Blog

Expert insights to

easy 1099 & W2 filing.

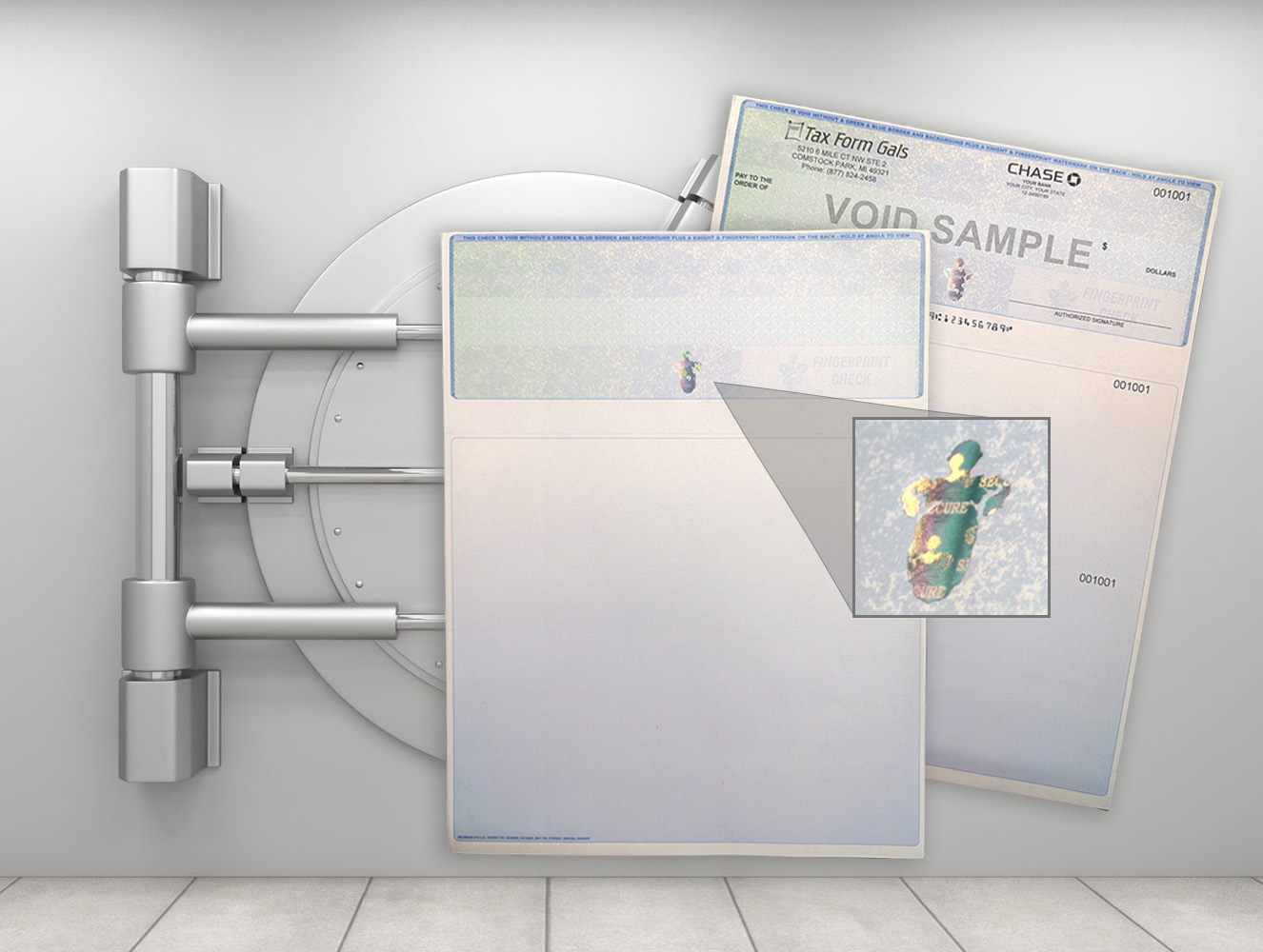

Why Should You Order Business Checks with a Hologram Icon?

