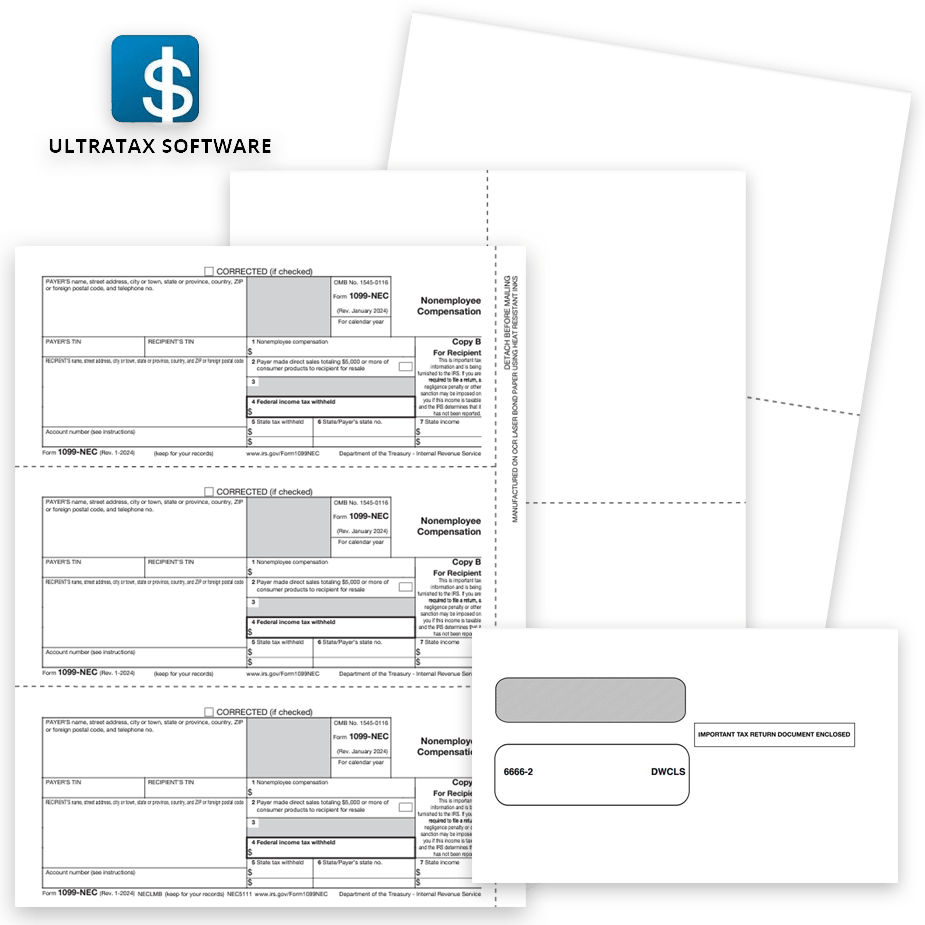

UltraTax CS™ Software Compatible Tax Forms

Order compatible 1099 & W2 tax forms and envelopes for UltraTax software.

Tax forms and security envelopes are guaranteed compatible, at big discounts – no coupon code required with The Tax Form Gals!

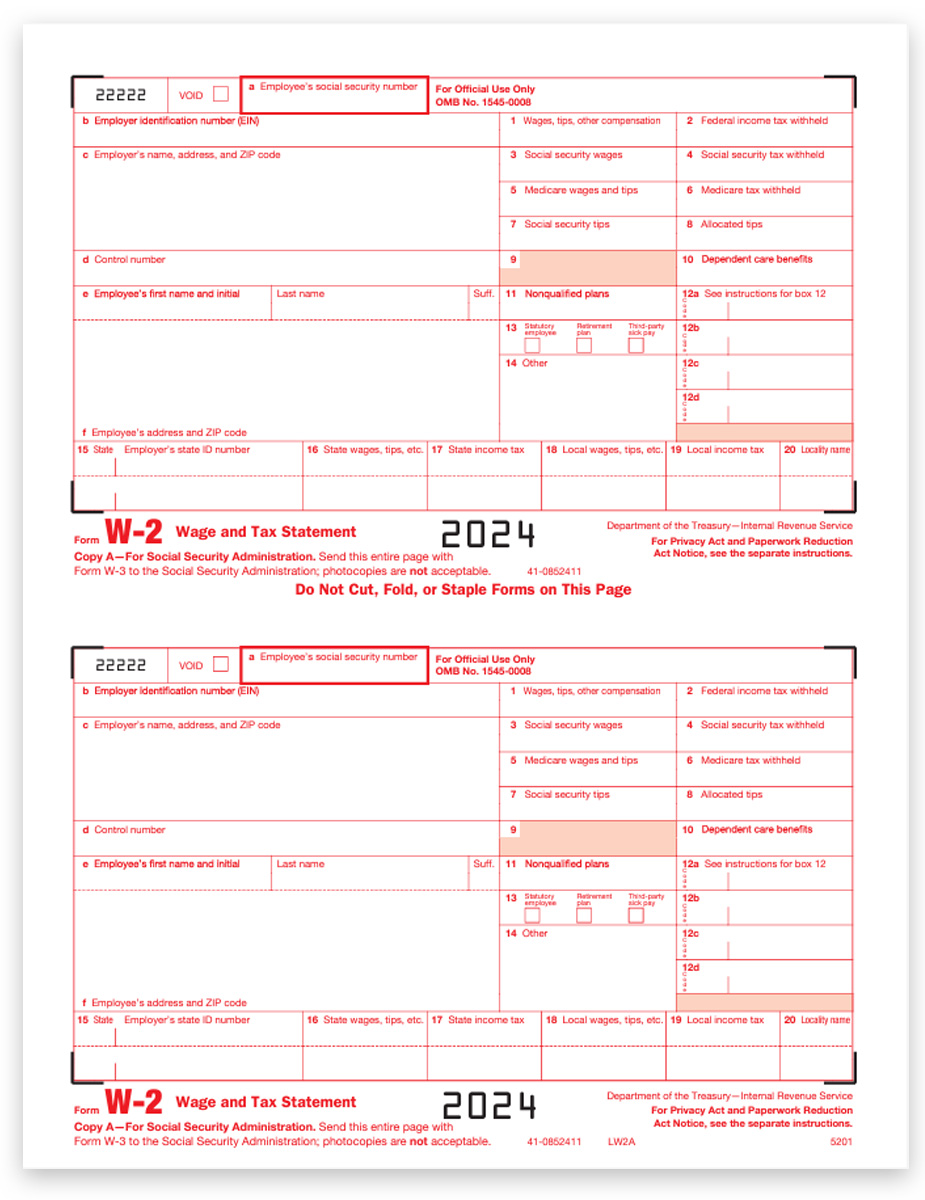

Printing year-end 1099 & W2 forms is quicker and easier when forms align perfectly with the data format of your software. We’ve done the research for you.

*Brand names are property of their respective owners

1099 & W-2 Forms for UltraTax CS™ Software

Guaranteed Compatible!

If you have any problems, we will replace the product or refund your money.

ONLINE 1099 & W2 E-FILING = EASY 2024!

Efile, print and mail 1099 & W2 forms online.

No paper, no software, no mailing, no hassles!

Use DiscountEfile.com to enter or import data, then we'll e-file with the IRS or SSA and can even print and mail recipient copies.

Create a free account and get started today!

