QuickBooks® Forms

100% Compatible tax forms, checks and envelopes for Intuit® QuickBooks® Software.

- Big discounts over Intuit® Marketplace – no coupon code required!

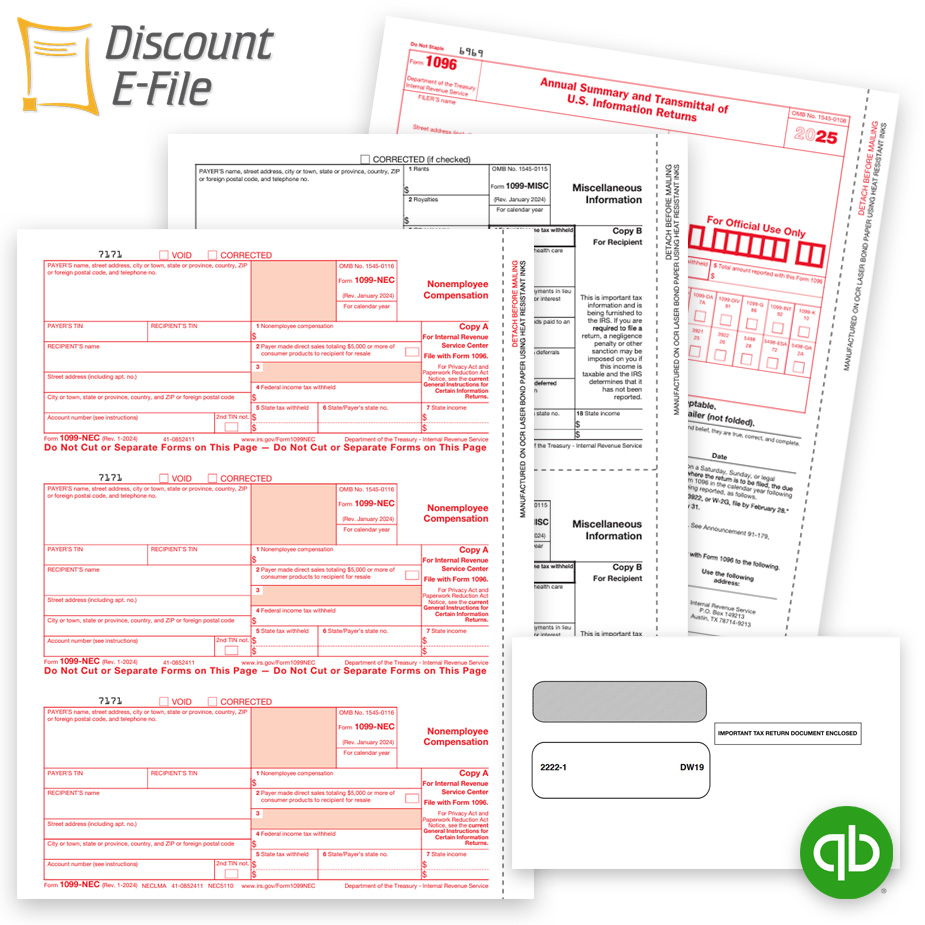

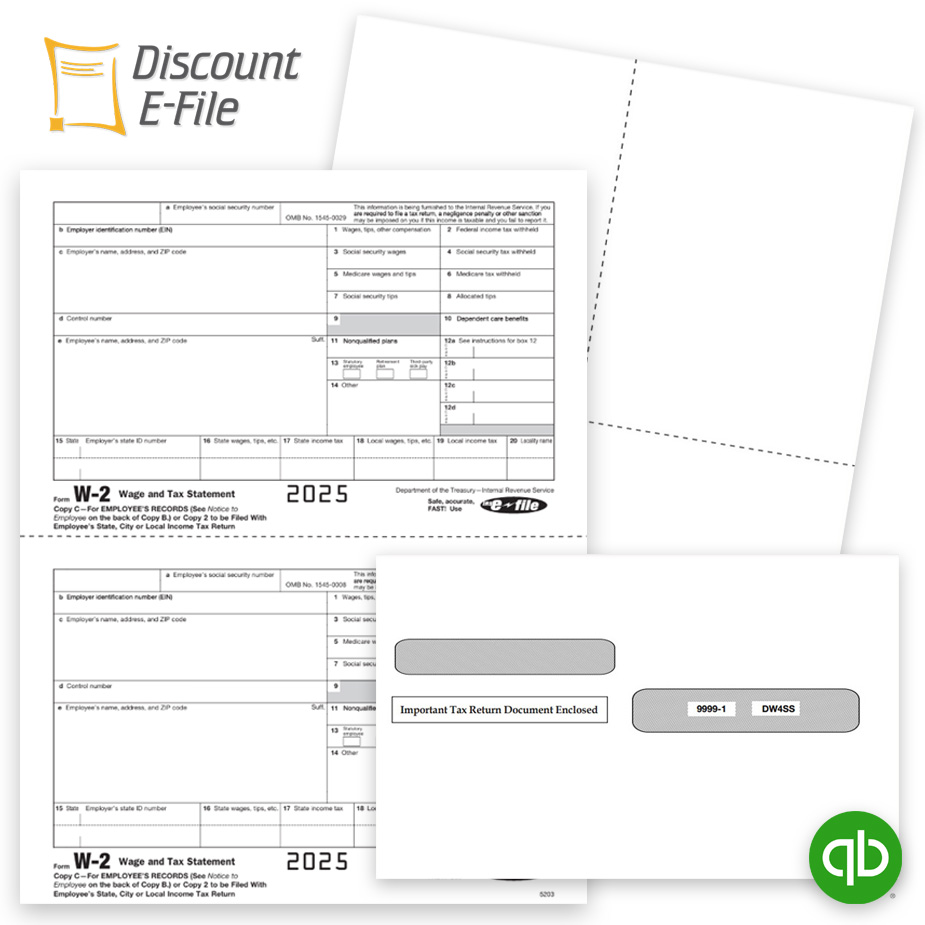

- 1099 & W2 tax forms

- Business checks with free logos

- Envelopes for tax forms and checks

- Guaranteed compatible

- Fast, friendly service from The Tax Form Gals!

Have questions? Just ask!

We’re real people, ready to help.

QuickBooks Compatible Forms, Business Checks, Tax Forms and Envelopes at Big Discounts – No Coupon Needed.

Shop Easy with The Tax Form Gals!

10% OFF TAX SUPPLIES

Save 10% on 1099 & W2 forms and envelopes, tax folders and large envelopes.

Order by October 31!

Code: 10OFF25

Offer does not apply to business checks, mortgage supplies or custom-printed promotional products.

Have 10+ W2 & 1099 Forms to File? You Must E-file!

E-filing is required for 10+ W2 &1099 forms, combined, per EIN.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except corrections. Efile Copy A forms by January 31.

