Blog

Expert insights to

easy 1099 & W2 filing.

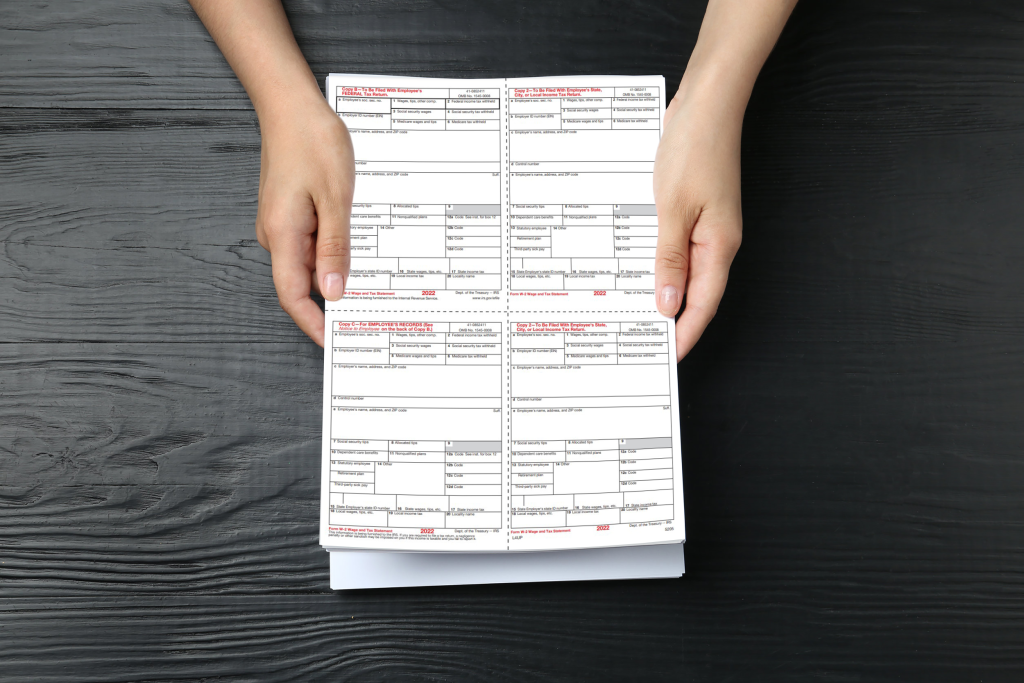

Official vs Condensed W2 Forms: Understanding the Formats

4up and 3up W2 Formats are More Efficient for Printing and Mailing Employee Copies.

Businesses that need to provide W2 forms to employees have a few options when it comes to buying W2 forms.