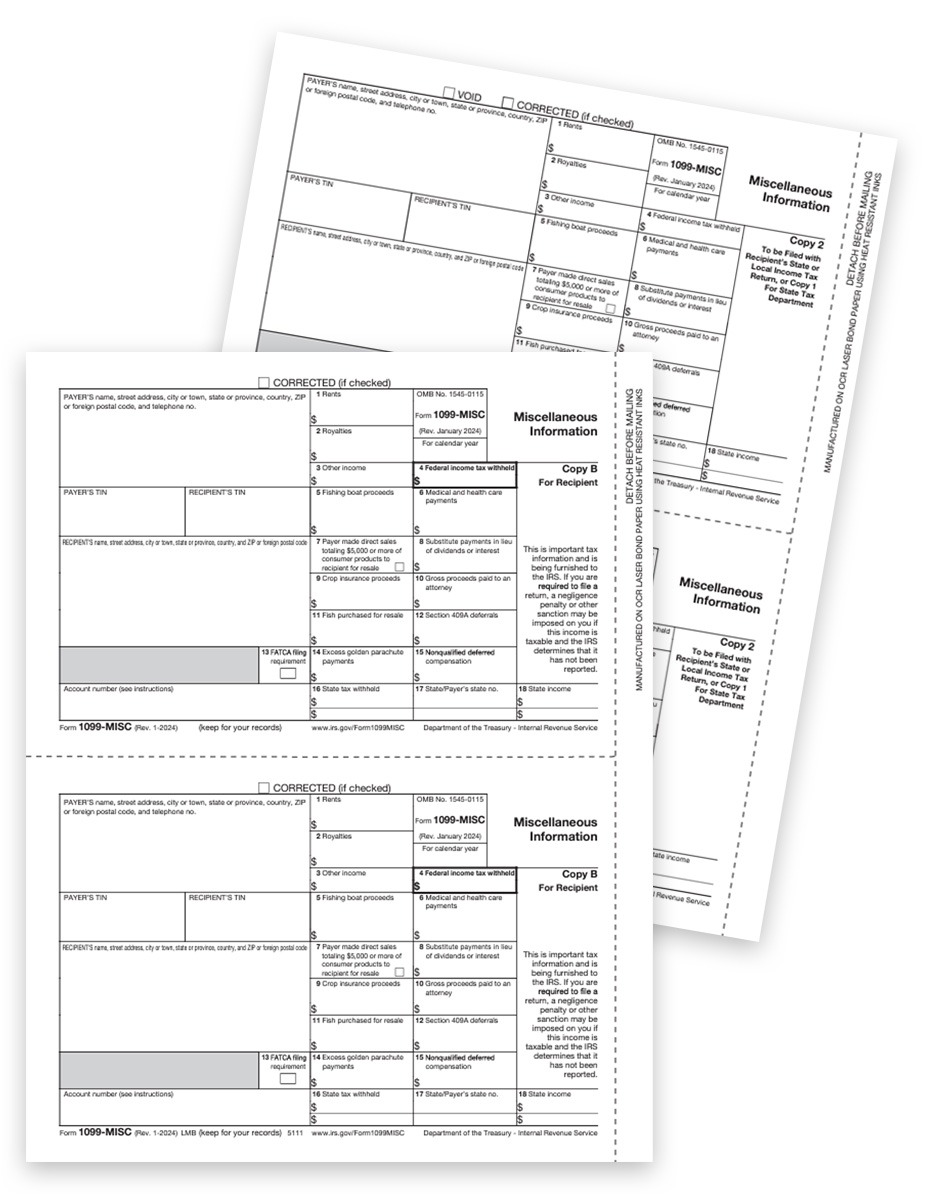

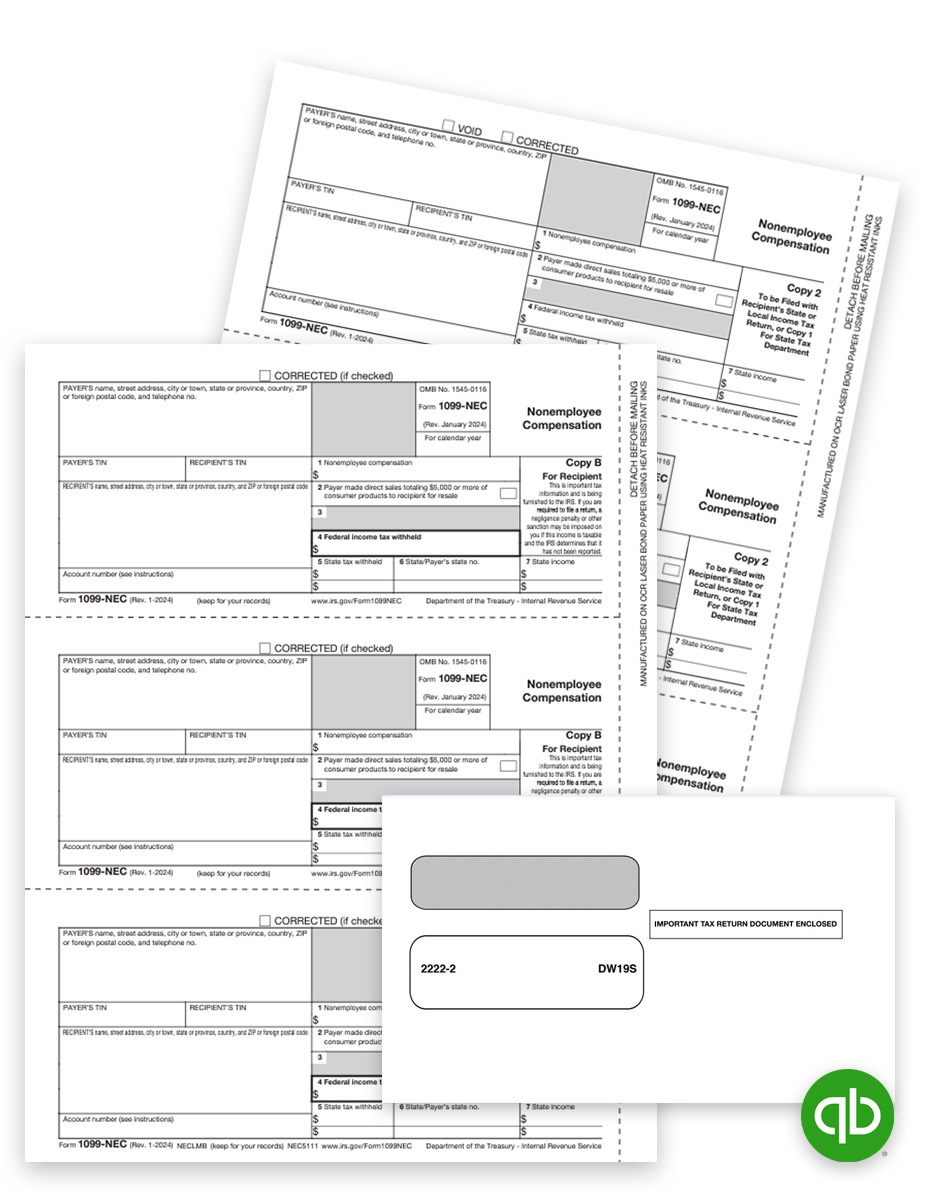

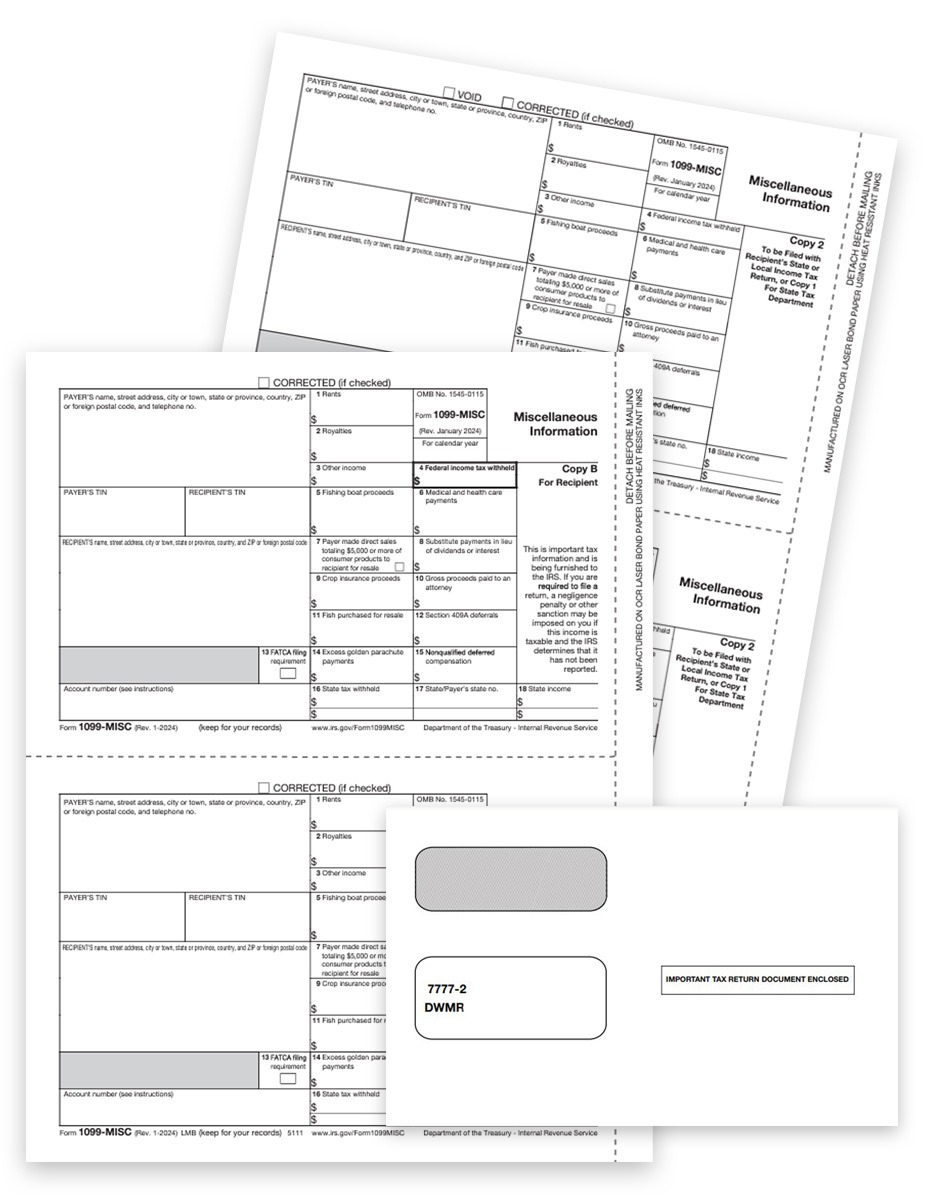

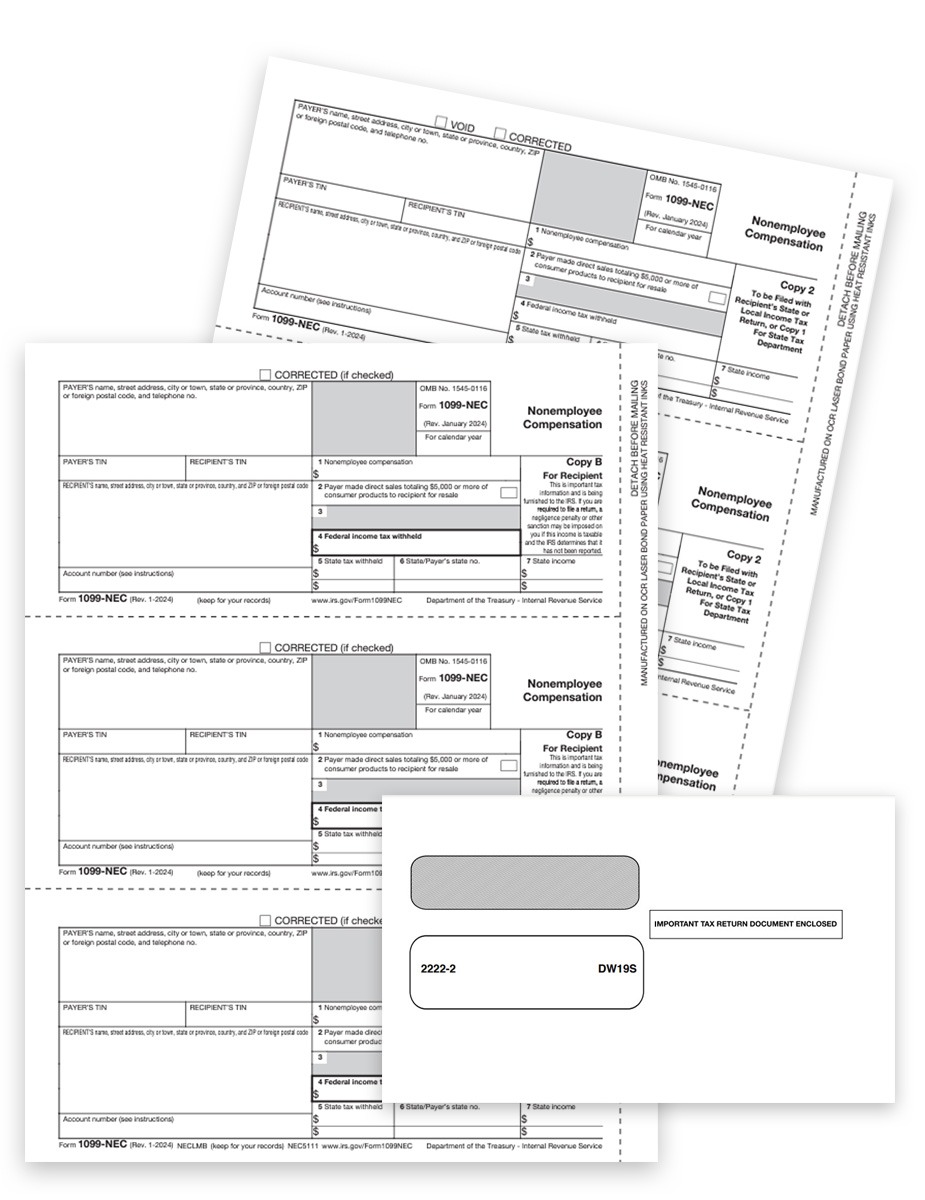

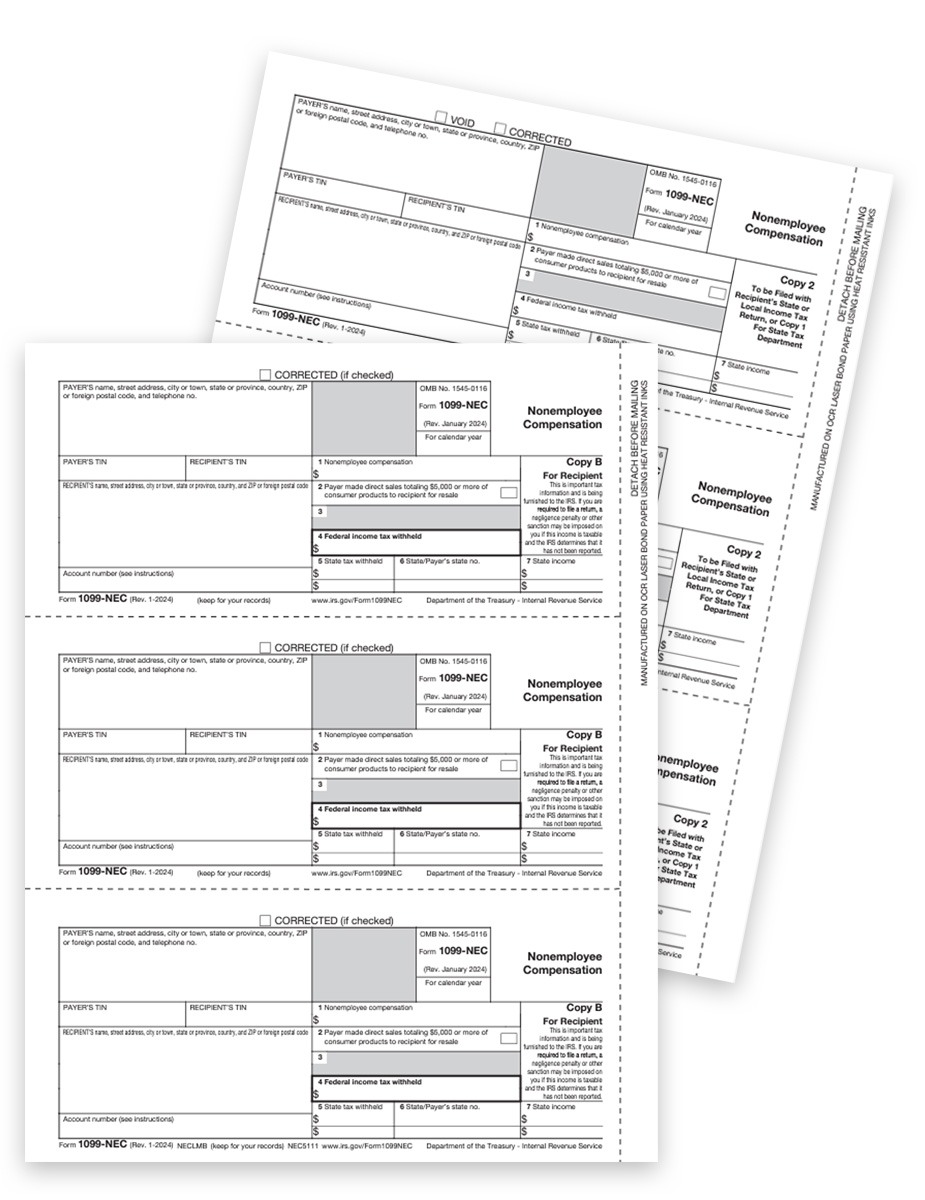

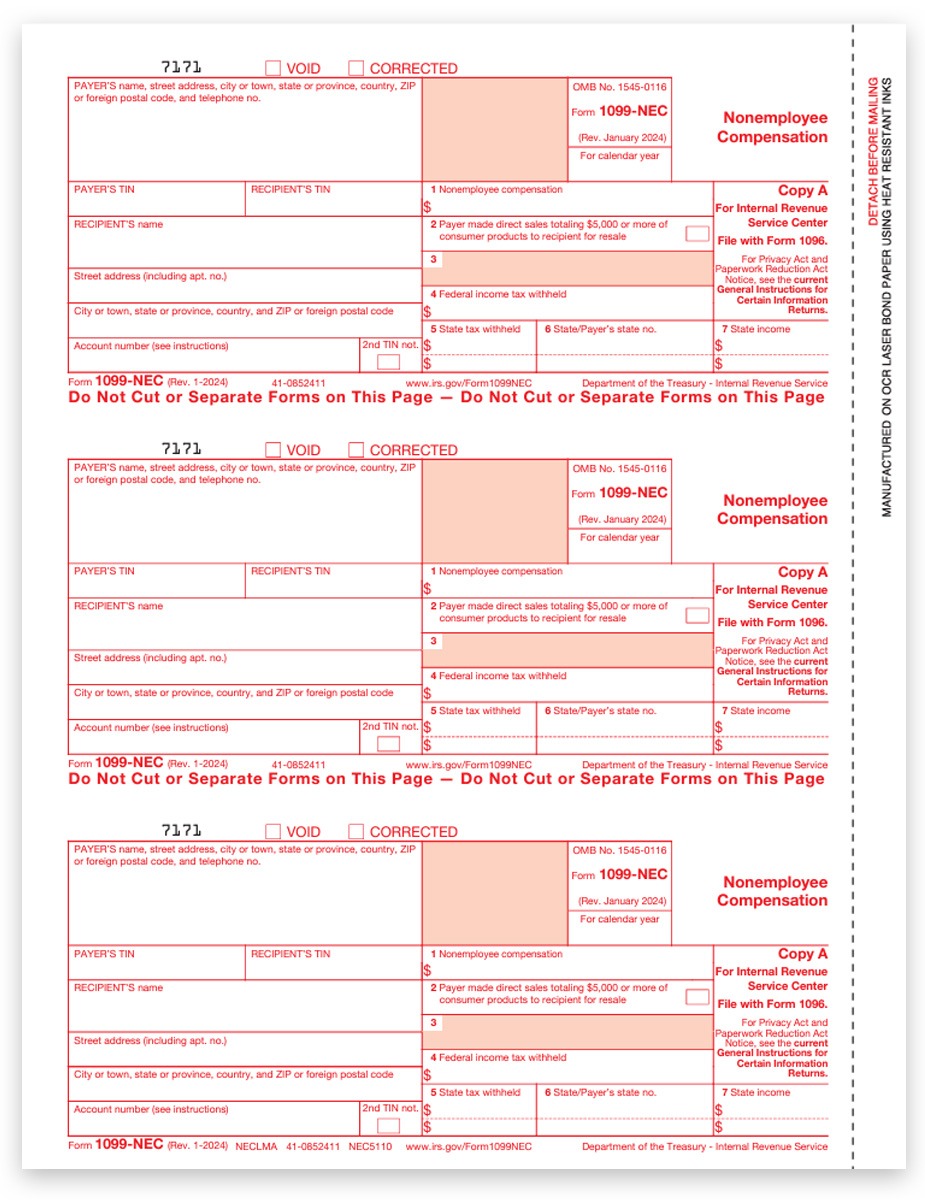

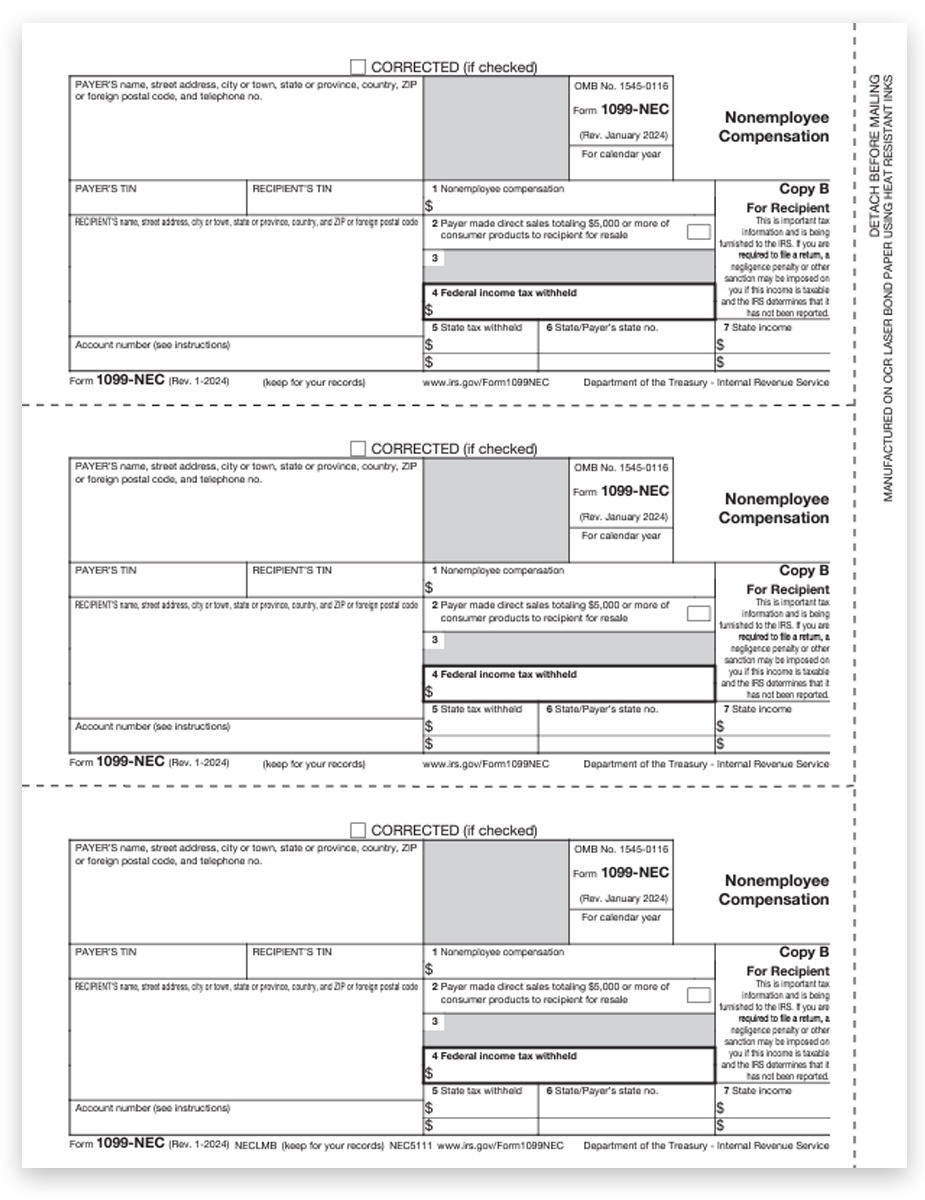

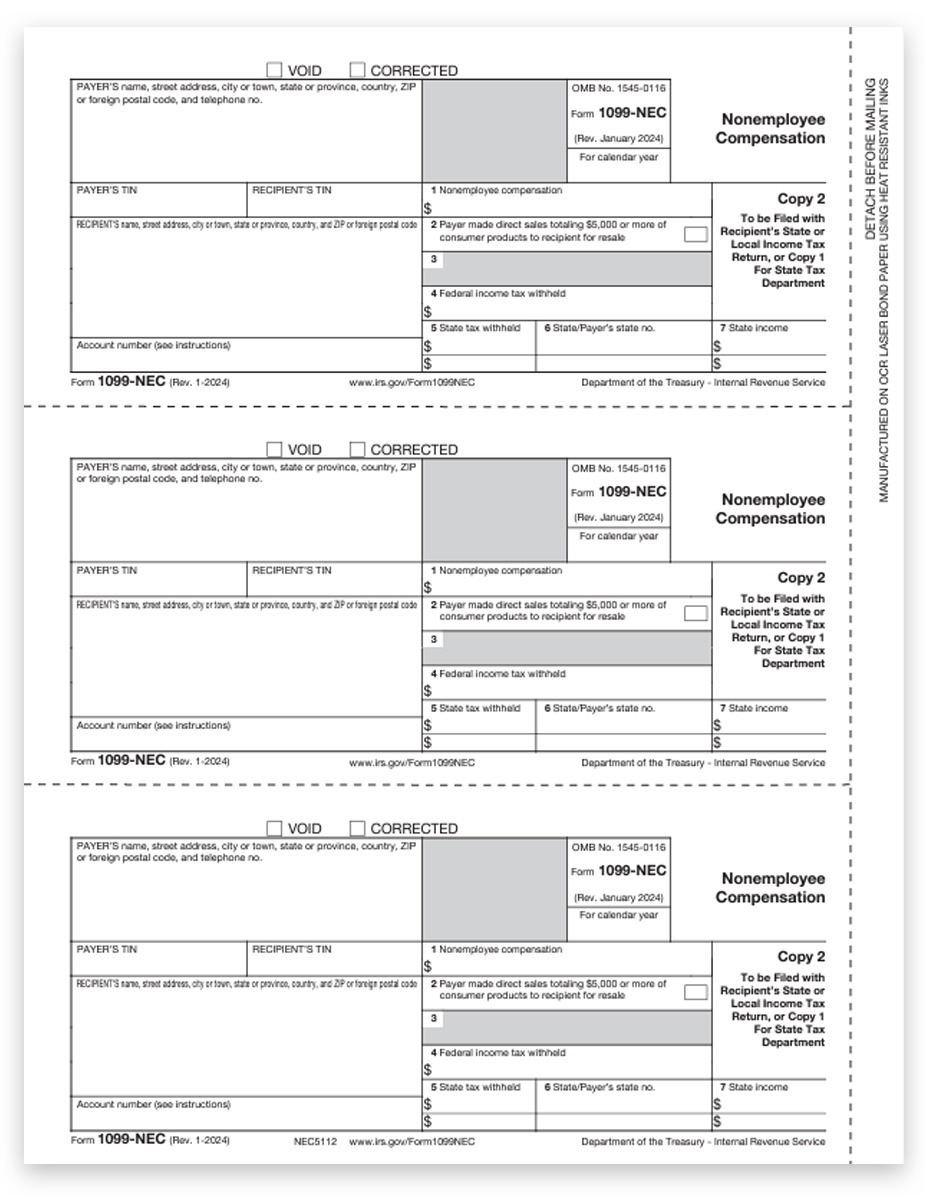

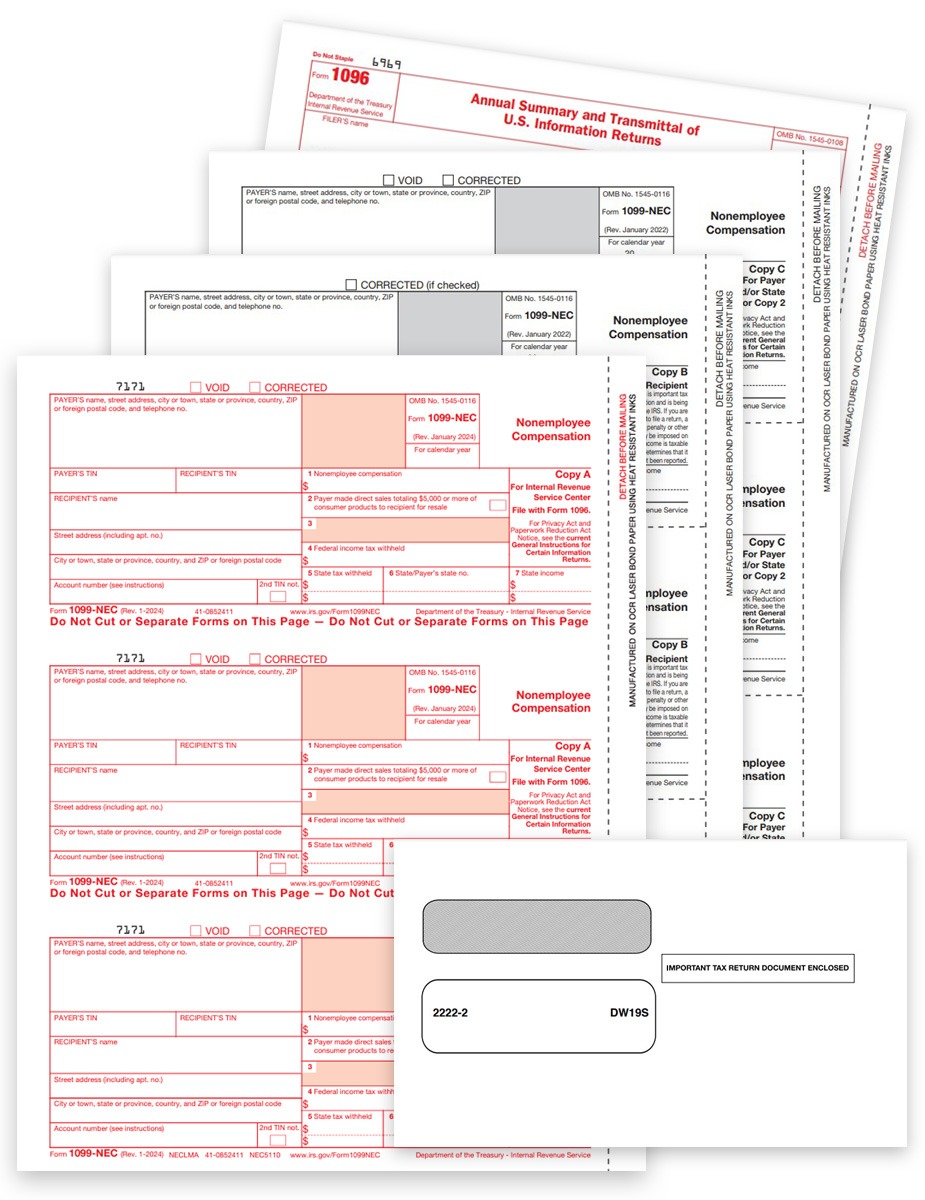

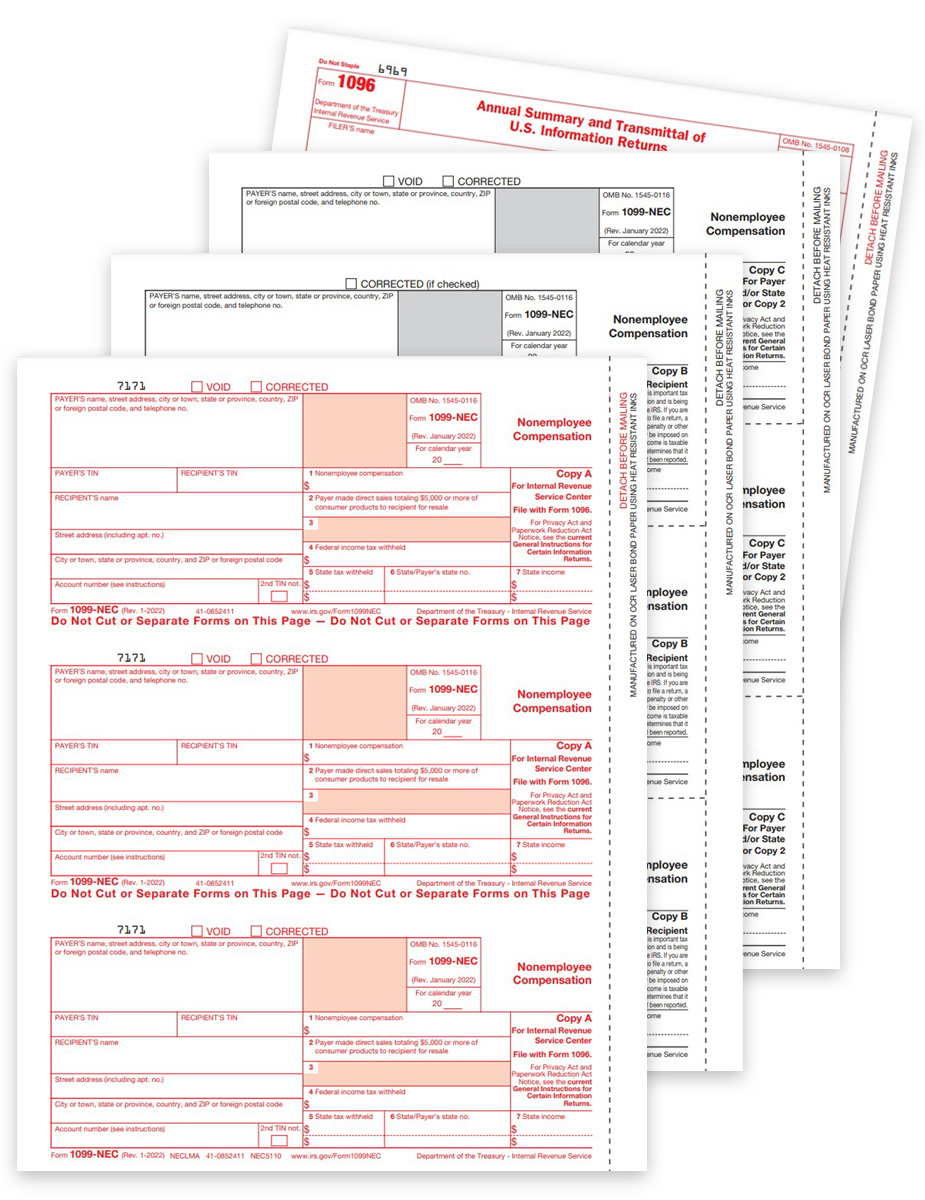

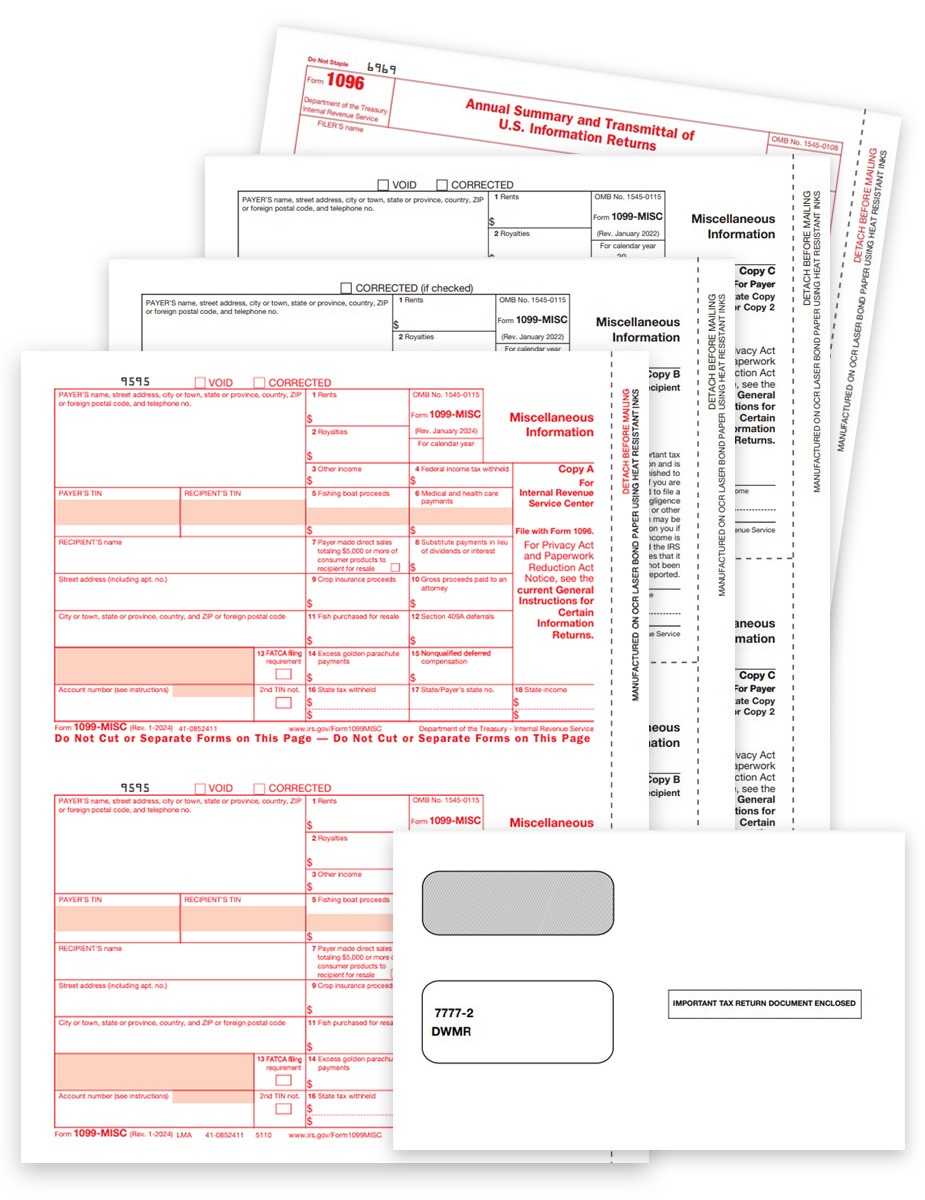

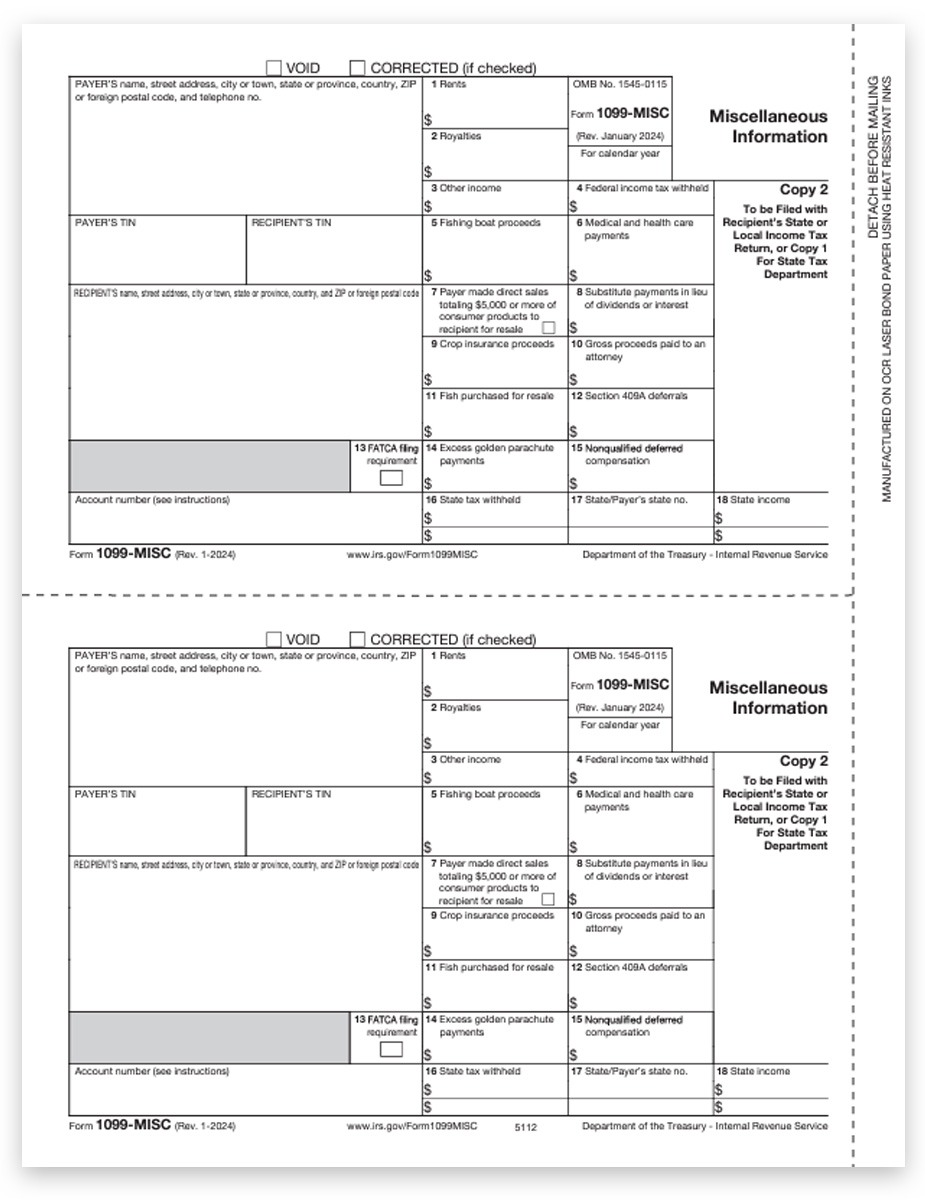

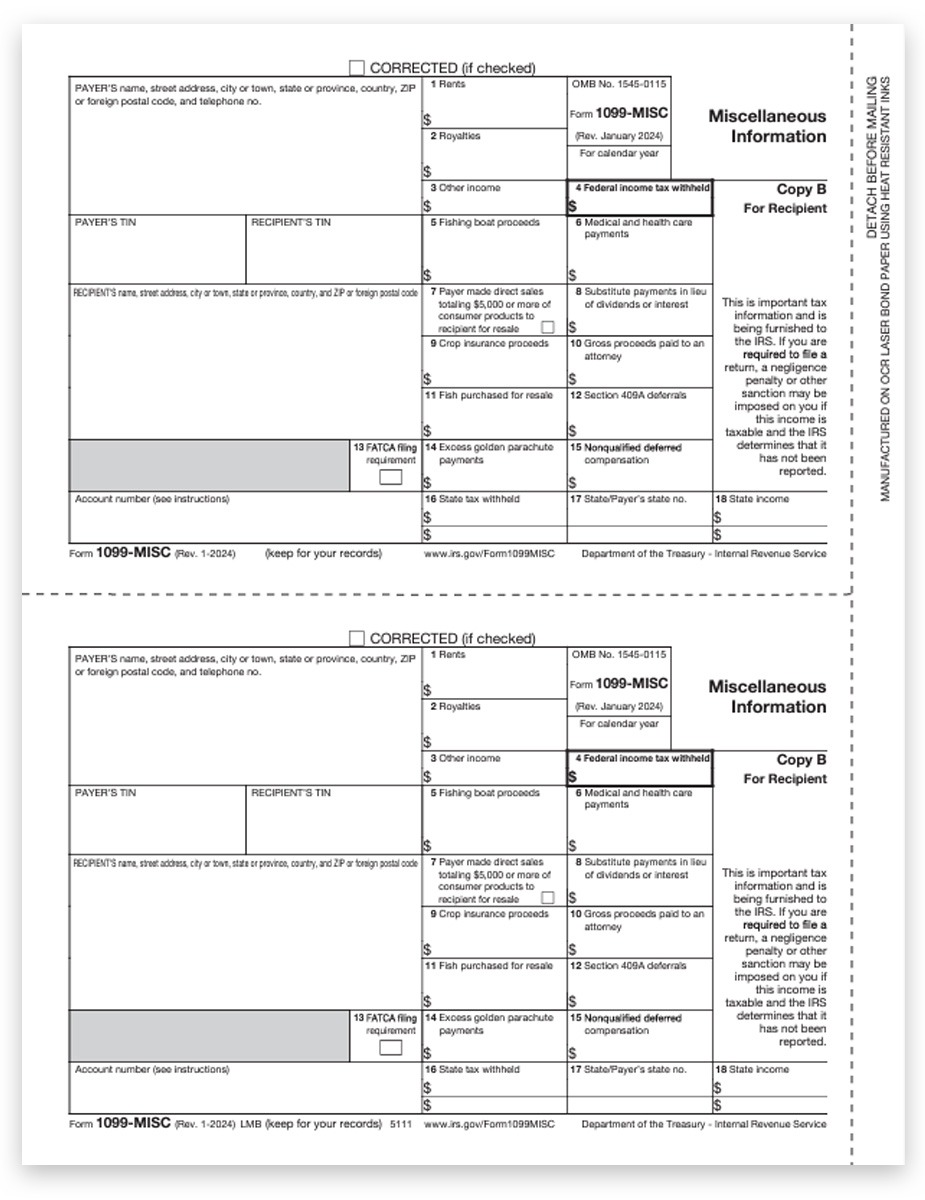

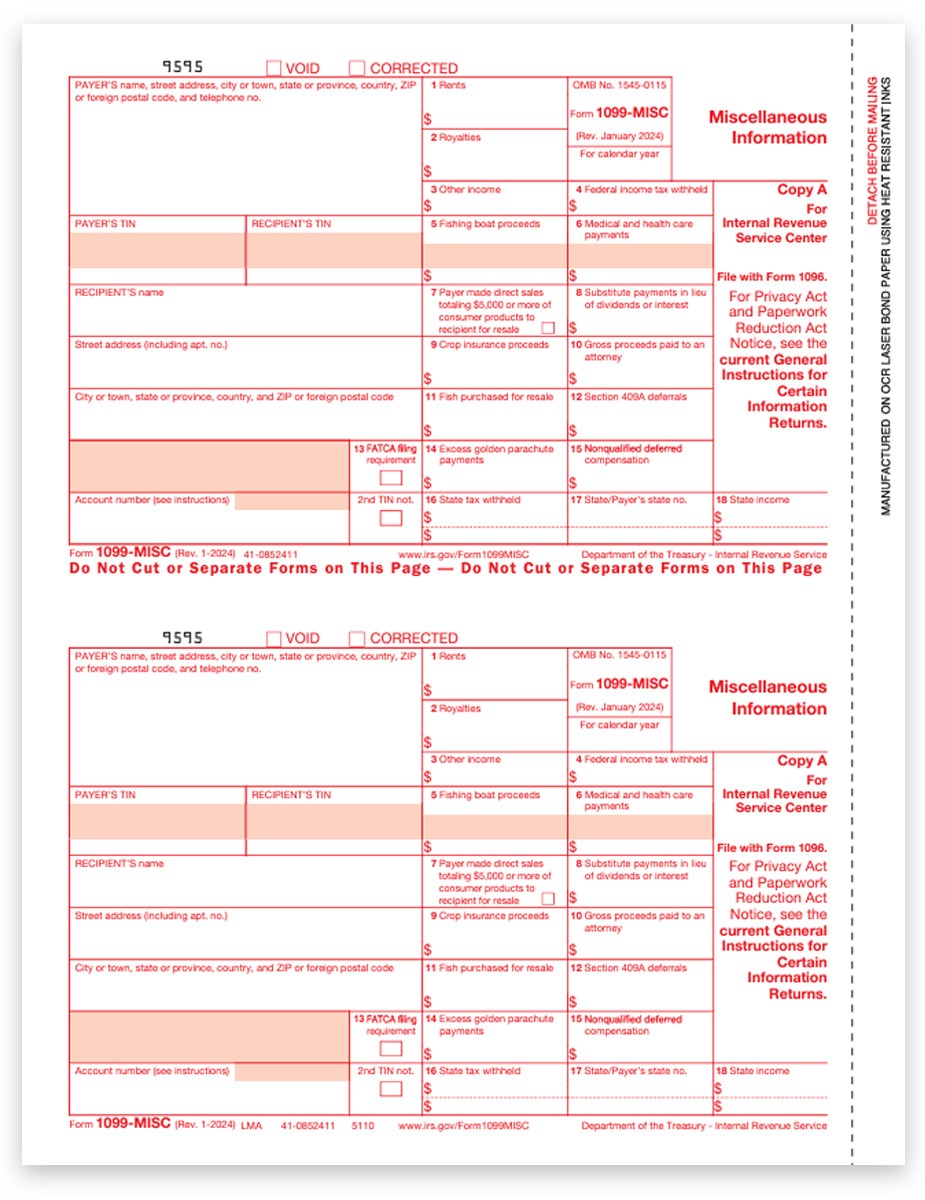

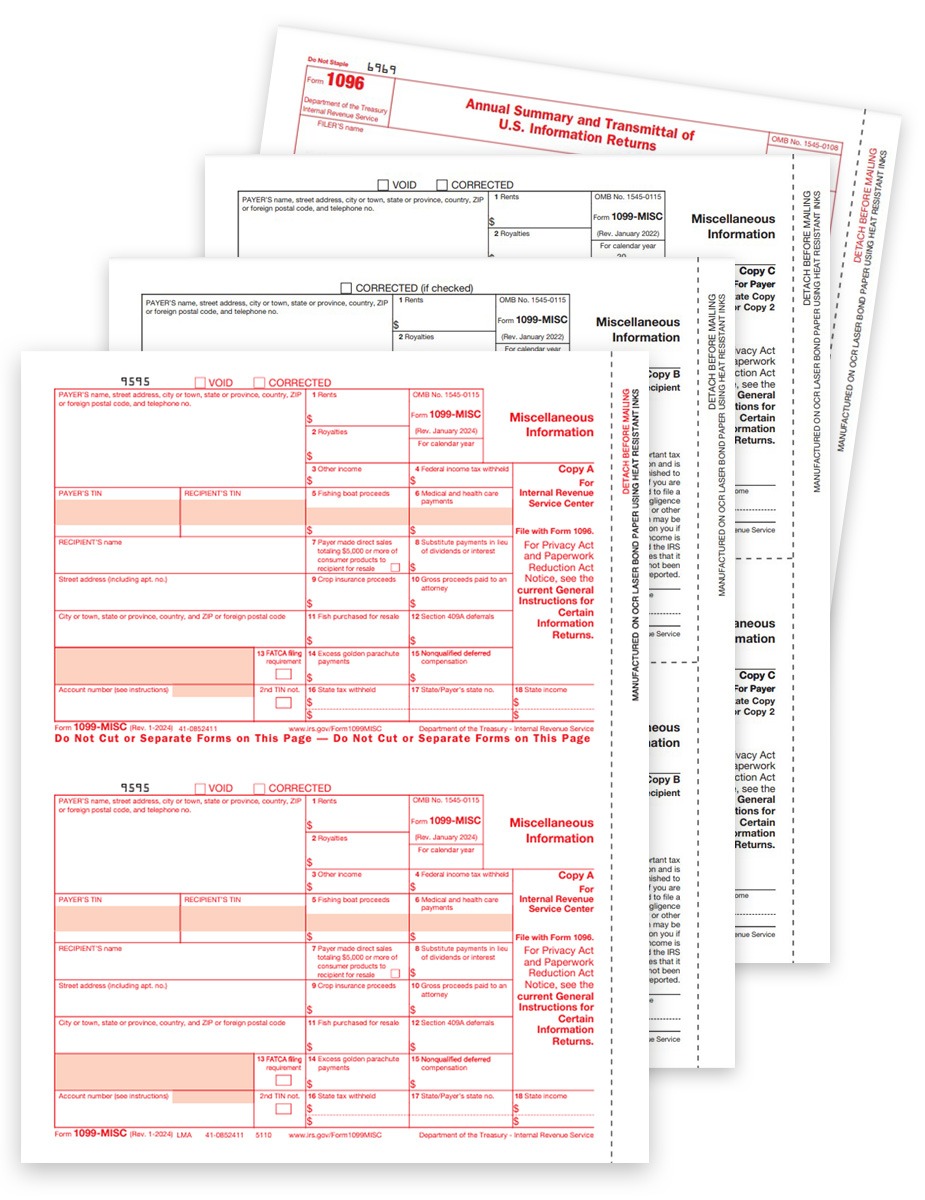

1099MISC & 1099NEC Forms Compatible with UltraTax CS Software

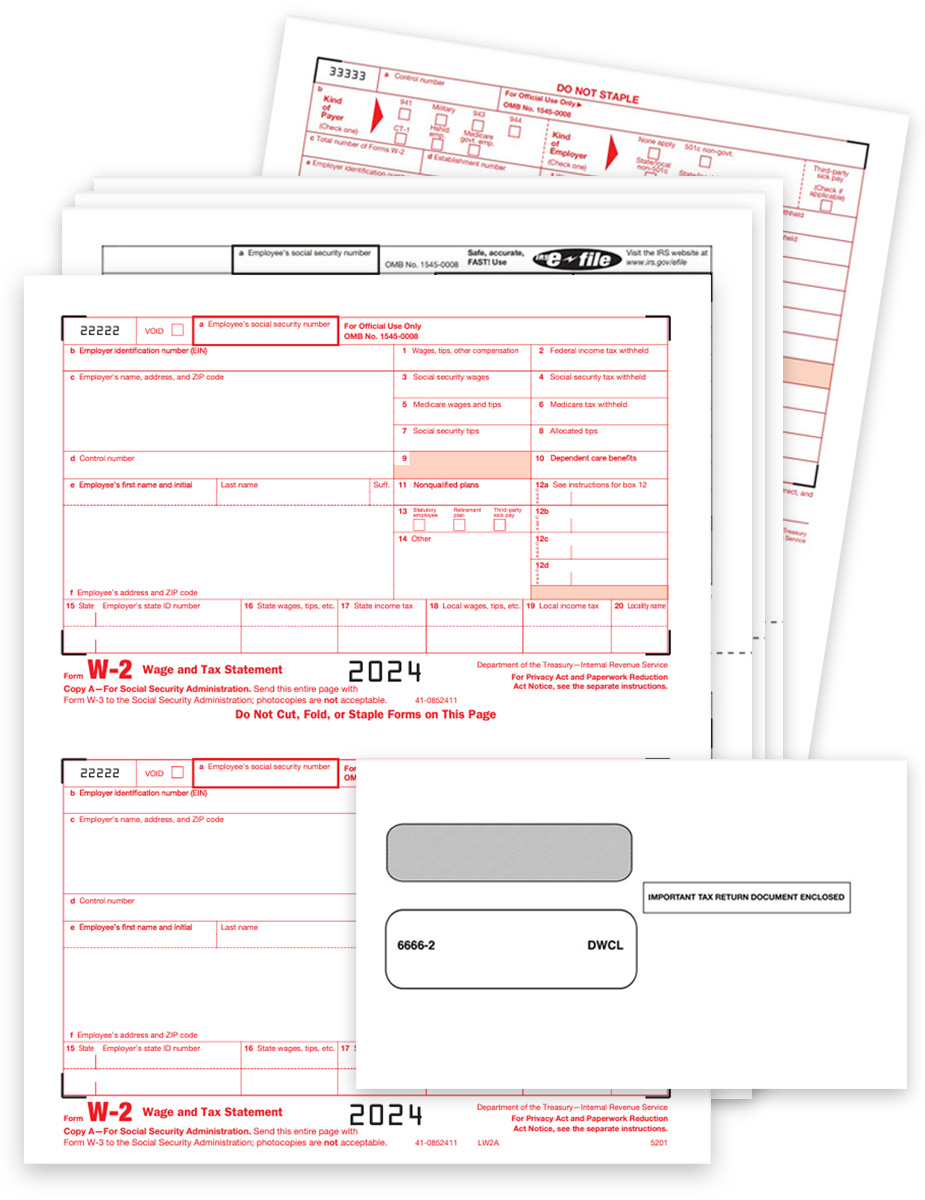