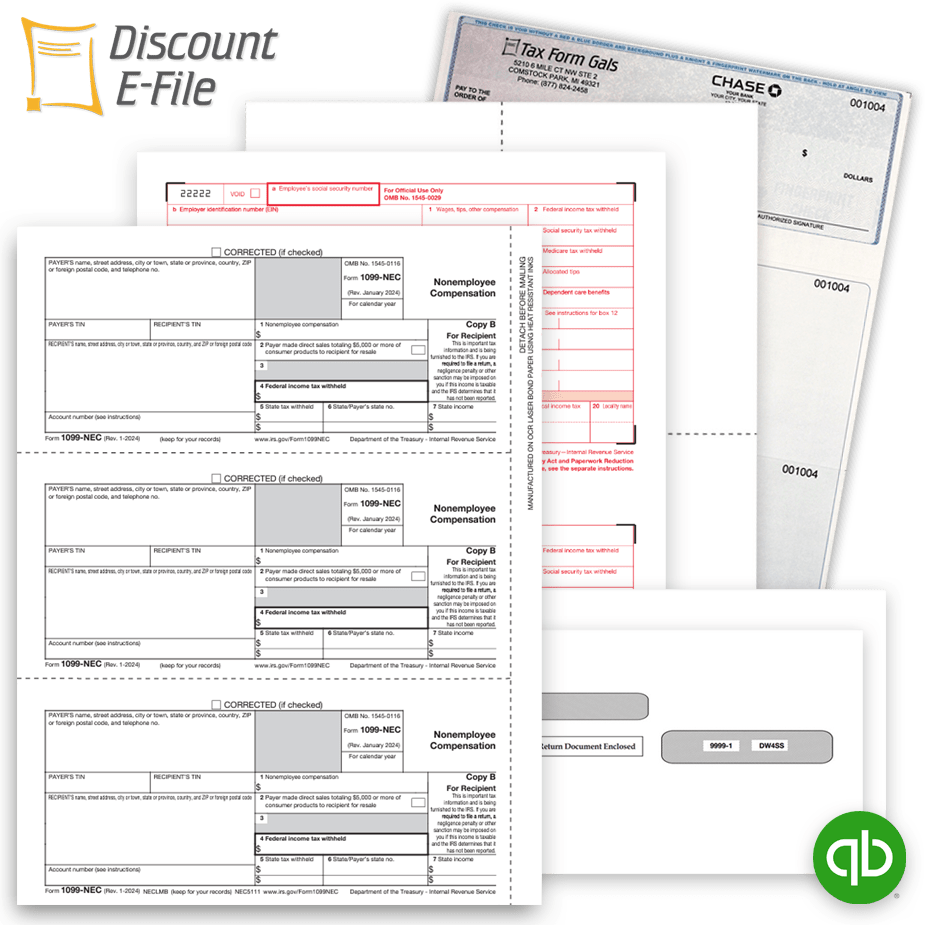

QuickBooks Compatible 1099 & W2 Forms

Rely on The Tax Form Gals for personal, friendly service and fast shipping.

As a women-owned and operated business in Michigan, the friendly Tax Form Gals at Discount Tax Forms work hard for you, and have fun every day – even on Mondays!

With the goal of delivering the best value and best service for essential business supplies that you rely on every day to make your small business run like a well oiled machine.

Give us a call at 877.824.2458 or email hello@taxformsgals.com.

Eliminate the Forms with Online 1099 & W2 Filing!

How Does It Work?

Import your year-end data from QuickBooks® and we’ll do the rest!

Easy online 1099 & W2 filing – we print and mail recipient copies, and E-file with the government.

File new 1099-NEC forms, W2 Forms, Corrections and More with just a few clicks.

Starting at just $4.75 per form with discounts for larger volumes.

