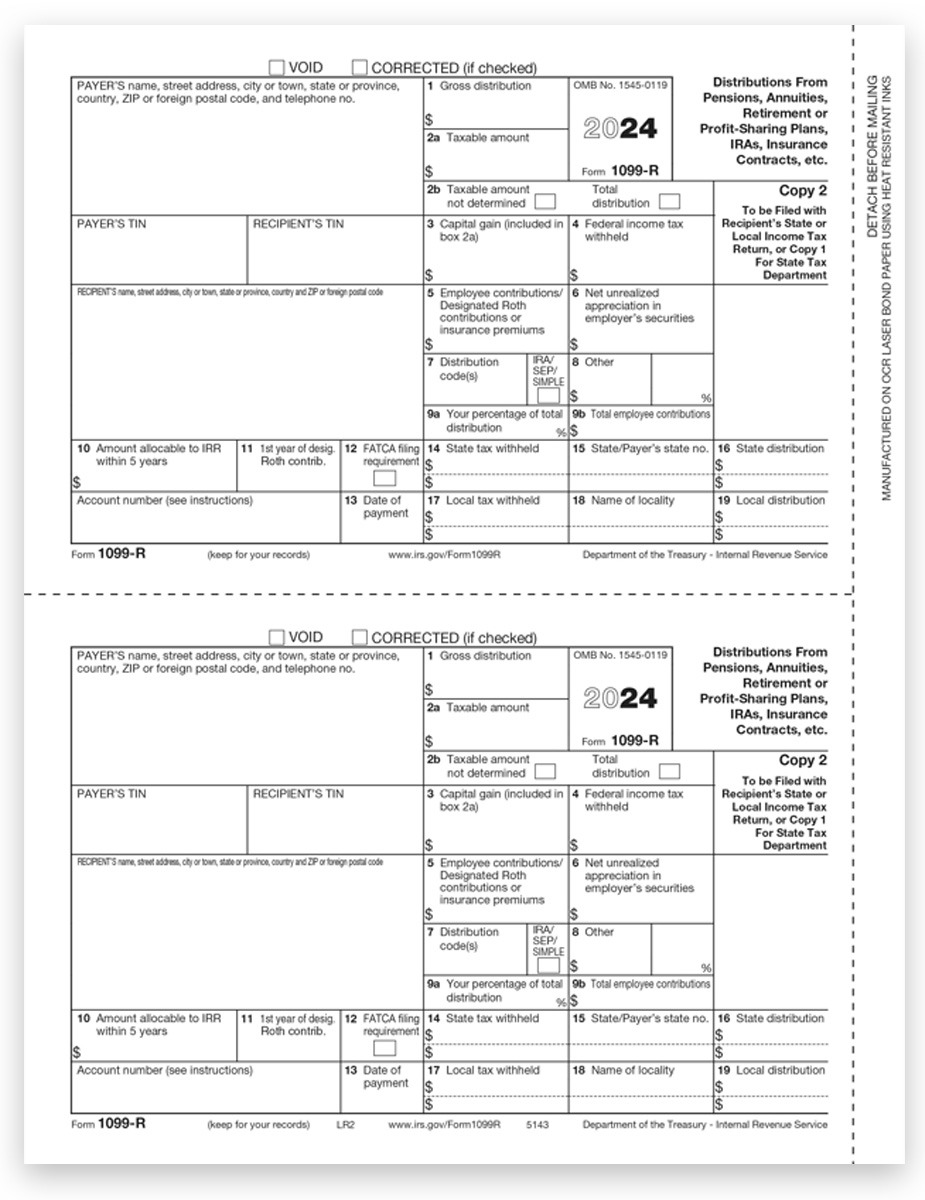

NUMBER OF PARTS

The number of 1099 pars needed is based on government filing requirements.

