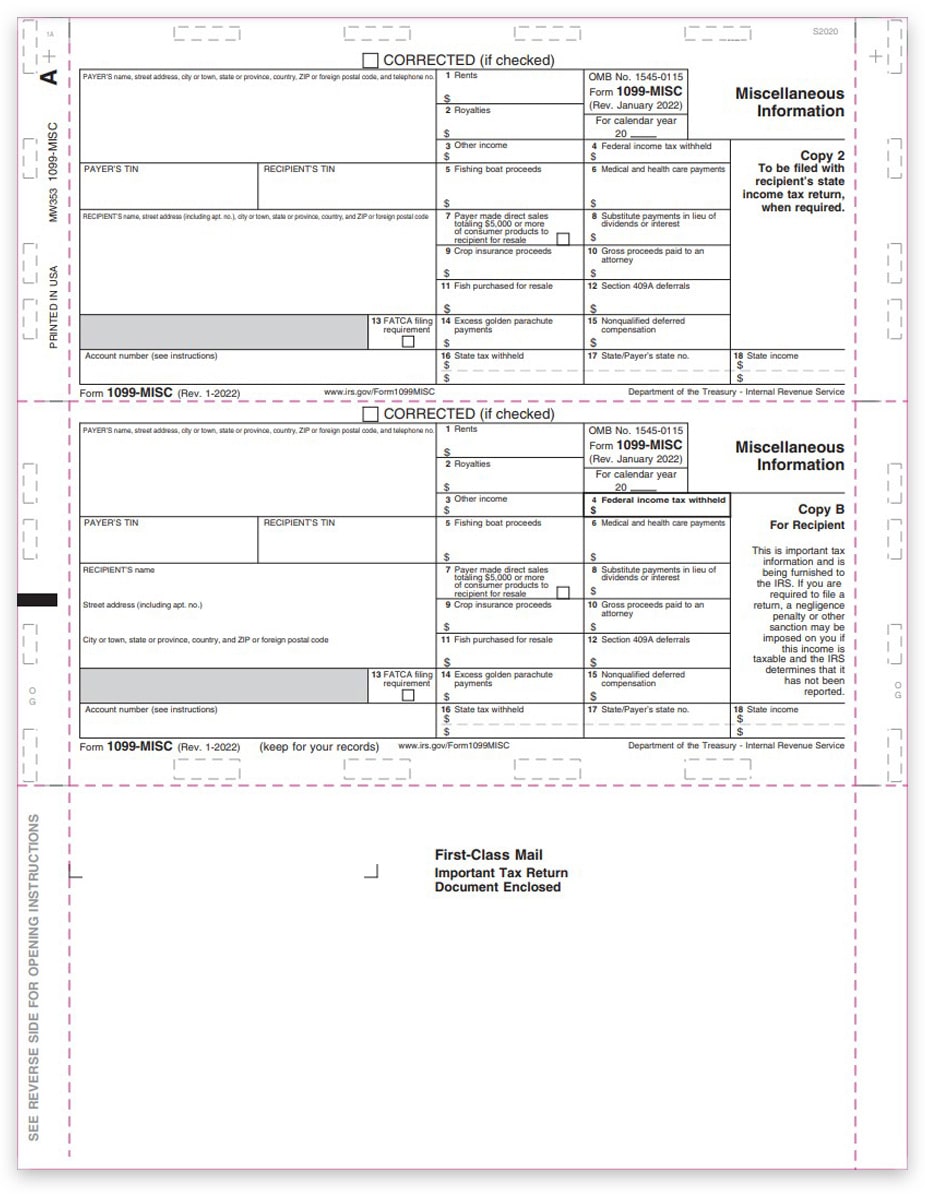

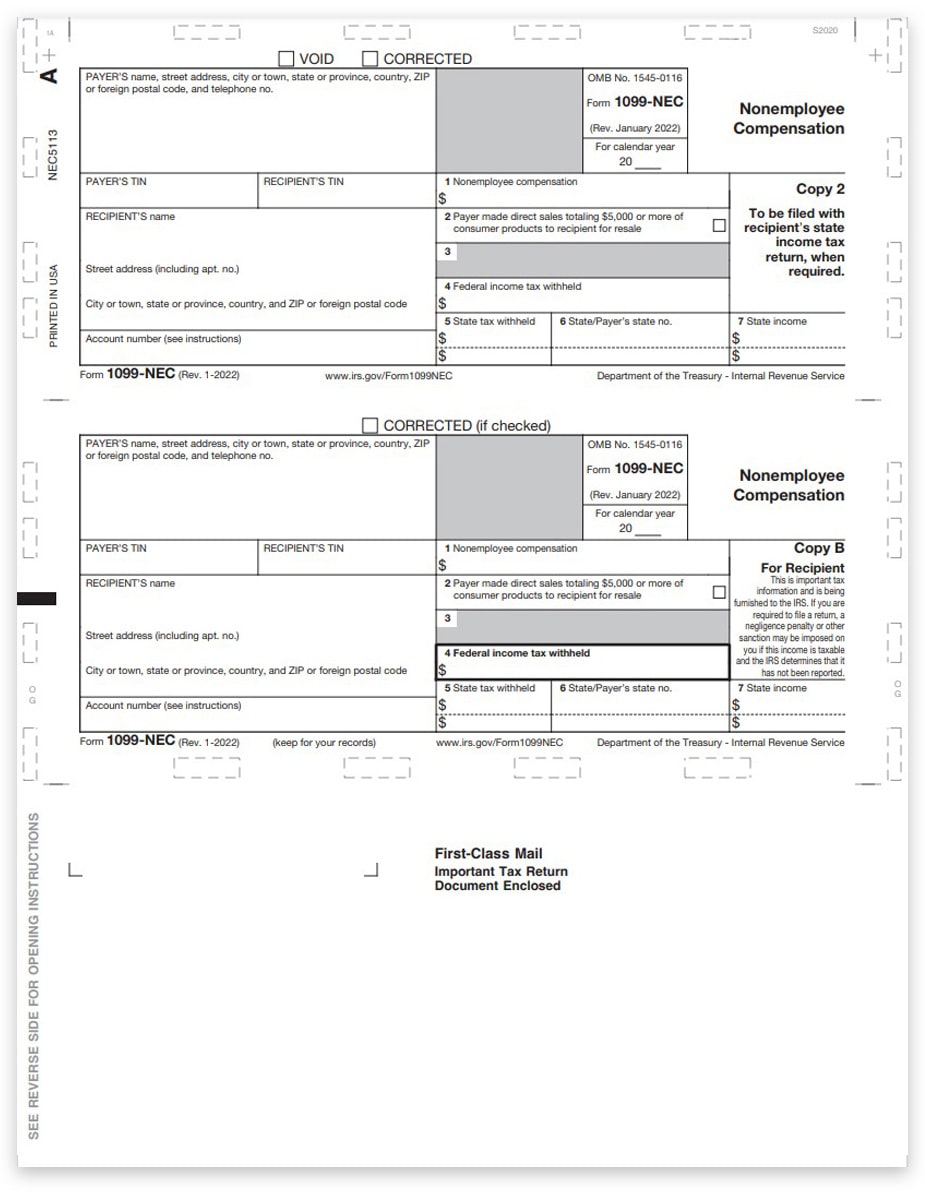

Pressure Seal 1099-MISC Pressure Seal Tax Forms for Reporting Miscellaneous Compensation

Preprinted 1099MISC pressure seal forms for printing a large volume of 1099-MISC recipient forms using pressure seal equipment. 11″, Z-Fold format.

Get big discounts on 1099 forms – no coupon code needed with The Tax Form Gals!

Use 1099-MISC Forms to report annual miscellaneous income of $600+.

NEW dateless format for 2022 – update your software to print the year on each form.

1099MISC Pressure Seal Form Specs:

- 11″ forms

- Preprinted 1099MISC form

- Z-fold format

- Recipient Copy B & 2 with instructions printed on backer

POSSIBLE CHANGE TO 1099 E-FILING REQUIREMENTS

The IRS is currently CONSIDERING a change to the e-filing threshold for 1099 & W2 forms. It is currently 250+ forms, but COULD change to 100+. Stay tuned to Discount Tax Forms and the Official IRS 1099 Instructions for developments.