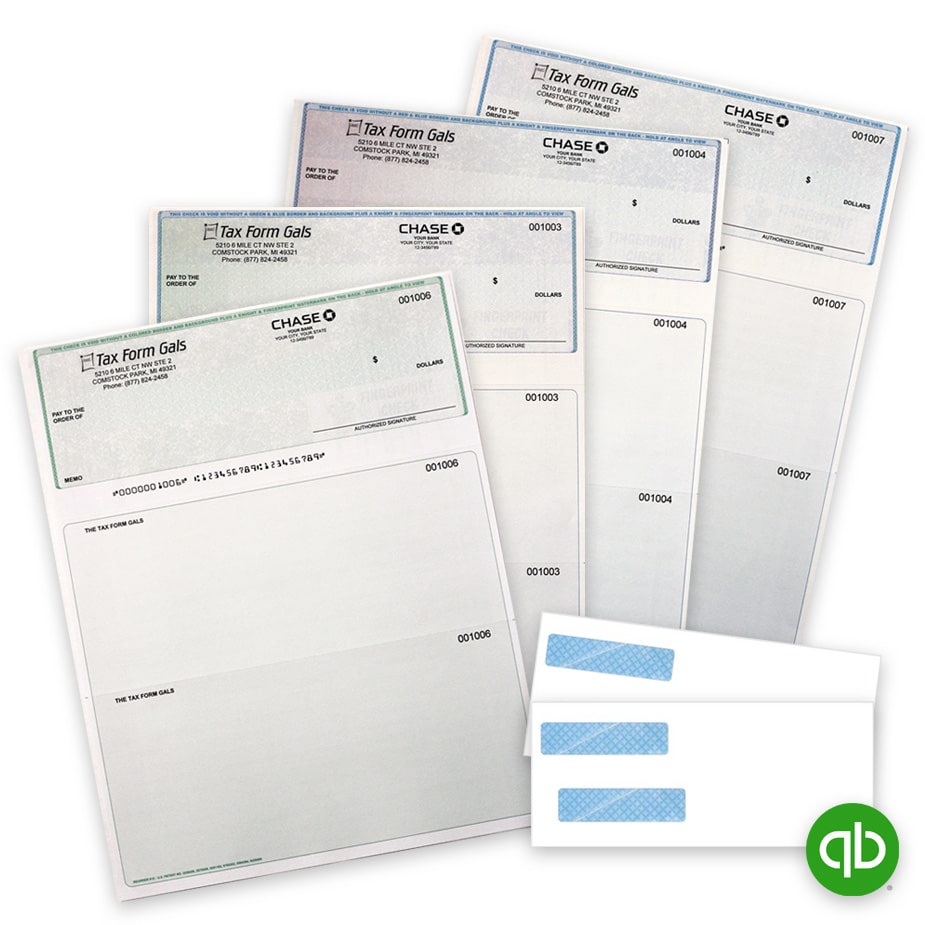

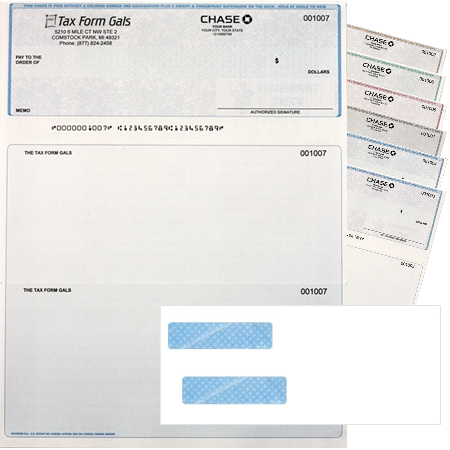

QuickBooks Compatible Business Checks

QuickBooks Checks at Discount Prices – No Coupon Code Needed!

Our business checks for QuickBooks software have the highest security features at significantly lower prices.

- Plus, we print your logo for free!

- Most checks ship within 48 hours from our local, secure facility.

- Fast, friendly service from the Tax Form Gals

Compare prices and save more with Discount Tax Forms everyday!

$100 from Discount Tax Forms

500 Printed Business Checks with Logo

$216.99 Intuit® QuickBooks®

$123.00 Deluxe® (first time orders)

QuickBooks Resources for Small Business

Small Business Guide to Filing 1099 & W-2 Forms.

Whether you need to file W2s for employees, or 1099-NEC for contractors, we can help!

Use this guide to understand how to file, when to file and the best forms, software and solutions for you.

Blog Posts on QuickBooks Forms

3 Easy Ways to File 1099 & W2 Forms

If your business needs to file W2 forms for employees, or 1099s for contractors or other purposes, we offer 3 simple ways to get them done efficiently before the January 31 deadline: Online Filing, Software, and Forms

Business Penalties & Fines for Incorrect 1099 & W2 Filing

If your business fails to file 1099 & W2 forms on time, or provides incorrect information, you could incur large fines. Learn about the penalties how how to avoid them!

Navigating the IRS E-Filing Requirement Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file Copy A forms with the IRS and SSA. We make it easy! And can even print and mail recipient copies for you.

Decoding 1099NEC Copy Requirements

1099-NEC ‘Copies’, or parts, report non-employee compensation to recipients and government agencies and help ensure accuracy of income tax filing. 1099-NEC Forms are filled out by the payer and provided to the recipient and government agency.

Official vs. Condensed W2 Forms: Understanding the Formats

Understand the Different W2 Formats Easily! Compare Traditional 2up W2 Forms to 4up & 3up W2 Forms for Efficient Printing & Mailing of Employee Copies.