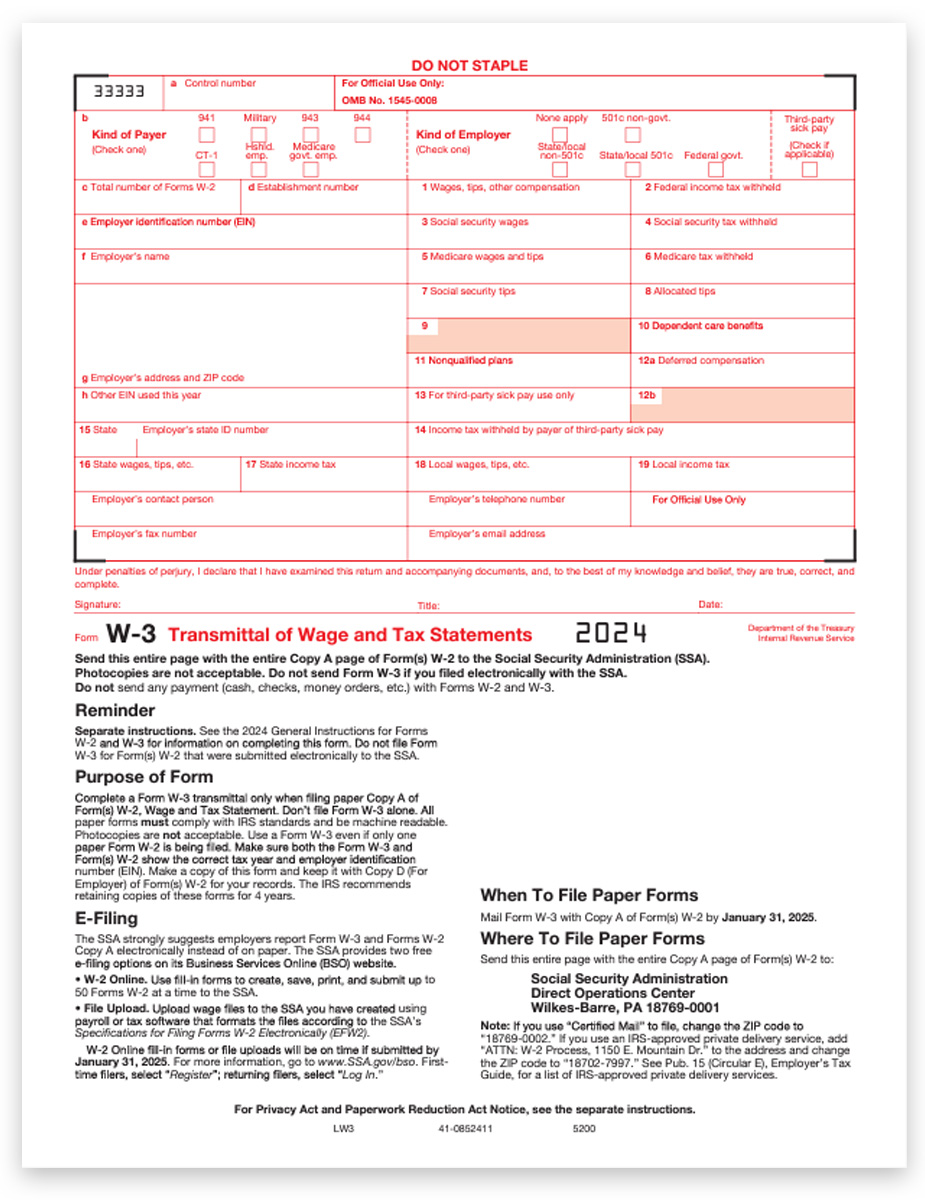

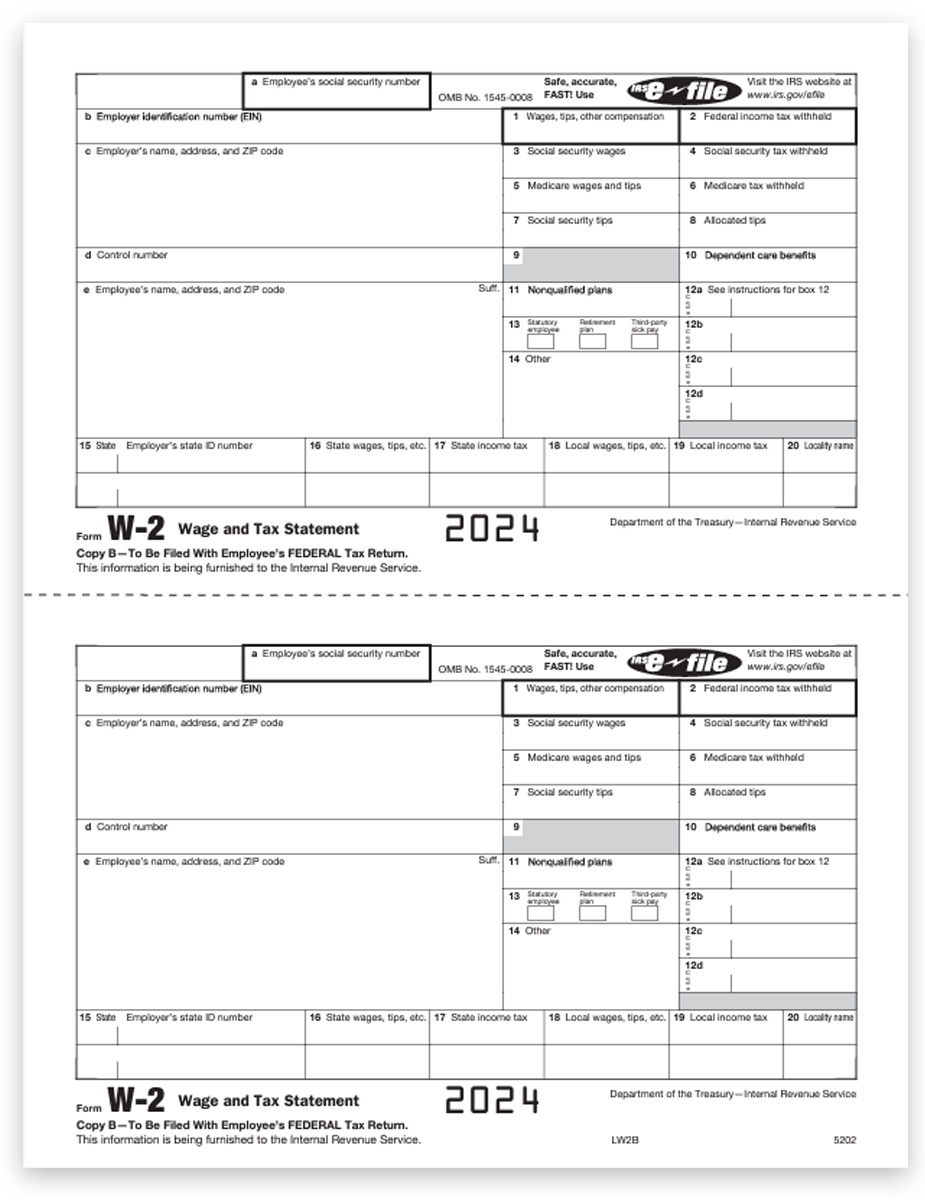

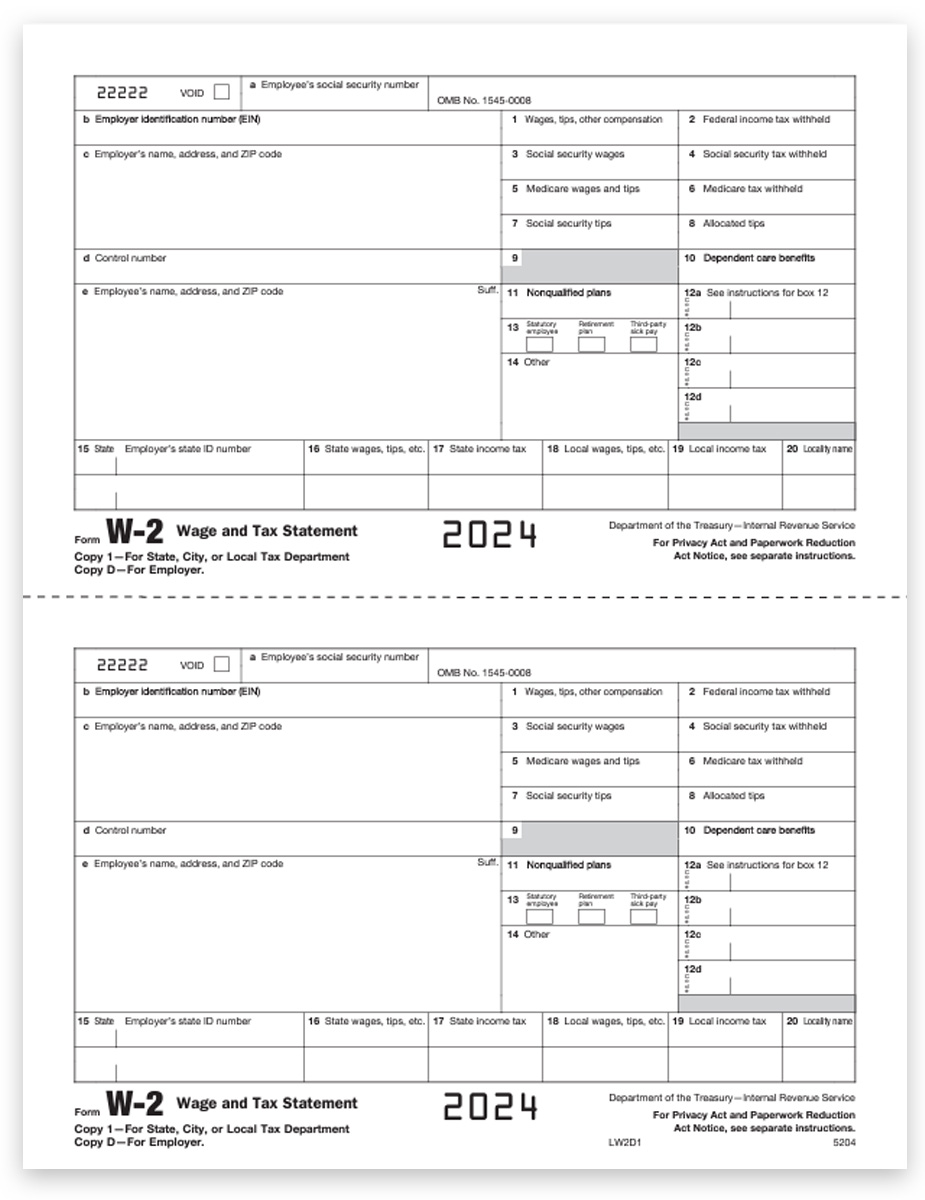

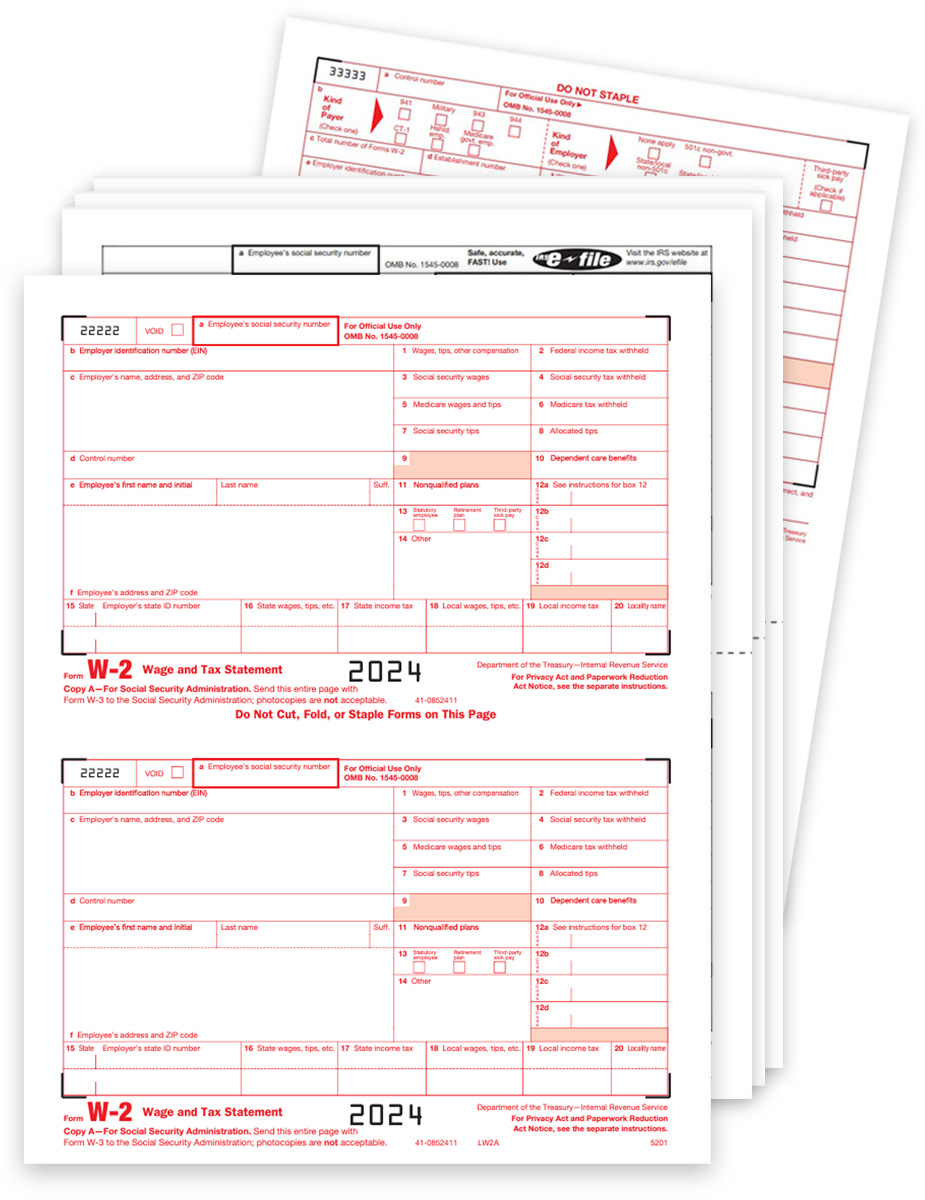

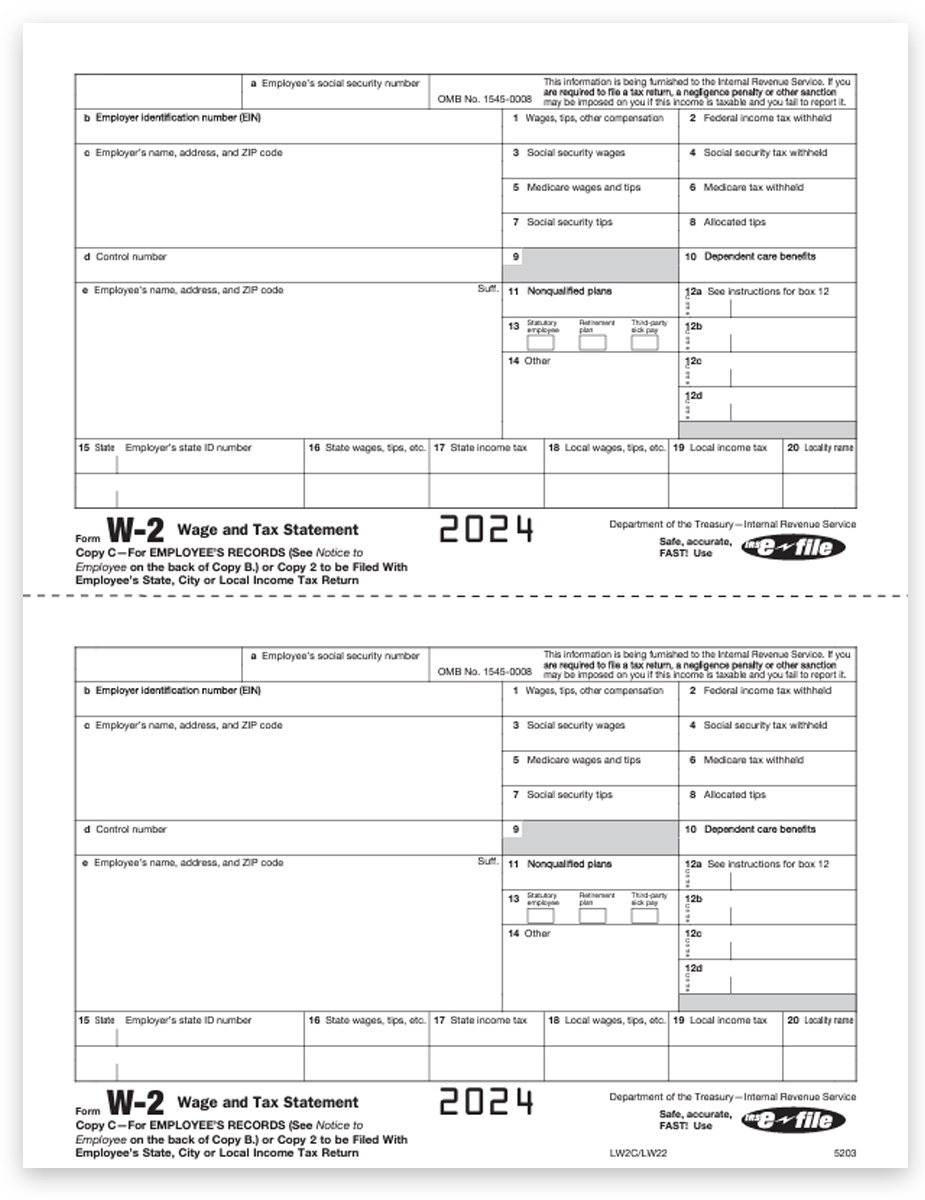

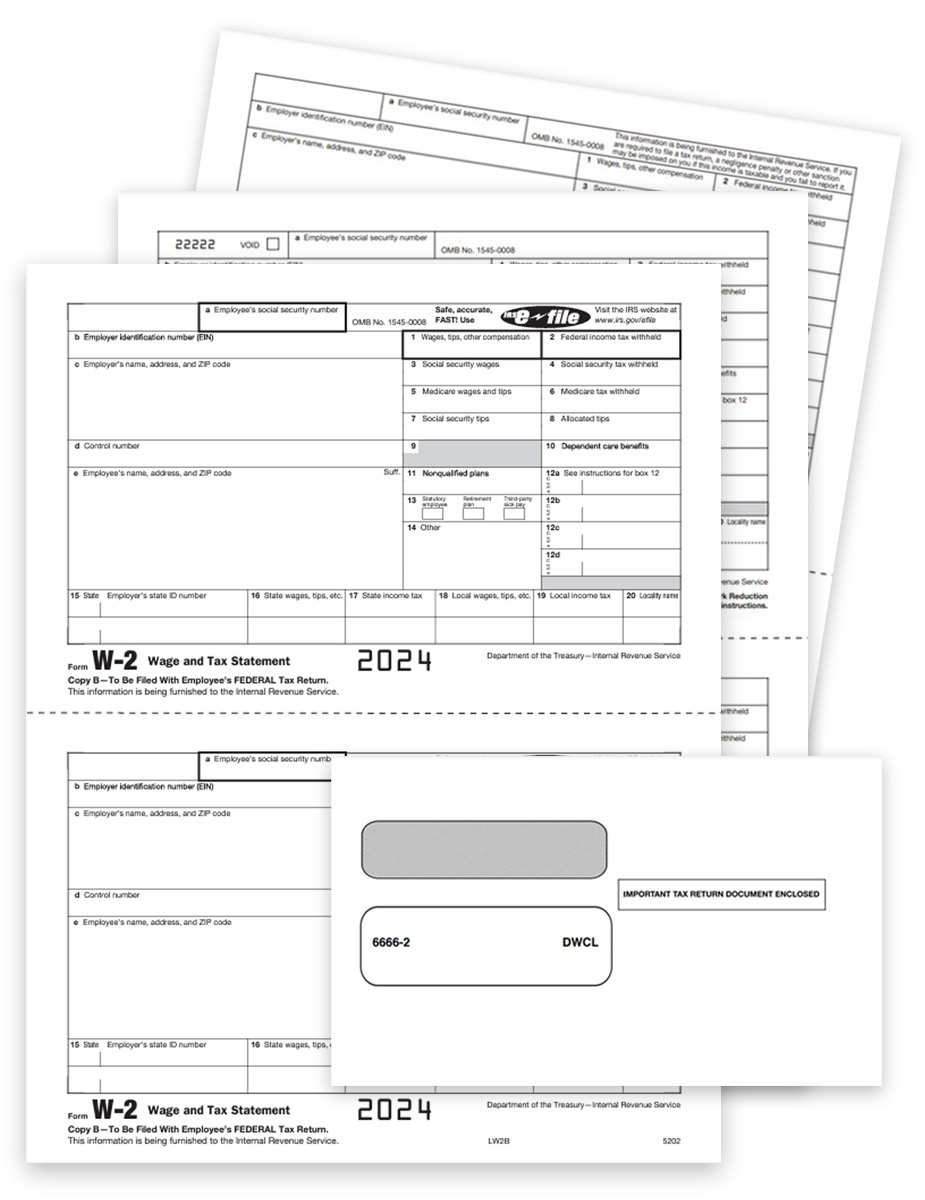

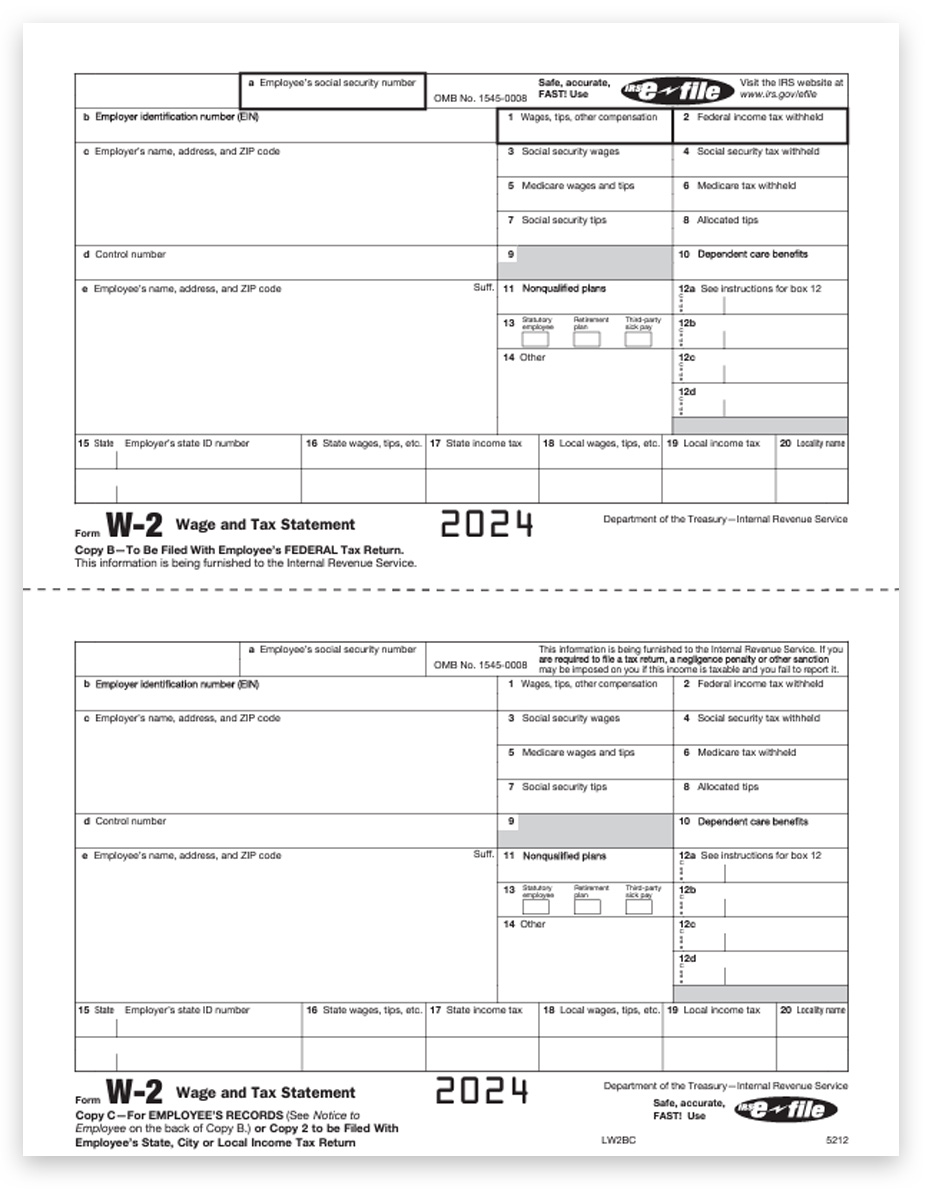

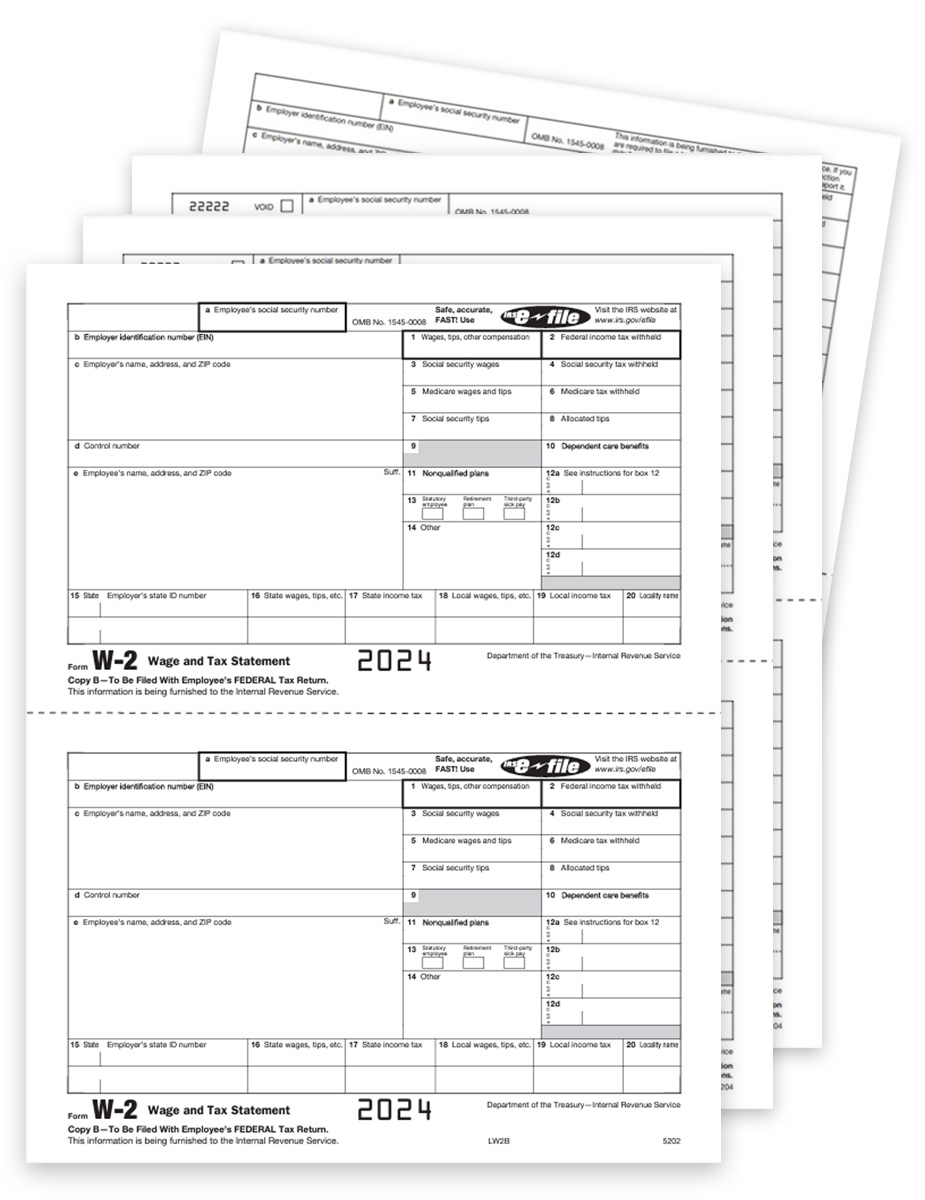

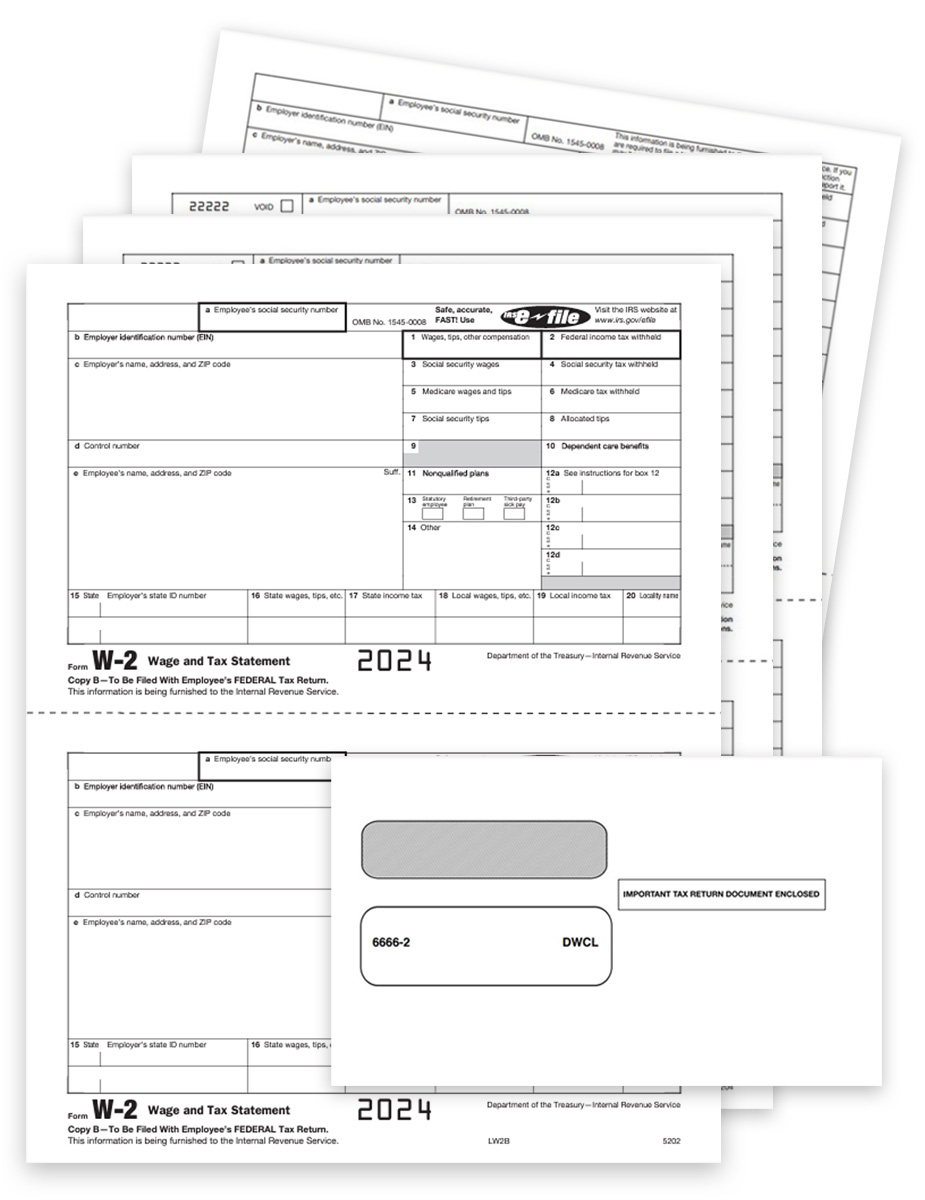

W2 Forms Compatible with UltraTax CS Software

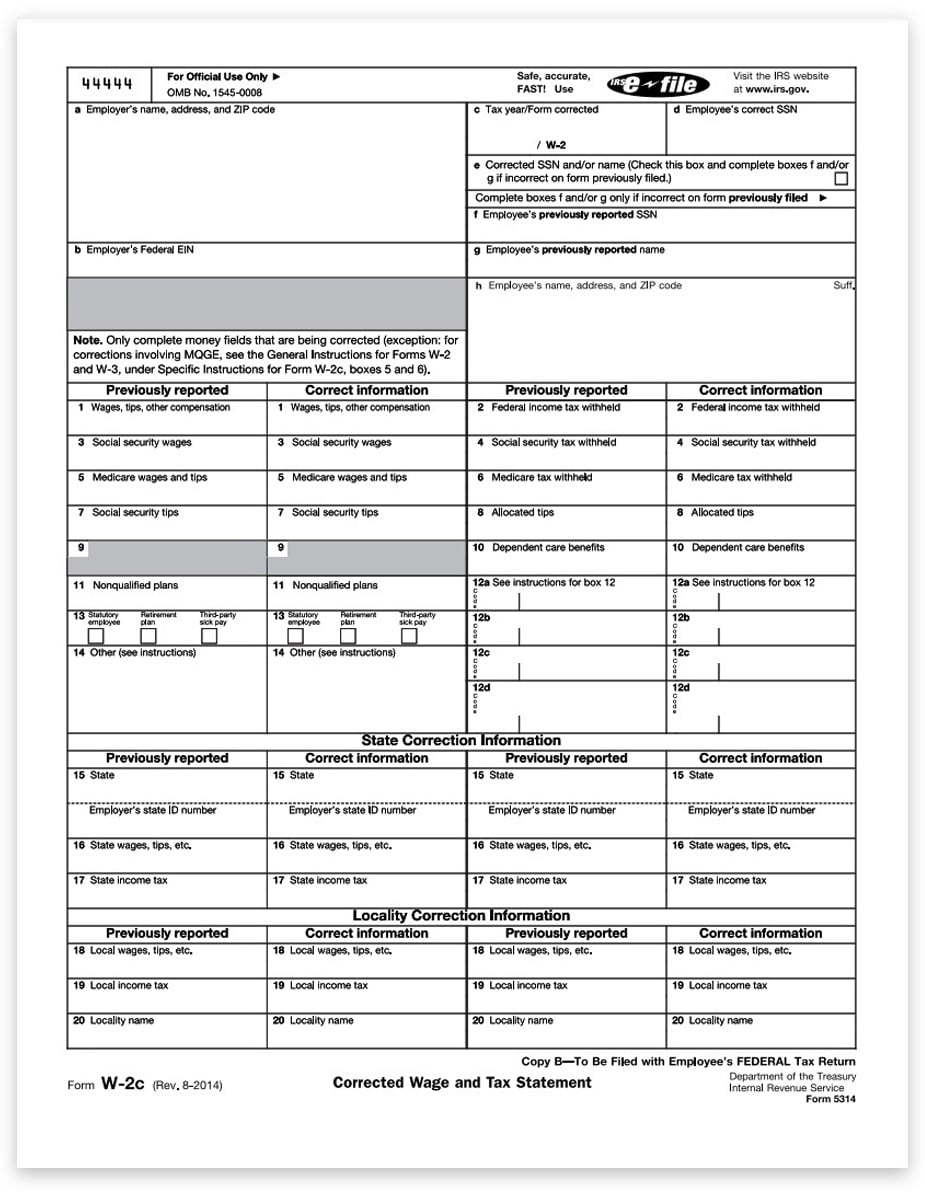

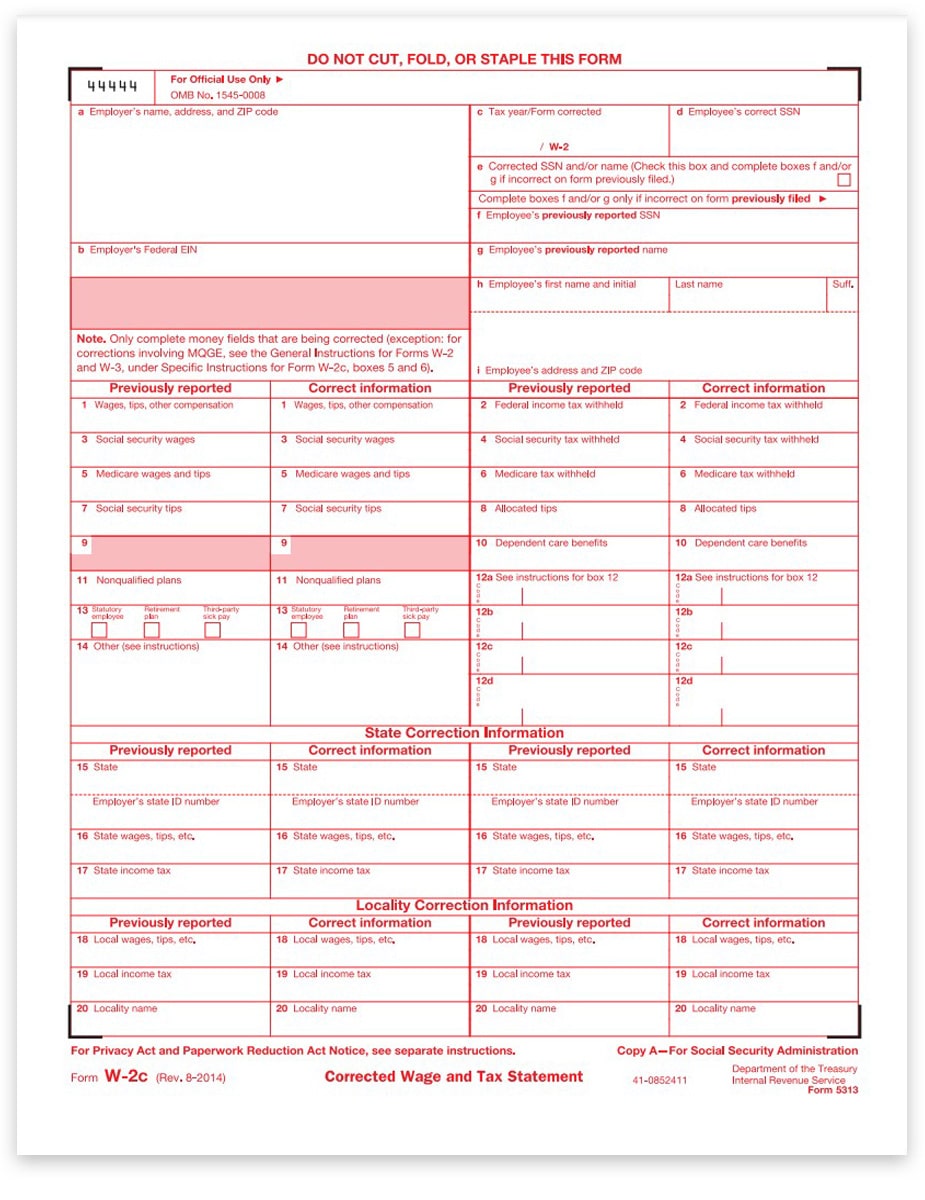

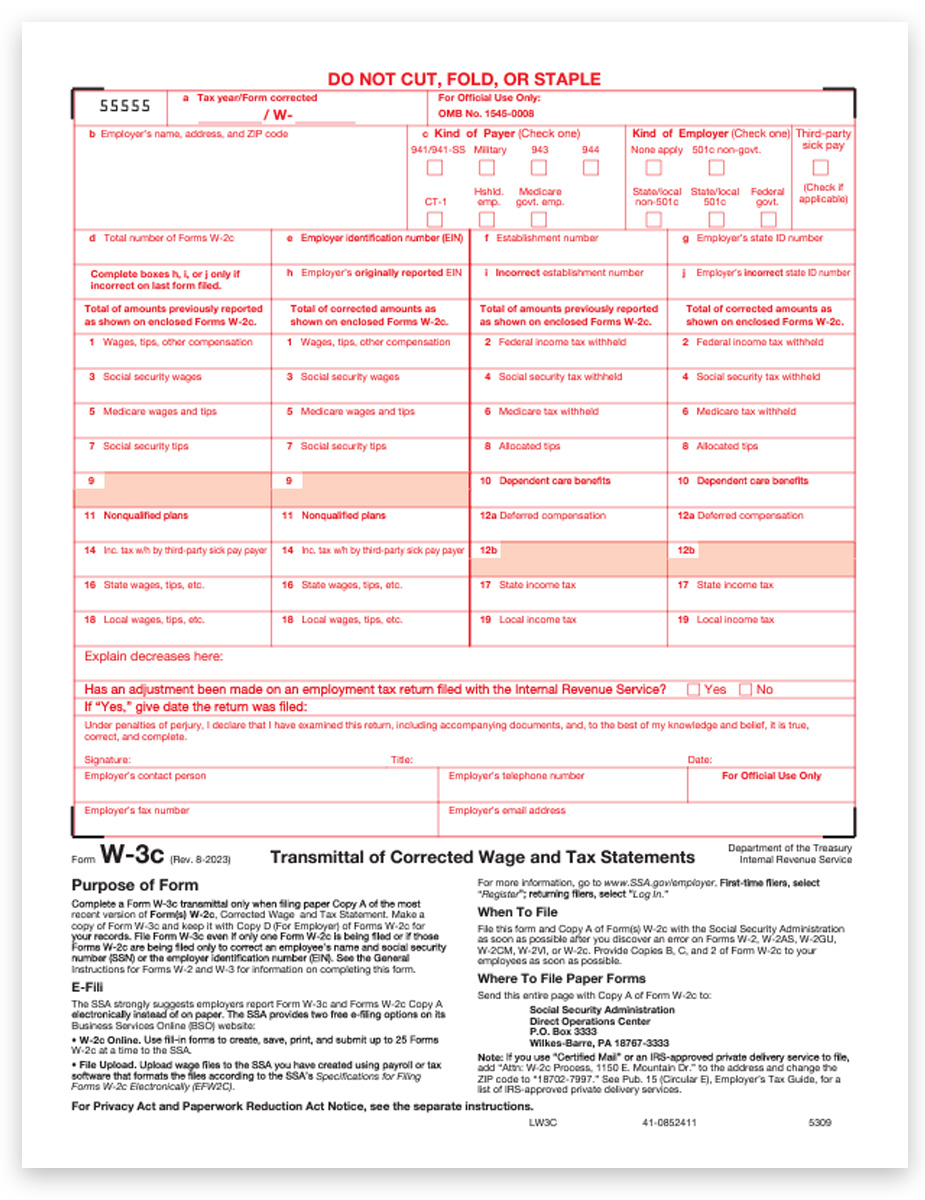

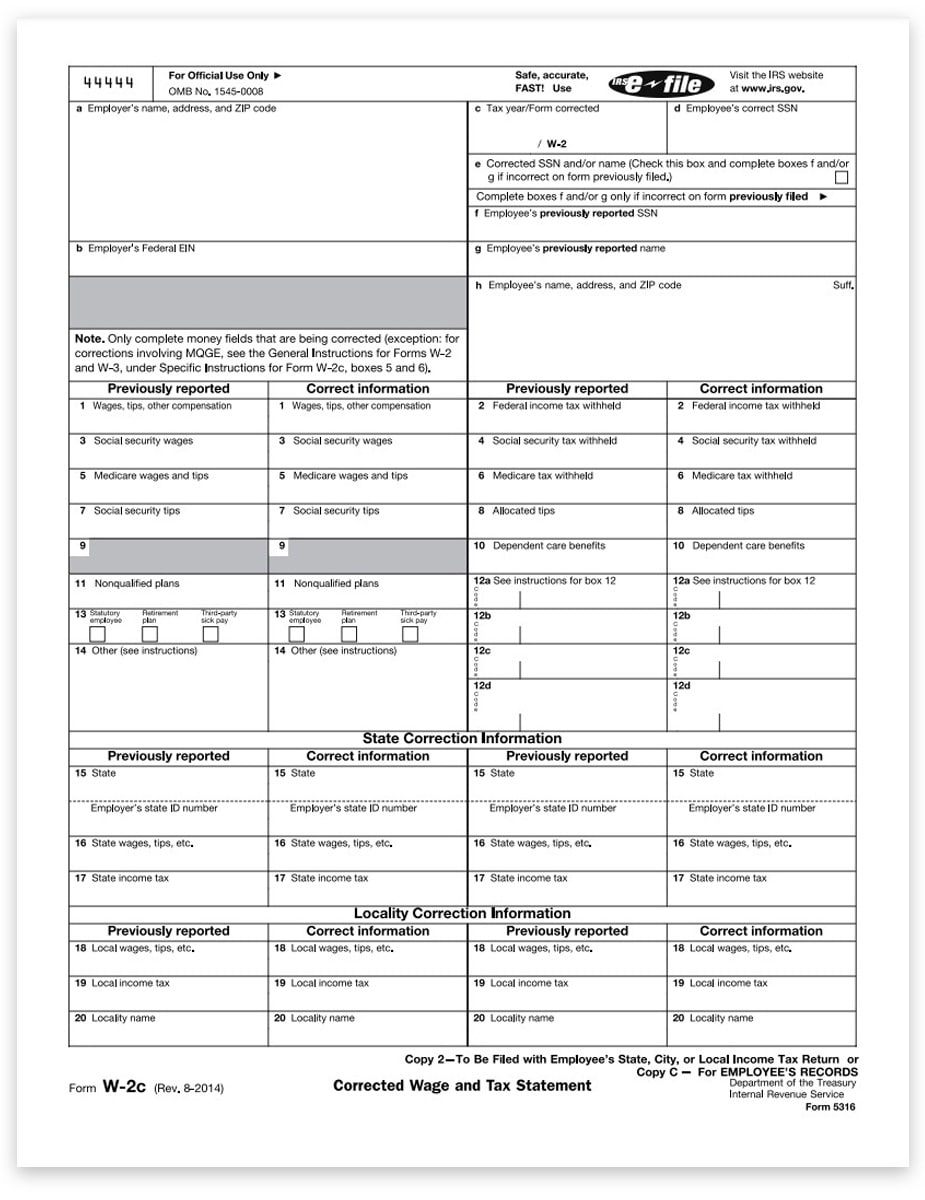

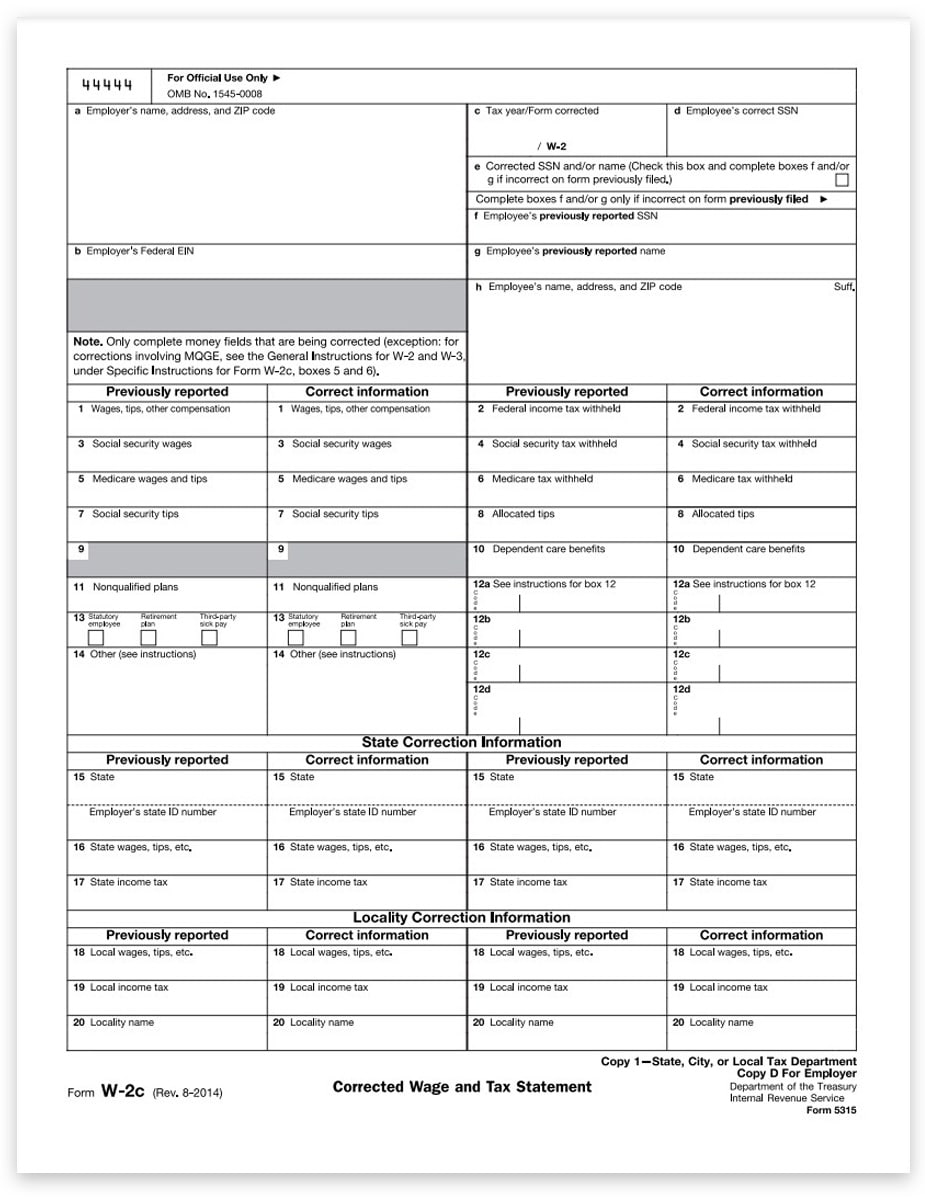

W2C Correction Forms for UltraTax CS Software

