Blog

Expert insights to

easy 1099 & W2 filing.

Business Penalties & Fines for Incorrect 1099 & W2 Filing

If your business fails to file 1099 or W2 forms on time with recipients or the IRS, or intentionally file incorrect information, you could face larger penalties and fines for the 2024 tax year.

You can even incur fines for mismatched TIN and name combinations.

Learn about the new penalties below, and how to avoid them!

1099 & W2 Mis-Filing Penalties for Tax Year 2024

For 1099 & W2 forms (information returns) filed with recipients, the IRS or SSA for tax year 2024 – filed between January 1, 2025 and December 31, 2025, you could be fined:

- $60 per information return if you correctly file within 30 days of the deadline; maximum penalty $664,500 per year ($232,500 for small business).

- $130 per information return if you correctly file more than 30 days after the due date, but by August 1; maximum penalty $3,987,000 per year ($1,329,000 for small business).

- Intentional disregard of filing requirements – If any failure to file a correct information is due to intentional disregard of the filing or correct information requirements, the penalty is at least $660 per information return, with no maximum amount.

WOW! Those amounts are big!

No one wants to incur those huge fines for filing 1099 or W2 forms after the deadline, or for intentionally providing the wrong information.

The deadlines for filing W2 forms, 1099MISC and 1099NEC forms are January 31 each year, for the prior tax year. Providing these forms to the recipients allows them the time to get the information that’s needed for them to file their annual 1040 return. The IRS and SSA also need the forms filed by this date.

For other 1099 forms, the filing deadlines vary by form, anywhere between the end of January and the end of March.

Penalties for Mismatched TIN and Names on 1099 & W2 Forms

If you submit a mismatched name/TIN combination on your W-2 or 1099 filings, the IRS will issue a CP21000 or CP2100A Notice to you if the payee’s name and Taxpayer Identification Number (TIN) on your filed information return do not match with IRS records.

You will then have to obtain the correct information and be able to prove that you tried to and if unsuccessful, start withholding funds on all future payments.

How to Avoid Penalties

Filing 1099 & W2 forms on time, with the correct information is essential to avoiding those large penalties for businesses. And the IRS isn’t very understanding when you don’t follow the rules.

Don’t forget, that you are required to e-file Copy A forms with the IRS or SSA if you have 10+ forms, combined per EIN. E-Filing Requirements

And certainly don’t worry… The Tax Form Gals at Discount Tax Forms can make it easy to file 1099 & W2 forms on time, and be ensure TIN matching too!

Here are your options…

Online E-Filing with Print + Mail Service for 1099 & W2 Forms

DiscountEfile.com – a simple, secure online 1099 & W2 filing service. You enter or import data, and we do the rest! We’ll e-file with the IRS or SSA, and even most states, then print and mail recipient copies directly to them. Automatic TIN matching is available too. You’ll get full reporting on the status of each form in the process and we’ll keep the copies on file for years for easy access if you need them. It’s free to set up an account and get everything set. You pay only when you submit forms for filing. Learn about Discount Efile

Software for 1099 & W2 Forms

1099 & W2 Software – stand-alone software that specializes in making year-end 1099 & W2 filing easy. You can enter or import data quickly, perform checks to ensure its accuracy, then e-file with the IRS or SSA and print recipient copies right in your office. Learn about 1099 Software or W2 Software options.

Tax & Accounting Software

Your Tax or Accounting Software – many accounting systems for small business, and tax software systems for accountants allow you to file 1099 and W2 forms too. The options and capabilities vary, so it’s best to check with support for your particular software. But we offer both 1099 forms and W2 forms that are compatible with most!

If you have any questions about the requirements, or your options for filing on time, please just reach out to the Tax Form Gals – we’re happy to help! Email hello@taxformgals.com or call 877-8247-2458.

More from the Blog…

3 Easy Ways to File 1099 & W2 Forms

If your business needs to file W2 forms for employees, or 1099s for contractors or other purposes, we offer 3 simple ways to get them done efficiently before the January 31 deadline: Online Filing, Software, and Forms

Navigating the IRS E-Filing Requirement Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file Copy A forms with the IRS and SSA. We make it easy! And can even print and mail recipient copies for you.

