Resources for QuickBooks® 1099 & W2 Filing

Videos and information to efficiently, and affordably file 1099 & W2 Forms with QuickBooks.

How to Set up a 1099 Contractor in QuickBooks

- Create a vendor with a Tax ID

- Create an account for 1099 payments for each vendor

- Assign account as Non-Employee Compensation

- Review list of vendors and add if needed

- Review information

- Print 1099 forms or import to DiscountEfile.com for easier online filing

How to E-file 1099 & W2 Forms in QuickBooks

- Use DiscountEfile.com for an easier way!

- Affordable! $3.95 per form or less

- Absolutely secure

- Complete e-file and/or mail service

- All the popular 1099 forms and corrections

- W-2 forms and corrections

- W3 & 1096 Transmittals included

How to Write Checks in QuickBooks

- Open a check

- Enter payee info

- Choose an account, date and category

- Enter the check amount and check number

- Print individually or as a batch

How to Print Checks in QuickBooks

- Choose print checks from the main menu

- Select type of check and preview a sample

- Load QuickBooks check stock and print!

How to Set Up Payroll Taxes

- Gather necessary tax information about your business

- Set up employees

- Enter Federal and State tax details

- Set up e-file and e-pay, or manually pay

- Set up verification and security information

How to Pay Payroll Taxes

- Click Pay Taxes in your activities area

- Click e-pay to submit electronically

- Approve tax payments as needed

Find a Certified QuickBooks ProAdvisor in Your Area

A ProAdvisor is a QuickBooks-Certified accounting professional who provides strategic insight and support to drive small business success.

A ProAdvisor pushes more than numbers—they push you to make your business the best it can be.

Blog Posts about QuickBooks 1099 & W2 Filing

Business Penalties & Fines for Incorrect 1099 & W2 Filing

If your business fails to file 1099 & W2 forms on time, or provides incorrect information, you could incur large fines. Learn about the penalties how how to avoid them!

