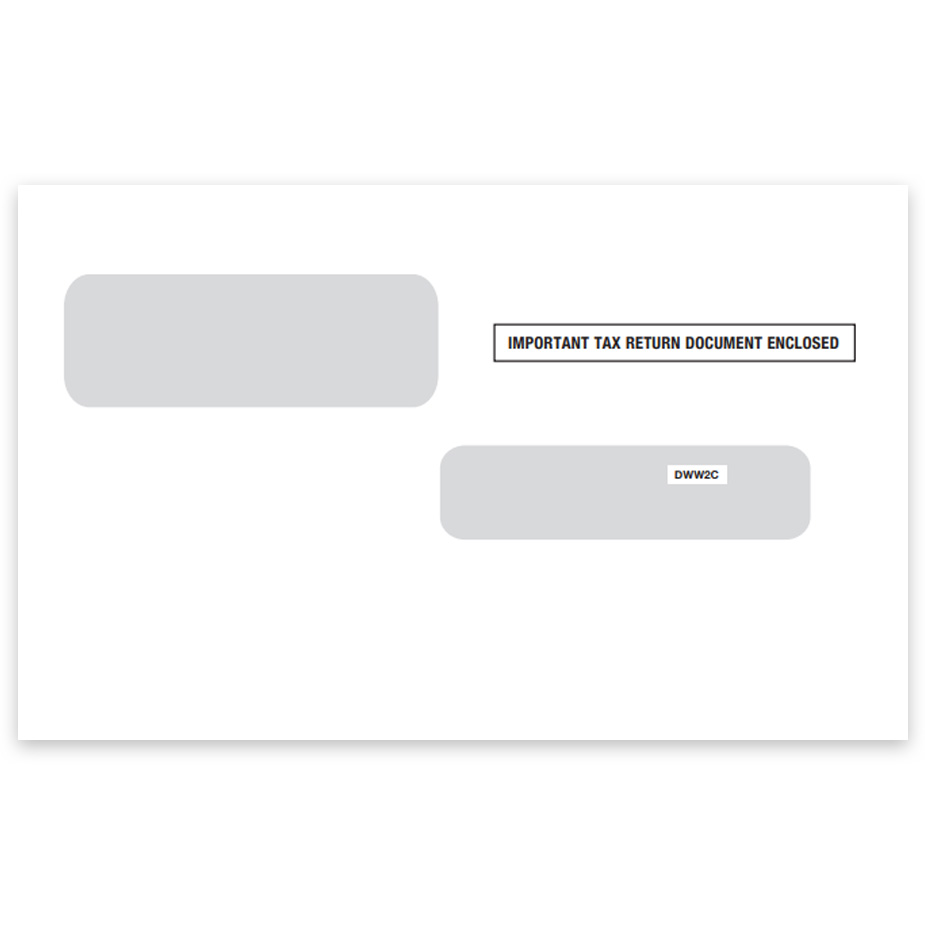

W2c Envelopes for Mailing W2C Correction Forms to Employees