Ordering business checks with a foil hologram icon delivers unmatched security and fraud prevention for business.

A customer of ours recently called us with panic in his voice. He discovered check fraud on is AP account and was working with his bank to recoup over a thousand dollars from just one fraudulent check. He purchased his checks from The Tax Form Gals at Discount Tax Forms, and wanted our help in figuring out how to prevent this from happening again.

Luckily, we had just the answer – hologram business checks! The foil hologram is nearly impossible to replicate and makes it much more difficult for a thief to pass fake checks.

Needless to say, he was the first customer to order our new line of hologram security checks.

Why It’s Smart for Businesses to Choose Hologram Checks

There are several reasons to invest in business checks with the highest level of security. While it may seem expensive, a few pennies more for a check can pay off dividends against potentially losing thousands of dollars and hours of time trying to sort out an incident of check fraud.

Ultimately, it comes down to security, professionalism and peace of mind.

Top 5 Reasons to Order Hologram Business Checks

Enhanced Check Security

The foil hologram icon on the front of a business check adds an additional layer of security. It makes checks more difficult to replicate or counterfeit, as the hologram is a unique and intricate feature that is challenging to reproduce accurately. This helps protect the business against fraud and unauthorized use of its checks. When used in conjunction with other top-of-the-line security elements, these checks provide the very best fraud protection on the market.

Fraud Deterrence

The presence of a foil hologram icon acts as a visual deterrent to potential check fraudsters. It sends a signal that the checks are well-protected and have security features that make them harder to forge. Criminals often target businesses that have weaker security measures, so the hologram can discourage fraudulent activities.

Branding and Professionalism

Checks with a foil hologram icon can help enhance a business’s branding and convey a sense of professionalism. The hologram adds a touch of sophistication to the checks, making them stand out and giving a positive impression to recipients. This can be especially important when dealing with clients, suppliers, or other business partners in the financial industry.

Compliance Requirements

In certain industries or for specific transactions, there may be regulatory or compliance requirements regarding check security. For example, businesses in the financial sector or those dealing with large sums of money may be mandated to use checks with advanced security features, such as foil holograms. Using such checks ensures compliance with the relevant regulations and industry standards.

Peace of Mind

By using checks with a foil hologram icon, a business can have peace of mind knowing that it has taken effective steps to protect its financial transactions. It adds an extra level of assurance that the checks being used are legitimate and secure. This can help reduce the risk of financial losses and maintain the integrity of the business’s financial operations.

It’s worth noting that while checks with foil hologram icons offer increased security, they should still be used in conjunction with other best practices, such as secure storage, controlled access to checkbooks, and regular account reconciliation to maintain overall financial security.

When you’re ready to make the switch to hologram checks, we have you covered, for less!

The Tax Form Gals at Discount Tax Forms have been delivering high-quality checks at discount prices for a decade, and we’re ready to help your business.

Get premium check security and peace of mind at deep discounts over the big guys – no coupon needed.

More from the Blog…

3 Easy Ways to File 1099 & W2 Forms

If your business needs to file W2 forms for employees, or 1099s for contractors or other purposes, we offer 3 simple ways to get them done efficiently before the January 31 deadline: Online Filing, Software, and Forms

Business Penalties & Fines for Incorrect 1099 & W2 Filing

If your business fails to file 1099 & W2 forms on time, or provides incorrect information, you could incur large fines. Learn about the penalties how how to avoid them!

Navigating the IRS E-Filing Requirement Change for Small Businesses: A Guide to Using DiscountEfile.com

If your business needs to file 10 or more 1099 & W2 forms combined, per EIN, you must e-file Copy A forms with the IRS and SSA. We make it easy! And can even print and mail recipient copies for you.