1099 & W-2 Guides for Small Business

Order the right 1099 & W2 forms and envelopes, see e-file and software options, and easily get everything done on time!

Easy-to-use 1099 & W2 Guides help small business alleviate the confusion, reduce errors, file faster and understand the process better.

Our small business is ready to help yours — call The Tax Form Gals at Discount Tax Forms!

E-filing requirements — e-file Copy A for 10+ W2 and 1099 forms combined. We make 1099 & W2 e-filing easy!

ONLINE 1099 & W2 E-FILING = EASY 2025!

Efile, print and mail 1099 & W2 forms online.

No paper, no software, no mailing, no hassles!

Use DiscountEfile.com to enter or import data, then we'll e-file with the IRS or SSA and can even print and mail recipient copies.

Create a free account and get started today!

Small Business Guide to Filing 1099 & W-2 Forms.

Whether you need to file W2s for employees, or 1099-NEC for contractors, we can help!

Use this guide to understand how to file, when to file and the best forms, software and solutions for you.

Industry-Specific Guides to Filing 1099 and W2 Forms

Filing Requirements Overview

Deadlines for 2025 1099 & W-2 Filing

February 2, 2026

All 1099 Recipient Copies B / 2 mailed to recipient

W-2 Employee Copies B / C / 2 mailed to employees

1099NEC Copy A forms to IRS*

W2 Copy A to IRS*

>> *E-FILE REQUIREMENTS << Businesses with 10+ 1099 and W2 forms combined MUST e-file Copy A forms with the IRS or SSA. Make it easy with DiscountEfile.com...

March 2, 2026 - Paper 1099 Copy A forms to IRS

1099 Form Copy A, along with 1096 Transmittals, mailed to the IRS for all 1099 forms except 1099-NEC with non-employee compensation, which are due February 2.

April 1, 2026 - E-file 1099 forms with IRS

1099 Forms E-filed to the IRS, except 1099-NEC with non-employee compensation, which are due February 2.

Let Us Do the Work for You This Year!

Instantly e-file, print and mail 1099 and W-2 forms.

DiscountEfile.com makes year end reporting easier than ever!

Simply enter your data, or import it from QuickBooks®, then click a few buttons and you're done.

We e-file with the IRS or SSA, and can optionally print and mail recipient copies, starting at about $4 per form and going down from there.

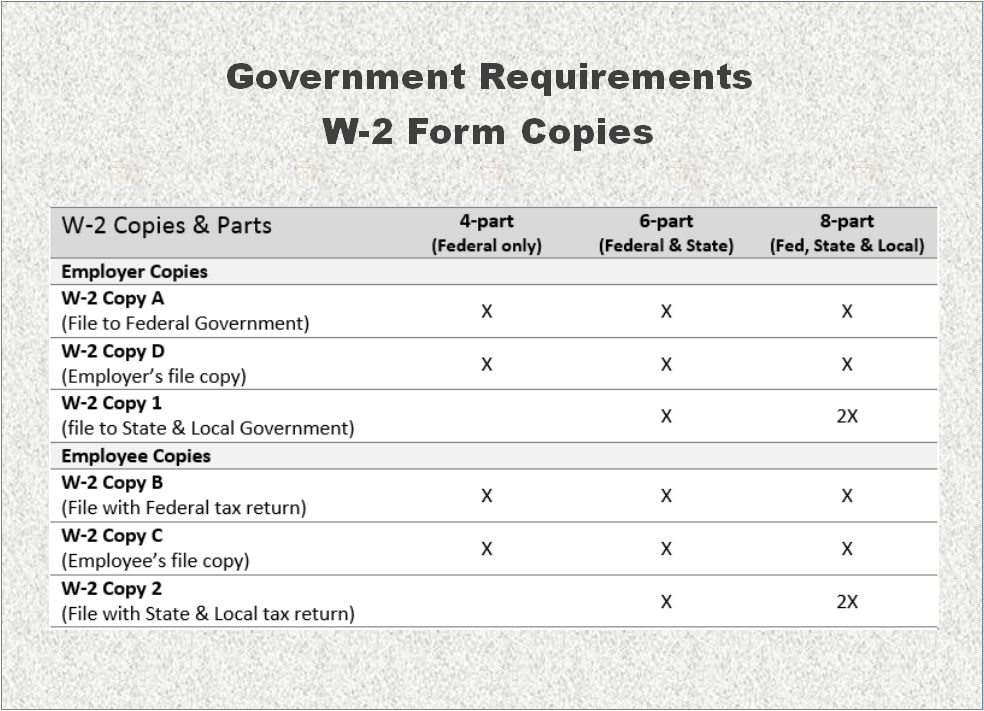

Decoding W-2 Formats

2up W2 Forms

2 forms on a sheet, with one center perforation to create 2 forms.

Use for traditional or condensed 2up W2 forms for employees, 4-pt Copies B and/or C for federal filing and the employee record copy.

