Blog

Expert insights to

easy 1099 & W2 filing.

ACA Reporting with 1095 Forms

Beginning in January 2016, most employers must file information returns for the Affordable Care Act (ACA) on new 1095 and 1094 Forms.

ACA Reporting Overview

ACA Reporting Overview

The Affordable Care Act (a.k.a. Patient Protection and Affordable Care Act, or ObamaCare) requires additional reporting for employers and insurers to remain compliant.

In 2016, employers and insurers must file information returns on Form 1095 with both the IRS and employees to report on healthcare coverage for the 2015 tax year.

Employer & Insurer Requirements

Not every business needs to file ACA forms in 2016. Yours must if you:

- Have 50+ employees who are full-time or full-time equivalent

- Are a self-insured employers regardless of size

Full time employees are those who worked an average of 30+ hours per week for more than 120 days in 2015. Use the HealthCare.gov FTE Employee Calculator for more information.

Required Forms

A new series of forms will be used for ACA reporting, the new 1095 forms. They can be filed on paper forms or e-filed to the IRS (required for 250+ forms).

1095-B: Health Coverage Forms are filed by insurers with the IRS and sent to taxpayers verify that individuals have the minimum essential coverage. Read the 1095-B Instructions >

1095-C: Employer-Provided Health Insurance Offer and Coverage Forms are filed by employers with 50+ full-time employees (or equivalent) to verify compliance with the employer “shared responsibility” mandate. It is also used to establish employee eligibility for premium tax credits if the employer doesn’t offer affordable or adequate coverage. Read the 1095-C Instructions >

1094-B & 1094-C Transmittal Forms are used to transmit and summarize the individual 1095-B and –C Forms to the IRS.

There are no requirements to file with states for these new forms.

Filing Deadlines

The same deadlines for 1099 forms and W-2 forms apply to the 1095 forms.

- Jan 31 for employee forms

- Feb 28 for IRS reporting on paper forms

- Mar 31 for IRS reporting via e-file

Penalties

Penalties may apply for forms filed late or with incorrect information.

Additional Resources

Q&A on the IRS Website, Affordable Care Act Section >

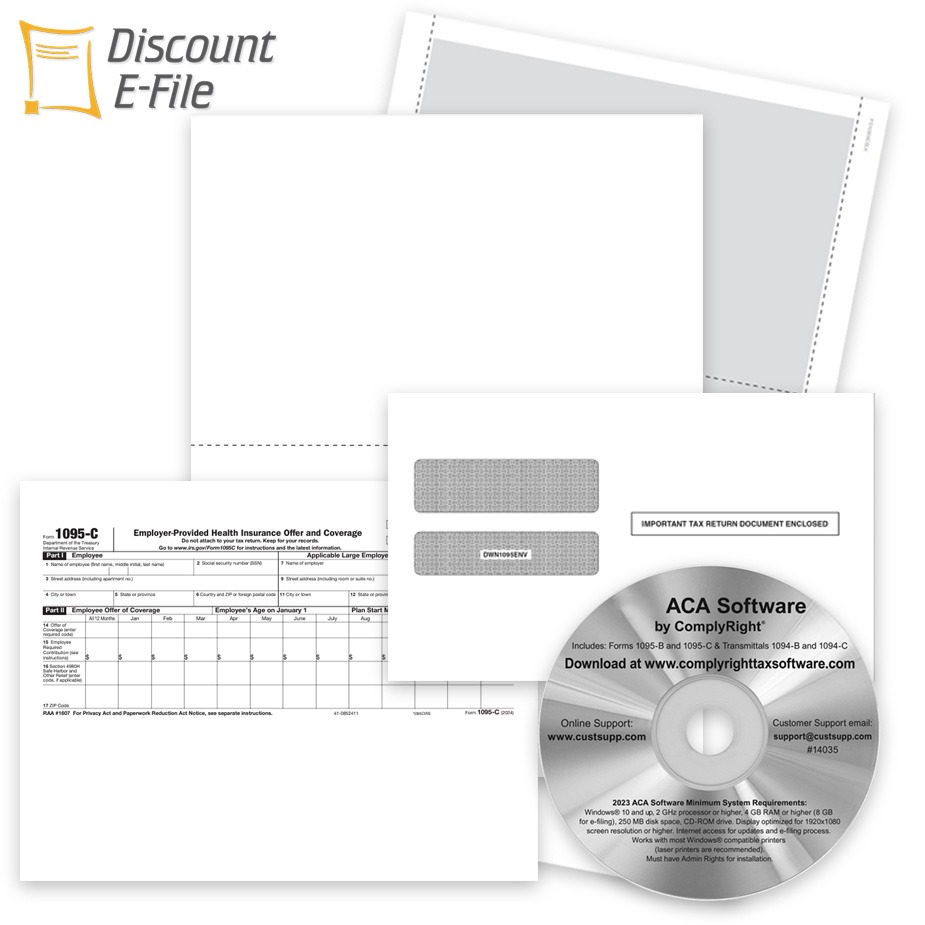

Buy the Forms

Get the forms you need to stay compliant from Discount Tax Forms!

Order 1095 Forms online

Call our experts at 1-877-824-2458

Live Chat on DiscountTaxForms.com