If you need to efile, check with your software provider or use our online service, DiscountEfile.com to get it all done easily. We can even print and mail recipient copies for you!

Efile 1099 Forms

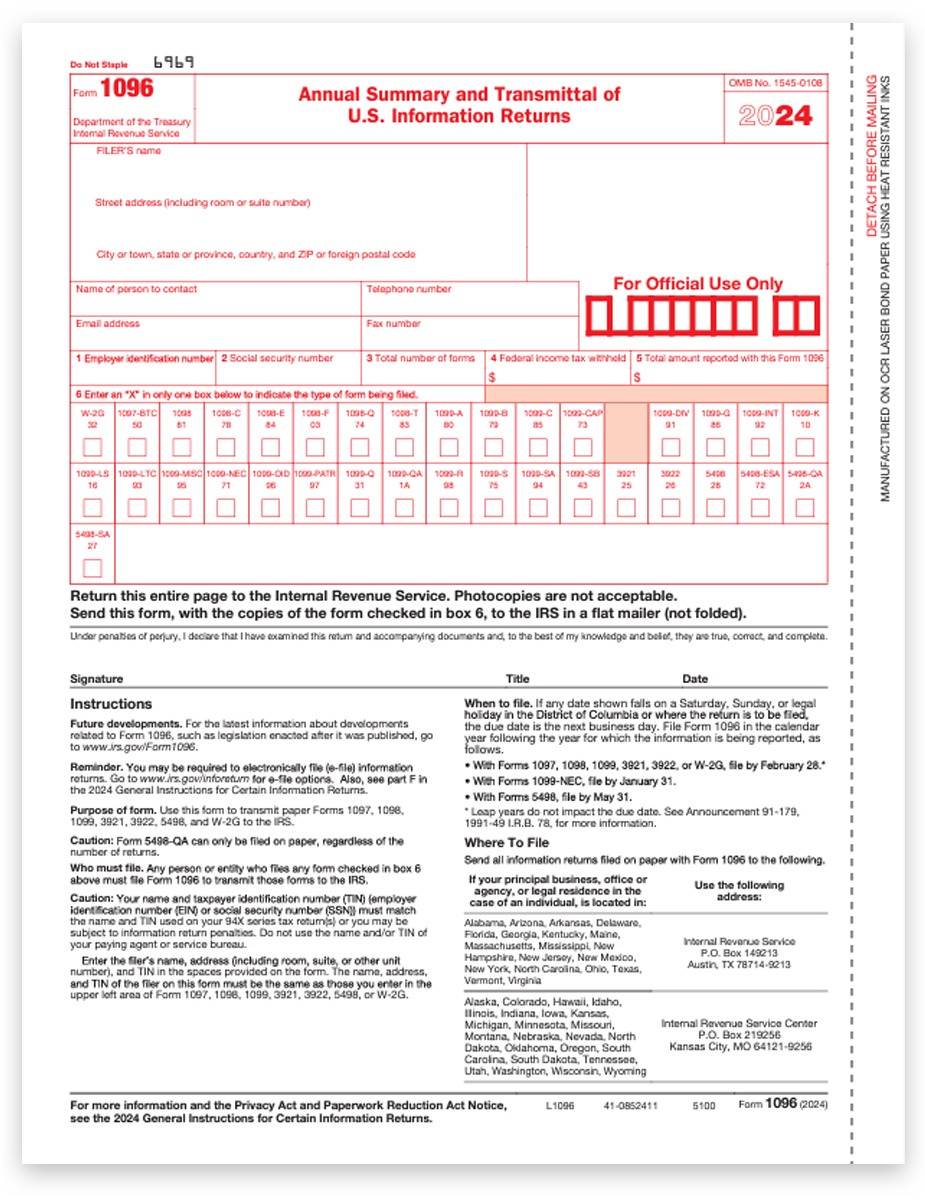

1099 & W2 E-filing Requirements for 2024

The threshold for e-filing with the IRS is 10+ W2 and 1099 forms, combined, per EIN. This was changed in 2023.