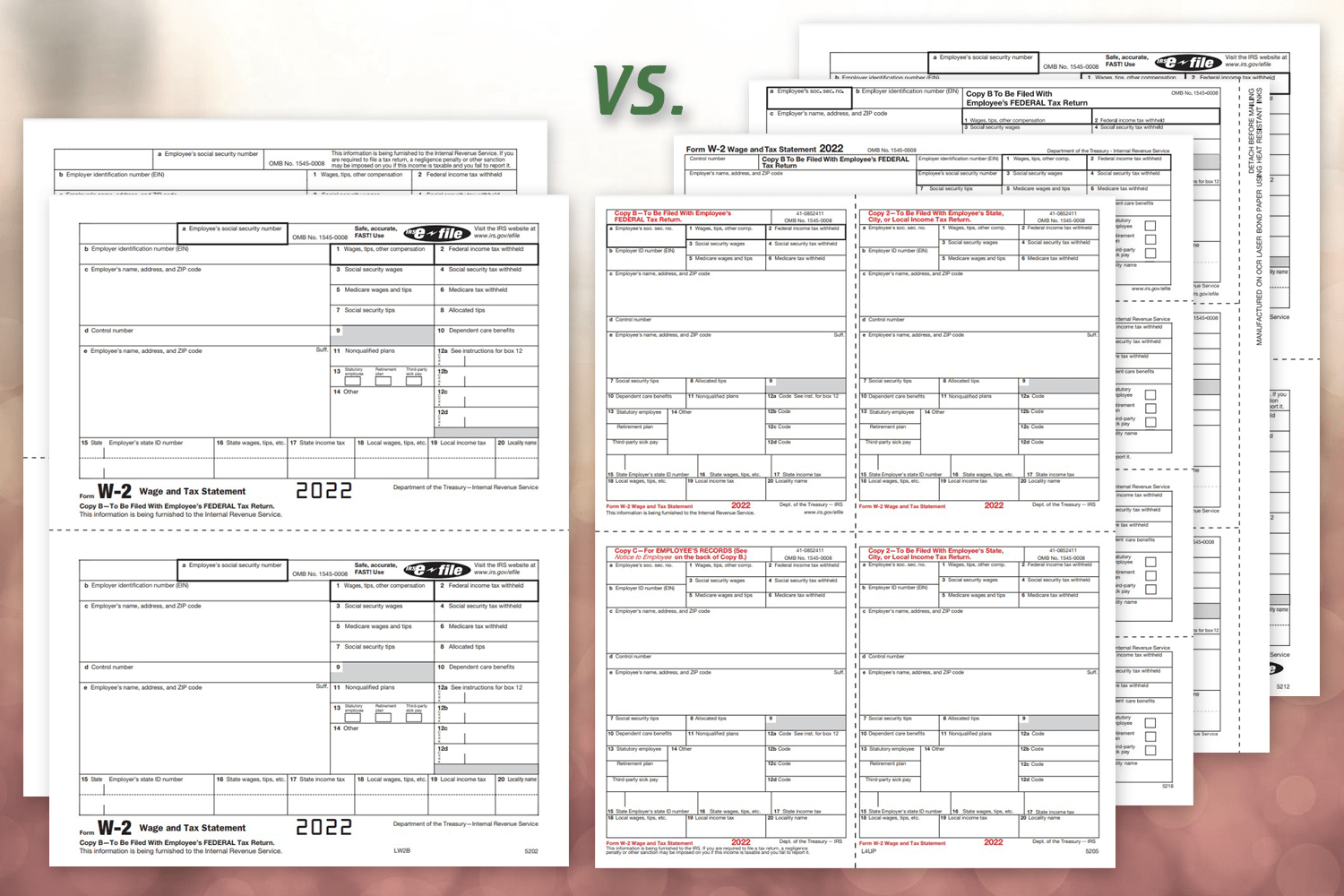

There are the official, traditional 2up W2 forms that are supported by most accounting and bookkeeping systems, and condensed 3up and 4up W2 forms that can be used with some.

Official, Traditional 2up W2 Forms

The official, SSA standard W2 forms have 2 forms on one sheet of paper, perforated in the middle, for easy separation. The 2 forms are always the same copy, with two employee Copy B, Copy C, Copy 2 on a sheet, or employer Copy A, Copy D-1.

The traditional 2up W2 employee forms need to be printed for 2 different employees, then separated and collated for mailing with the other copies.

This just takes time and can be a hassle when it comes to matching up the different copies for the same employee.

But if you have the right software, there is a better way!