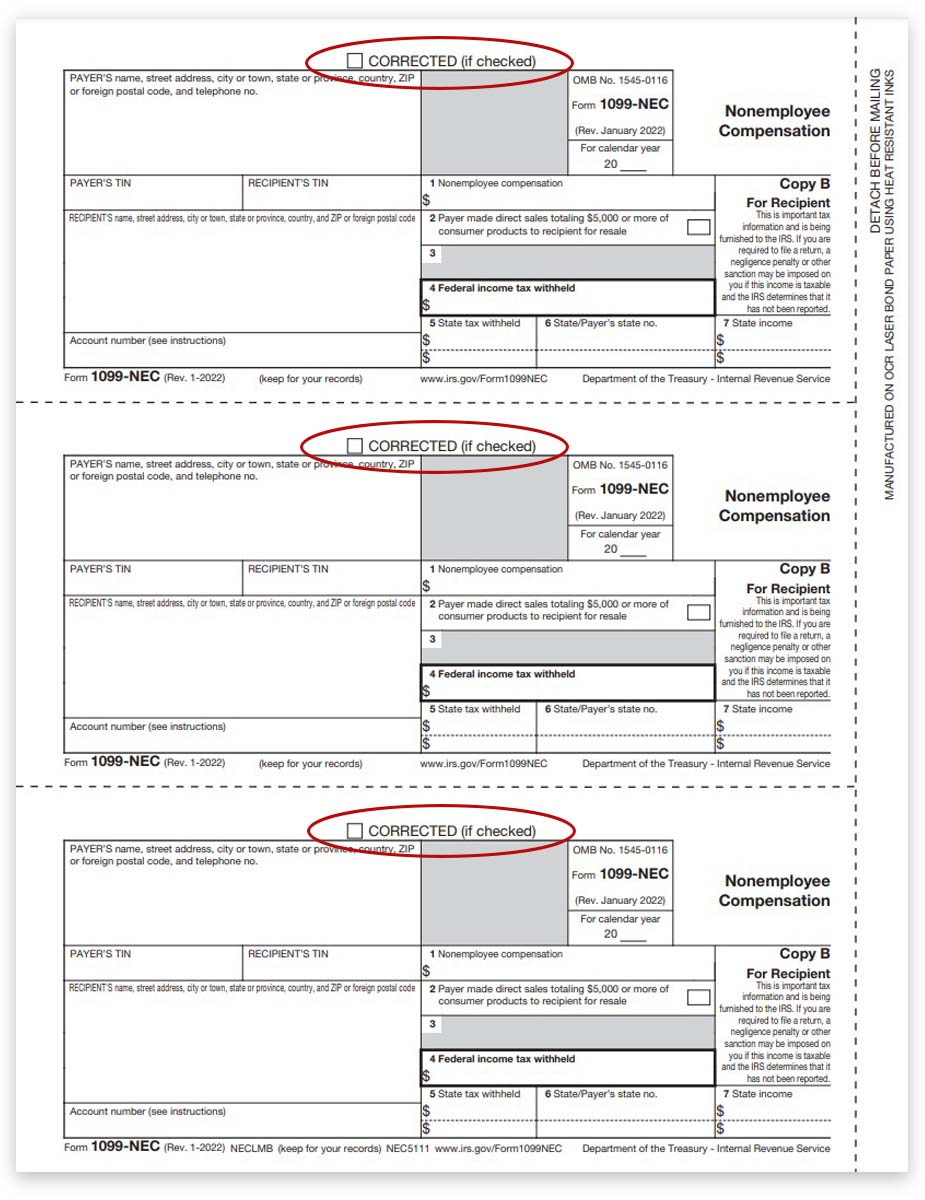

How to Correct a 1099 Form

If you need to correct a 1099 form because the original has errors, you will need to re-file the 1099 form and check the box at the top. But there is an easier way…

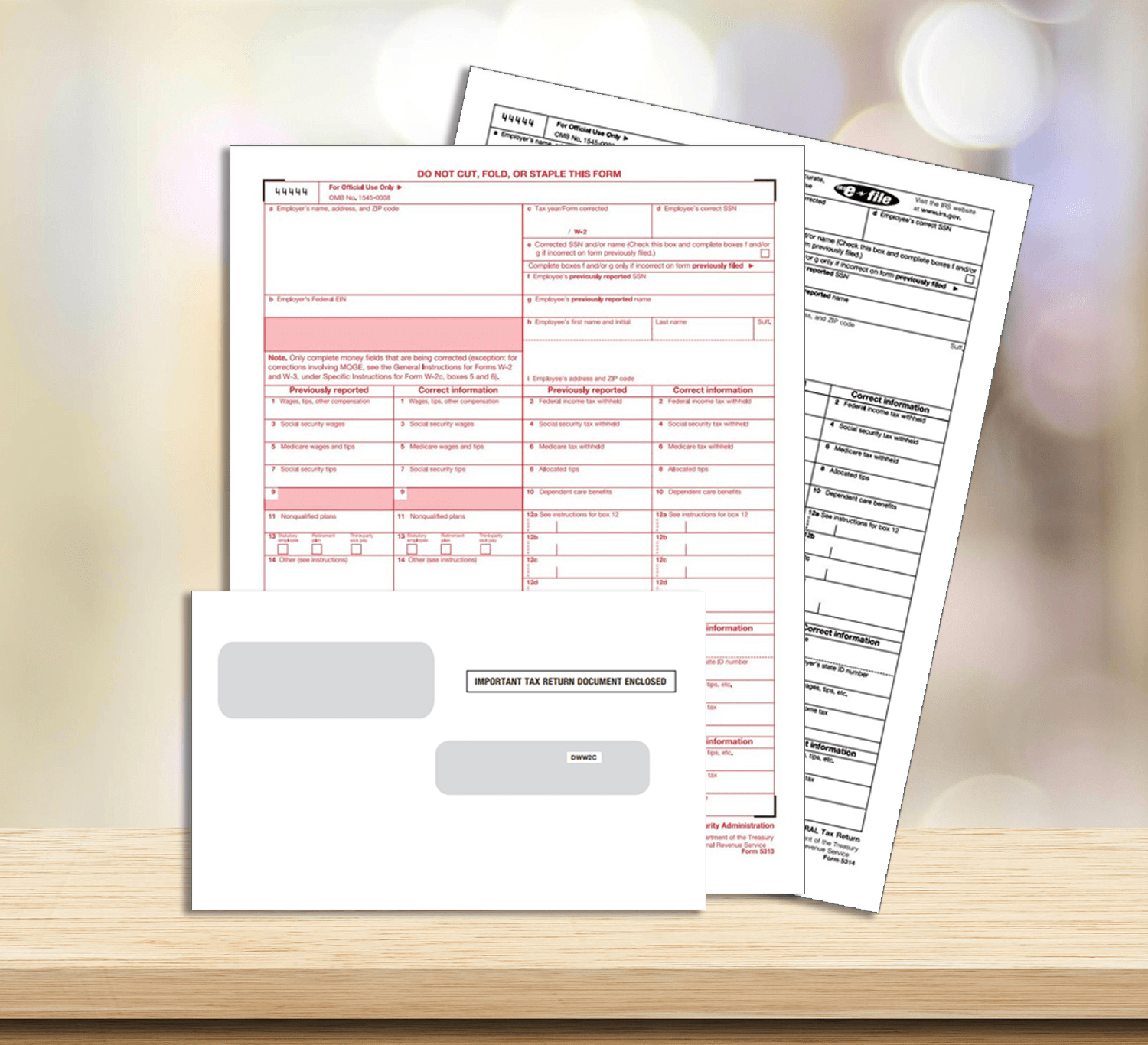

How to Correct W2 Forms

If you need to correct a W2 form because the original has errors, you will likely need to file a W2C form (W-2 Correction Form). This is different than a standard W2 form, and requires a few additional steps. But first, you need to answer one big question: Have you already filed W2 Copy A with the SSA?