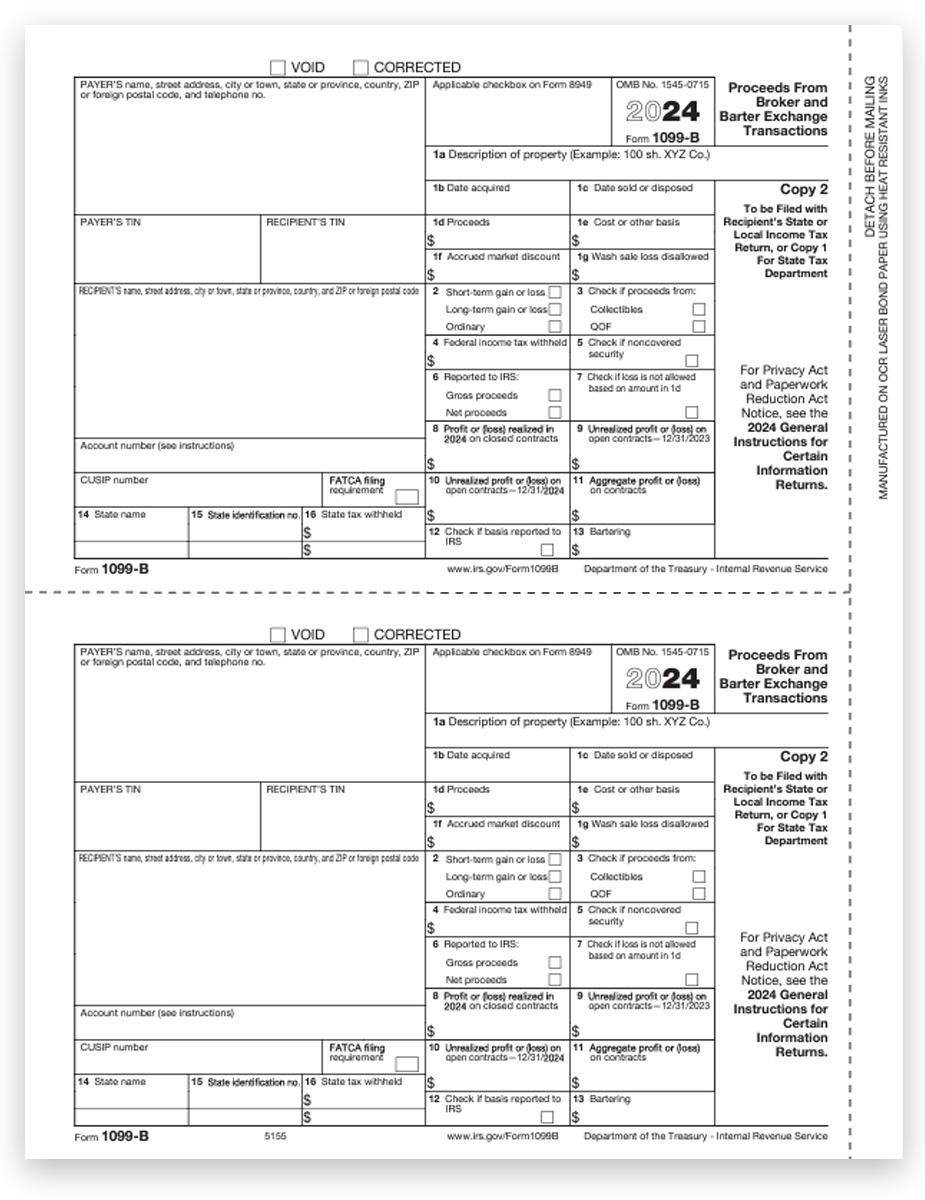

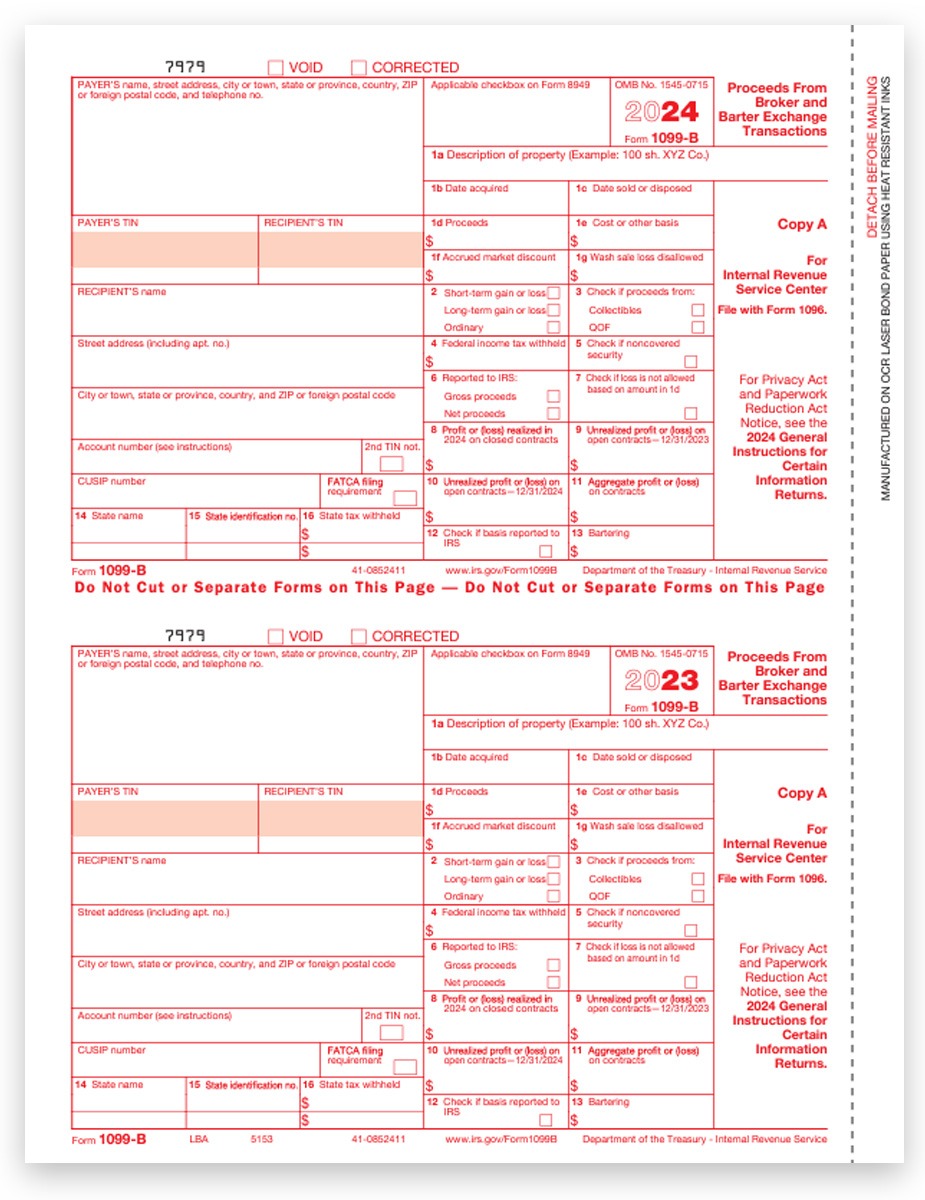

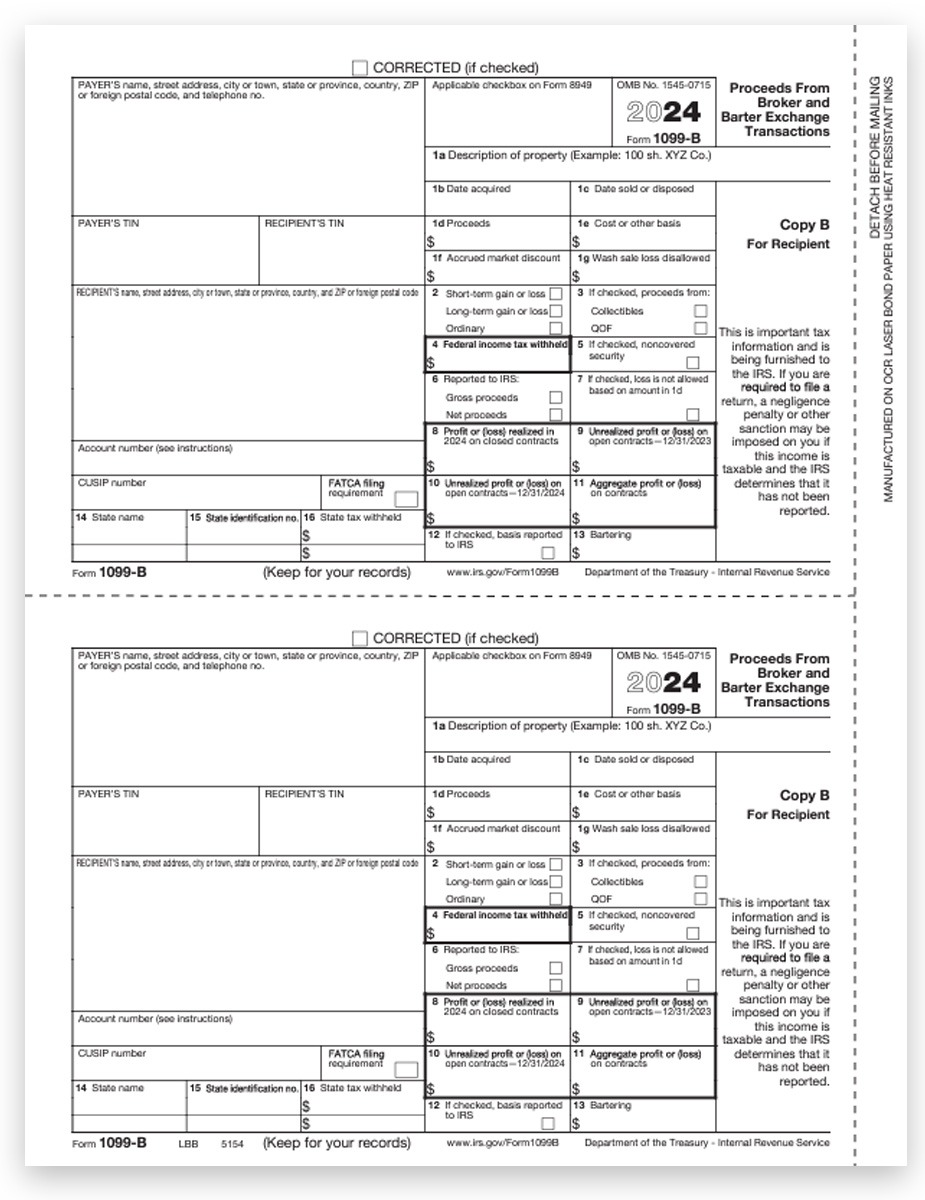

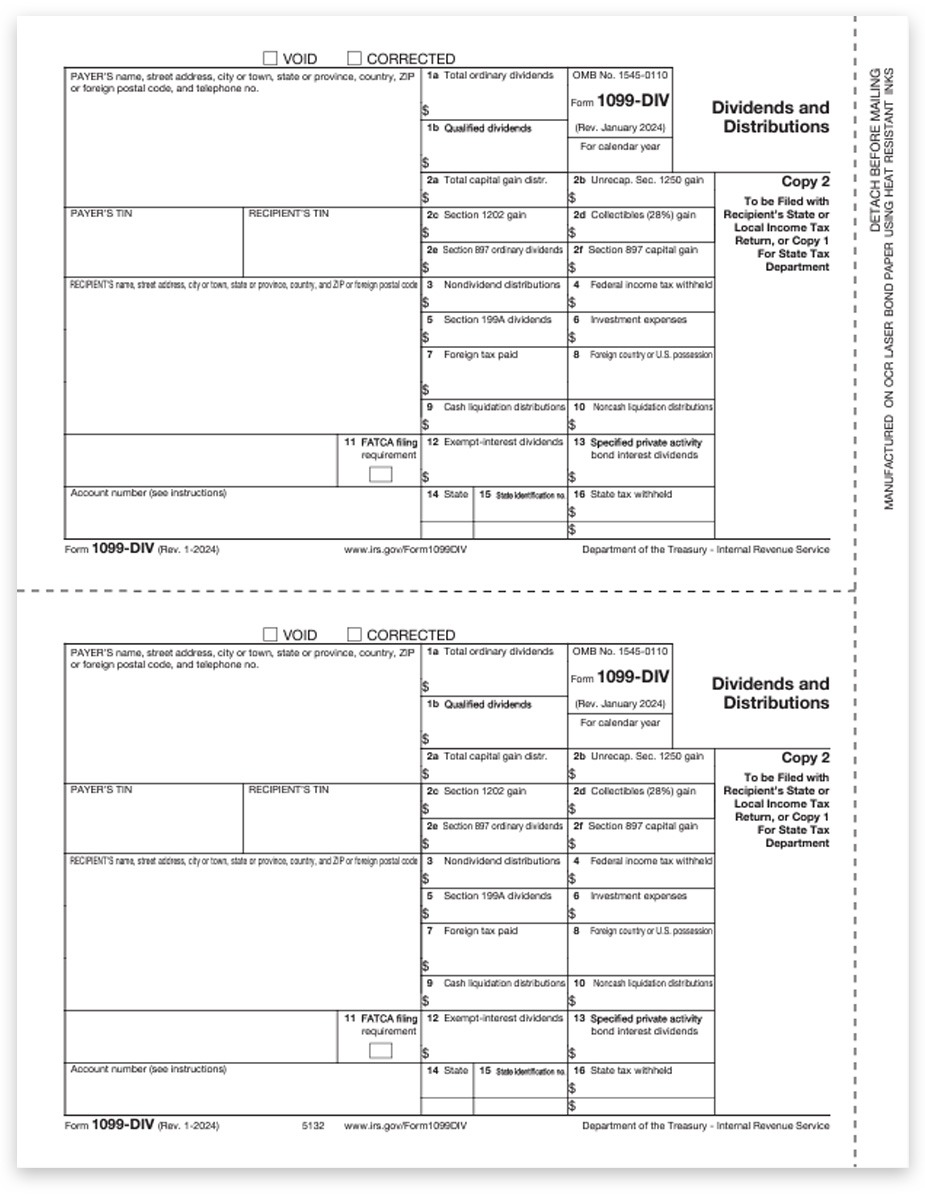

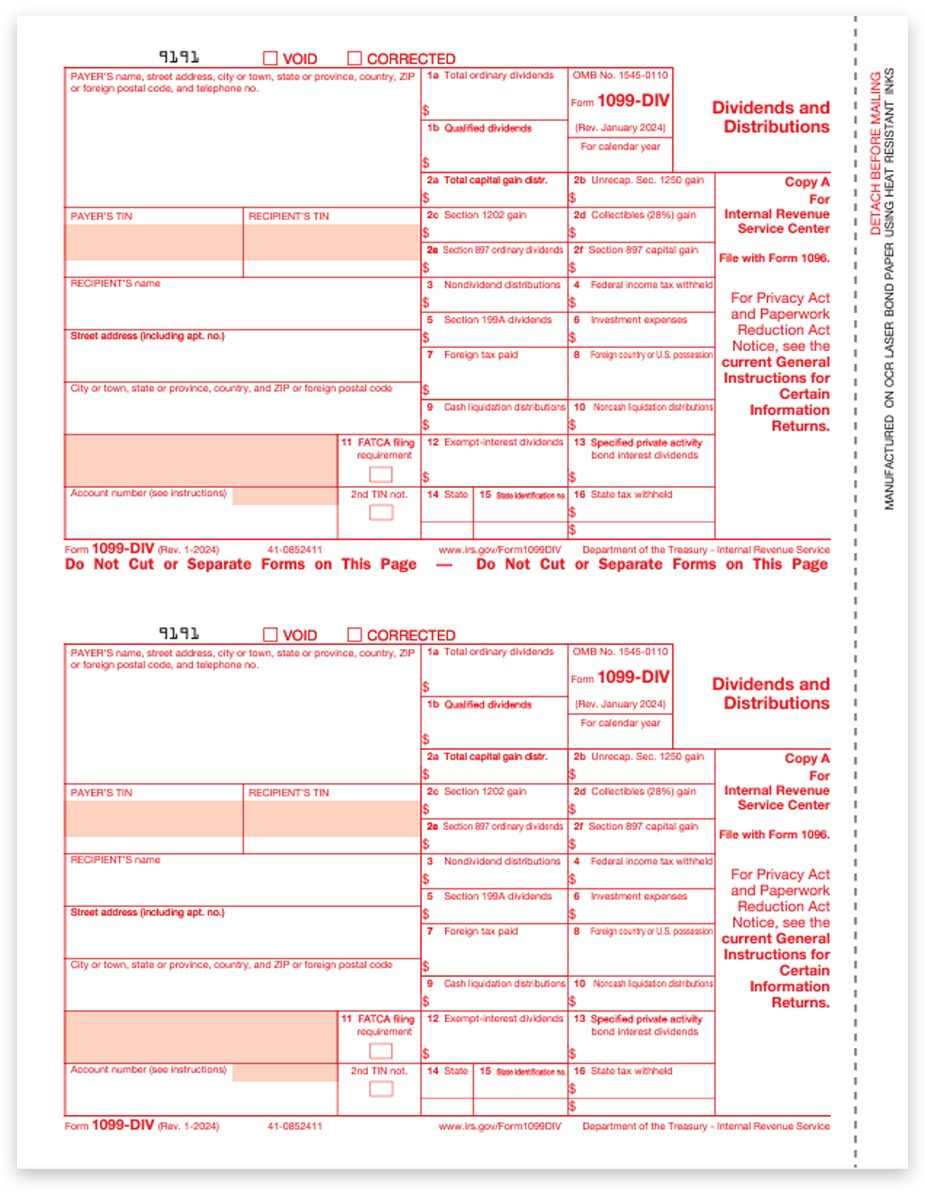

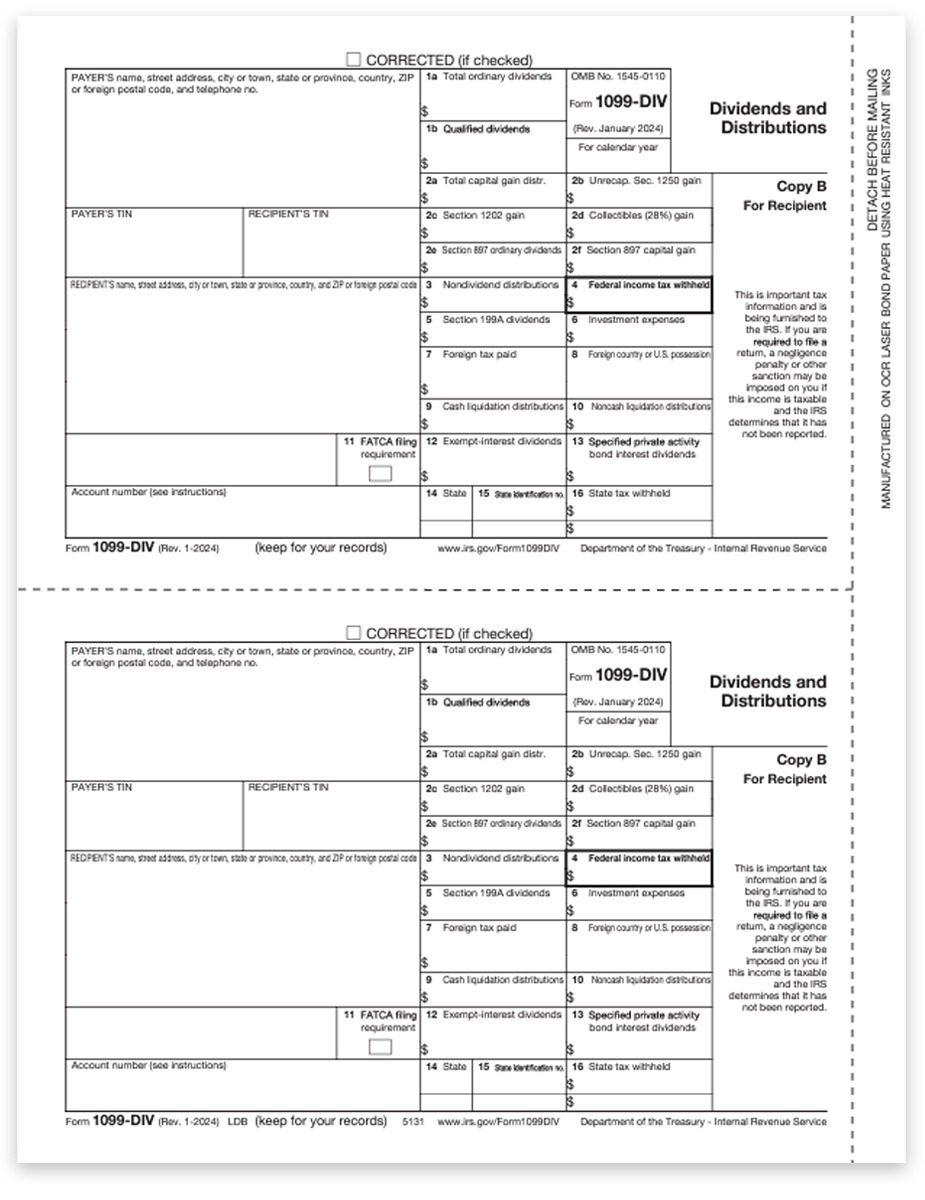

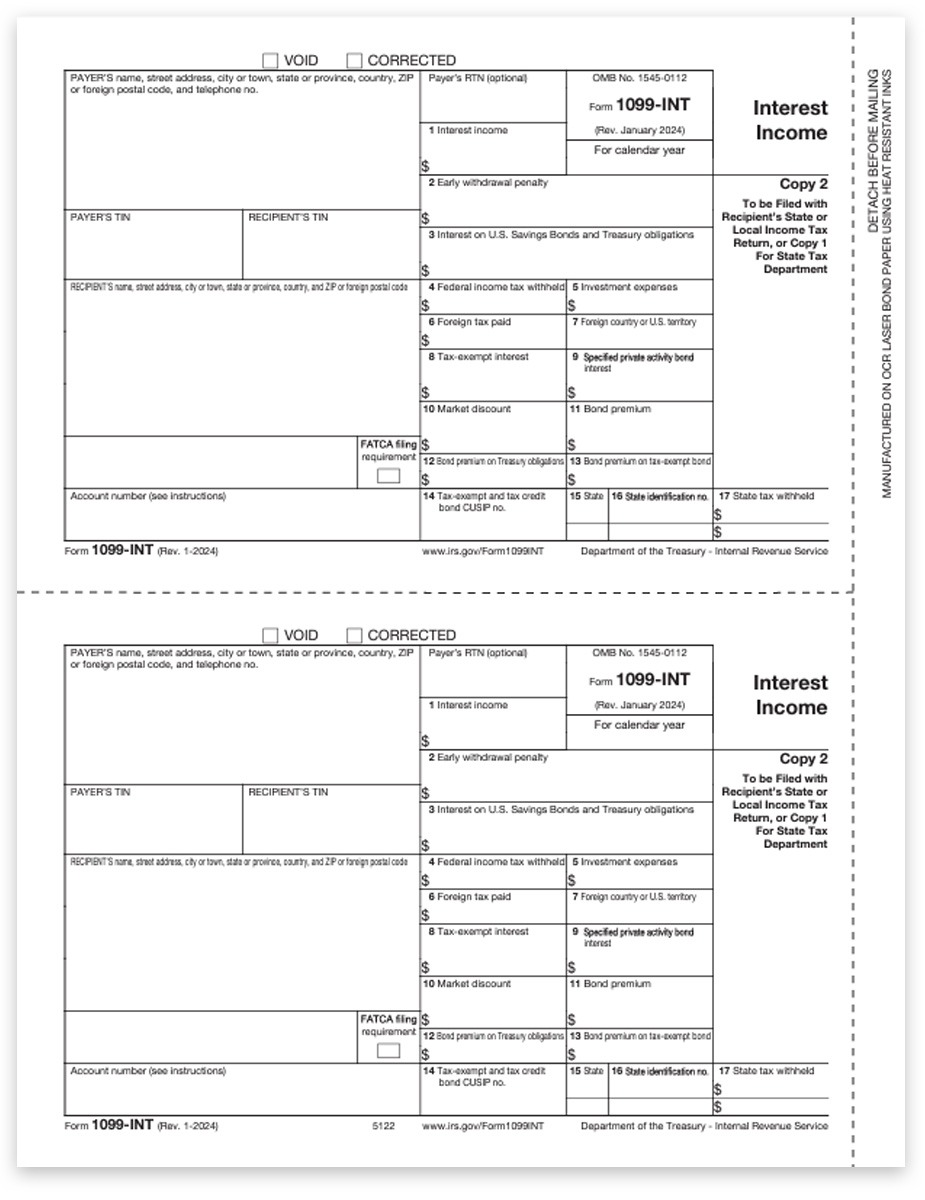

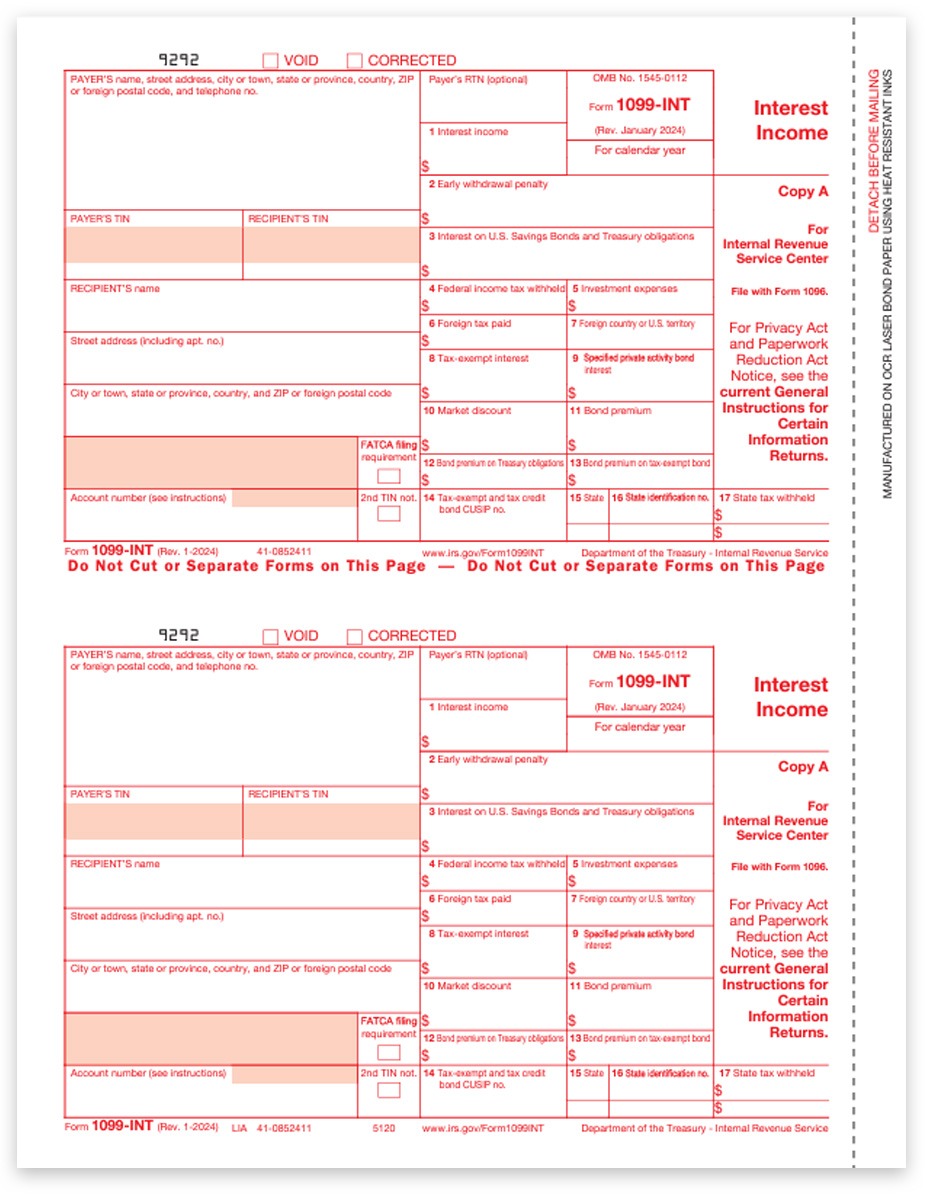

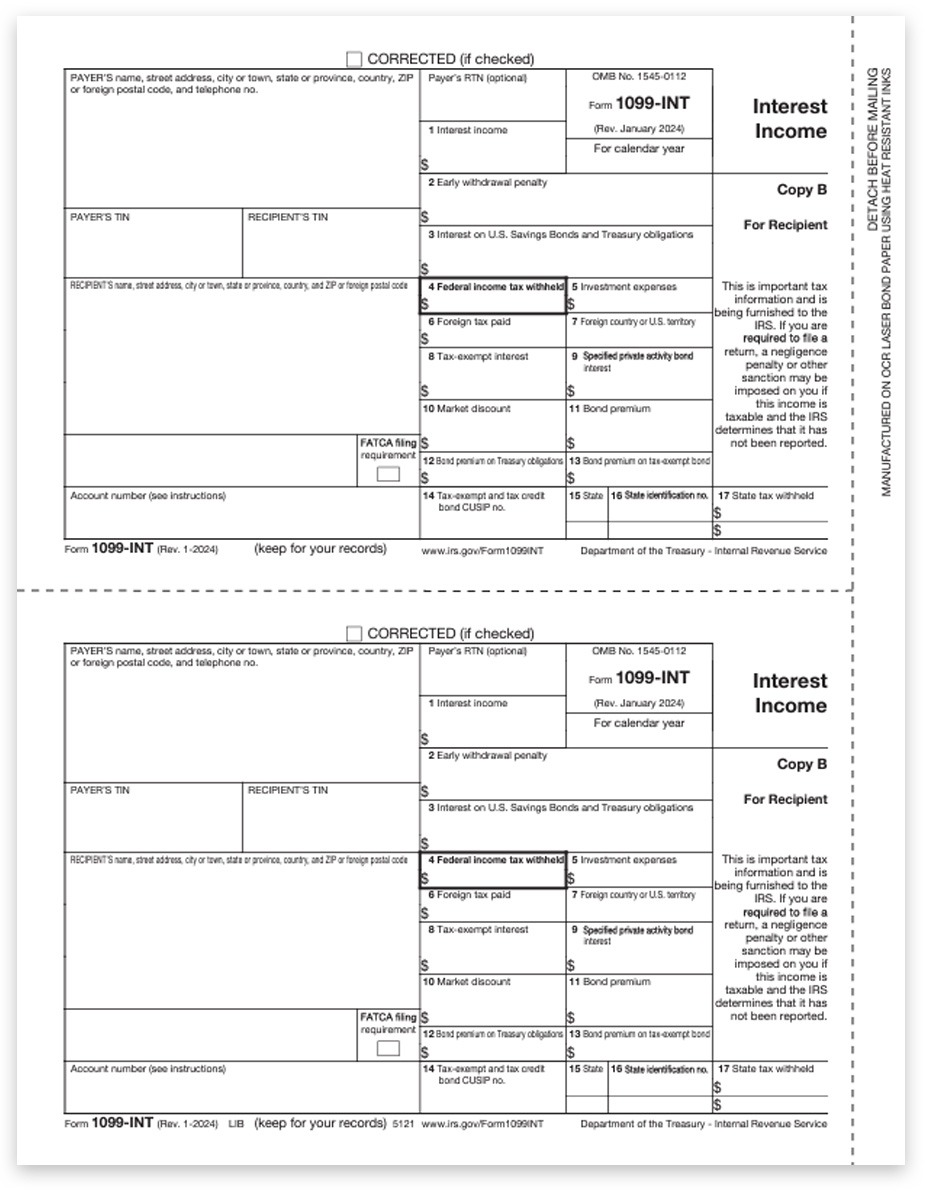

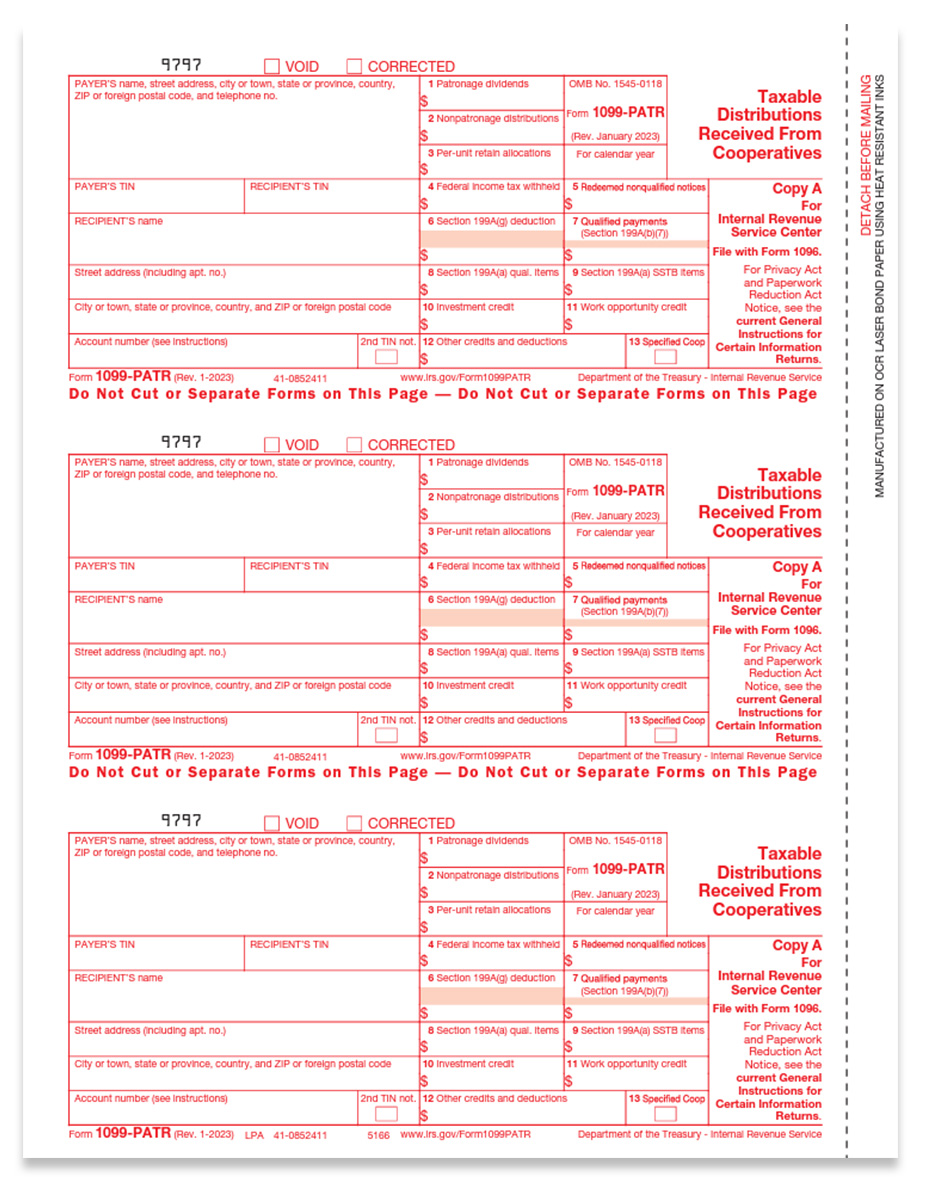

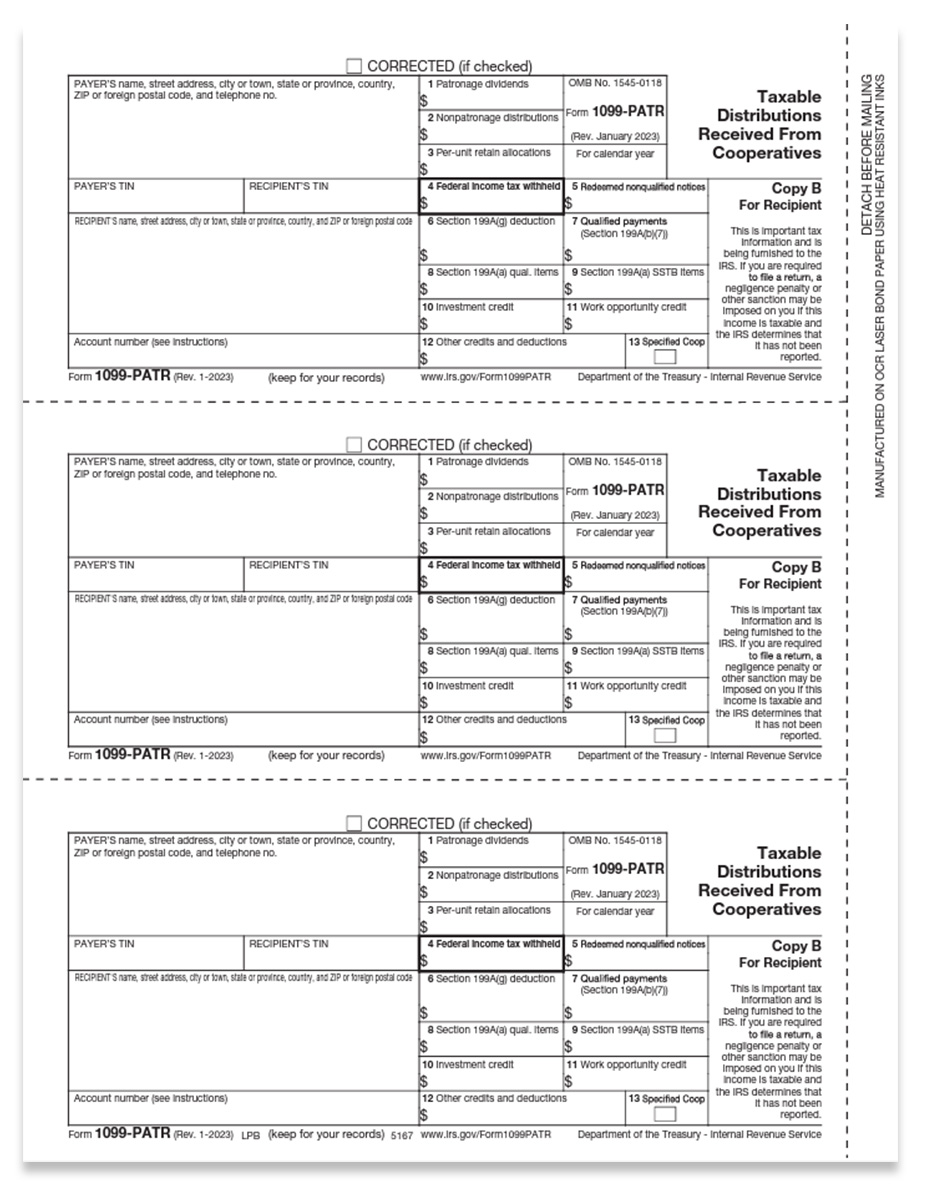

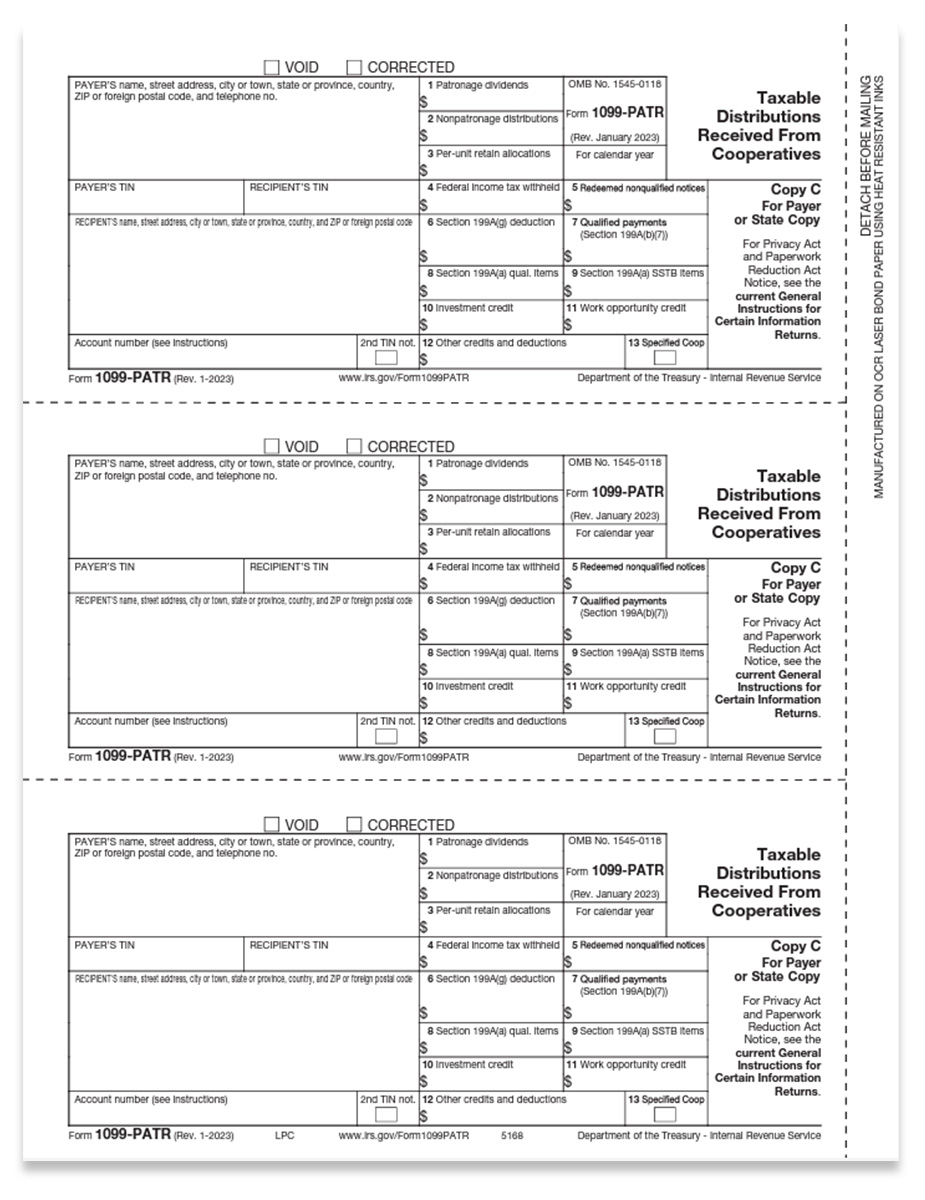

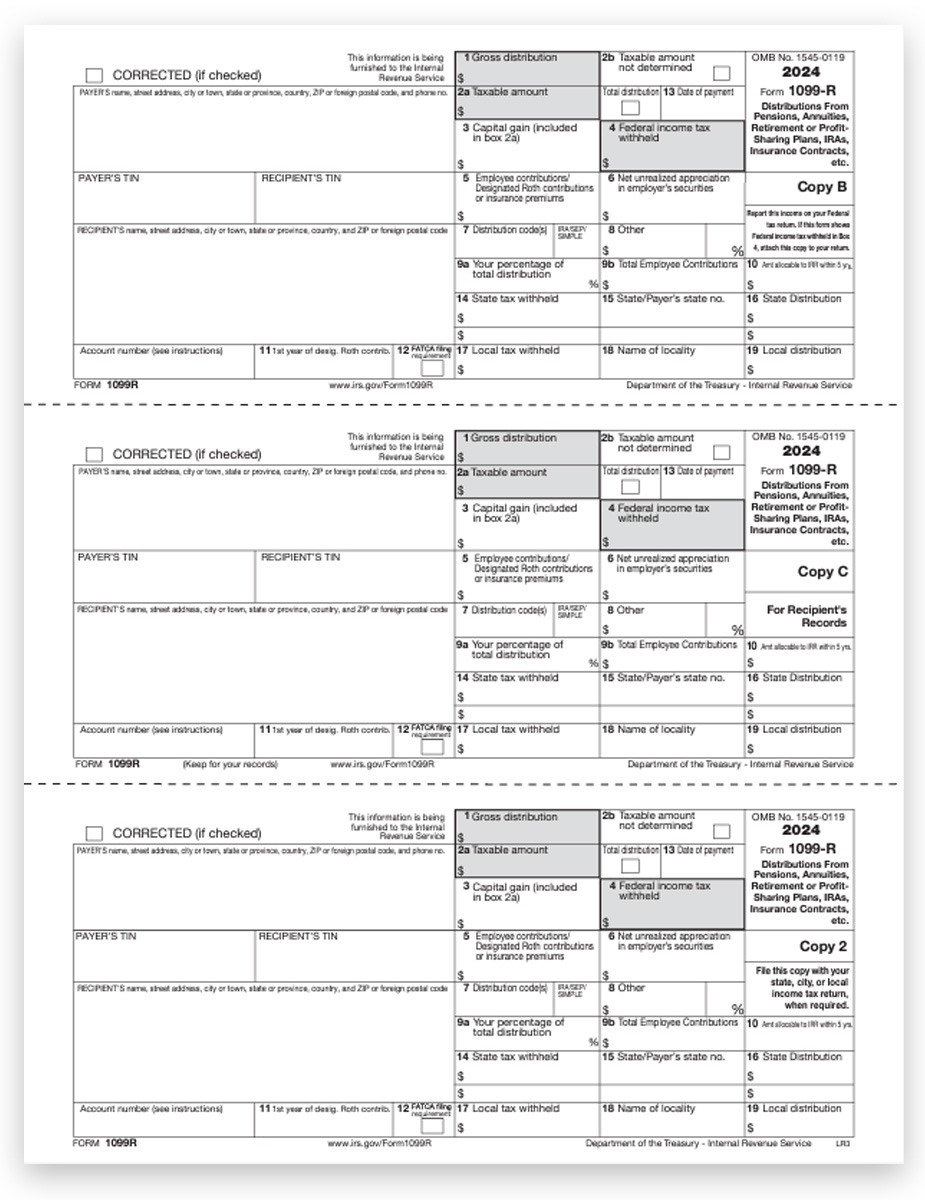

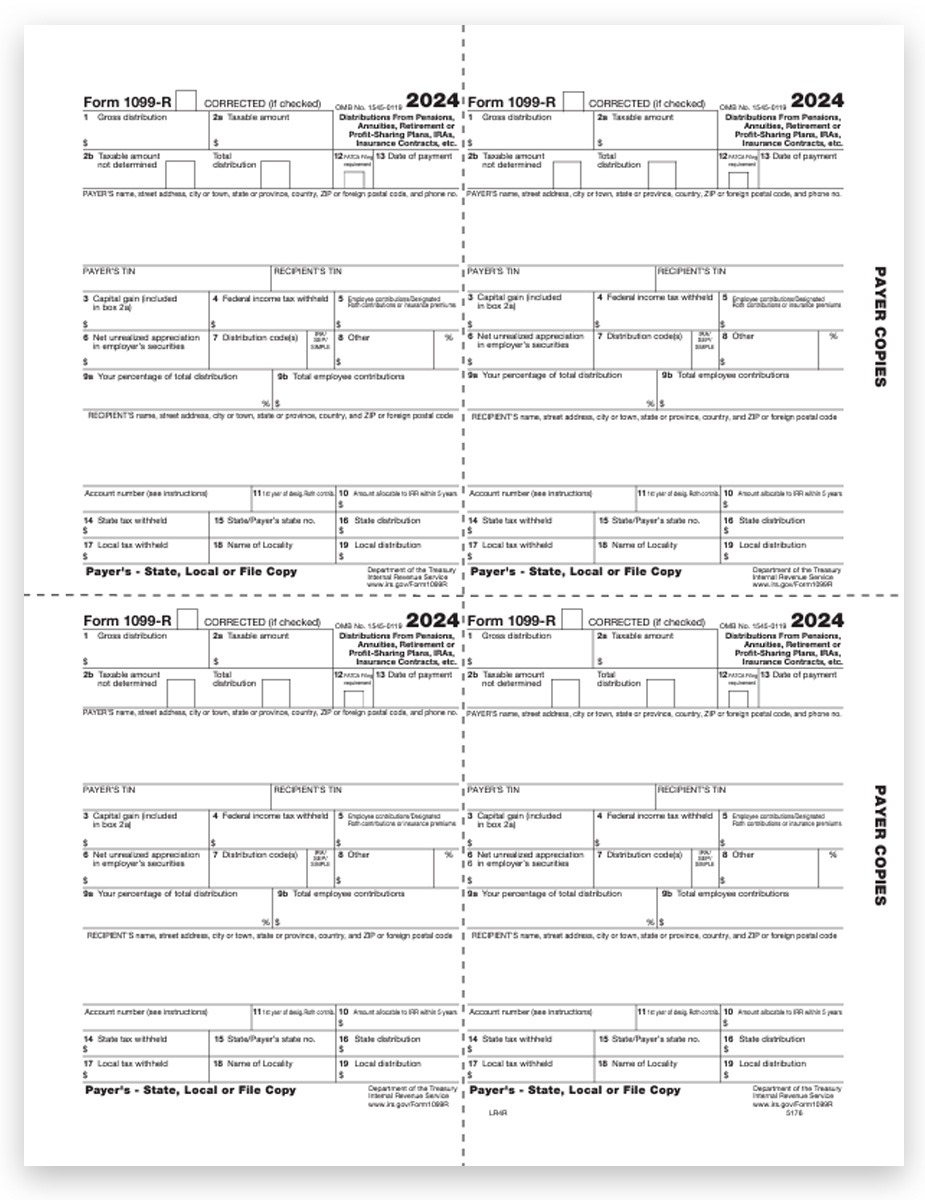

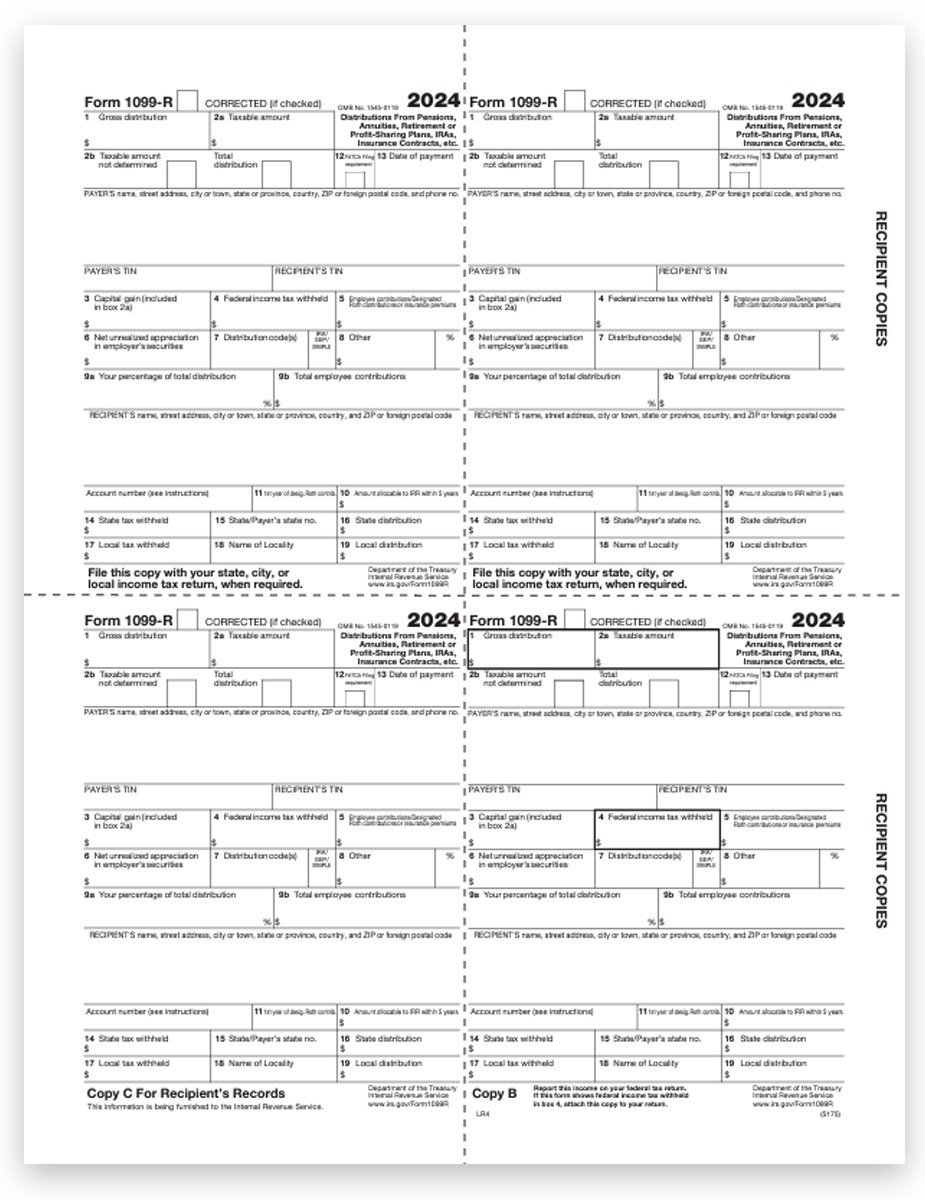

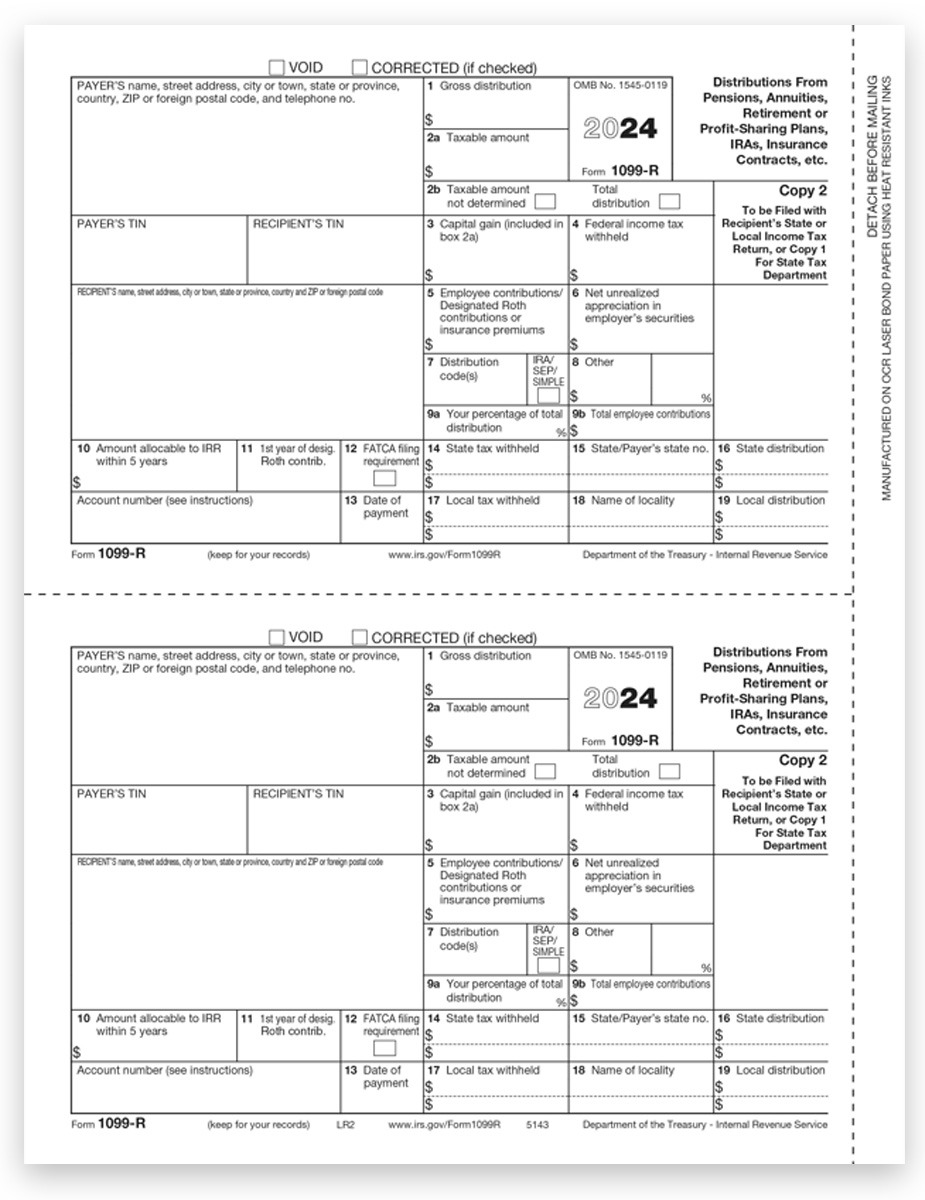

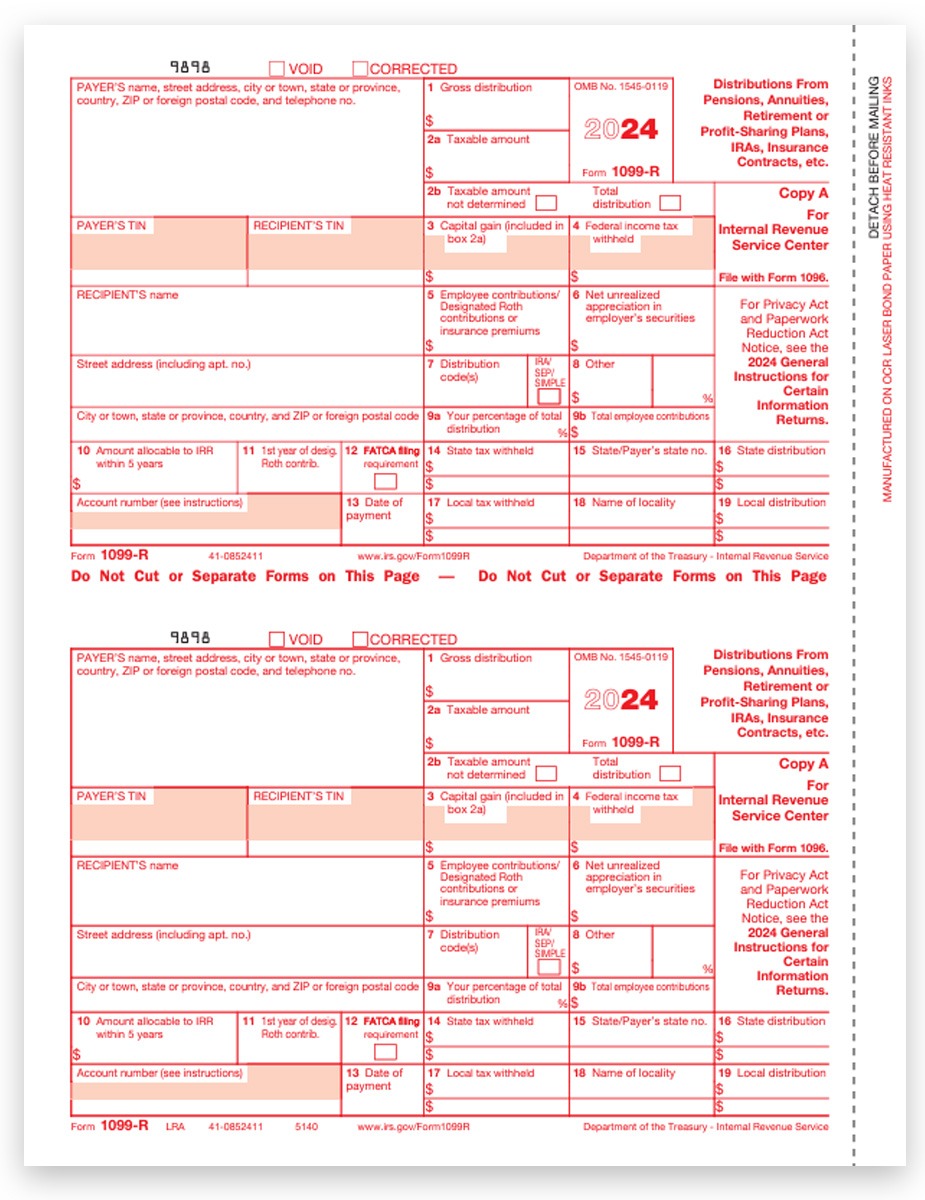