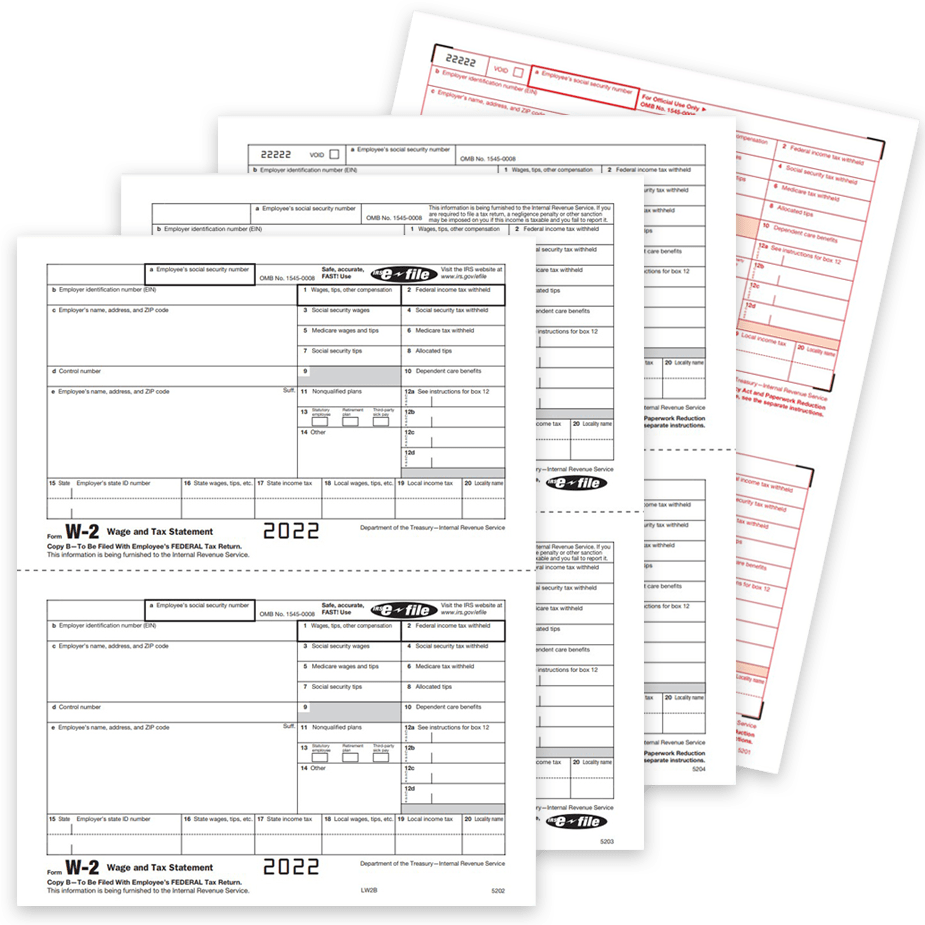

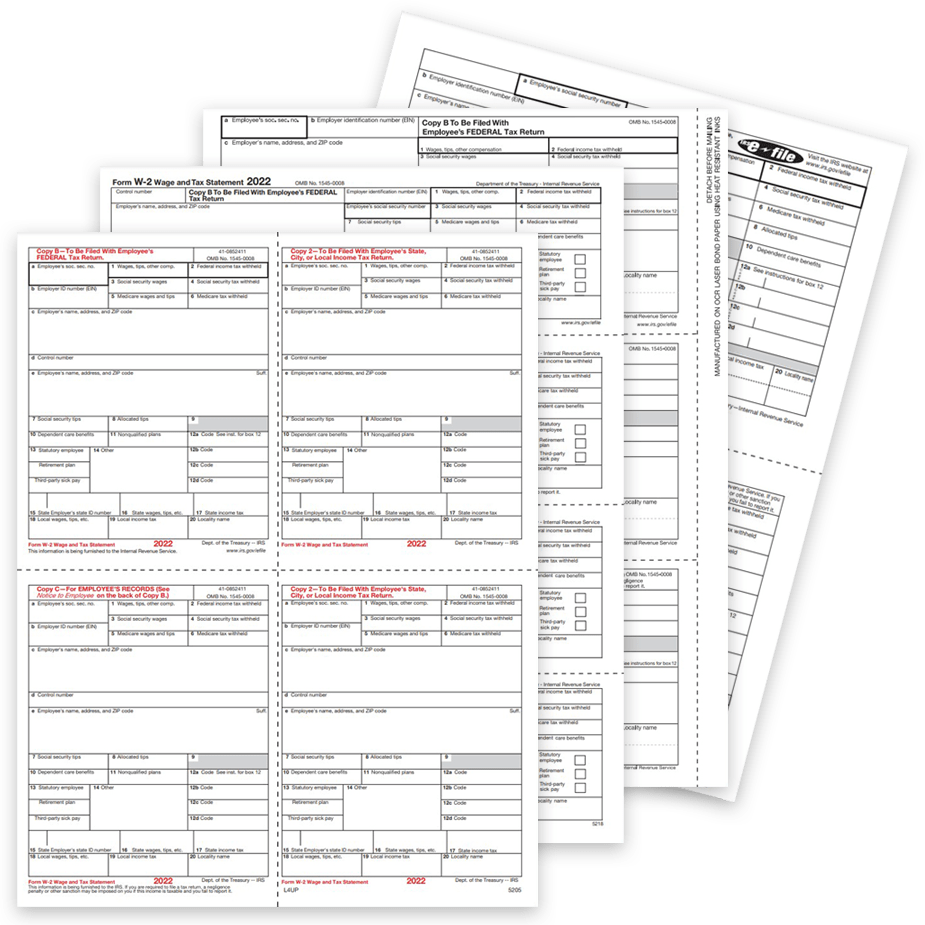

Condensed 2up, 3up and 4up W2 Forms

Simplify the process by printing all of the copies for one employee on a sheet, then just fold and mail!

This is accomplished by using condensed 2up, 3up and 4up W2 forms for employees.