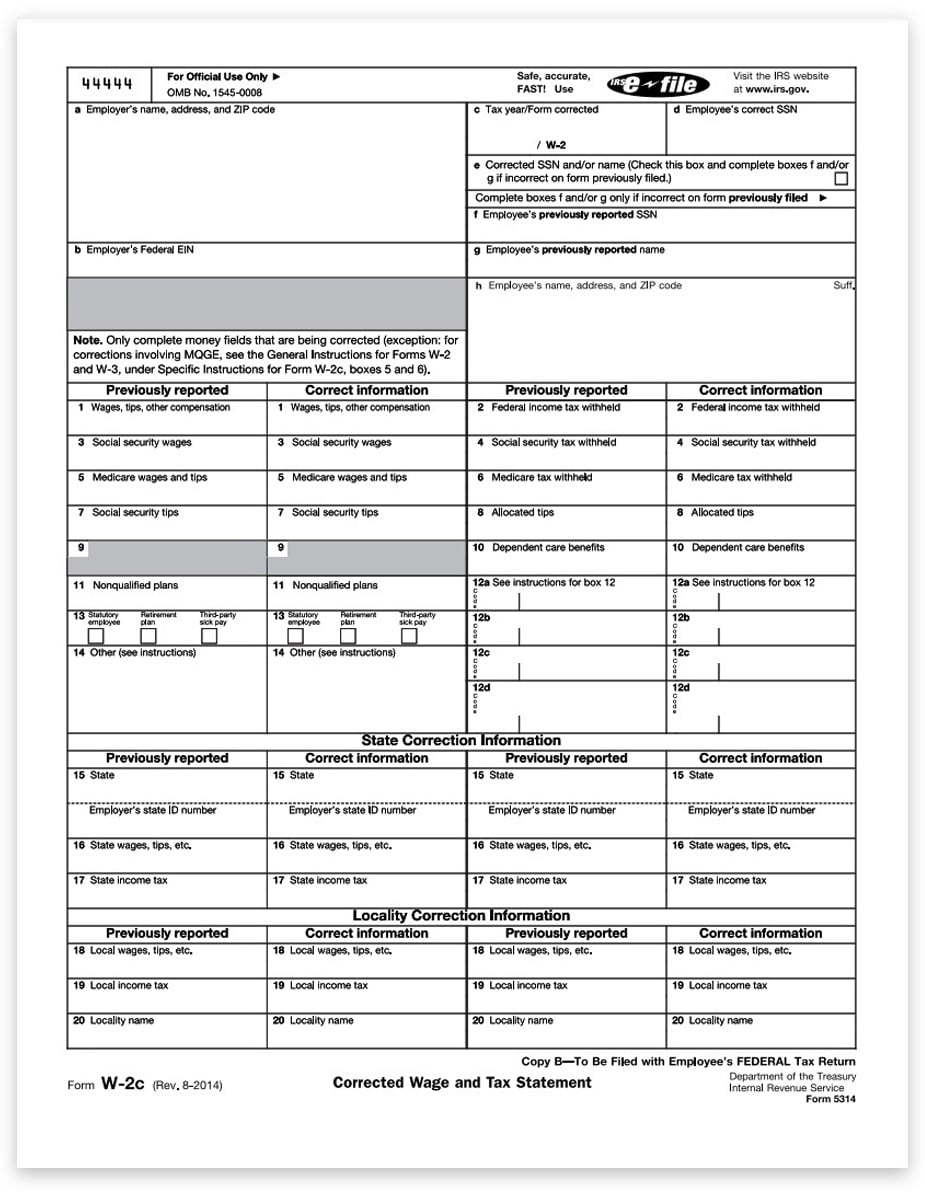

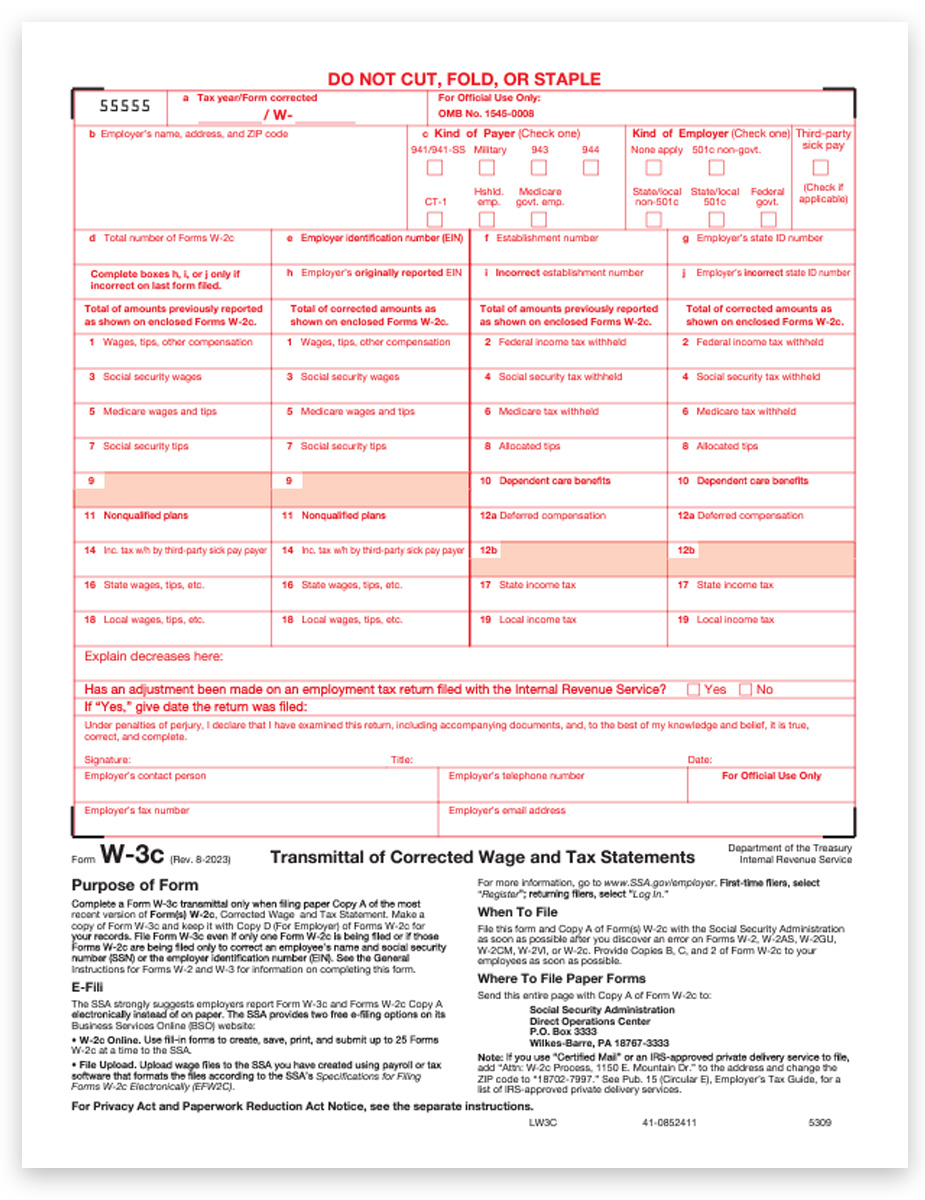

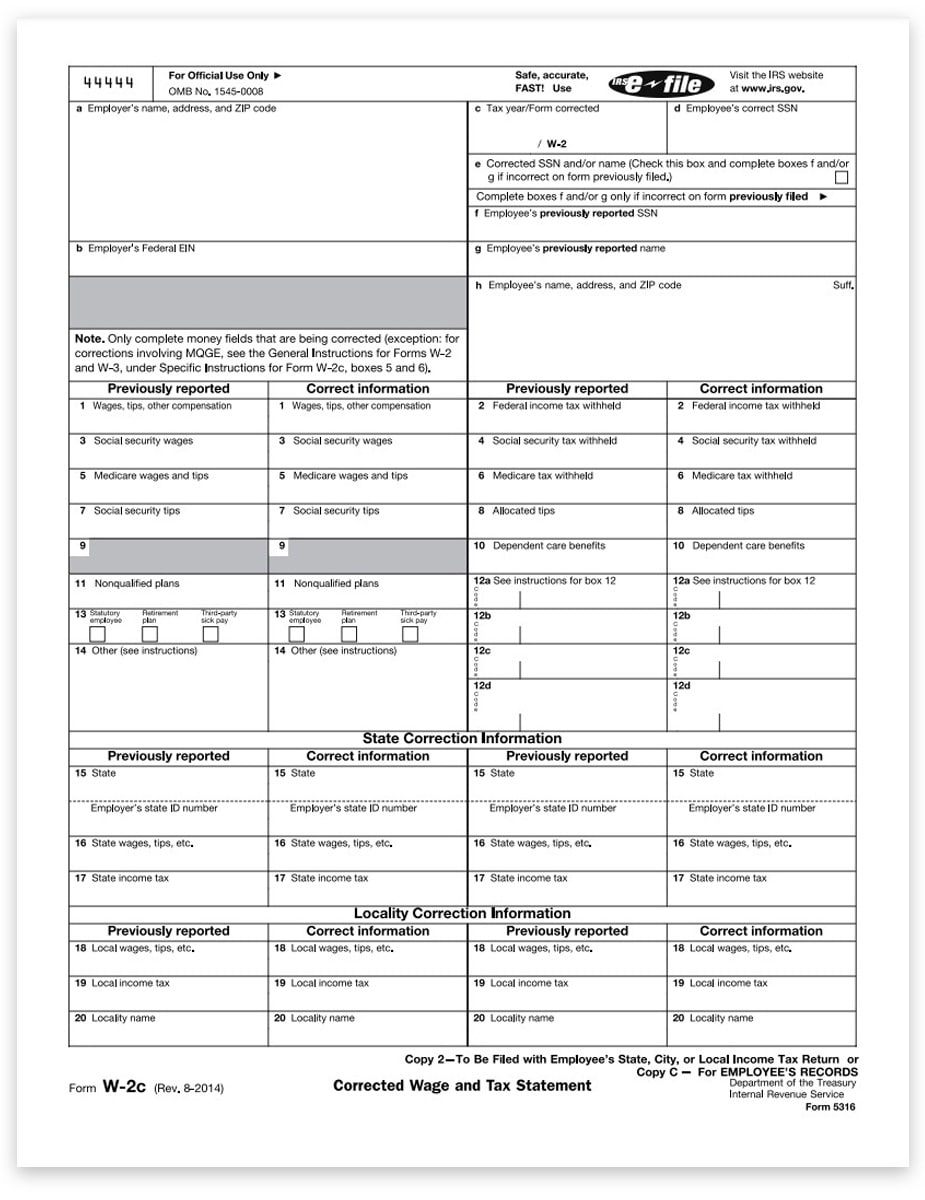

Order W2C envelopes to easily and securely mail W2C tax forms to employees. Compatible with W2C Copy B and W2C Copy C-2 forms.

