Blog

Expert insights to

easy 1099 & W2 filing.

Navigating the 2023 IRS E-Filing Threshold Change for Small Businesses: A Guide to Using DiscountEfile.com

If Your Business Needs to File 10 or more 1099 & W2 Forms Combined, Per EIN, You Must E-file with the IRS and SSA in 2023

In 2023, the IRS has made significant changes to the e-filing threshold for small businesses, impacting those who need to file 1099 and W-2 forms. For many small businesses, this change will affect how they manage year-end tax reporting.

Fortunately, there’s a convenient solution that can help you navigate this new threshold smoothly – DiscountEfile.com. In this article, we’ll delve into the IRS e-filing threshold change, its implications for small businesses, and how DiscountEfile.com can simplify the process.

Understanding the IRS E-Filing Threshold Change

Starting in 2023, small businesses are required to e-file their 1099 and W-2 forms if they have 10 or more forms to file. This change aims to streamline the tax reporting process, reduce paper waste, and enhance overall tax compliance. While this might seem like a small tweak, it can have a significant impact on small businesses that are used to filing on paper or have previously filed electronically for fewer forms.

Implications for Small Businesses

1. Increased Compliance Pressure: The IRS e-filing threshold change means that more small businesses will need to adapt to electronic filing, potentially causing confusion and stress for those not familiar with the process.

2. Potential Penalties: Failure to comply with the new e-filing threshold can result in penalties. Small businesses can face substantial fines if they do not meet the e-filing requirements.

3. Time-Consuming Manual Filing: For small business owners who still rely on manual paper filing or outdated software, meeting the new threshold can be time-consuming and prone to errors.

How DiscountEfile.com Can Make E-filing Easy

DiscountEfile.com is an easy-to-use and cost-effective e-filing solution that can be a lifesaver for small businesses grappling with the new IRS e-filing threshold.

Here’s how it helps!

User-Friendly Interface: DiscountEfile.com offers a user-friendly platform that makes e-filing 1099 and W-2 forms a breeze, even for those who are not tech-savvy. Plus, it can print and mail recipient copies without any additional work for the business.

Cost-Effective: DiscountEfie.com ensures that small businesses won’t break the bank while complying with IRS requirements.

Guidance Every Step of the Way: Step-by-step instructions throughout the e-filing process, reducing the chances of errors and ensuring compliance.

Secure Data Handling: Security is paramount when handling sensitive financial data. DiscountEfile.com employs state-of-the-art encryption and security measures to protect your information.

Time Savings: Not only does DiscountEfile.com e-file with the IRS, SSA and select states, it can also print and mail your recipient copies with no extra work, so you don’t need to buy forms, envelopes or postage at all.

Compliance Assurance: With DiscountEfile.com, you can rest easy knowing that you are fully compliant with the IRS e-filing threshold change.

How to Get Started with DiscountEfile.com

Getting started with DiscountEfile.com is simple:

- Sign Up: Visit DiscountEfile.com and create a free account.

- Input or Import Data: Enter the necessary information for your 1099 and W-2 forms manually, or import it from QuickBooks or other accounting software (full instructions are provided).

- Review and Confirm: Double-check your data to ensure accuracy.

- Submit: Submit your forms for filing, and instantly efile with the IRS or SSA and, if you choose, print and mail recipient copies. When you submit your forms is when you pay for them, so you can ensure everything is correct and compliant before spending a dime!

Set up a Free Account and Start Efiling

Support is Just a Click Away

If you need help understanding the requirements and your options for 2023 year end filing, just contact The Tax Form Gals at Discount Tax Forms! Email us at hello@taxformgals.com or call 877-824-2458.

And if you need technical assistance during the filing process, our expert support team is on standby via email or chat.

More from the Blog…

3 Easy Ways to File 1099 & W2 Forms

If your business needs to file W2 forms for employees, or 1099s for contractors or other purposes, we offer 3 simple ways to get them done efficiently before the January 31 deadline: Online Filing, Software, and Forms

Business Penalties & Fines for Incorrect 1099 & W2 Filing

If your business fails to file 1099 & W2 forms on time, or provides incorrect information, you could incur large fines. Learn about the penalties how how to avoid them!