Condensed W2 forms have different copies on a single sheet, perforated for easy separation by the employee when filing tax returns.

To determine which condensed W2 form is right for you, consider 2 factors: your filing requirements and software capabilities.

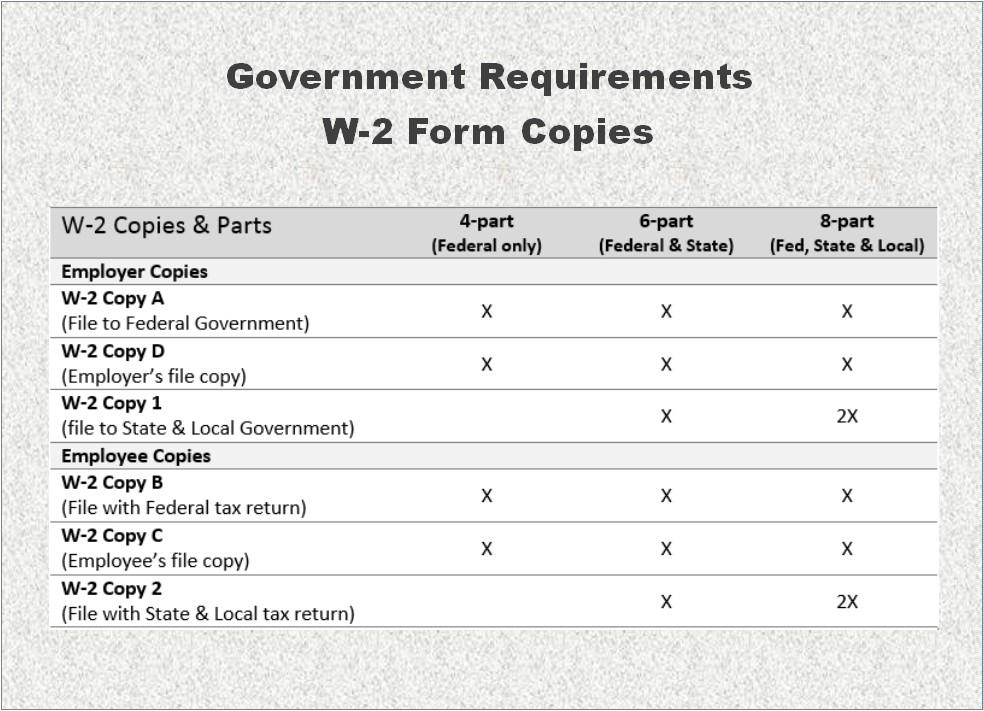

W2 Filing Requirements

Depending on where your employee lives, and what kind of taxes have been withheld from their paychecks, you will need to provide various copies of W2 forms for federal, state and local requirements.

If an employee needs to file only a federal tax return, they will need a 4-part W2 with Copy B for the federal tax return and Copy C for their records.

If an employee needs to file a federal and state tax return, they will need a 6-part W2 with Copy B for the federal tax return, Copy 2 for the State and Copy C for their records.

If an employee needs to file a federal, state and city tax return, they will need an 8-part W2 with Copy B for the federal tax return, two Copy 2 forms for state and city, and Copy C for their records.

There are corresponding, condensed W2 forms for each, but to determine which one will work best, you need to understand what your software will print.

Regardless of the format you choose, the SSA requires that W-2 instructions for the employee are printed on the back, or otherwise provided along with the forms.

W2 Software Capabilities for Condensed Forms

Now that you know the filing requirements, you can choose the condensed W2 form format that will work best for you!

Some systems support preprinted condensed W2 forms, and some support only blank perforated W2 forms.

Depending on the format that your software supports (it should tell you in the help system), you can choose:

Condensed 2up W2 forms for 4pt filing with Copy B & C

Condensed 3up W2 forms for 6pt filing with Copy B & C & 2

Condensed 4up W2 forms for 8pt filing with Copy B & C & 2 & 2

(available in quadrant/corner or horizontal perforation formats)

For QuickBooks Desktop software compatible forms, choose blank perforated paper in condensed formats: W2 blank 2up, blank 3up, or blank 4up V1 (quadrant perforation).

For QuickBooks Online or Assisted PR compatible forms, choose blank perforated paper in condensed formats: W2 blank 2up, or blank 4up V2 paper (horizontal).

For other popular tax and accounting software systems, we have a full list of compatible W2 forms for software on our website. Find software compatible W2 forms.