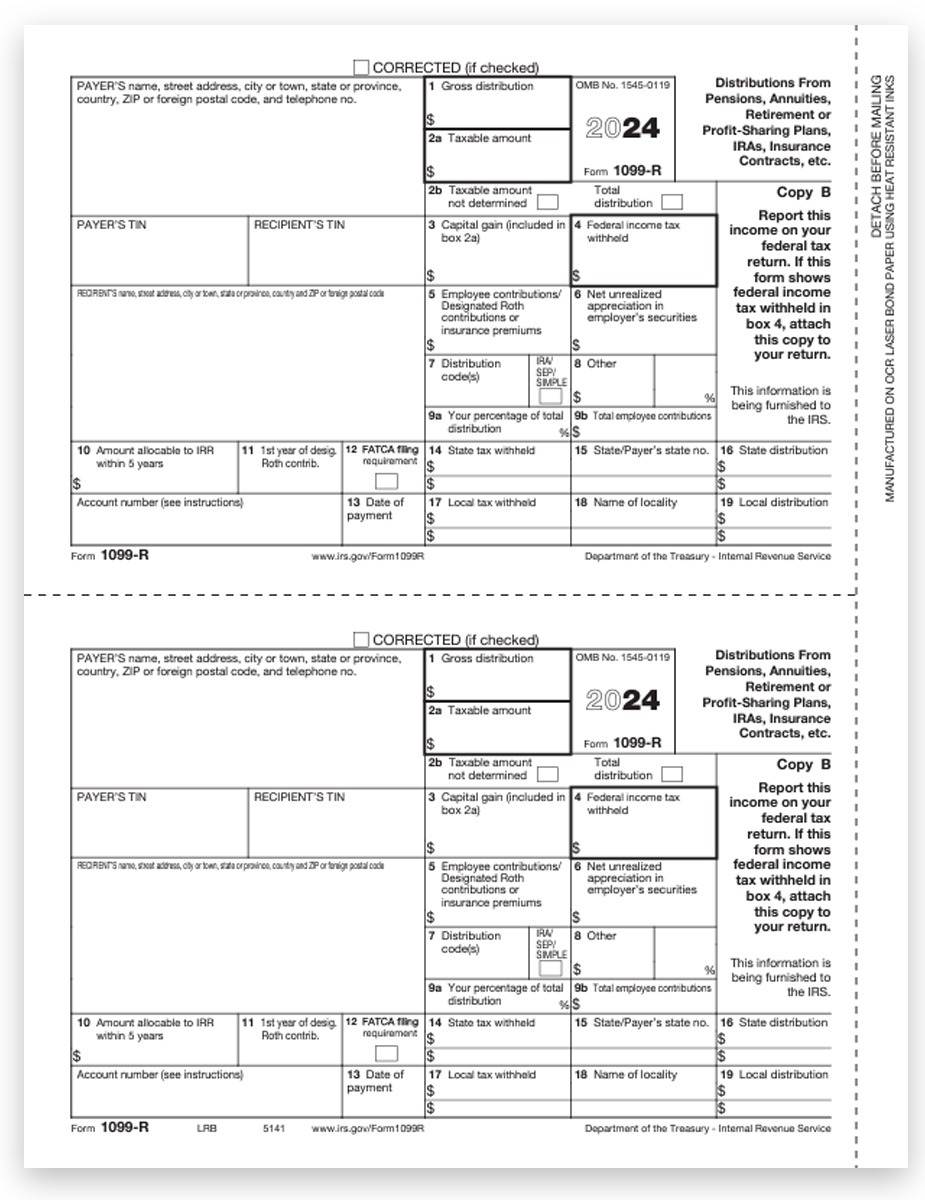

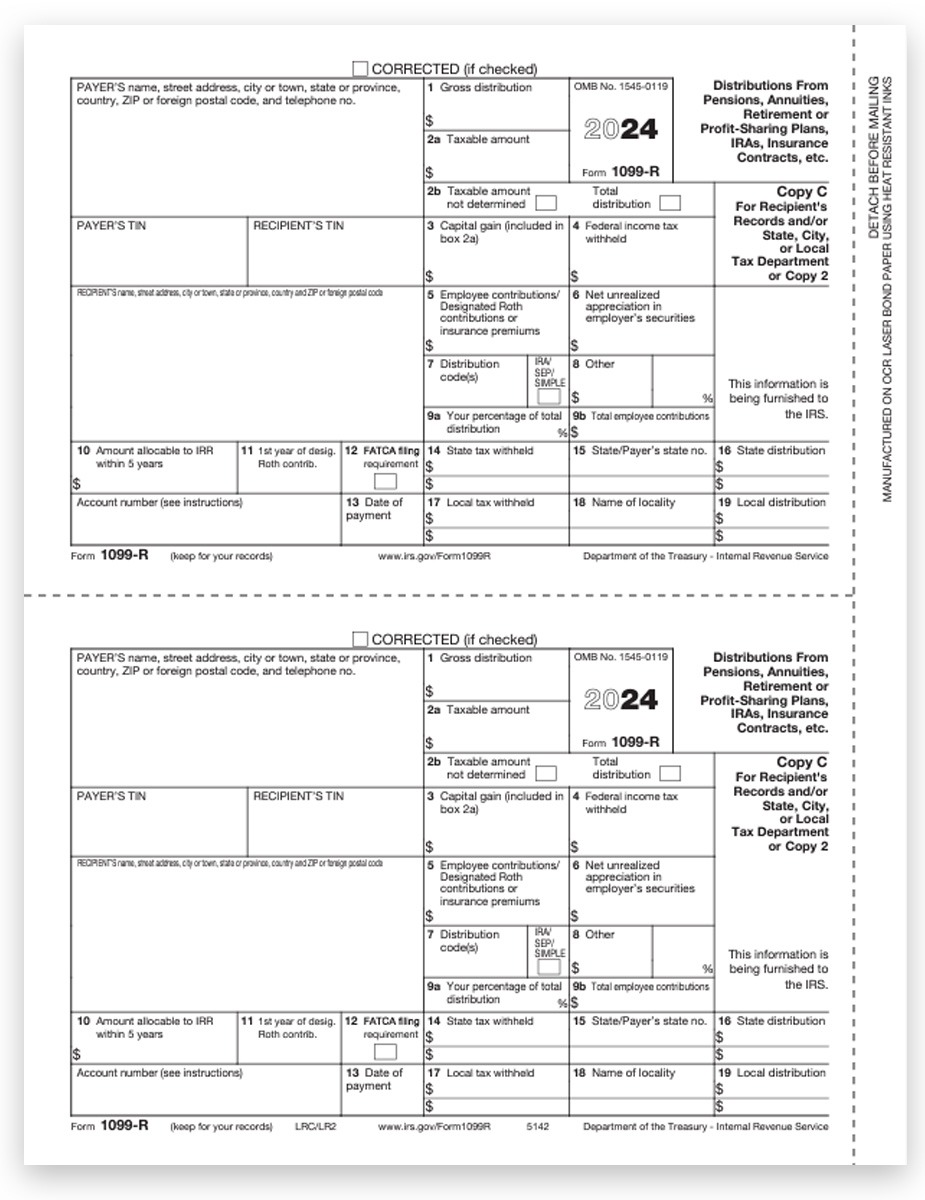

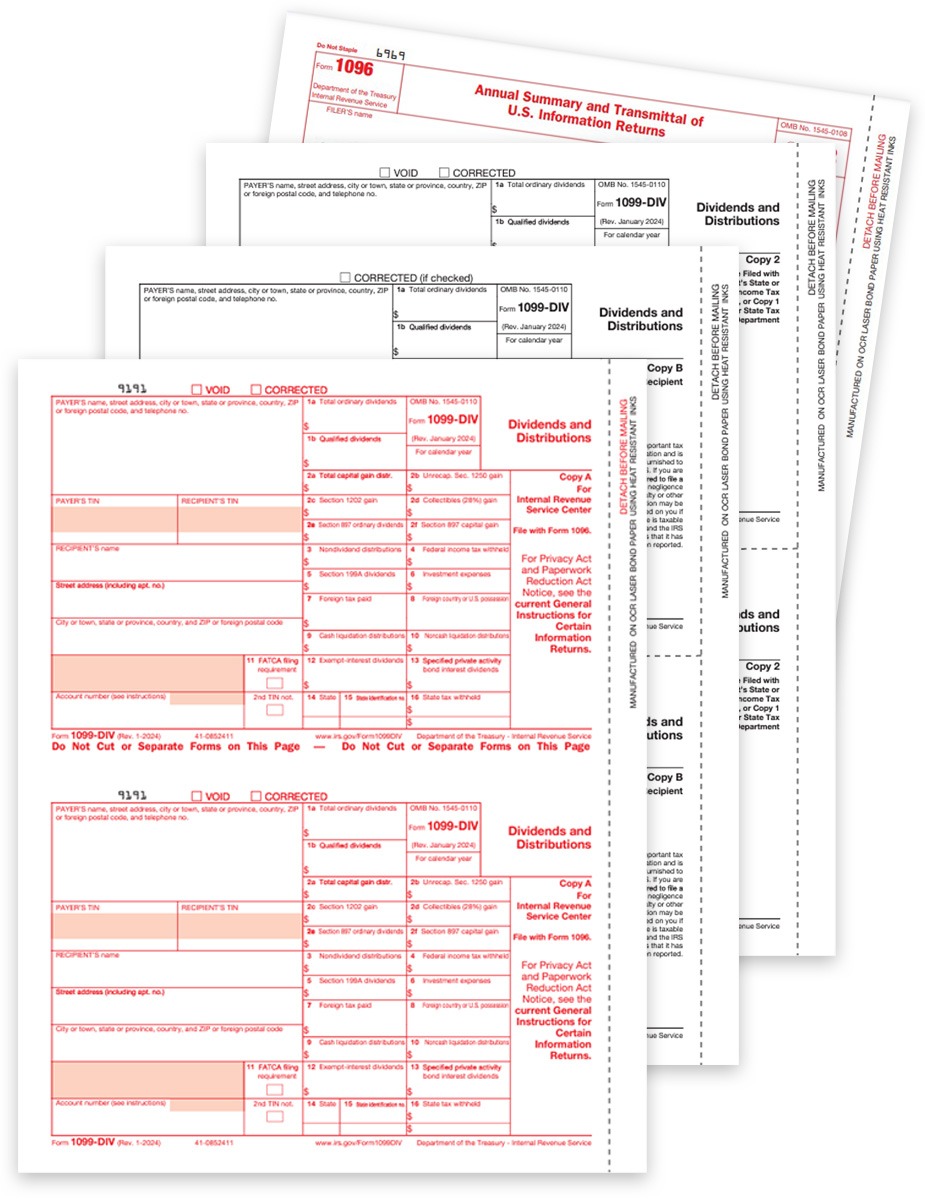

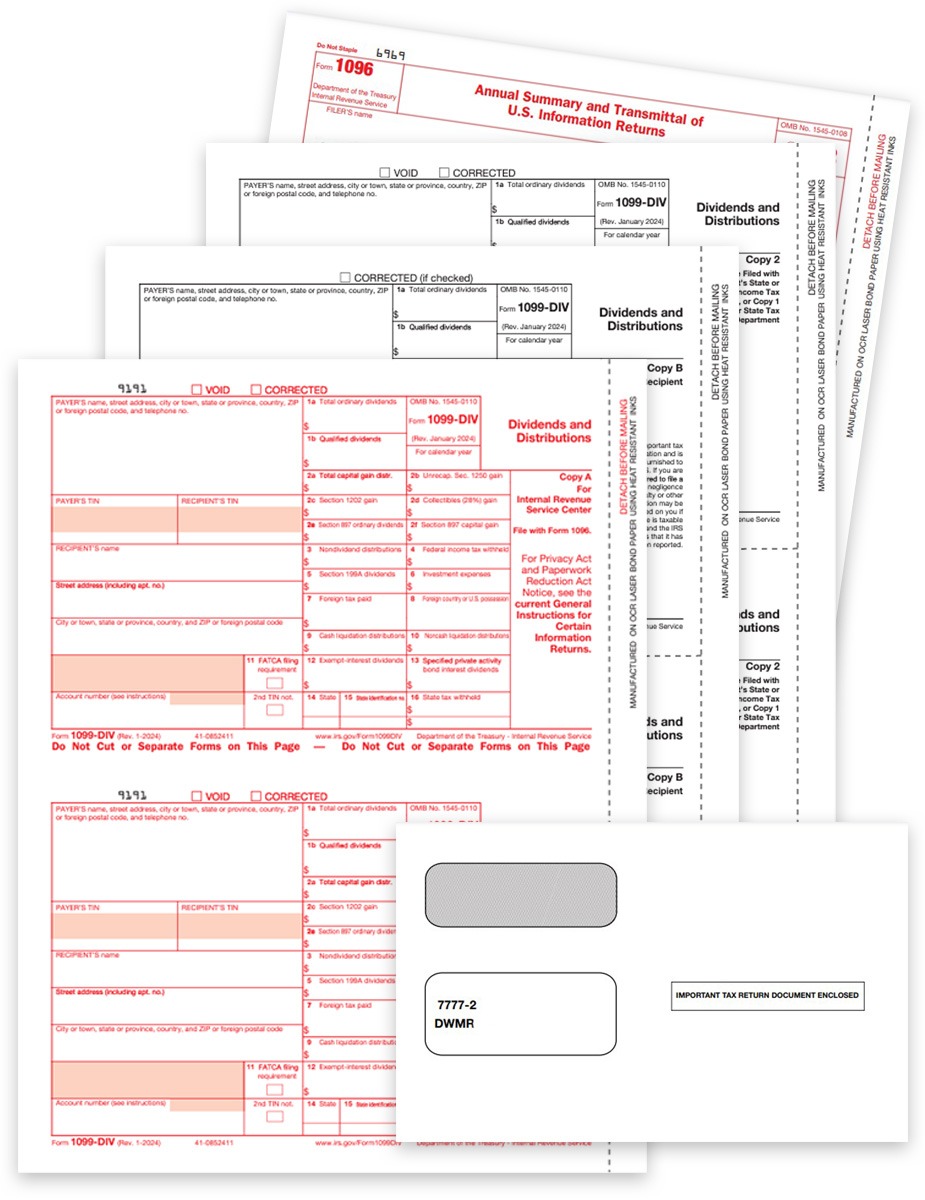

Other 1099 Forms & Envelopes for UltraTax CS

Rely on The Tax Form Gals for personal, friendly service and fast shipping.

As a women-owned and operated business in Michigan, the friendly Tax Form Gals at Discount Tax Forms work hard for you, and have fun every day – even on Mondays!

With the goal of delivering the best value and best service for essential business supplies that you rely on every day to make your small business run like a well oiled machine.

Give us a call at 877.824.2458 or email hello@taxformsgals.com.

Small Business Guide to Filing 1099 & W-2 Forms.