3up W2 Forms

3 forms on a sheet, typically with a vertical side strip to remove before mailing.

Use for condensed 3up W2 forms for employees, 6-part Copies B/C/2 for federal and state filing.

4up W2 Forms

4 forms on a single sheet, perforated into quadrants or horizontal sections depending on your software.

Use for 8pt W2 printing of employee Copies B/C/2/2 for federal, state and local filing.

Tips for Easier W2 Filing

Check your software for supported formats:

- Preprinted forms (prints data on a pre-made form) or

- Blank paper (prints data and boxes on a perforated sheet)

- 2up, 3up or 4up forms

- Be sure your envelope windows match!

W3 Transmittal forms must be mailed with Red Copy A forms. We include a couple FREE W3 forms with each W2 order.

Online filing is an option! DiscountEfile.com lets you enter or import data, and then takes care of the rest. Your forms are e-filed with the IRS/SSA and mailed to employees automatically. With a few clicks, you're done! Learn more.

Blog

Expert insights to

easy 1099 & W2 filing.

Business Penalties & Fines for Incorrect 1099 & W2 Filing

If your business fails to file 1099 & W2 forms on time, or provides incorrect information, you could incur large fines. Learn about the penalties how how to avoid them!

Navigating the IRS E-Filing Requirement Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file Copy A forms with the IRS and SSA. We make it easy! And can even print and mail recipient copies for you.

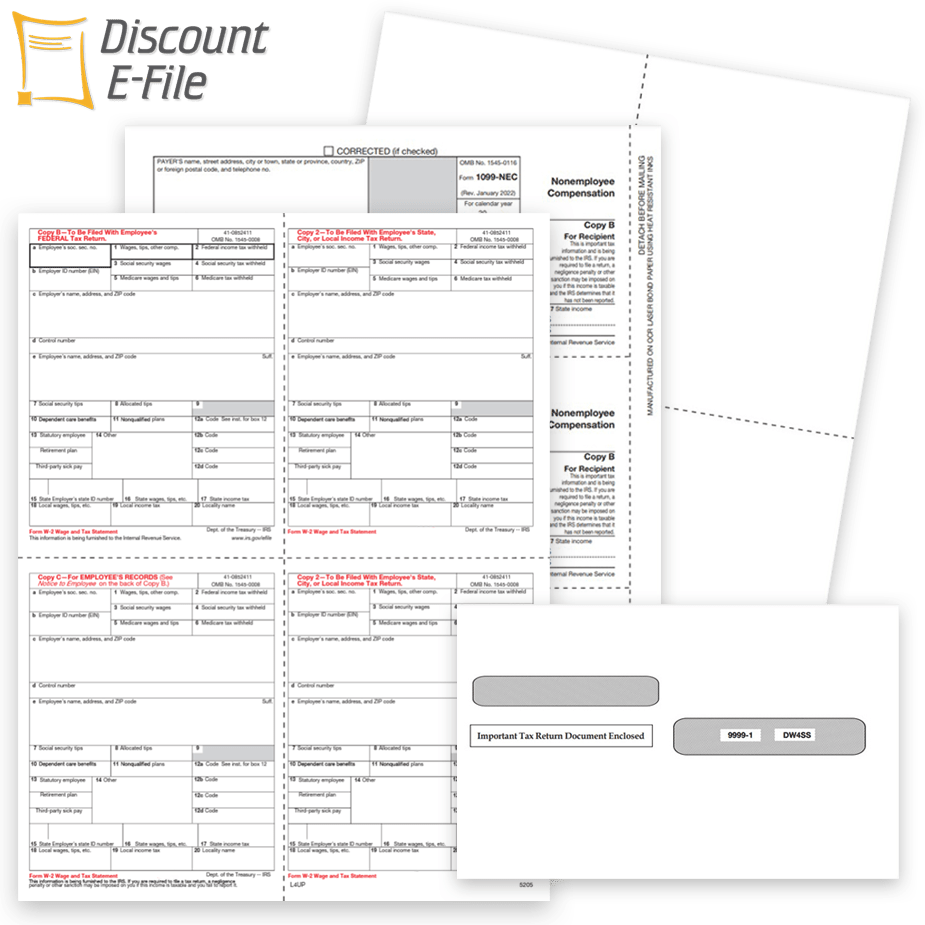

Decoding 1099NEC Copy Requirements

1099-NEC ‘Copies’, or parts, report non-employee compensation to recipients and government agencies and help ensure accuracy of income tax filing. 1099-NEC Forms are filled out by the payer and provided to the recipient and government agency.

How to E-File 1099 & W2 Forms

It’s easy for businesses to efile 1099 & W2 forms with the right online system! You don’t need special software or technical knowledge, and certainly don’t need to spend hundreds of dollars.

Guide to Filing 1099 & W2 Forms Online

Filing 1099 & W2 forms online simplifies the entire process for businesses and bookkeepers, eliminating the time-consuming process of printing and mailing forms.