Get big discounts on W2 envelopes – no coupons needed with The Tax Form Gals!

W2C Envelope Specs:

- Features the required text on the front: “Important Tax Return Documents Enclosed”

- Double windows with cellophane

- Interior security tint

- Moisture-Seal flap

- Overall Size: 5-5/8″ x 9″

- Top Window: 1-5/16″ x 3-3/4″

- Bottom Window: 7/8″ x 3-11/16″

- Top Position: 1/2″ from left | 2-3/4″ from bottom

- Bottom Position: 4/1/4″ from left | 1-7/16″ from bottom

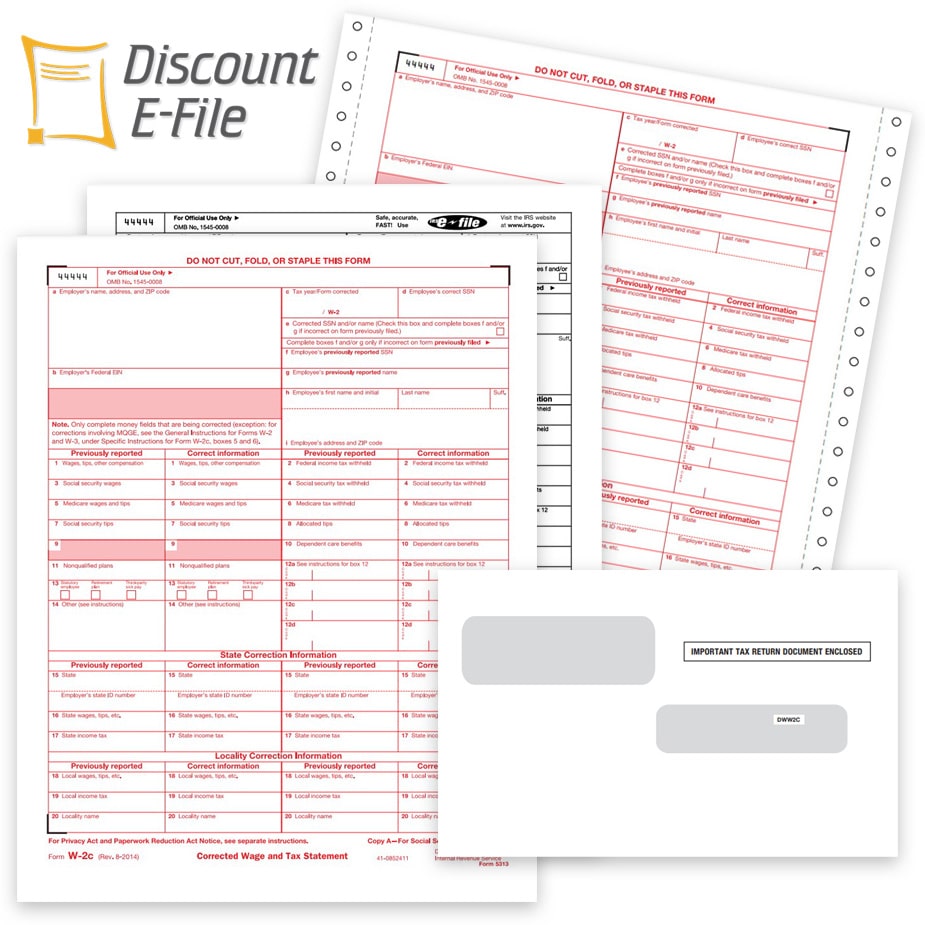

File W2C Forms the Easy Way!

File W2C forms online with DiscountEfile.com – no forms or envelopes needed! Simply enter the corrected data and we’ll e-file with the SSA, and mail employee copies too. If you have already mailed W2 Copy A to the SSA, or e-filed using any system, use DiscountEfile.com for W2C filing – it’s the easiest way to provide corrected information to the SSA and the employee.

How to Correct a W2 Form

How to Correct a W2 Form