Whether you need to file W2s for employees, or 1099-NEC for contractors, we can help!

Use this guide to understand how to file, when to file and the best forms, software and solutions for you.

Deadlines for 2024 1099 & W-2 Filing

January 31, 2025

All 1099 Recipient Copies B / C / 2 mailed to recipient

W-2 Employee Copies B / C / 2 mailed to employees

1099NEC Copy A forms to IRS*

W2 Copy A to IRS*

>> *E-FILE REQUIREMENTS << Businesses with 10+ 1099 and W2 forms combined MUST e-file Copy A forms with the IRS or SSA. Make it easy with DiscountEfile.com...

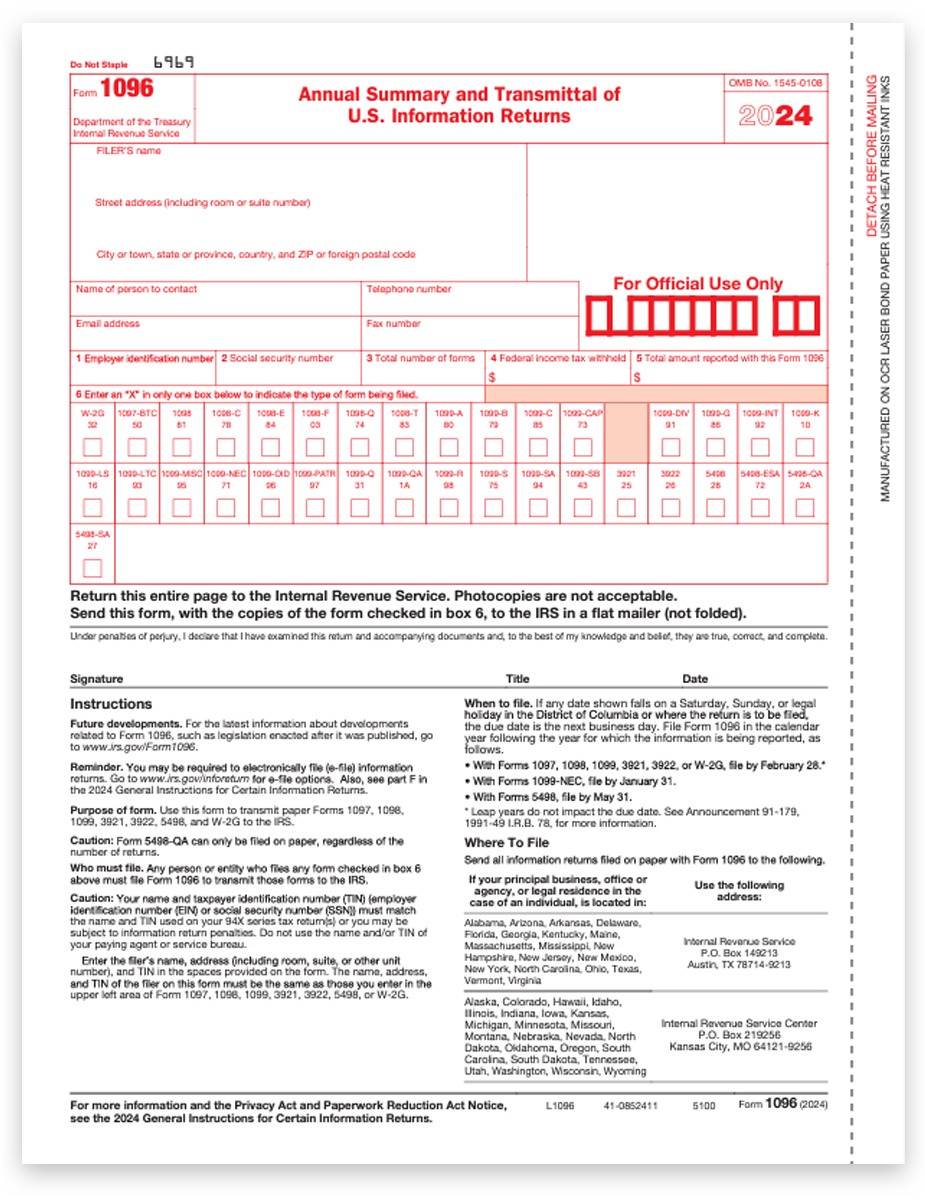

February 28, 2025 - Paper 1099 Copy A forms to IRS

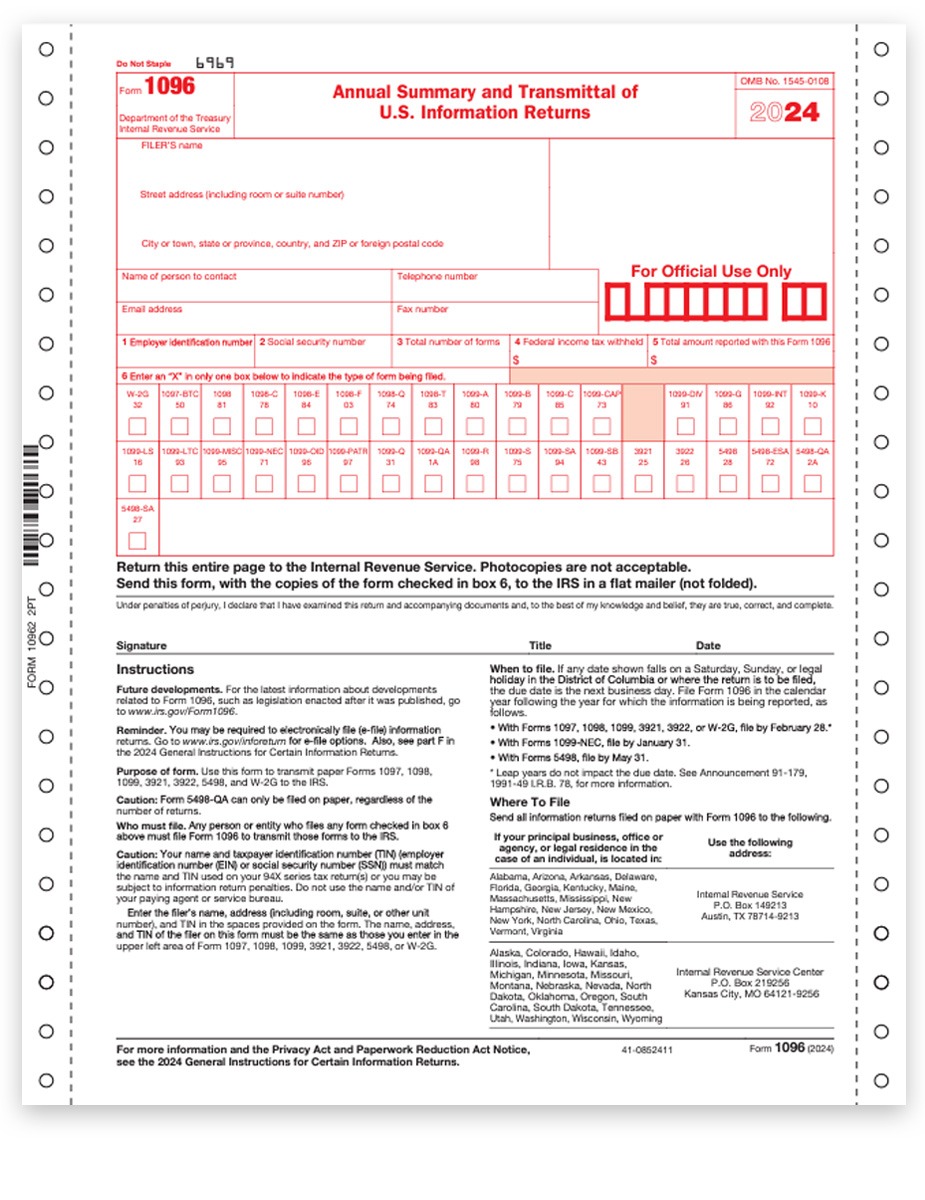