- Copy A: Federal Copy for the IRS

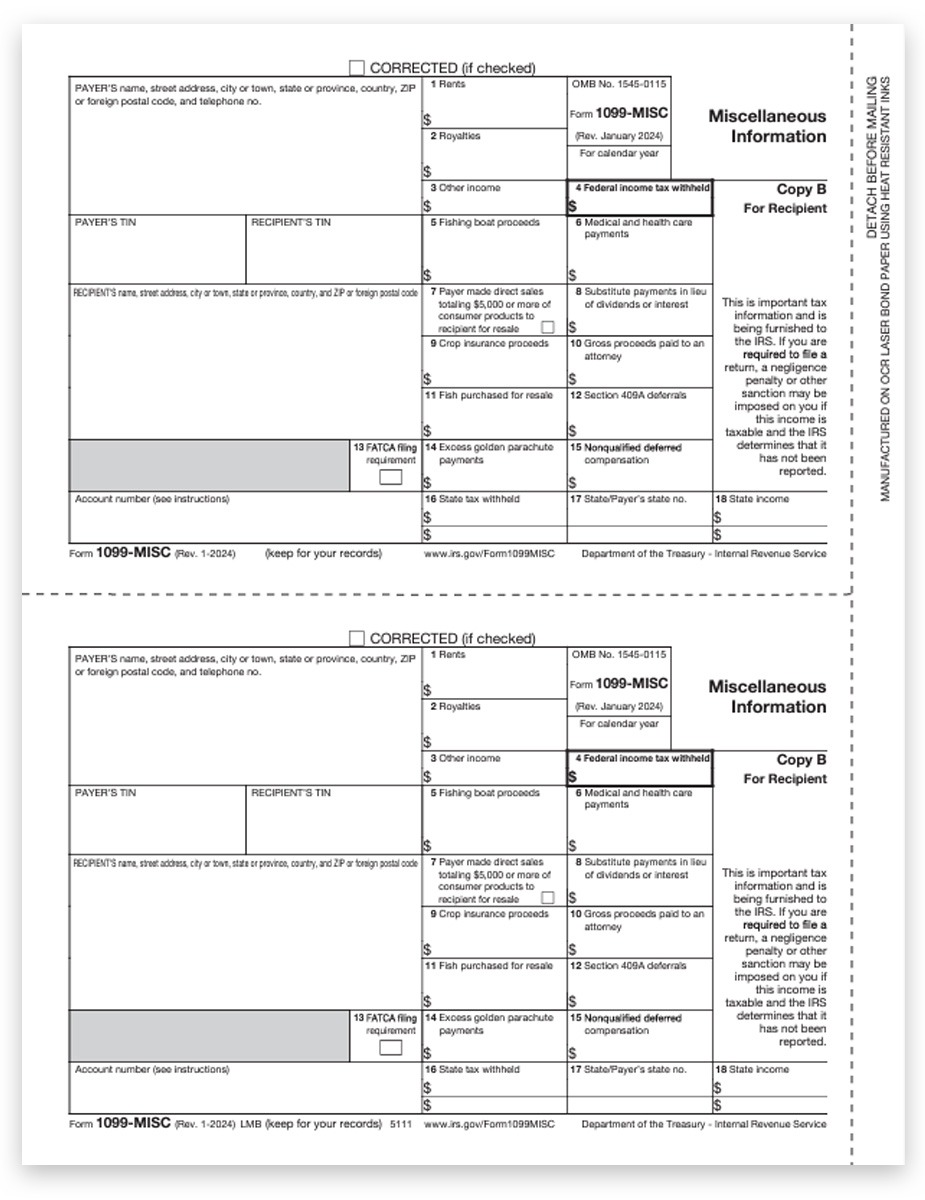

- Copy B: Recipient Copy

- Copy C: Payer Copy

- Copy 2: State and Local Copies

Read more on our blog: Decoding 1099-MISC Copy Requirements

3-PART STATES: AK, CA, FL, GA, IL, IN, IA, KY, LA, MD, MI, MO, NV, NH, NM, NY, OR, SD, TN, TX, VT, WA, WY

4-PART STATES: AL, AR, AZ, CA, CO, CT, DE, DC, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MO, MS, MT, NE, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, UT, VT, VA, WV, WI

5-PART STATES: AL, AZ, CO, CT, DE, HI, ID, ME, MA, MN, MS, MT, NE, NC, ND, OH, OK, PA, SC, UT, WI

1096 FORMS

Transmittal 1096 forms are required only if you are printing and mailing 1099-MISC Copy A to the Federal Government. One 1096 is required to summarize all 1099s for a single payer.