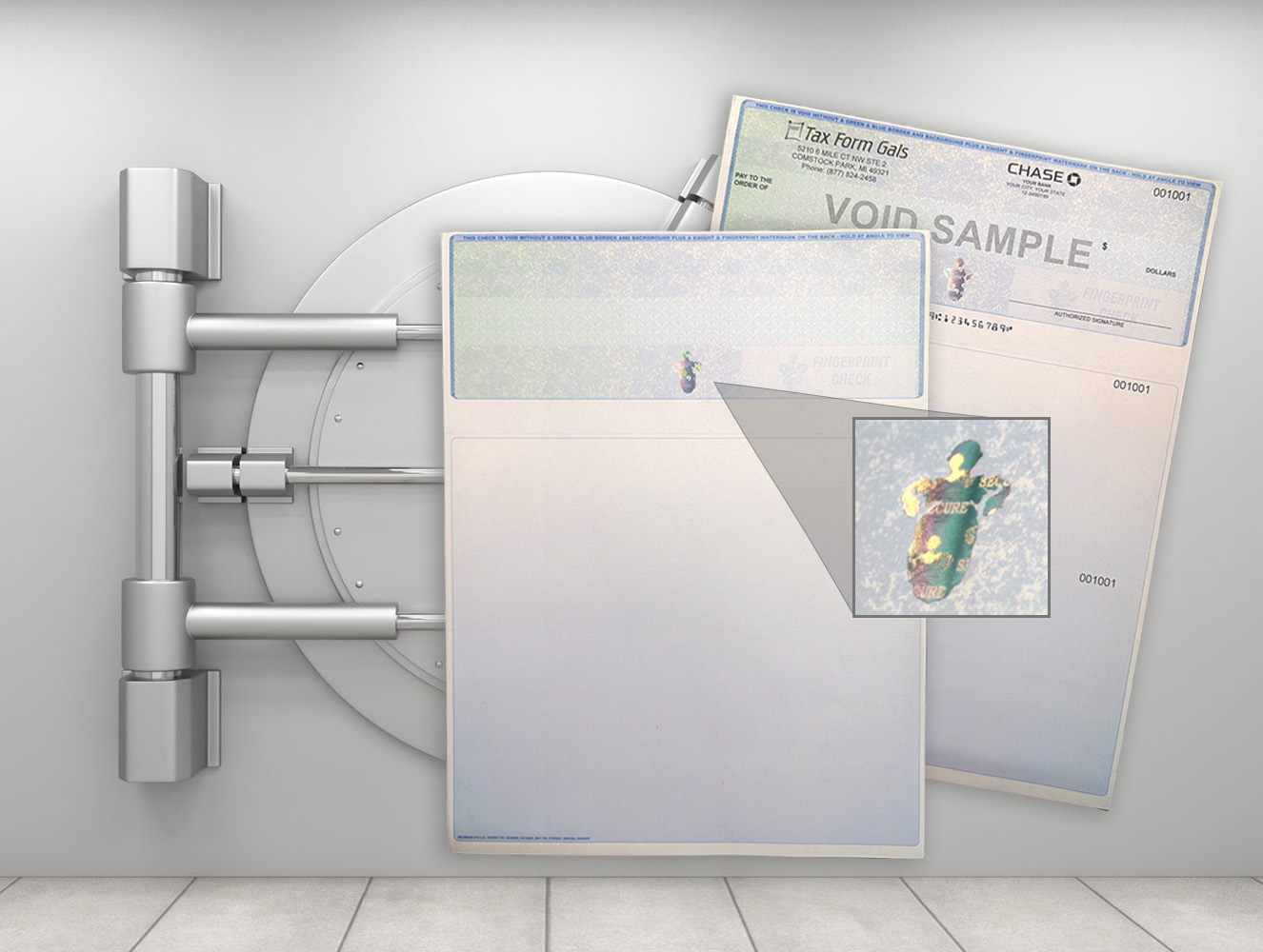

Why Order Business Checks with a Hologram Icon?

Premium security and peace of mind come with the top-level fraud protection offered by business checks with a foil hologram icon. Hear a customer’s story and learn why they made the switch after battling check fraud that could have cost them thousands.