1099 Form Copy A, along with 1096 Transmittals, mailed to the IRS for all 1099 forms except 1099-NEC with non-employee compensation, which are due January 31.

April 1, 2025 - E-file 1099 forms with IRS

1099 Forms E-filed to the IRS, except 1099-NEC with non-employee compensation, which are due January 31.

Let Us Do the Work for You This Year!

Instantly e-file, print and mail 1099 and W-2 forms.

DiscountEfile.com makes year end reporting easier than ever!

Simply enter your data, or import it from QuickBooks®, then click a few buttons and you're done.

We e-file with the IRS or SSA, and can optionally print and mail recipient copies, starting at about $4 per form and going down from there.

Insights from our Blog...

3 Easy Ways to File 1099 & W2 Forms

If your business needs to file W2 forms for employees, or 1099s for contractors or other purposes, we offer 3 simple ways to get them done efficiently before the January 31 deadline: Online Filing, Software, and Forms

Business Penalties & Fines for Incorrect 1099 & W2 Filing

If your business fails to file 1099 & W2 forms on time, or provides incorrect information, you could incur large fines. Learn about the penalties how how to avoid them!

Navigating the IRS E-Filing Requirement Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file Copy A forms with the IRS and SSA. We make it easy! And can even print and mail recipient copies for you.