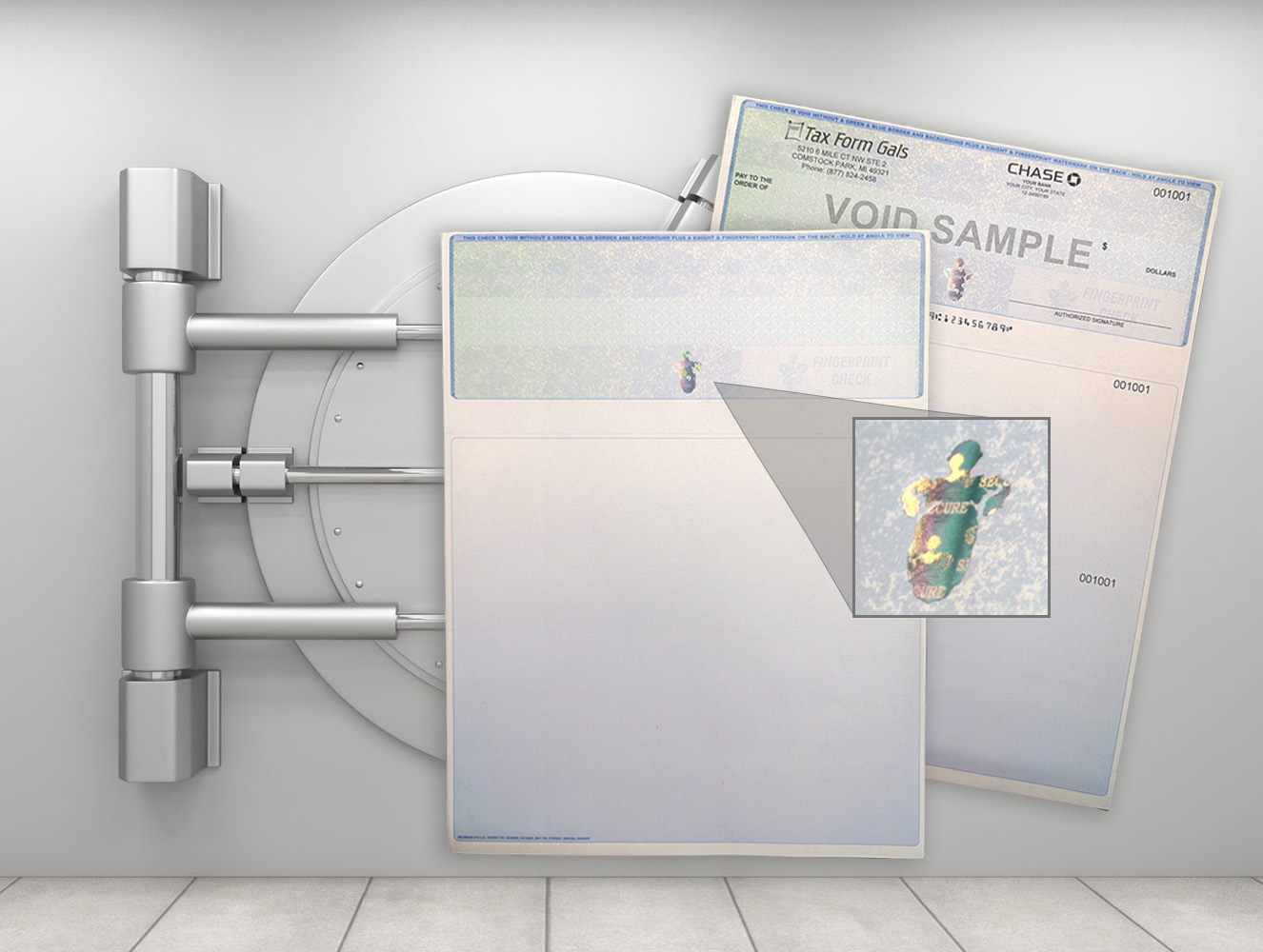

Why Order Business Checks with a Hologram Icon?

Premium security and peace of mind come with the top-level fraud protection offered by business checks with a foil hologram icon. Hear a customer’s story and learn why they made the switch after battling check fraud that could have cost them thousands.