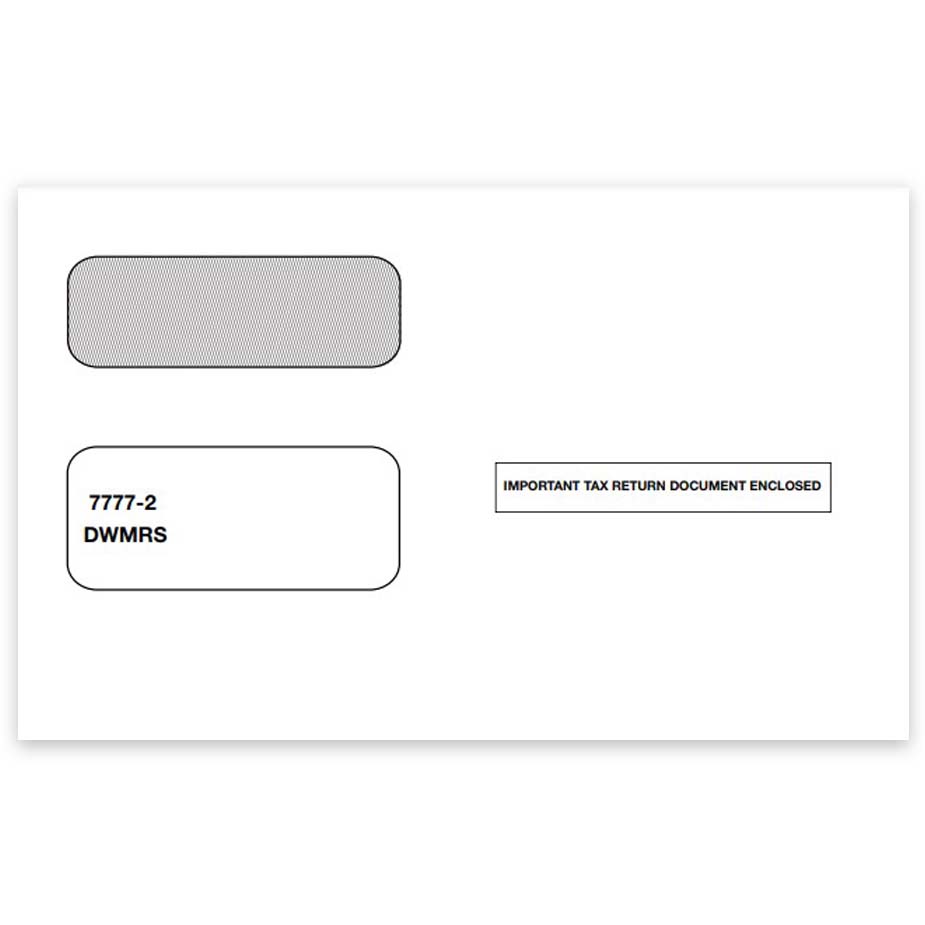

1099 ENVELOPES

Order compatible 1099 envelopes to ensure mailing information aligns correctly in the windows.

1099 FILING DEADLINES

- January 31 – All W2 & 1099 Recipient Postmarked; 1099-NEC and W2 Federal Copy A Postmarked or e-filed with IRS

- February 28 – Paper Copy A filed with the IRS for all 1099s except MISC

- March 31 – E-filed copies to the IRS for all 1099s except MISC

These are Federal filing deadlines. Most states follow the same dates.

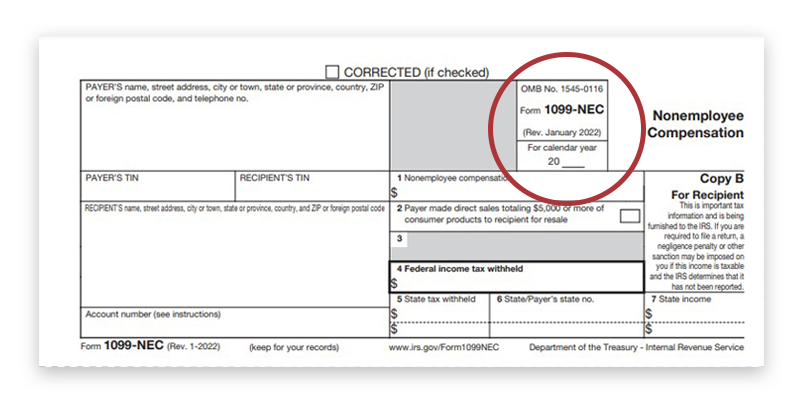

1099 CORRECTIONS

If you need to correct a 1099 form because the original has errors, you will need to re-file the same 1099 form.

The only difference is a simple “Corrected” checkbox at the very top of the 1099. Checking this box signifies to the IRS and recipient that there is different information than on the original 1099.

This is the approach for correcting any type of 1099 form, from the popular 1099NEC and 1099MISC to obscure types of 1099 forms too.

You can print and mail the corrected 1099 forms yourself, or file them all online to save time!

Online 1099 Correction Filing

DATELESS 1099 FORMAT

DATELESS 1099 FORMAT

Reviews

There are no reviews yet.