Blog

Expert insights to

easy 1099 & W2 filing.

Decoding 1099-NEC Copy Requirements

1099-NEC ‘Copies’, or parts, report non-employee compensation to recipients and government agencies and help ensure accuracy of income tax filing. They include identical information about the payer and recipient, payments and withholdings, but each copy is given to a different entity.

1099-NEC Forms are filled out by the payer and provided to the recipient or a government agency.

Each recipient receives multiple copies of their 1099-NEC. One is filed with their federal income tax return and if required, one is filed with their state return or kept as a copy for their records.

The Payer files 1099-NEC forms with the federal government, plus state and/or local tax agencies if needed. A copy is retained for their business records as well.

Not all states or cities require a 1099-NEC filed by the payer. Some just use the federal information. See which states require a 1099-NEC later in this post.

Shop for 1099-NEC Forms on DiscountTaxForms.com >

| 1099-NEC Form Copy |

3-Part |

4-Part |

5-Part |

| Payer Copies | |||

| 1099-MISC Copy A (file to Federal Government) |

X |

X |

X |

| 1099-MISC Copy C-2 (payer state or file copy) |

X |

||

| Recipient Copies | |||

| 1099-MISC Copy B (file with Federal tax return) |

X |

X |

X |

| 1099-MISC Copy 2 (file with State/Local tax return or keep for files) |

X |

X |

|

1099-NEC Must be Filed with these States

Alabama, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Georgia, Hawaii, Idaho, Kansas, Kentucky, Maine, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Jersey, New Mexico, North Carolina, North Dakota, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, Utah, Vermont, Virginia, West Virginia, Wisconsin

Don’t forget to file a 1096 Summary and Transmittal with each Payer’s bath of 1099s.

Shop for 1099-NEC Forms on DiscountTaxForms.com >

Read About Decoding W-2 Copy Requirements>

More from the Blog…

Business Penalties & Fines for Incorrect 1099 & W2 Filing

If your business fails to file 1099 & W2 forms on time, or provides incorrect information, you could incur large fines. Learn about the penalties how how to avoid them!

Navigating the IRS E-Filing Requirement Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file Copy A forms with the IRS and SSA. We make it easy! And can even print and mail recipient copies for you.

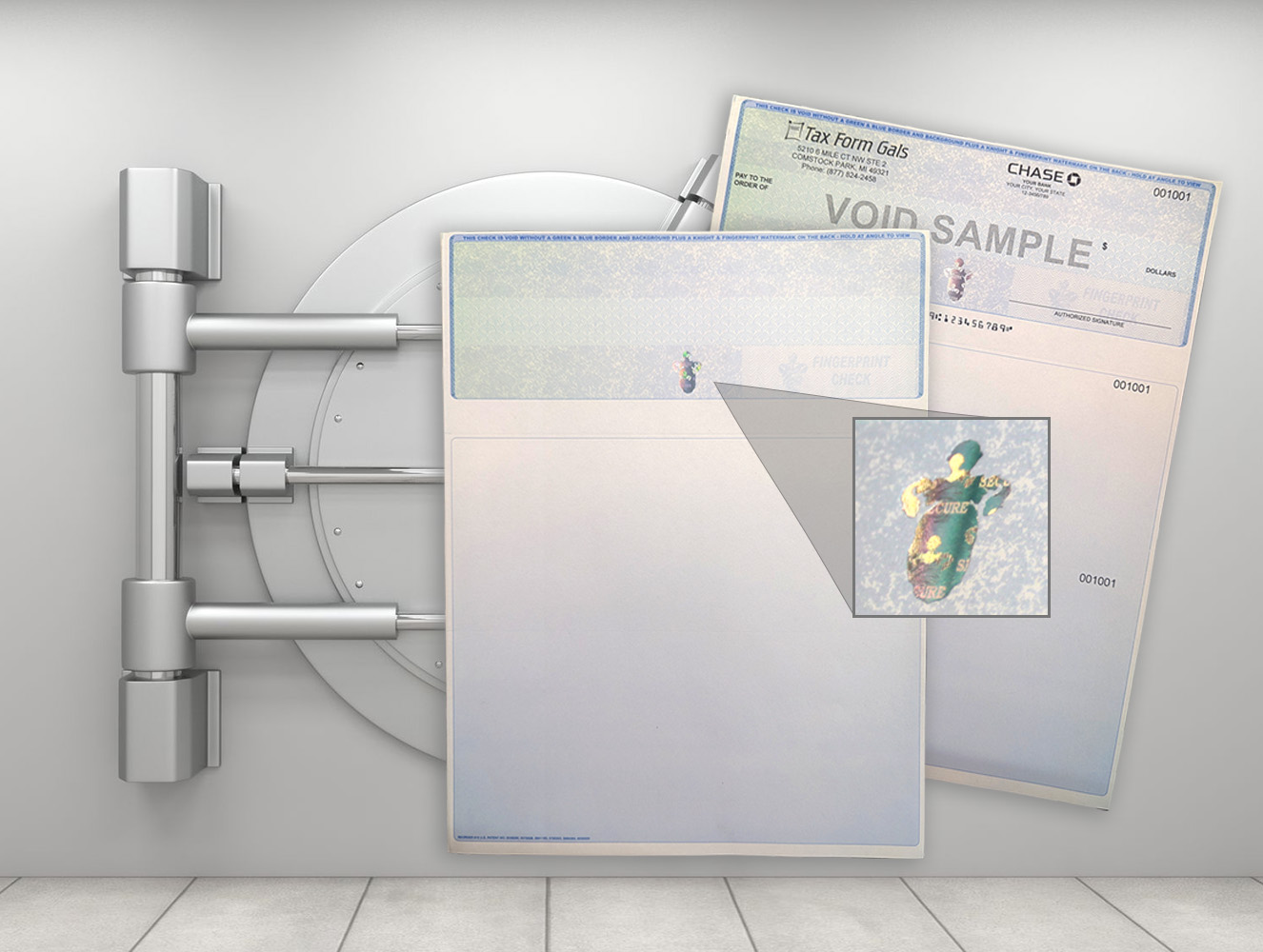

Why Order Business Checks with a Hologram Icon?

Premium security and peace of mind come with the top-level fraud protection offered by business checks with a foil hologram icon. Hear a customer’s story and learn why they made the switch after battling check fraud that could have cost them thousands.