That means, for example, if your business has 5 1099NEC forms and 5 W2 forms, you must e-file the red Copy A forms with the IRS and SSA by January 31, 2024.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except correction forms. Here is a great article with insights to the changes.

Penalties apply if you don’t – $60 per form if you file on time and up to $310 per form if you file late.

Get the Details

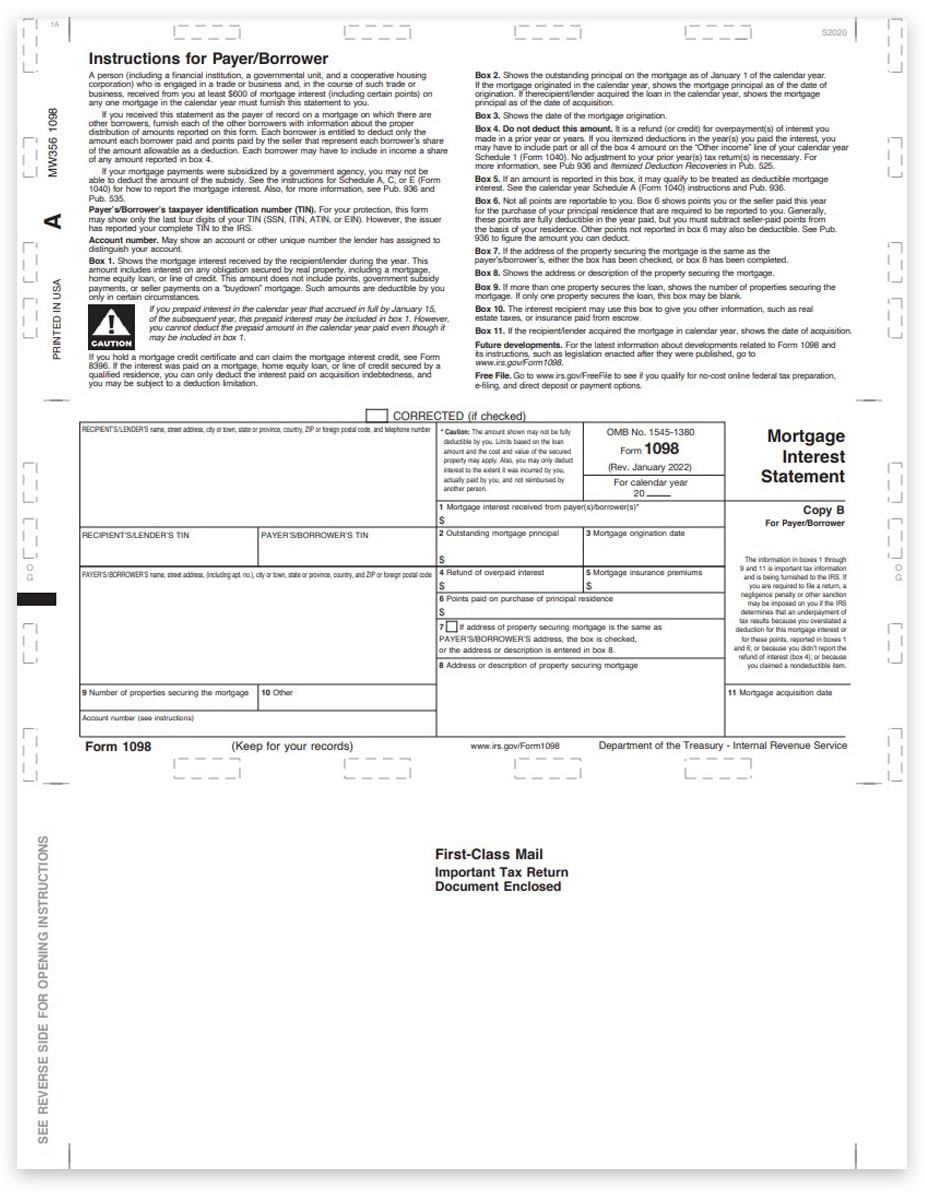

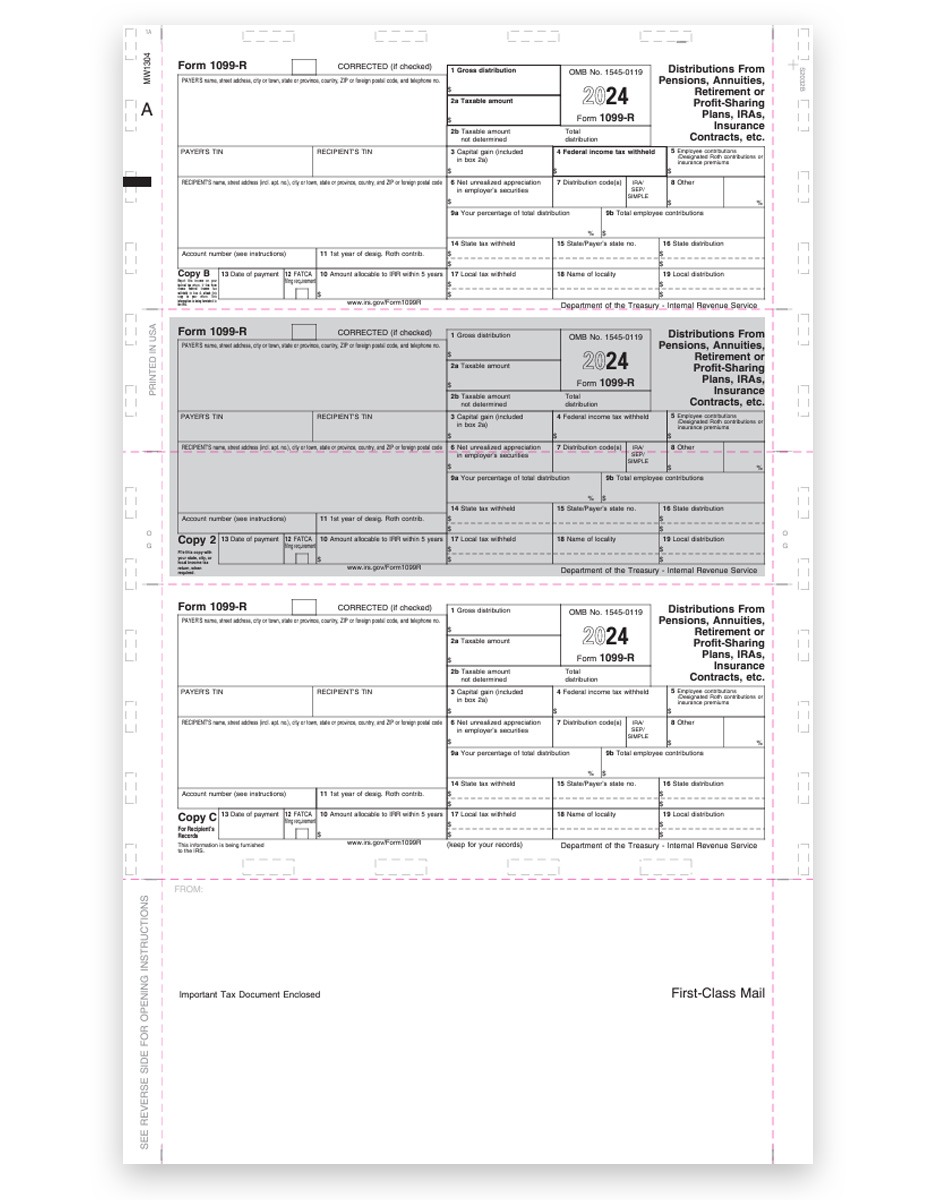

1099 & W2 Forms that must be e-filed according to the requirements above: 1042-S, 1094 series, 1095-B, 1095-C, 1097-BTC, 1098, 1098-C, 1098-E, 1098-Q, 1098-T, 1099 series, 3921, 3922, 5498 series, 8027, W-2, and W-2G.

Efile Online with DiscountEfile.com

If your business is required to e-file 1099 & W2 forms, we make it easy! Use our top-rated online filing system, DiscountEfile.com and we’ll e-file with the IRS for you, and can even print and mail recipient copies for you. Get it all done quickly, without purchasing any forms.

Online 1099 & W2 Filing